Courtesy of Market Tamer

Improve Your Market Timing: The Bullish Engulfing Pattern

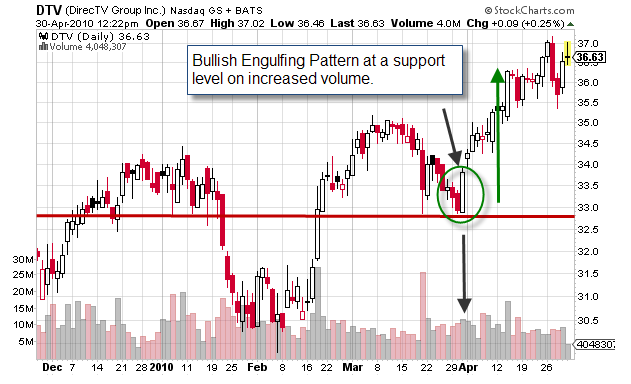

- The Bullish Engulfing Pattern is a bullish reversal pattern and is considered a major candlestick formation.

- The pattern is most effective when found at the bottom of a downtrend.

- The pattern represents a change in investor sentiment and is characterized by an initial gap down from the prior trading day.

- The stock will not follow through with the initial gap and will begin to trade up on increased volume.

- The mature pattern will end the session with a close above the prior session’s open, thus engulfing the prior session’s real body.

- The pattern is considered stronger when the stock trades up from a larger gap down and if it not only engulfs the real body but the entire trading range of the prior session.

- Sometimes you will see a situation when the Bullish Engulfing Pattern wraps around and engulfs several prior sessions and that is a very convincing reversal scenario.

- The Pattern is additionally effective when combined with a pre-defined level of support as represented by chart patterns, major moving averages, Fibonacci levels and trend lines.

- Oscillators such as Stochastics or RSI can also confirm a changing sentiment from being oversold to becoming more bullish.