Back on Jan 2nd, on a run from 8,400 to 9,100, I went bearish.

Back on Jan 2nd, on a run from 8,400 to 9,100, I went bearish.

Over in our Phil’s Favorites section today, Corey Rosenbloom posted this chart, saying "We’re all set to Test or Break November Lows" and I like the chart that points to the word "trap" as trap is exactly what we talked about as we had an almost unbroken streak of 6 consecutive positive days in a low-volume run-up. At the time I said: "our worry is that this weekend’s reading of annual reviews is going to be downright depressing as well as the very distinct possibility that the entire "rally" may have been nothing more than window dressing."

Well now we are clearly UNdressed again and searching for the real floor but that same "trap" applies to the lows as well as the highs in a range-bound market. My premise on Jan 2nd was that the run-up in energy stocks was overdone (check), that oil prices would fall again (check) and that "the dollar will most likely assert itself in a flight to safety, knocking all commodity prices (including stocks) back down sharply" (check). We hit our 8,200 bottom target yesterday and broke through it, barely getting back there at the close, which is considered a bad sign on the 5% rule as 8,217 is 95% of our 8,650 mid-point. My 9:31 comment to members yesterday was that the degree of fear we were seeing in the morning could lead us down to 8,080 on a spike down and we hit 8,147 before a minor "stick save" into the close that got no one excited.

AAPL was no help at the close and may give us our bottom this morning but the financial frenzy seemed a little overdone and our last trade idea of the day was the naked sale of the SKF $150 calls for $4.40. Even if SKF does hit that as C, BAC and JPM go back to their lows, that caller can be rolled to the Feb $200s, now $8.90 and, if SKF maintains that level for more than a couple of days, we will all have much bigger things to worry about than paying off that caller! Of course SKF was also one of our first trades of the day and we may already need that roll for the $140s that we played the same way in the morning for $5.50 but that seemed overdone as well and can also be rolled.

AAPL was no help at the close and may give us our bottom this morning but the financial frenzy seemed a little overdone and our last trade idea of the day was the naked sale of the SKF $150 calls for $4.40. Even if SKF does hit that as C, BAC and JPM go back to their lows, that caller can be rolled to the Feb $200s, now $8.90 and, if SKF maintains that level for more than a couple of days, we will all have much bigger things to worry about than paying off that caller! Of course SKF was also one of our first trades of the day and we may already need that roll for the $140s that we played the same way in the morning for $5.50 but that seemed overdone as well and can also be rolled.

We actually had a very busy day with a lot of bottom fishing plays – mostly selling naked puts from our list of Stocks to Buy at the Bottom but only 18 out of 40 stocks on the list were low enough for us to nibble on – the rest are still holding up too well for us to want to jump back in. So on the one hand, we’re hoping that 22 stocks we love get cheaper but,on the other hand, we can’t resist the deals being offered on 18 of them. This is what fishing is all about – patience. Sometimes you fish all day and get nothing and sometimes the ones you get are too small (not ready yet) and have to get thrown back. A fisherman understands that there will always be another fish and a good stock trader needs to do the same!

So here we are with an unbroken streak of 6 consecutive days down and perhaps this too will merit a "trap" tag when we turn back into our range. All of Asia fell off to the 5% rule this morning but the HSI recovered into the close to get back to -3.3% while the Shanghai finished down just half a point. RTP led the mining sector down globally with in-line production numbers that were pretty dismal and reflective of slumping global demand. "Risk aversion has returned, replacing hope of an early rebound and we expect the U.S. dollar to remain supported as capital preservation becomes increasingly important," said analysts at UBS.

Financials also got globally crushed this morning led by the news that BAC will be taking another $10Bn from the Treasury (they got $15Bn in October) but this was money that was really going to go to MER anyway before BAC acquired them so I’m not sure what everyone is acting all so shocked about. What’s shocking is that, as of Tuesday, the government has injected $192Bn into 257 banks AND STILL INVESTORS THINK THEY ARE INSOLVENT.

Financials also got globally crushed this morning led by the news that BAC will be taking another $10Bn from the Treasury (they got $15Bn in October) but this was money that was really going to go to MER anyway before BAC acquired them so I’m not sure what everyone is acting all so shocked about. What’s shocking is that, as of Tuesday, the government has injected $192Bn into 257 banks AND STILL INVESTORS THINK THEY ARE INSOLVENT.

Our pal Meredith Whitney was on CNBC last night with her estimate that they would lose $3.25 a share next year – 10 times what the average analyst believes likely. She was not on a panel and there was no analyst to counter her claim. In fact, Whitney’s proclamations are treated as if she is the be all and end all of future financial earnings and that is one of the reasons I started picking XLF and UYG the past two days.

Perhaps one or two banks may fail but not the entire banking system. Bernanke has flat out said he is willing to keep rates at zero for as long as it takes, which means a bank can effectively borrow money at 0% and profitably lend it to you at 2% and make good money (how do you think Japanese banks ended up being the strongest in the world). Even people with fantastic credit and bullet-proof assets surely want to borrow some money for 2%. Forget the "moral hazard" or the US debt issues, which are all real and scary, this is about the banks as a business and a business in which you can have money for free and get interest from someone else is a good one but it’s not going to show results in just one quarter. The biggest banks – the ones in position to lend the most money CONSERVATIVELY will be the biggest winners. We just spent a decade watching this work in Japan and the US program is like Japan on steroids and was implemented much faster than the Japanese bailout.

