This is the most important chart in the World:

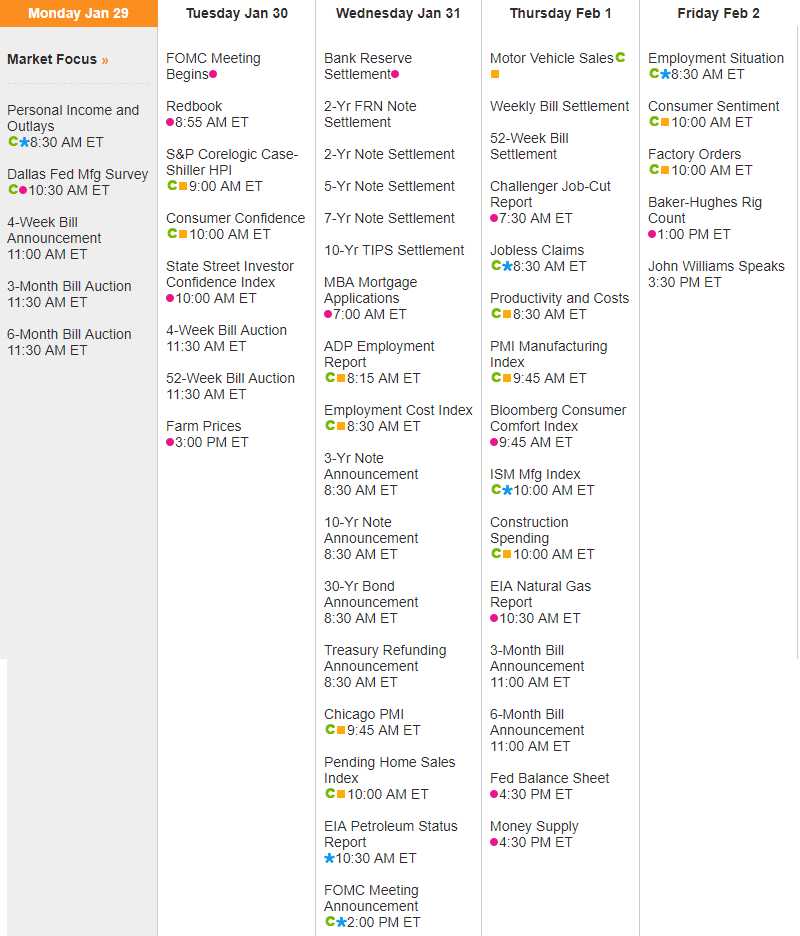

It illustrates the $2Tn "taper" that is about to take place and is, in fact, taking place right now and projected to accellerate rapidly into 2019 at which point (gasp!) Central Banks will become net sellers of assets and there is NO WAY that doesn't depress prices, even with a theoretical $2Tn being repatriated from overseas accounts on the Corporate side.

While we can't count on Corporations to spend the cash they bring back in, we can expect the massive stock buyback trend to continue. As you can see from Credit Suisse's chart, the only real buyer of US equities for the past 10 years has been the Corporations themselves – who have engaged in MASSIVE buy-back programs that have lowered the share count of US equites by 20% which has therefore inflated the earnings per share by 20% by simply reducing the number of shares those earnings are divided by.

While we can't count on Corporations to spend the cash they bring back in, we can expect the massive stock buyback trend to continue. As you can see from Credit Suisse's chart, the only real buyer of US equities for the past 10 years has been the Corporations themselves – who have engaged in MASSIVE buy-back programs that have lowered the share count of US equites by 20% which has therefore inflated the earnings per share by 20% by simply reducing the number of shares those earnings are divided by.

This makes our Top 1% CEOs look good and also makes them much, much richer (see: "Stock buybacks enrich the bosses even when business sags") and so far, so good, as the market has gone up despite most companies making roughly the same amount of Dollars they did back in 2008 – they are just changing the math to make things look pretty.

But, much like the Oil Cartel (OPEC) benefits from cutting supply and making oil more scarce and Crypto Currency purveyors keep their supplies limited to jack up the prices – the Corporate Cartel (MFers) reduces the supply of stock AND they themselves begin buying their stock – as if it's valuable at any price. The higher the market goes, the more they buy – what can possibly go wrong?

Like any meth addict, they are now hopelessly hooked on buybacks and simply can't stop. It's a finite World and they have infinite amounts of money and they can't grow market share so they will reduce the number of shares in their companies to make it look like there's great demand for their stock and, most importantly, to make it look like they are accomplishing something.

