Wheeee, what a ride!

Wheeee, what a ride!

There's nothing like a nice market shake-out to let you know where things stand. After all the drama though, we're right back to the same 2,835 line we were watching on the S&P in yesterday morning's PSW Report. If we're back over 2,835 this morning, then all that panic was for nothing and this is merely a little consolidation off a huge run but we did run levels in our Live Member Chat Room that now need to hold on each index (futures) in order to be bullish again (currently we're just waiting and seeing):

- Weak bounce lines: Dow 26,130, S&P 2,835, Nas 6,980 and Russell 1,585.

- Strong bounce lines: Dow 26,260, S&P 2,850, Nas 7,010 and Russell 1,590

At 8am, we have (in the Futures) Dow 26,257, S&P 2,836, Nasdaq 6,968 and Russell 1,595 so mixed signals so far and nothing we'd like to throw money at though yesterday, in our Live Chat Room, we were throwing money in all sorts of directions as we played the nice, violent market moves in the Futures.

- We played the Dow (/YM) Futures long at 26,200 for a quick bounce at the open: Up $125 per contract

- At 10:12 we played the Russell (/TF) Futures long at 1,585: Up $375 per contract

- At 11:33 we played the Nasdaq (/NQ) Futures short at 6,950: Up $600 per contract

- At 1:30 we went long on the Dow (/YM) Futures again at 26,000 and that one I predicted our $400 per contract gain at the entry:

OK, that was a nice dip to 6,920 but $500+ is always a good place to give your horse a rest so done with /NQ and now looking for a bounce again.

We have 26,000 on /YM, that's a no-brainer to play with tight stops below. Lined up with 2,820, 1,580 and 6,920 so /YM is the cleanest line to play (we're a bit above) and down 400 means a weak bounce is 80 and 80 points on the Dow = $400!

Obviously bad for all if weak bounces fail. Looking for 6 on /ES, 3.5 on /TF and 15 on /NQ as bounces off those levels.

That was it for our futures trades for the day as there was too much static going into the close with Trump's State of the Union and the Fed announcement coming up. So far, Trump's speech went off without too much turmoil so the markets are up this morning and now we'll see what the Fed does at 2pm today (and we'll have our Live Trading Webinar at 1pm, EST) and then we can consider which position we want to adjust.

Meanwhile, it was a nice day trading the Futures with gains of $1,500 for each contract set traded so congratulations to all our Members and, of course – You're Welcome!

We're not a futures trading site but our portfolios are well-hedged so we really don't have much to do during a big drop other than wait patiently to see what stocks we can buy at good prices when the dust clears. Futures trading is just a fun way to pass the time while we wait and it pays for lunch, so win-win. Our Long-Term Portfolio did give up 50% of it's January gains and is now up just 2.8% for the month but our Short-Term Portfolio, which is paired with it and has our protective plays, is up 1.7% so we're up about 3% for the month and our insurance cost was zero – you're welcome!

Being well-hedged is such a benefit when the market is crashing. We can sit back and relax and check out our Watch List and look for bargains on stocks we REALLY want to buy, like Apple (AAPL), which pulled back to $166 but we're waiting on earnings to buy more – hoping they disappoint, actually – even though we already have a bullish position. Barrick Gold (ABX) will be featured in my appearance on Money Talk this evening (7pm), Alaska Air (ALK) just got downgraded by JPM for stupid reasons (United is trying to compete with them in San Fran). Yes, businesses have competion – get over it!

Being well-hedged is such a benefit when the market is crashing. We can sit back and relax and check out our Watch List and look for bargains on stocks we REALLY want to buy, like Apple (AAPL), which pulled back to $166 but we're waiting on earnings to buy more – hoping they disappoint, actually – even though we already have a bullish position. Barrick Gold (ABX) will be featured in my appearance on Money Talk this evening (7pm), Alaska Air (ALK) just got downgraded by JPM for stupid reasons (United is trying to compete with them in San Fran). Yes, businesses have competion – get over it!

Bed Bath and Beyond is still cheap at $22.99 and they are already in our portfolios but a strong buy here. Coeur Mining (CDE) got cheap again and we already have them too. Chimera Investment (CIM) is way down, so time to buy them around $17.33 and Annaly Capital (NLY) is the same management team and down to $10.50 so that's a BUYBUYBUY as well and we'll add them to our portfolios this morning. We're ready to pull the trigger on Ford (F) at $11 – patience paid off there!

See, we're only up to F on our Watch list and plenty of things we can pick up cheaply on this little market dip. Now that we know our hedges held up well on a sharp drop (2.5%), we can confidently add more longs and then punch the hedges up proportionally and you know what that makes us? BALANCED!!!

There is nothing better than being well-balanced in your portfolios. Of course, most traders reading this won't get it as they thing "balanced" means no profits but that's only because they are the suckers while we are "Being the House – NOT the Gambler" and selling premium so our balanced positions continue to make nice, steady gains while the premium we sold continues to decay. It's boring, but effective!

There is nothing better than being well-balanced in your portfolios. Of course, most traders reading this won't get it as they thing "balanced" means no profits but that's only because they are the suckers while we are "Being the House – NOT the Gambler" and selling premium so our balanced positions continue to make nice, steady gains while the premium we sold continues to decay. It's boring, but effective!

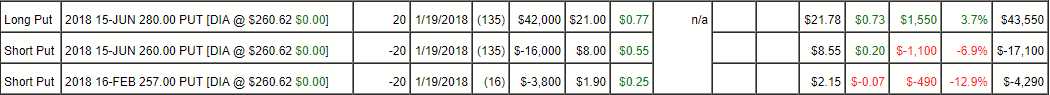

Take our Dow (DIA) hedge in the Short-Term Portfolio, at the moment it's even (well-balanced) although it's 100% in the money as it's a June $280/260 bear put spread we bought for $13 and against it we sold the Feb $257 puts for $1.90 (20 in the STP). That dropped our net cost to $11.10 ($22,200) and it's a $40,000 spread and, right now, it's about even as the net of the bear spread is currently $34,000 but the short DIA puts are now $2.15 ($4,300) which negates our profits on the spread.

But the DIA puts are out of the money and are 100% premium while our bear spread is 100% in the money and has no premium, so all we have to do is let the clock run out and we have another $15,630 (70%) coming to us if the levels stay the same and, if not – it's very easy to adjust along the way.

The idea of this INSURANCE is that, if the Dow kept going up, we'd sell the March and April whatever puts for another $3,500 each month and that would net us $10,500ish from put sales against our $26,000 hedge so net $16,000 is our risk against a $24,000 reward and the only way we can lose on the spread is if the Dow is up to 28,000 – in which case we're pretty sure our longs would more than cover the $16,000 loss on the insurance!

On the downside, we're $40,000 in the money after laying out net $22,200 so we have a $17,800 advantage on the short puts and, of course, they can be rolled lower. For example, the March $250 puts are $2.05 and the April $240 puts are $1.92 so the Dow would have to drop 1,000 points per month (5%) before we were even worried and, even then, we would simply add another bear put spread that would make another $17,800 and then another after that – adding to our hedges while still protected by the short puts.

That's what we call a Mattress Play over at PSW (see: "Hedging Your Way to Fun and Profit – Once Upon a Mattress Play").