F/Albo - I love them down here.

In fact, I don't think I've done a Top Trade this week so let's make it Ford who, unlike Tesla, Made $4.6Bn last year on $152Bn in sales (TSLA lost $2Bn on $7Bn in sales) yet you can buy F for $44.4Bn at $11.15 per share while TSLA is at $49.75Bn at $305/share (up again today).

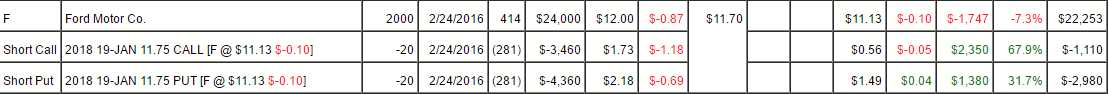

Even better, with F, you can hedge the Hell out of them and they pay an 0.60 dividend (5.34%) so they are worth owning too. In our LTP, we came in at $12 on Feb and our position is:

In the LTP, I'd like to buy back the short Jan $11.75 calls for 0.56 and we can buy back the 2018 $11.75 puts ($1.48) and sell 20 2019 $12 puts ($2.43) to drop another $2,000 in our pocket and get more aggressively long (no short calls) but we will sell short 2019 $12 calls (now 0.88) when F is back at $12.

As a new trade idea, I like the following:

- Sell 10 F 2019 $12 puts for $2.43 ($2,430)

- Buy 1,000 shares of F for $11.15 ($11,500)

- Sell 10 F 2019 $10 calls for $1.80 ($1,800)

That's net $7,270 ($7.27/share) which make the 0.60 dividend 8.2% while you wait to see if you are called away at $10 for an additional 37.5% gain. Of course we would likely roll the short calls to 2021 before they expire and sell more puts but 37.5% + 7 dividends (missed 1) at 0.15 = $1.05 = 14.4% so 51.9% in less than 2 years is a really nice play and the low cost means it's not even bad in an IRA with high margin requirements.