3,998.95!

3,998.95!

That’s where we finished up yesterday after spiking to 4,004.75 and we’re thrilled just to be in the neighborhood after our first week of Q2 earnings. Now, before we get too excited, let’s keep in mind that we fell 20% from 4,800 back to 3,840 (the rest is just an overshoot we ignore) AS PREDICTED and getting back to 4,000 is merely a WEAK BOUNCE – also as predicted by our fabulous 5% Rule™ – not to mention our Fundamental Valuation Model.

Earnings are simply bearing out our expectations for the large caps at the moment and, don’t forget, we’re still enjoying that technical tailwind provided by the rising MACD – which is coming to an end in the next week or so – so we’re not expecting to get further than the Weak Bounce Line (4,160) before we’ll need some macro condition changes to take us any higher.

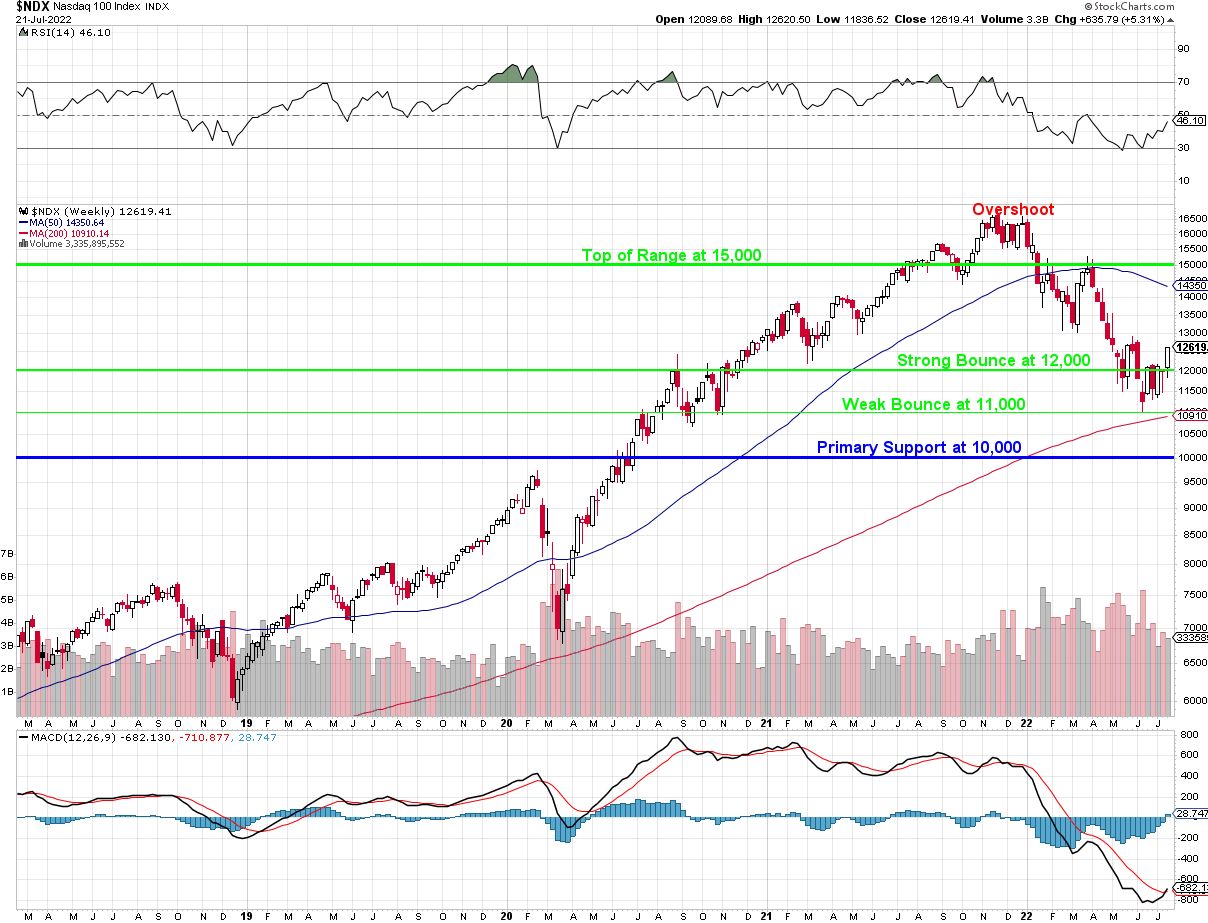

On a brighter note, the indefatigable Nasdaq 100 (NDX) has survived its 30% pullback with style and we are looking MASSIVELY OVERSOLD from a technical standpoint on the weekly chart although, FUNDAMENTALLY, it is very much a stock-picker’s index and you should be very careful about placing those bets.

This is NOT a rally you want to miss if it happens but keep in mind this is a weekly chart so it can take another quarter to play out. Still, as long as the Nasdaq is over 12,000 (strong bounce line), it’s consolidating 100% higher than we were in 2018 – and that’s certainly nothing to complain about.

The S&P 500 has 350 points (8.75%) to go to get to its 50-day moving average and the Nasdaq has 1,750 points (13.8%) to go to get to it’s 50-week moving average but we need to keep in mind that both of those MA’s were from overpriced levels – we don’t expect breaks above them. Still not something we want to miss either.

