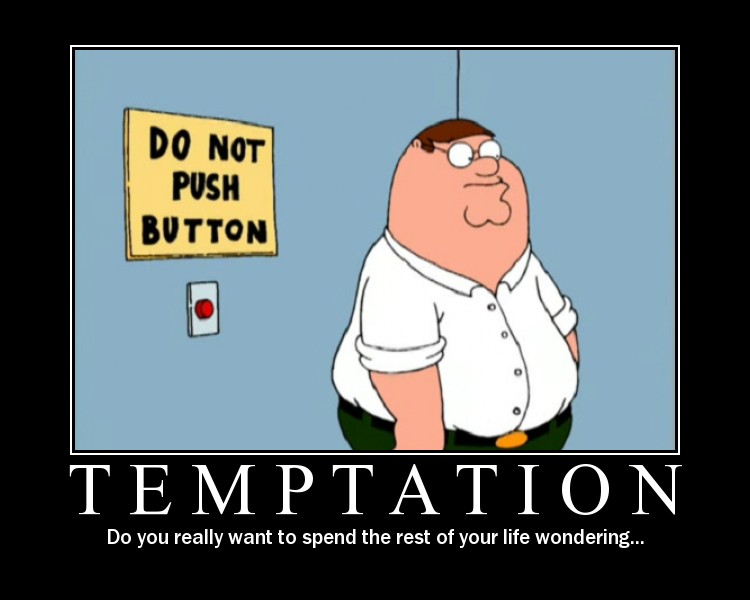

Once again the markets will lead us to temptation.

According to Bloomberg, Zhang Shibao covers 12 Chinese stocks and recommends investors buy all of them, even after they've more than tripled on average in the past year. “We are still in the middle of the bull market and the uptrend is irreversible,'' said Zhang, a steel analyst at China Merchants Securities Co. in Shenzhen.

Oh, the IRREVERSABLE uptrend – that's the missing piece of the puzzle! Now I can BUYBUYBUY with confidence! Foreign investors certainly jumped back into the Shanghai B-shares with confidence as they bought that market up over 5.6% on the day while the A side of the market held flat, perhaps waiting for them to catch up (yesterday we noted a 20% disparity between the two). Despite the irrational exuberance over in China, Asian markets were flat to lower yesterday but it was a strange day as the Hang Seng reversed an opening 150-point gain while the Nikkei reversed an opening 100-point loss.

Much of Shanghai's standout performance can be attributed to the debut of shipping firm Cosco Holdings' 93% gain in its first trading day. Gosh, a shipping company doing well based in the World's largest exporter – who'd have thunk it? Also from our "Duh File" (any Chinese stock with an obvious name), Huangshi Dongbei Electrical Appliance went limit up (10%) for the day. In reason #114 of why I hate to play ADRs, SNP's stock fell 5.7% as the Chairman suddenly resigned for "personal reasons."

The leaders of China's top state-owned companies are all appointed by the government, and changes often are made suddenly with little or no explanation. Because the government owns controlling stakes in companies such as Sinopec, outside investors generally have no say in such decisions. The Sinopec chairman has been a leading advocate of easing government controls on fuel prices in China. Goldman Sachs said Mr. Chen's departure, two years before his expected retirement date, could slow the pace of fuel-price restructuring in China and hurt the company's expansion plans.

Meanwhile the most significant news in Asia is conspicuously absent from the WSJ today, the Yen carry trade is starting to really unwind after Japan's Finance Minister warned that this was no longer going to be a safe bet for investors. It was the fear of the unwinding carry trade that led to the Feb 27th market correction so you'd think it would rate a mention in the Journal (or did Murdoch already buy it?).

Over in Europe (where Mr. Murdoch already controls the media and one of his British papers, The Sun, has NO business section), the markets are coming off a poor open to recover into the afternoon. As we noted in yesterday's wrap-up, it's the FTSE we are most concerned with as it hovers around to 6,000 mark. Europe got some good news from MO, who are shutting down a plant in North Carolina and moving 25,000 production jobs to Europe and despite all that pesky free health care, government oversight and higher taxes they still expect to save about $335M a year by 2011.

For our part, we're going to worry about the Dow and the Nasdaq confirming the breaks below the 50 dmas (red lines) made by the NYSE and the S&P yesterday. Until the S&P gets firmly back over 1,510 we shall not be tempted to go long and I will want to a couple of these blue lines broken before I look for anything other than an upside momentum play:

Happy Trading has analysis of both the Nasdaq and the S&P over at Wang's World and we'll be watching his buy recommendations of GOOG $540s, WFR $60s (I hope not because I sold these!) and BUCY $70s as our best upside targets if we really start to rally. Of course we still have our reverse mattress plays on the DIA and the Qs but with oil holding over $69, I don't think we're in danger of the markets running away on us.

We have new home sales and consumer sentiment numbers coming today and Fed Gov Moskow is making a speech so anything can happen after the market opens. We do not want to see gold going up as it's an inflationary sign but if it turns sharply down it may mean the dollar is rallying and that can be a worry for commodities, which would include US housing and securities. In short: lots of ways to get hurt + not too many ways to win = a good time to watch and wait.

I'm hearing rumors that Mac notebook sales are through the roof this quarter and we already know that Quanta, their main supplier, is gearing up for a record 2007. The Apple bashing is fast and furious ahead of the IPhone release, just like it was ahead of the IPhone announcement around Thanksgiving (remember when Jobs was going to be arrested for options fraud or whatever they were saying?). There was a great "sell on the news" move in December, pushed by the options scandal but all the people who jumped out as the stock fell from $93 to $77 might be just a bit sorry with the stock at $123 if they've been waiting for it to pull back a little more.

My current Apple strategy is accumulate on the dips but the dips have been few and far between so I have open calls protected by October puts but I see $125 forming up as a pretty solid floor for future advancement once they make it through.

While we may get another rally today, let's make sure we see the other side of our levels before we start chasing rainbows today. 13,500 or bust is my new rally cry (my S&P 1,540 or bust last week was dead on) so let's not kid ourselves. Home values in 20 metropolitan areas fell the most in 6 years with home values down 2.1% amid record supplies of properties for sale. The average home fell .2% in April after falling .3% in March. While that may not sound like much that's effectively $200 per $100,000 in home value you are spending per month to hold onto your house and this is the 17th consecutive month of declines.

Reality is far worse for cities like Detroit, where home prices fell 9.3% from last year.