We're up 300 more points!

We're up 300 more points!

That would be exciting but it's only 1.25%, which is exactly what our 5% Rule™ predicted and, at this stage, is certainly no sign of market strength yet. While we flipped bullish in Friday Morning's PSW Reprort, with a long at Dow (/YM) 24,000 that is now up $2,500 per contract (you're welcome). Of course, first it was down $2,500 per contract (cue screams) but not if you followed our instructions, which were:

Well here's the test of 24,000 and we're failing that and 2,600 and 6,350 and 1,470 but those are now the lines we want to play long if we move back up but very ugly if we're failing that.

Just before the market opened (9:17), in our Live Member Chat Room, I updated my prediction for our Members:

For now, we'll worry about the S&P lines – same as yesterday because, if we have to redraw them, then the Index is already failing (and forcing us to use lower levels).

And, of course, the lines don't change but the line we key off does. Right now, we are looking at the 20% line on /ES and premising we consolidate there but, as I said yesterday, I think it's more likely we drift down to the 10% line (2,420) and that's where we should consolidate into Q2. So, on the whole, I'm thinking 2,684 is going to fail today and we'll retest 2,640 next week and possibly blow it – hence the desire for more hedges!

Meanwhile, our index longs are doing great – don't be greedy. Should hit resistance at 1,480 on /TF, 24,100 on /YM, 6,400 on /NQ (big time) and 2,615 on /ES.

That was a chart we drew for Thursday Morning's PSW Report and now we can update is so you can see how good the 5% Rule is at predicting these moves:

Since we can exactly predict the moves of the S&P 500 2 days in advance (and actually we're using numbers we based out 4 months ago!), it should come as no surpise that, at 1:17pm on Friday, in our Live Member Chat Room, I was able to make the following call:

Back in the saddle on /YM long at 23,453 (2).

As it turns out, that was pretty much the exact moment we turned back up and the move back to 24,000 was good for gains of $5,500 for 2 contracs for our Members – not bad for a Friday! Overall, we positioned ourselves long into the weekend but, as noted by the S&P chart above, we remain skeptical until we see that strong bounce line on the S&P 500 being crossed at 2,728 – and that's another 3% higher than the 1.25% gain we're showing in the Futures at the moment (8:30).

Still, we did a lot of bargain-shopping last week and we put more money into existing bullish positions in our portfolio as they got cheaper so we are certainly hopeful that this 10% correction will be enough to satisfy the market Gods – for the short-term, at least. Overall, I think this may still be the top of a lower range we drift into by June but drifting lower won't be bad for our well-hedged, well-balanced portfolio – it's the short, sharp shocks we have to watch out for.

Anyway, I'd love to get back to discussing the fundamentals of the market but nothing really happened over the weekend so we're very likely to just drift up towards the weak bounce line while we wait for a proper catalyst. We'll get details of Trump's Infrastructure plan this week but that's likely to be a bit of a disappointment – though still gives the market something to rally about – the question is, where will the sellers show up?

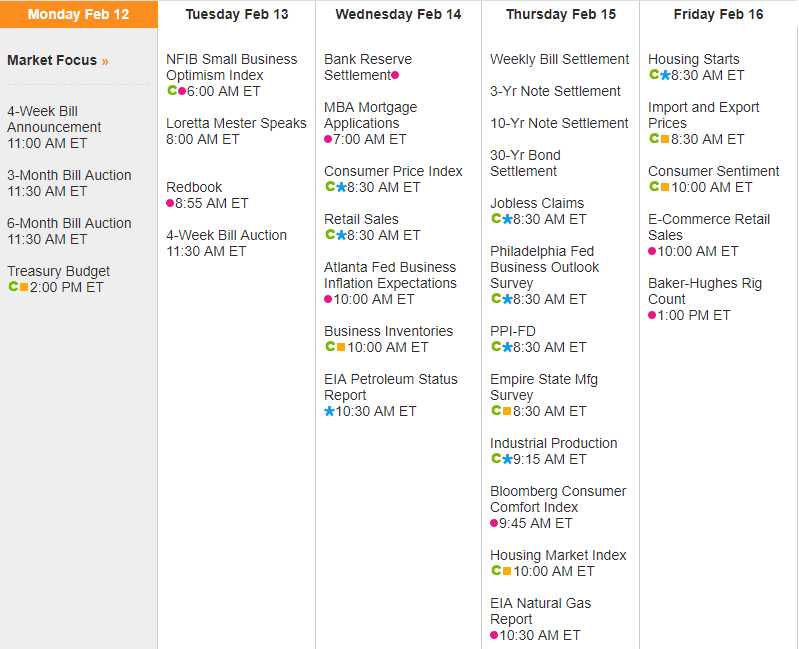

Not a lot of Fed speak and not a lot of data but at least we have earnings, with pretty much the last 100 of the S&P 500 reporting earnings this week:

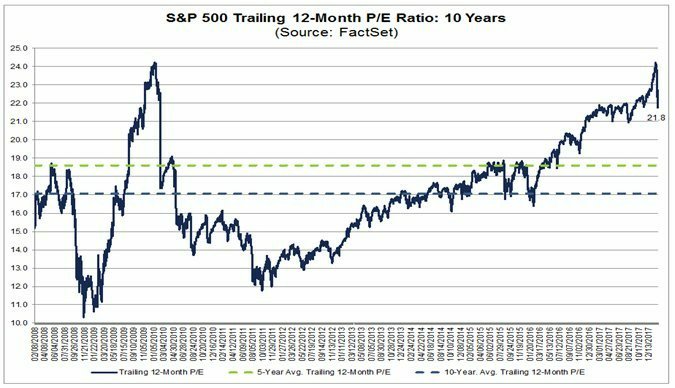

Earnings ratios have corrected off their insane highs but there is still a lot of work to be done to get back into "normal" territory. HOWEVER, it doesn't have to be all prices coming down, a combination of lower prices and higher earnings will do the trick and, so far, earnings are up about 6% from last year overall, though mainly driven by a sharp recovery in the energy sector. Still, if prices come down another 10% and there's even a mild increase in earnings from lower taxes, repatriation of overseas cash, infrastructure spending and continued QE (which is winding down) along with interest rates which are still very cheap – it's easy to see why we don't expect more than a 10% additional move down this year.

We're just watching and waiting this morning – pre-market moves are meaningless and Monday's are meaningless anyway so we'll just see where we drift before placing any new bets.