What a great start to the year!

What a great start to the year!

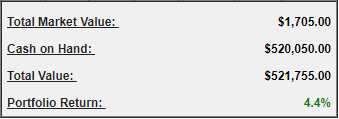

The S&P 500 is up from 2,680 to 2,770 so 90 points is 3.3% and our Long-Term Portfolio is already up 4.4% or $21,755 in 8 days of trading. As you can see, we still have all of our cash on the sidelines as the well-hedged positions we picked up have been cash-positive for us so far – we haven't been confident enough to take big risks yet. Our $100,000 Options Opportunity Portfolio, which you can follow at Seeking Alpha, is only up 3.3% because we're down $900 on our TZA hedge while, in the $500,000 LTP, CASH!!! is still our primary hedge against a market collapse.

Our goal is not to "beat" the market on the way up, our goal is to kick the market's ass on the way down or if the market is flat. By capturing all the good stuff and avoiding all the bad stuff, we can consistently outperform the market year after year without suffering the portflio-killing pullbacks that plague more aggressive traders. While it's fun to brag about making outsized returns during these market bubbles – it's more fun to "Get Rich Slowly" and retire with plenty of money, isn't it?

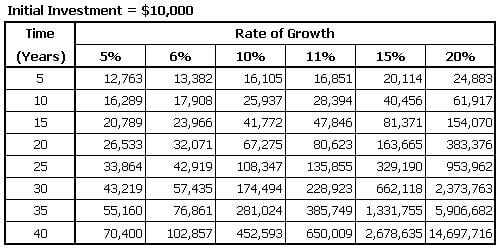

The key to building wealthy over time is CONSISTENCY. Warren Buffett's Berkshire Hathaway has "only" averaged 16% returns but he's been doing it for 50 years, allowing his initial investors to make 10,000 x returns on their invesments.

The key to building wealthy over time is CONSISTENCY. Warren Buffett's Berkshire Hathaway has "only" averaged 16% returns but he's been doing it for 50 years, allowing his initial investors to make 10,000 x returns on their invesments.

But that's not the way it starts. It starts in year one with a 16% return and $100,000 becomes $116,000 and then $116,000 becomes $134,000 which becomes $156,000 in year 3 and then $181,000 after 4 years and finally, in year 5, you get to say you've doubled up. While it may seem like you'll never get to $1Bn in 50 years at that pace – the math doesn't lie – you just need to learn how to CONSISTENTLY make good returns.

And, of course, anyone who says they have a better system is LYING to you because, after 50 years of measuring, no investor on this planet is richer than Warren Buffett so it's Warren Buffett's model we pursue, picking up good stocks at good prices and building our portfolios over time. Our only modification to Buffett's system is to use stock options both to leverage and to hedge our portfolios, which is our own: "Secret to Consistent 20-40% Annual Returns."

For example: Last Wednesday we published our 2018 Watch List, which already has 33 trade ideas to kick-start the year, half of which ened up in the Options Opportunity Portfolio already. The featured trade idea was for General Electric (GE), which I called the best buy in the market and Buffett finally agreed with me on Wednesday.

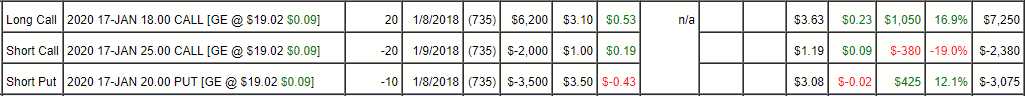

Our trade idea the week before was simply to sell the 2020 $18 puts for $2.40 which would give us that "right price" entry on GE at net $15.60 if it were assigned to us but, more likely, GE will stay over $18 and the short puts will expire worthless, paying us $2.40 for NOT owning the stock. In the Options Opportunity Portfolio, we also added a bull call spread and our trade came out like this:

As you can see, our net cash outlay on the trade was just $700 and the ordinary margin requirement for 10 short $20 puts (we went more aggressive on the final trade) is $2,005 so $2,750 cash and margin committed to the trade and, already, less than a week later, we're up $1,095 – a 40% return on our cash and margin and a 156% return on cash. And it's still good for a new trade as the net $1,795 current price of the spread will return $14,000 for a gain of $12,205 (680%) if GE is over $25 in Jan 2020.

You can see why we don't worry about whether or not we can beat the market. This one trade in our OOP, using 1.5% of the ordinary margin (2x) and with the very low risk of GE dropping considerably from here will, by itself, create a 15% gain in our portfolio over 2 years. You don't have to risk a lot to make a lot – that's what we try to teach our Members. And it only takes a few good trades like this to give our entire portfolio Berkshire-like returns so PATIENCE is a winning strategy here. Earnings season will give us endless opportunities to pick up good companies at low prices, Intel (INTC) springs to mind, as they are pulling back due to their recent chip issues, which everyone will have forgotten about by next quarter.

This morning, Canadian Solar (CSIQ) is down 2.5% as they cut Q4 guidance but, because we understand the nature of the Solar Industry, we know that very small shifts in schedules on large solar installations can cause these issues, which have nothing to do with the overall health of the company. That is exactly the sort of OPPORTUNITY we look for and CSIQ happens to be one of the trades we cashed out of in early December so now is a chance to get back in at $17 or less, hopefully $16 and probably we can sell the 2020 $15 puts for $2.50 or better so all we'll be doing is promising to buy CSIQ at net $12.50 and, if it dooesn't go that low – then we'll just keep the $2.50 for doing nothing. Isn't investing fun?

We're still expecting a 10% market correction and we discussed a Banking Ultra-Short (FAZ) hedge in yesterday's report as well as Monday and, last Friday, our morning Report had a the Russell Ultra-Short (TZA) hedge that we're using in the Options Opportunity Portfolio which will pay us $20,000 if all goes well. We'd almost rather the market goes lower than higher at this point!

And that's about the size of it. I'd say they short story is that we're defensively buying stocks to keep our 90% CASH!!! portfolios on par with the market gains while keeping PLENTY of dry powder on the sidelines for reall bargains as they pop up. Meanwhile, we're still amusing ourselves playing the Futures while we wait (see Wednesday's Live Trading Webinar). This morning I put out a note to short the Russell (/TF) at 1,592 and the Nasdaq (/NQ) at 6,750 while taking our profits (again) in Gasoline (/RB) shorts from $1.85.

Have a great weekend,

– Phil