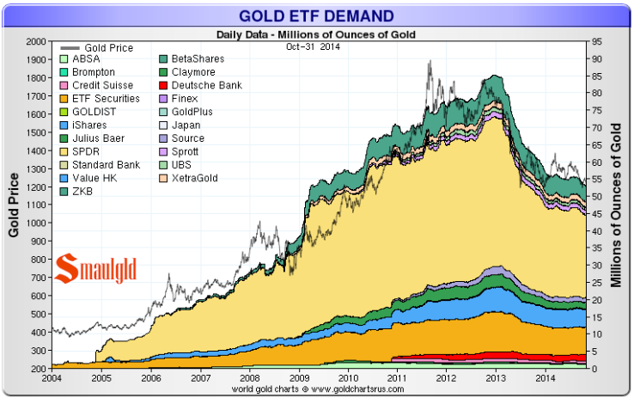

Gold/StJ – I think there's been a supply glut this year as miners dump inventory as well as ETFs flooding the markets with their physical gold. Demand has been off as people don't have the money to buy gold and there's only so many bathrooms Trump can decorate. I think the real swing is in ETF holdings, which have dumped 40M ounces (1,250 tons) of gold onto the market in the last two years:

When (and if) gold comes back in vogue and these ETFs start buying, there will be no way to keep up with the surge in demand. Since the ETFs only have 50M ounces left, it's not likely we'd have another move like we did (from $1,800 to $1,200) so figure another 33% drop to $800 is very unlikely and, even if it happens, it would be time to BUYBUYBUY at that bottom. Realistically, $1,000 should be a very solid floor and it won't take much to kick us back to $1,200 – so that makes this a great entry point.

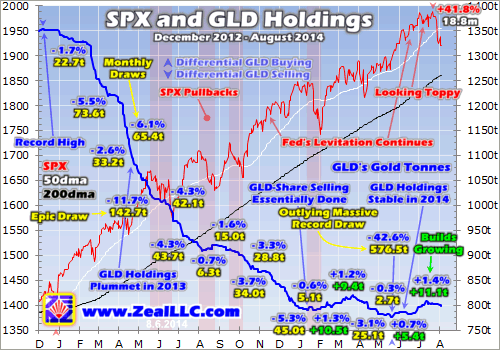

That chart may not even tell the whole story as this one from Zeal says GLD alone dumped 500 TONS of gold since Dec 2012 – that's almost doubling the supply hitting the market for two years, ovewhelming any buying done by Central Banks or gold bugs.

Oops, bad math before, StJ was correct, it's 2,500 tons per year that's mined so the ETFs dumping 1,250 tons on the market over 2 years bloated the supply by 25% - still a lot, of course. Good gold facts here.

Of course, that goes back to my point that, even if they dump half their gold again in the next year or two - it will have 50% less effect than the last two years have had in depressing prices.