Just this morning, Lowe's (LOW) announced a $5Bn stock buyback program ON TOP OF their previous $2.1Bn program. The entire market cap of LOW is $89Bn so we're talking close to 10% of the company being bought back in just a couple of years. That has helped Lowe's stock to go up from $20 per share in 2012 to $107 per share this morning despite earnings only going from $1.8Bn to $3.5Bn. Yes, it's an impressive 100% gain in earnings (20% per year average) but the stock is up 400%, outpacing earnings growth by 3x!

| Year End 03rd Feb | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | TTM | 2018E | 2019E | CAGR / Avg | |

| $m | 50,208 | 50,521 | 53,417 | 56,223 | 59,074 | 65,017 | 68,909 | 68,568 | 71,266 | +5.3% | |

| $m | 2,906 | 3,137 | 3,718 | 4,322 | 4,971 | 5,846 | 6,293 | +15.0% | |||

| $m | 1,839 | 1,959 | 2,286 | 2,698 | 2,546 | 3,093 | 3,556 | 3,800 | 4,516 | +11.0% | |

| $ | 1.43 | 1.69 | 2.14 | 2.71 | 2.73 | 3.48 | 4.16 | +19.4% | |||

| $ | 1.63 | 1.73 | 2.17 | 2.73 | 2.73 | 3.50 | 4.51 | 4.52 | 5.65 | +16.6% | |

| % | +12.0 | +6.4 | +25.2 | +25.9 | +0.3 | +28.2 | +64.3 | +29.0 | +25.0 | ||

| x | 30.6 | 23.8 | 23.8 | 19.0 | |||||||

| x | 1.06 | 0.82 | 0.95 | 1.68 | |||||||

| Profitability | |||||||||||

People consistently overpaying for housing led to the housing crisis that tanked the Global Economy in 2008 and now, Corporations are binge-buying their own overpriced stock with all the free, ARTIFICIALLY low-interest money that has been floating around in order to bail people out of the housing collapse. Isn't it obvious that this is only going to lead to a stock price collapse down the road???

LOW is a great company, we bought them at $75 last year as a relative value play but $107 is RIDICULOUS as it's a hardware store with a $90Bn valuation and "only" $3Bn in profits so we're paying 30x earnings at $107. Well, not "we" because I wouldn't touch it at this price but THEY are going to buy $5Bn worth, 2.5% of the company, using 1.6 YEARS worth of earnings. Does that not sound insane to you?

Clearly the company doesn't have anything better to do with $5Bn, which is sad because Home Depot (HD) is 50% bigger than LOW in sales ($95Bn) and 166% bigger in profits ($8Bn) but also 3 times bigger in market cap ($241Bn). That's right, HD is bigger in market cap than Goldman Sachs ($101Bn), Nike ($110Bn), GE ($139Bn), IBM ($155Bn) – even United Health ($240Bn), which has $184Bn in revenues and $10Bn in profits.

This doesn't seem wrong to you? Do you really think this can just keep going on and on and the markets will go higher and higher and we'll pay 40, 50, 60 times earnings and nothing bad will happen? The global GDP simply can't possibly grow fast enough to keep up with market valuations so, every year, more and more of the global GDP is being sucked up by the markets (and the Top 1%) leaving less of everything for the Bottom 99%. In fact, we just got disappointing GDP numbers on Friday and the markets still went higher – INSANE!

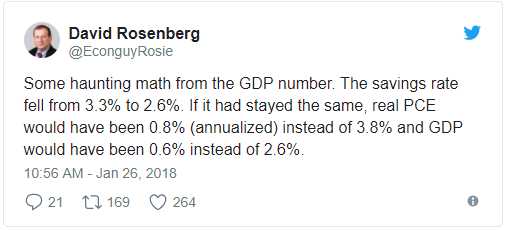

David Rosenberg took a closer look at the GDP numbers and noticed something odd. It seems that the Personal Savings Rate (something we discussed on Friday) fell from 3.3% to 2.6% and that caused the PCE to jump from 0.8% to 3.8% and that caused the GDP to read 2.6% instead of 0.6% so almost the ENTIRE GDP came on the backs of consumers draining their savings accounts over the holidays in the misguided hopes that they will really benefit from Trump's Tax Plan.

