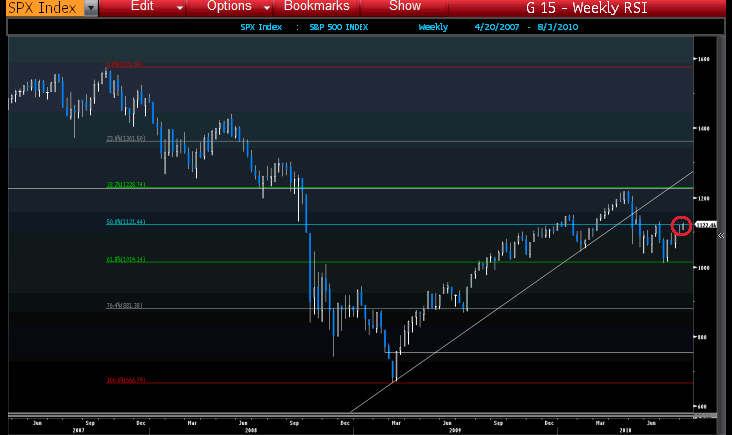

Here we are back on the 50% retracement line at 1,121 on the S&P. As Barry Ritholtz points out, it’s the 5th time we’ve been here and, as I said yesterday, Barry says "Its going to take a lot of something — good earnings, liquidity, sentiment, breadth, momentum, psychology, quantitative easing, something – to move higher from here." Also great on Barry’s site today is a very neat summation of the housing crisis and his take on Timmy G’s NY Times Op Ed column, which I need to add my own .02 to.

Mr. Geithner tries to give us that "something" Barry and I are looking for by boldly stating: "Welcome to the Recovery," writing that "uncertainty is understandable, but a review of recent data on the American economy shows that we are on a path back to growth." He continues:

While the economy has a long way to go before reaching its full potential, last week’s data on economic growth show that large parts of the private sector continue to strengthen. Business investment and consumption — the two keys to private demand — are getting stronger, better than last year and better than last quarter. Uncertainty is still inhibiting investment, but business capital spending increased at a solid annual rate of about 17 percent.

• Exports are booming because American companies are very competitive and lead the world in many high-tech industries.

• Private job growth has returned — not as fast as we would like, but at an earlier stage of this recovery than in the last two recoveries. Manufacturing has generated 136,000 new jobs in the past six months.

• Businesses have repaired their balance sheets and are now in a strong financial position to reinvest and grow.

• American families are saving more, paying down their debt and borrowing more responsibly. This has been a necessary adjustment because the borrow-and-spend path we were on wasn’t sustainable.

• The auto industry is coming back, and the Big Three — Chrysler, Ford and General Motors — are now leaner, generating profits despite lower annual sales.

• Major banks, forced by the stress tests to raise capital and open their books, are stronger and more competitive. Now, as businesses expand again, our banks are better positioned to finance growth.

• The government’s investment in banks has already earned more than $20 billion in profits for taxpayers, and the TARP program will be out of business earlier than expected — and costing nearly a quarter of a trillion dollars less than projected last year.

While I agree with Geithner that there are plenty of "green shoots" to go around, it’s still a little early to plan a garden party. I suppose the administration has decided it’s time to try to give the people an attitude adjustment – which is a necessary step to properly get us out of a recession. The difference between a recession and a depression is attitude, the Great Depression was called that because people were literally depressed. Depressed people don’t try to get jobs, they don’t try to expand and hire and they sure don’t shop. I am happy with Timmy’s closing comment, which indicates their eye is still on the ball:

While I agree with Geithner that there are plenty of "green shoots" to go around, it’s still a little early to plan a garden party. I suppose the administration has decided it’s time to try to give the people an attitude adjustment – which is a necessary step to properly get us out of a recession. The difference between a recession and a depression is attitude, the Great Depression was called that because people were literally depressed. Depressed people don’t try to get jobs, they don’t try to expand and hire and they sure don’t shop. I am happy with Timmy’s closing comment, which indicates their eye is still on the ball:

There are urgent tasks to be undertaken to reinforce the recovery, and Congress should move now to help small business, to assist states in keeping teachers in the classroom, to increase investments in public infrastructure, to promote clean energy and to increase exports. And while making smart, targeted investments in our future, we must also cut the deficit over the next few years and make sure that America once again lives within its means.