Primarily what we have going on in the markets is a mini temper tantrum by investors who are looking for a V-shaped recovery when clearly we will be lucky to have a U-shaped recovery. You can see from this chart that the global markets spiked down in unison in late October and, since then, the World Banks have put over $12Tn of stimulus programs into play, looking to shore up the global $50Tn economy. Most of these measures have had just weeks to begin to be measured and NONE of the reports we are getting reflect any of those changes other than LIBOR, which came back down to normal levels and was also our early indicator of the crisis. If we were playing for a V-shaped recovery, we wouldn’t be selling calls against everything we buy – we expect a long-term flat trend and, in this volatile market, it means we should be as unsurprised by 8,100 as we are by 9,100. The 40% line still rules and it’s going to take a lot for us to decide the proper discount for gobal markets is 50% or 30% for that matter.

Primarily what we have going on in the markets is a mini temper tantrum by investors who are looking for a V-shaped recovery when clearly we will be lucky to have a U-shaped recovery. You can see from this chart that the global markets spiked down in unison in late October and, since then, the World Banks have put over $12Tn of stimulus programs into play, looking to shore up the global $50Tn economy. Most of these measures have had just weeks to begin to be measured and NONE of the reports we are getting reflect any of those changes other than LIBOR, which came back down to normal levels and was also our early indicator of the crisis. If we were playing for a V-shaped recovery, we wouldn’t be selling calls against everything we buy – we expect a long-term flat trend and, in this volatile market, it means we should be as unsurprised by 8,100 as we are by 9,100. The 40% line still rules and it’s going to take a lot for us to decide the proper discount for gobal markets is 50% or 30% for that matter.

As we expected, the ECB dropped their discount rate to 2% but the half-point cut got a big ho-hum from the EU markets, which are down about half a point ahead of the US open but improving slightly. Greece got a credit downgrade and S&P has also threatened Spain, Ireland and Portugal with downgrades. Ireland was forced to deny that it needed aid from the International Monetary Fund. Germany may be looking at -2% GDP growth and the credit rating downgrades make it hard for those governments to put more stimulus packages to work as their cost of borrowing money grows. This is the problem with a unified currency with independently rated nations underneath it – Why would you buy Greek bonds with A- ratings when French ones pay the same interests in the same currency with an A+ rating? S&P blamed Greece’s "repeated failures to stick to budgetary plans" for the downgrade and warned that the country’s economic and budget forecasts for this year were so optimistic as to be "unattainable."

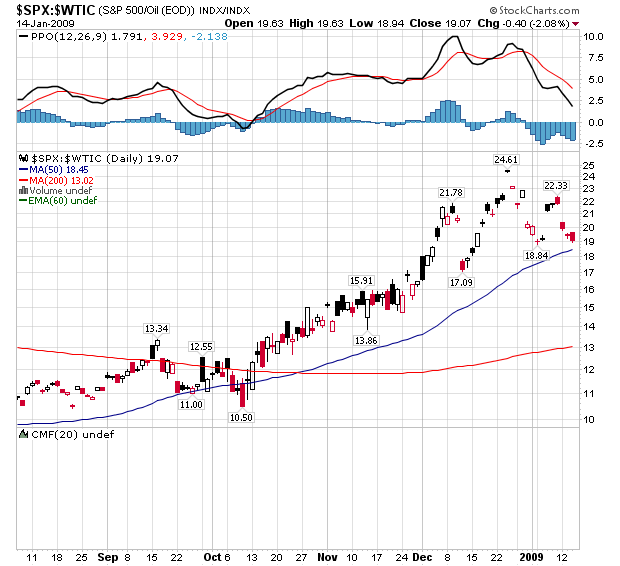

This sent the Euro tumbling to $1.30, a five-week low and the ECB is widely expected to have to join the rest of the world in the 0% club and the fact that Trichet is dragging his feet is putting a lot of pressure on EU markets. Keep in mind that everything is relative and the most important chart I can show you is this:

This chart is the S&P 500 priced in barrels of oil and the weekly chart shows an even stronger trend that has been in place since June of last year. A similar chart would show up if you substituted most metals or housing or retail goods as most commodities are being marked down far faster than stocks. If your 10,000 shares of AAPL in 2007 at $140 could have been traded for a 1,500-foot New York City apartment and if the same 10,000 shars of AAPL at $80 can be traded for that same apartment – what have you really lost? AAPL lost $5 today as Jobs takes a leave of absence but oil is down 5% pre-market as well.

Keep that in mind before you join the herd and panic out of your assets. Over the long haul, it’s all about relative performance and this market has forced us to become long-term investors but there are plenty of people willing to pay us a good premium to gamble that our stocks will spike up or down and they provide an excellent monthly income opportunity while we wait for the next thrill ride.