Government shutdown!

Government shutdown!

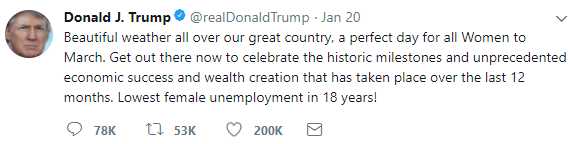

No one really cares. It sounds like something, but it's nothing. The government was shut down for 2 weeks in 2013 and hardly anyone noticed and, frankly, this Government has been dysfunctional for pretty much all of 2017, so it's not like we're going to miss it. Meanwhile, our President is tweeting from the twilight zone where Global Warming is "good weather" and millions of women marching against him all over the country is a "celebration" of his policies. You can't make this stuff up. No, really, you can't, because a sane person couldn't imagine having that reaction to what is actually happening.

Meanwhile, the last time the markets were this bullish was 1987 and we begain that year with a rally from S&P 250 to S&P 335 in August and then back to 200 (-40%) in October – so a hell of a fun ride that time! More recently though, we were also very enthusiastic in 2015 and there we topped out, also in August, at 2,200 on the S&P and we only fell to 1,850 (-16%) into 2016 so maybe this rally can last into the summer but, if it does, it will be the most overbought, overconfident market ever measured – much healthier to have a small correction now.

Meanwhile, the last time the markets were this bullish was 1987 and we begain that year with a rally from S&P 250 to S&P 335 in August and then back to 200 (-40%) in October – so a hell of a fun ride that time! More recently though, we were also very enthusiastic in 2015 and there we topped out, also in August, at 2,200 on the S&P and we only fell to 1,850 (-16%) into 2016 so maybe this rally can last into the summer but, if it does, it will be the most overbought, overconfident market ever measured – much healthier to have a small correction now.

We added some portfolio hedges into the Government shut-down weekend but, so far, there's no indication that the markets care and we assume there will be a relief rally once Congress comes to an agreement so, if anything, we may go higher from here. Earnings, so far, have not been bad so no particular reason for a pullback but, this week, 20% of the S&P 500 (100) Companies will report and then we'll have a pretty good picture of what's happening in various sectors.

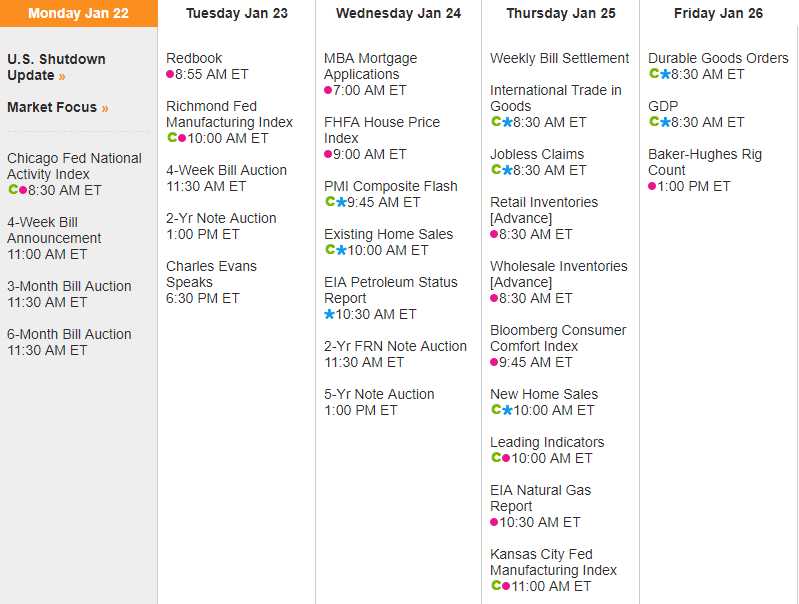

Not only is there not much data scheduled to be released this week but it might not be released at all if the Government contines to be shut down. Currently on the schedule are reports from the Chicago, Richmond and Kansas City Feds along with some housing data but nothing major until we get our GDP and Durable Good Reports on Friday. All of this is up in the air, however, as there are no people around to release the reports:

While things may SEEM to be going well and while the spin on the markets is still positive – it struck me this weekend that US banks are reporting a 20% jump in Credit Card losses for 2017 – usually a sign of deteriorating Consumer Health. “People are using their cards to get from pay cheque to pay cheque,” said Charles Peabody, managing director at the Washington-based investment group Compass Point. “There’s an underlying deterioration in the ability of the consumer to keep up with their debt service burden.” Citigroup (C), JP Morgan (JPM), Bank of America (BAC) and Wells Fargo (WFC) took a $12.5Bn hit with 7.5% of credit cards now over 30 days past due.

This makes sense because the "recovery," such as it is, has almost exclusively benefitted the Top 1%, who captured 82% of the wealth gains in 2017 while the Bottom 53% got NOTHING at all. In 2018, we're going to not tax the gains made by the Top 1% to prevent them from accidentally sharing that wealth with the Bottom 99% – I'm sure that's a great idea that will all work out great.

This makes sense because the "recovery," such as it is, has almost exclusively benefitted the Top 1%, who captured 82% of the wealth gains in 2017 while the Bottom 53% got NOTHING at all. In 2018, we're going to not tax the gains made by the Top 1% to prevent them from accidentally sharing that wealth with the Bottom 99% – I'm sure that's a great idea that will all work out great.

In particular, Oxfam criticised President Trump, who is attending the World Economic Forum, for creating “a cabinet of billionaires” and implementing tax legislation that she said rewarded the super-rich, not ordinary Americans. The annual report by Oxfam found that the number of billionaires rose at a rate of one every two days between March 2016 and March 2017, while in the United States the three richest people own the same wealth as the poorest half of the population.

“The economic model is not working at all,” Oxfam report co-author, Iñigo Macías Aymar, told the Thomson Reuters Foundation. “The way this wealth is being distributed we are really worried, it’s being concentrated in fewer hands.” Oxfam called for all workers to receive a minimum living wage, the elimination of the gender pay gap and tougher rules to crackdown on tax avoidance.

We're not going to be able to have a stable growth economy if all the benefits accrue to the top so we're remaining cautios on earnings and, as I noted, we added a couple of hedges to our Short-Term Portfolio on Friday, which were also published in our Top Trade Alerts.

From a Futures perspective, we're watching Dow (/YM) 26,000, S&P (/ES) 2,810, Nasdaq (/NQ) 6,850 and Russell (/TF) 1,600 and, as usual, we short the last one to cross under with very tight stops if ANY of the indexes get back over their line so risking very small losses against nice potential gains.

Other than that, it's more of a "watch and wait" kind of day.