We suffered a terrible blow, but we are coming back.

Bill Clinton proved that you can come back from a terrible blow – so we should probably give this adminstration the chance to do the same… Obviously the timing of Geithner’s piece in the Times is no accident and we’re probably in a full-court press this week to pop our levels and get us over those 50% lines to start the 2nd half of 2010. China moved up about 0.5% this morning but the Yen rose to 85.31 to the dollar in early Nikkei action and that sent the Nikkei flying down 2.1% for the day, back to 9,500 where, yawn, once again we can grab the EWJs if we can stay green today.

Perhaps Timmy (and I know this is a stretch) should be worried less about the spinning and more about the Dollar, which is looking very weak, right on our 200 dma at 80.60 to the penny. We began to get the bounce I predicted last night (and congrats to our oil futures traders as we went well below our $82 target AND we get a chance to re-load shorts at $82.75 this morning ahead of inventories) but that flipped right around this morning and we are not testing $1.60 to the Pound (down 12.5% since mid-May) and $1.33 to the Euro (down 11%). We are down 15% to the Yen as well so the question I have to ask is – what on Earth are we so happy about?

Perhaps Timmy (and I know this is a stretch) should be worried less about the spinning and more about the Dollar, which is looking very weak, right on our 200 dma at 80.60 to the penny. We began to get the bounce I predicted last night (and congrats to our oil futures traders as we went well below our $82 target AND we get a chance to re-load shorts at $82.75 this morning ahead of inventories) but that flipped right around this morning and we are not testing $1.60 to the Pound (down 12.5% since mid-May) and $1.33 to the Euro (down 11%). We are down 15% to the Yen as well so the question I have to ask is – what on Earth are we so happy about?

Housing is flat to down (Mortgage Apps are up 1.3% this month – woopie!) and the S&P is flat since mid-may which means if you cash all your assets now, you can buy about 12.5% LESS than you could have just 90 days ago. I think if they tell me there’s no inflation one more time I WILL SCREAM!!!

Copper is up 17% and since mid-May’s $2.90 and oil is up 22% from $67, silver is flat, gold and platinum are flat so the declining dollar (as I have been pointing out all last month) is masking a huge exodus from speculative metals since platinum crashed in, you guessed it – mid May! You can draw your own conspiracy theories as to who would want to weaken the dollar so they could dump their metals at inflated prices but my take is that it (whatever "it" is) is coming to an end tomorrow – at the ECB Meeting, which is the first time in about a year when there hasn’t been a huge crisis going on when the bankers got together.

Lots of stuff going on today ahead of tomorrow’s Unemployment Data and Friday’s Non-Farm Payroll report, which will be a real market mover if we manage to add 100,000 jobs (or the other way if we lose them). ADP was so-so this morning, with 42,000 jobs added in July, almost double what was expected and more than double last month’s 19,000 jobs additions, which was itself revised up from 13,000. Later today we get the ISM Service Number (10 am, 52 expected) along with Oil Inventories at 10:30, where a draw is expected and any build will disappoint. Also, after the market closes, Timmy speaks again in a live Web-Cast titled: "A Pro-Growth Strategy on Tax and Fiscal Policy.’"

All this happy talk makes me think someone got a peak at the jobs numbers and they are looking good but we’ll see how it plays out (no chasing!). As I said, it’s more of a watch and wait kind of week, although we’ve been finding tons of fun trades all week – they are a mix of up and down trades based on good old-fashioned stock picking as the market essentially flatlines at our 5% lines.