Hopefully this portends a shake-up of the Administration’s economic policy but that will very much depend on who is appointed to replace him. It is, once again, the economy stupid and Larry’s stint as Director of the National Economics Council has given us far too much of the same at a time where we really needed — change. As Barry Rhitholtz points out:

He was one of the chief architects of the crisis. In addition to believing all of the usual foolishness about efficient markets, he bought into the radical deregulation arguments pushed by the free market absolutists.

Summers was Treasury Secretary when Glass Steagall was repealed. Instead of speaking out against the irresponsible Gramm–Leach–Bliley Act (Financial Services Modernization Act of 1999), he actively supported it. Instead of explaining to the public how Glass Steagall prevented Wall Street crises from spilling over into Main Street for 65 years, he rolled over for Citibank. The repeal of Glass Steagall was not a cause of the crisis, but it allowed the net damage to be far, far worse than it would have otherwise been. And it was emblematic of the corporate takeover of the legislative process. For a fee (campaign donation) you could write your own regulations. How could that ever go wrong?

Even more ruinously, Summers oversaw the passage of Commodities Futures Modernization Act of 2000 that exempted financial derivatives from all regulatory oversight. The CFMA made the AIG collapse not only possible, but likely. It helped to set up both Lehman and Bear Stearns. CFMA allowed AIG FP to write over $3 trillion in derivatives, reserving precisely zero dollars in case an underwritten derivative needed to be paid.

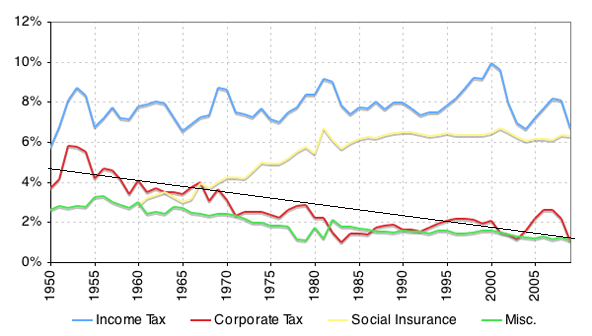

Conservatives should not be celebrating the departure of Larry Summers, he was a guy who "played ball" with Big Business and it is very likely that his replacement will have a less friendly stance towards our Corporate Citizens, who made 60% of the income in this country in 2009 but paid just 6% of the taxes ($138Bn).

Conservatives should not be celebrating the departure of Larry Summers, he was a guy who "played ball" with Big Business and it is very likely that his replacement will have a less friendly stance towards our Corporate Citizens, who made 60% of the income in this country in 2009 but paid just 6% of the taxes ($138Bn).

Larry has to get out of town before the Administration goes after his meal-ticket and begins asking Big Business to pay their fair share, an issue that is very likely to shape the next election cycle. The chart on the left is a measure of taxes paid in relation to GDP and you’ll notice that corporations now pay 75% less than they did in the 50s. Income taxes are now 6 times the level of corporate taxes and, much worse for the middle class, Social Insurance has gone from 2% to 6%, tripling the tax for those making less than $106,000 in order to allow Corporations who make Billions to pay 75% LESS! Clearly something has to be done and clearly Summers is NOT the guy to do it…

So yesterday’s Autumnal Equinox marked the end of Summers and now we have to look ahead to the fall and the possible end of the summer rally – such as it is. We flipped a bit more bearish on what was a fairly bullish Fed statement (if you like easy money policies), picking up directional shorts on DIA and IWM in my 2:50 Alert to Members as the post-Fed run-up seemed downright silly and we wanted to lock in those unexpected bullish profits.

So yesterday’s Autumnal Equinox marked the end of Summers and now we have to look ahead to the fall and the possible end of the summer rally – such as it is. We flipped a bit more bearish on what was a fairly bullish Fed statement (if you like easy money policies), picking up directional shorts on DIA and IWM in my 2:50 Alert to Members as the post-Fed run-up seemed downright silly and we wanted to lock in those unexpected bullish profits.