David Rosenberg took a closer look at the GDP numbers and noticed something odd. It seems that the Personal Savings Rate (something we discussed on Friday) fell from 3.3% to 2.6% and that caused the PCE to jump from 0.8% to 3.8% and that caused the GDP to read 2.6% instead of 0.6% so almost the ENTIRE GDP came on the backs of consumers draining their savings accounts over the holidays in the misguided hopes that they will really benefit from Trump's Tax Plan.

A t this point, we can only cross our fingers and pray that it works or there will be Hell to pay when that check comes due. What is very clear to economists, but apparently not at all understood by market cheerleaders, is that this level of borrowing is NOT sustainable and certainly can't be extropolated to continue by paying 30x earnings for consumer goods companies.

In fact, just this morning, China warned investors that their GDP will likly slow to 6.5%-6.8% this year and warned of potential black swan or grey rhino effects. Black swans, or unforeseen occurrences, and gray rhinos, or highly obvious yet ignored threats, are likely to occur this year with adverse consequences – according to China's Vice-Secretary General of National Development, not in a speech but in an Op-Ed of a state controlled newspaper so it's an official Government statement. That echos an earlier statement made by a former Chief Economist of the Chinese Central Bank.

The Chinese government, unlike the US Government, has been cracking down on debt risks as well as factory pollution, which by itself puts a cap on how much the economy can expand. There's also a lot of concern about the debts run up by provinces who've used stimulus measures to meet their economic goals for decades. Earlier this month, China’s banking regulator chief told the official People’s Daily in an interview that a black swan event could threaten the country’s financial stability, adding that risks, while still manageable, are “complex and serious.”

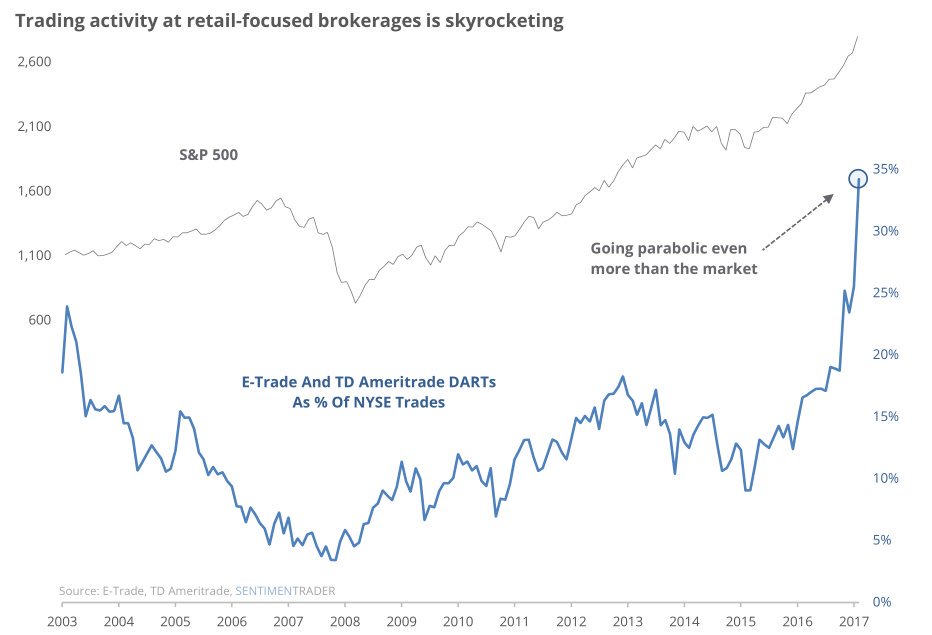

Global credit rating agencies S&P and Moody’s both downgraded China’s sovereign credit rating last year, citing worries about its rapid build-up in debt after years of credit-fueled stimulus used to meet official economic growth targets yet investors could care less and keep buying China, Japan, Europe, the US as if everyting is fine and only going to get better, spurred on by the Banksters, who need the retailers to come in and take these tremendous bags off their hands (see: "Earnings have been ‘unambiguously positive,’ and it’s going to get even better, says JPMorgan"). Those are the kind of superlatives you tend to get ahead of a correction and just look at the little suckers pouring in at the top:

I'm not saying the economy sucks or is even in trouble (though China is and Japan is) but it's not so great that we should be paying 30 times earnings for hardware stores or sneaker companies or soft drink makers – all of whom historically trade at more like 15 times earnings than 30. We had this same conversation about housing back in 2005, 2006 and 2007 and it took 3 more years of record gains before the market finally corrected so far be it for me to keep you from having fun but please, Please, PLEASE:

Be careful out there!