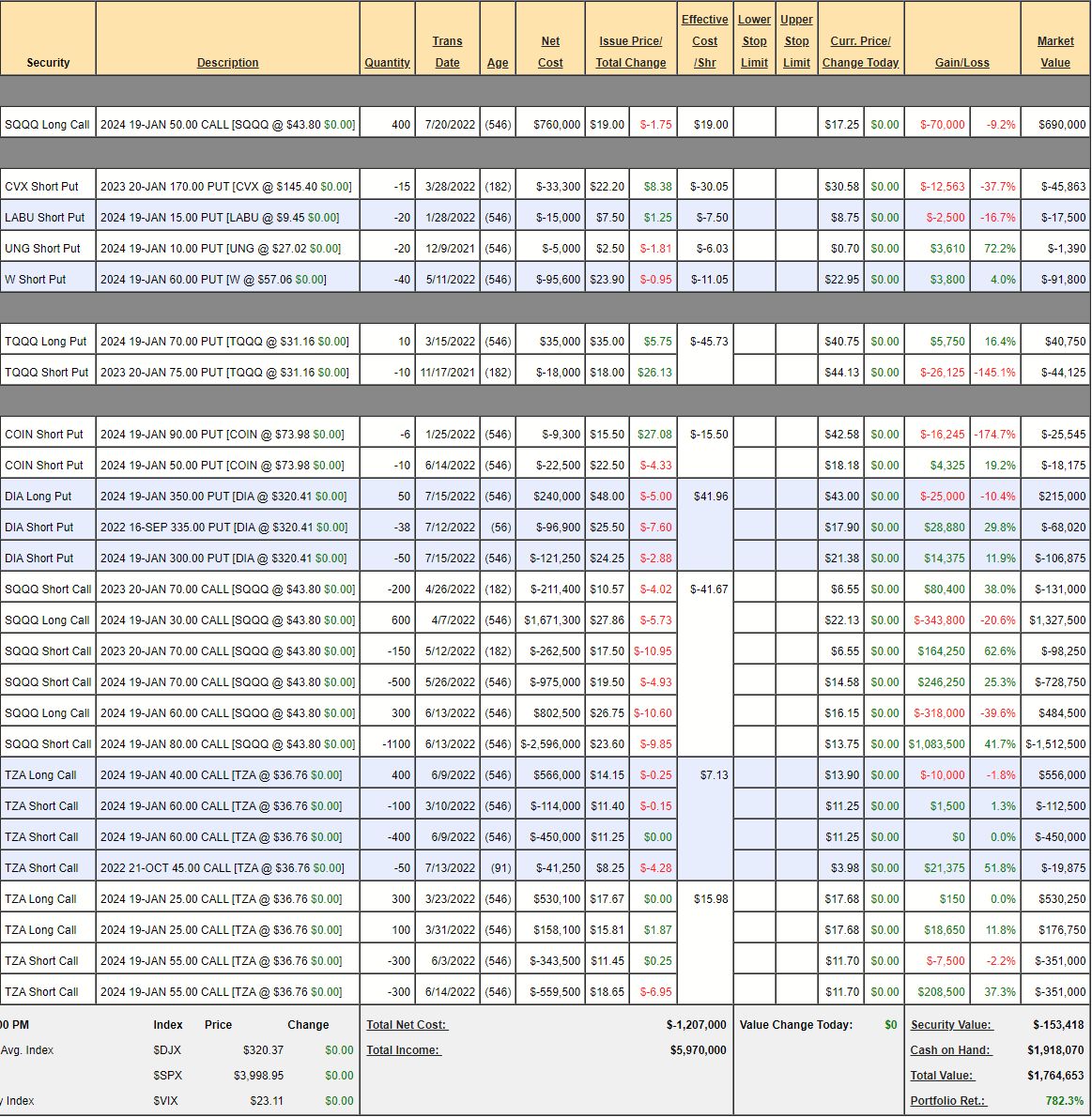

And we’re not missing a thing so far as, despite last Friday’s slightly bearish adjustment, the hedges in our Short-Term Portfolio are at $1,764,653, which is up $230,965 (15%) from our July 12th review – as we had flipped pretty bullish by then. The LTP is back near $2M so we’re very close to our expected $4M combined goal for this upswing already and we’re going to do some relatively inexpensive housekeeping to lock those gains in:

-

- SQQQ – To be discussed below

- Short Puts – Just a way to generate cash. We collected $148,900 in exchange for promising to buy 4 stocks at lower prices (mostly leftovers from successful short spreads) and now they are bouncing back and improving our fortunes.

- TQQQ – Also a leftover so the money has been made and we’re gambling that the shorter-term premium will burn off and leave us with more profits.

- COIN – Finally making a small comeback. We sold the 10 $50 puts as a pre-roll to the 6 short $90 puts and we’ll be thrilled to just get out even on this one.

-

- DIA – We were losing on our July short puts so we rolled them to September and now we’re being rewarded.

- SQQQ – Our main hedge is where we can make the small adjustment of buying back 150 of the short Jan $70 calls while they are under $100,000 and up 62%. Not because I think we’ll be over $70 but to clear the deck for our next move. Assuming the 200 remaining short Jan $70 calls expire worthless, we’re left with 1,400 longs and 1,600 shorts – that’s a balance we can live with on another downturn – especially as we have 600 of the 2024 $30 calls. We will look to cash 200 more of those if they get back over $30!

Remember, this is a HEDGE and not a bet. We are SUPPOSED to lose money in the STP when the LTP is doing well. What we did in the last two reviews was a BET – we called the bottom and cashed in some of our hedges – leaving the STP bullish. It paid off but it’s not something we should be doing as a rule, so now we get back to work and move back to a more bearish posture to lock in our LTP gains.

-

- TZA – We got too close to being in trouble on the short October $45 calls on this dip, so let’s buy those back as well. That leaves us with 800 long and 1,100 short and our next move (if we feel it necessary) would be to roll the short $55 calls to higher strikes to widen the spread. Figure we’ll spend $5 or less to roll up $10 and that would be $150,00 per 300 we’d have to spend but we have plenty of cash and, hopefully, the market behaves and we don’t need to do that.

Last we checked, we had about $4M of downside protection before we started to give money back to the short callers and that is PLENTY – especially if we stay over 4,000 on /ES and over 12,000 on /NQ.

Have a great weekend,

-

- Phil