Now this is what I call trading!

Now this is what I call trading!

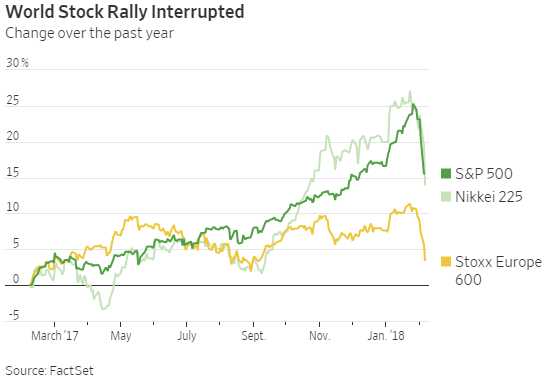

As you can see from the FactSet chart, we're about 5% below where I called for cashing out our Member Portfolios on December 5th (see "Tempting Tuesday – Stop Buying that Dip and GET OUT!!!"). At that time, I said the market was perhaps 20% overbought and, now that we've had a 5% rally and a 10% drop, I still think we're 5-10% overbought but I will concede 5% to better earnings and good global conditions (so far).

At the time, our portfolios, after 4 years, were up 200-250% and we didn't want to risk our gains gambling on the holidays – as I expected what happened this week to happen in early January, not early February. My timing was off but the call was right and we restarted our portfolios on Jan 2nd with 1/3 of what we took off the table and then we deployed less than half of that on new positions. After getting off to a great start (up about 5%) they are all in the red but yesterday we took advantage of this 10% sell-off to press our longs and take some of our hedging profits off the table.

We don't play our hedges to negate ALL downside damage – when you do that, you spend so much money on the hedges you can't make any money. What we use hedges for is to MITIGATE the damage, so we don't lose too much on a dip. All we need is some quick cash to put back into our long positions while they are low, like this adjustment to IMAX we made in our Options Opportunity Portfolio yesterday:

5 IMAX (IMAX) June $23 puts, now $4 ($2,000) can be rolled to 10 Sept $19 puts at $2.20 ($2,200) and, if we can pick up $4 in strike every 3 months, we'll be at $0 by 2020! We have 15 Sept $19 ($3.20)/25 ($1.10) bull call spreads at $2.10 ($3,150) and we can roll that down to 20 of the Sept $15 ($5.80)/20 ($2.70) bull call spreads at $3.10 ($6,200). Our initial outlay was $2,415 and now spending $2,850 so net $5,265 on what is now a $10,000 spread but mostly in the money now!

We began this trade on 1/3, when IMAX was up at $23 and now $19.70 yet we can still make almost a double at our much lower strike. That's the beauty of using these options spreads – lots of ways to adjust along the way.

The original position cost us net $2,415 and would return $9,000 at $25 while our new position (using money we made on our hedges) now cost $5,265 and returns $10,000 at just $20 so, while our expectations of gains on cash have gone from $6,585 (272%) to $4,735 (90%), our chances of collecting the money have gone up tremendously (as a new trade it's net $4,000 to make $10,000 (150%)). In any case, making 90% in 9 months is respectable – especially for a position we had to "save" after dropping 20% since we bought it! As I said to our Members:

Successful investing is about stringing together many years of 20% gains. It's better to be consistent in your winning than making big wins. That's one of the hardest things to get people to understand but nothing beats compound rate returns over time.

.jpg) Congratulations to those of you who followed our Futures trading yesterday morning. As we expected (and even charted for you!) 2,550 held on the S&P Futures (/ES) and we rallied up there past our 100-point expectations – all the way to 2,700, which was a fantastic $7,500 per contract winner on the Futures (every day this week!). As I said yesterday morning:

Congratulations to those of you who followed our Futures trading yesterday morning. As we expected (and even charted for you!) 2,550 held on the S&P Futures (/ES) and we rallied up there past our 100-point expectations – all the way to 2,700, which was a fantastic $7,500 per contract winner on the Futures (every day this week!). As I said yesterday morning:

This is, so far, simply a much-needed correction in a market that had gone too far, too fast. It would be fantastic if we settle down here and move around the 2,550 line for a while – up and down 100 points and consolidate while the rest of earnings play out because a quick rebound won't be healthy and an additional drop will quickly erode confidence and possibly lead to too much of a correction – though we'd be thrilled to buy down there – as we still have most of our cash on the sidelines.

This morning, we had a little dip and I put up a note in our Live Member Chat Room to play long as follows:

Europe was holding us back yesterday and I think they aren't done selling US Equities is why we're down. I'd play /TF long IF they get back over 1,500 – that's a good line, as is 6,600 on /NQ, 2,670 on /ES and 24,600 on /YM is more of a check-sum for the others – if all are above, play the laggard long (I'm going back to sleep, I have a Webinar). Those are also good shorting lines as we go the other way into the EU open but hopefully we hold a 1% pullback – which is 250 points on the Dow (about 24,550).

For their own trading, Europe looks to be opening up over 1%, but they are just catching up on our weak bounces from yesterday – don't mean a thing if we can't take the strong bounces and not good if the weak ones fail!

Nikkei had a terrible morning and China is heading into their Golden Week holiday, so people are selling – just in case and Shanghai is down 1.8% and Hang Seng down 0.7% but it's more like cautious selling into a holiday weekend's uncertainty at this point.

If my blame China theory is correct, we should start turning back up around 4am (when they close). Meanwhile, we're down 1% at 25,550, 2,666, 6,587.50 and 1,492 but very dangerous to play until we get our better bullish crosses.

As you can see, 2,666 held perfectly on the S&P (/ES), giving us nice, quick $1,000 gain and NOW we are waiting and seeing what happens next because 2,685 is a bit below yesterday's close and today is all about holding that strong bounce line (see yesterday's notes) at 2,650. On the whole, I'd rather if we consolidate here before even popping above 2,700 again as 2,850 was too high. Hopefuly we can hang around 2,650 for a week or two and form a proper base before trying to move higher again – but traders are so impatient.…

As you can see, 2,666 held perfectly on the S&P (/ES), giving us nice, quick $1,000 gain and NOW we are waiting and seeing what happens next because 2,685 is a bit below yesterday's close and today is all about holding that strong bounce line (see yesterday's notes) at 2,650. On the whole, I'd rather if we consolidate here before even popping above 2,700 again as 2,850 was too high. Hopefuly we can hang around 2,650 for a week or two and form a proper base before trying to move higher again – but traders are so impatient.…

We are not traders, we are investors and we took advantage of yesterday's dip to press some of our longs and we even added 4 new positions – as they were just too good to pass up. Today, we'll be looking for positive signs of consolidation and certainly we'll be doing a bit of bargain-hunting.

We have a Live Trading Webinar at 1pm, EST and we'll do an extensive review of our Watch List, which has dozens of great trade set-ups, ready to go!