I had earlier in the day put up a chart series, warning Members that the last two Fed meetings had also formed violent spikes on the news that were both followed by 5% drops in the following 10 days so we choose to error on the side of caution on this one, especially coming off our 10% gains in September.

We topped out at 10,833 and fell all the way back to 10,739 at 3:38 and pulled a very lame bounce into the close that wasn’t enough to impress us. We had already gone naked on our Mattress Plays, simply following our usual pattern on the 5% Rule, and we already made one nice run with the DIA $105 puts in the morning so reloading them at .89 was a no-brainer. The IWM 9/30 $67 puts were a little more aggressive at $1.10 but they were up over 30% already at the close and provide excellent overnight protection into today’s uncertainty.

Despite the BOJ’s best efforts to the contrary, the Fed’s threat of additional Dollar drops put our 3am trade back in business for the second day in a row as the Yen rose from 85 to 84.5 against the dollar this morning and down from 85.8 on Monday. As I said to Members in yesterday’s chat: "The Fed knows the BOJ will support 85 Yen to the Dollar no matter what, so they may take advantage and do some QE that, ultimately, Japan will pay for as they will probably buy whatever the Fed/Treasury jams down their throats between now and XMas." There was talk of additional BOJ intervention that got the Nikkei off the floor this morning but talk is no longer enough to actually boost the Yen so we’ll see what line gets defended in today’s trading.

The weak dollar will mask a weak market this morning and that will support commodities and the commodity pushers in early trading but watch that dollar, which will likely get bought up by the BOJ at some point and that will send oil and copper down and those strong sectors will pull back and likely lead us back down to test our 4% levels at Dow 10,608, S&P 1,112, Nas 2,288, NYSE 7,072 and Russell 660. Failing 3 of 5 of those will turn us bearish for the moment. The 10:30 oil inventory report will be a dangerous spot this morning.

The weak dollar will mask a weak market this morning and that will support commodities and the commodity pushers in early trading but watch that dollar, which will likely get bought up by the BOJ at some point and that will send oil and copper down and those strong sectors will pull back and likely lead us back down to test our 4% levels at Dow 10,608, S&P 1,112, Nas 2,288, NYSE 7,072 and Russell 660. Failing 3 of 5 of those will turn us bearish for the moment. The 10:30 oil inventory report will be a dangerous spot this morning.

Of course Japan has bigger fish to fry as tensions with China are heating up over Japan’s continued detention (ie capture) of a Chinese "fishing boat" Captain.

China’s Premier Wen Jiabao threatened more retaliatory action unless Japan “immediately and unconditionally” releases the fishing captain detained two weeks ago in disputed waters, Xinhua News Agency said. Japan is China’s second-biggest trading partner after the U.S., with two-way commerce in the first seven months of the year rising 25 percent from the same period in 2009 to $65.2 billion, Chinese customs data show. China is Japan’s largest trading partner, buying 10.2 trillion yen ($121 billion) of the nation’s goods and services last year. A sanctions war could knock both economies down and threaten a global sell-off led by Asia – something else to worry about.

The Hang Seng plunged 200 points in the last hour, giving up all of the day’s gains and the Shanghai was also flat while the Nikkei lost 0.4% for the day. Even India finally had an off day, dropping 60 points (0.3%) to 19,941. Europe is down about half a point ahead of the US open but off its lows as Spanish Prime Minister, Zapatero declares that the European debt crisis is OVER! This is, of course great news and, had we known that one of the countries that were deeply in debt could end the crisis by just saying it was over, I’m sure someone would have done it sooner – next time we’ll know better!

The BOE didn’t quite agree with Mr Zapatero as they voted 8 to 1 to keep rates on hold and also saw a high probability that they would have to add further stimulus to keep the UK economy growing. Iceland’s Central Bank went as far as to cut rates as Euro-Zone Industrial Orders posted their sharpest monthly drop in 19 months, led by a slump in orders for capital goods.

Many good reasons to be wary on Wednesday and we expect a 2% pullback off the 10% September run anyway so bear is the word until we see how our levels hold up – hopefully we see some volume so we get a real test but let’s remember to be careful out there – it’s going to be a wild ride!