Have you no shame?

Have you no shame?

That's what the Senators should have said to Ben Bernanke as he hemmed and hawed his way through his ridiculous testimony yesterday. What was it that that Joseph Welch said to Joe McCarthy when he tried to lie to the Senate? "You've done enough! Have you no sense of decency, sir, at long last? Have you no sense of decency?" As Mr. Welch said about McCarthy, the same can be said about Bernanke: "I think I never really gauged your cruelty, or your recklessness…"

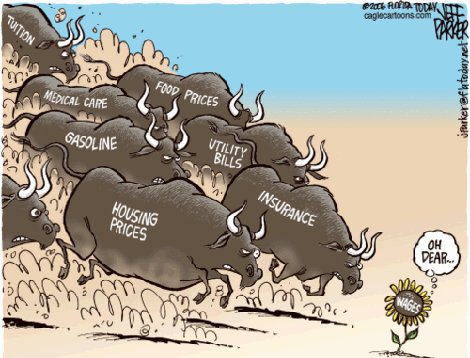

Maybe it was the atmosphere of the Senate hearings that made me think of it but I was so sickened by the farce going on at the Senate yesterday, punctuated by the joke of oil rising to $100, even as The Bernanke told us inflation was under control, that there was little left to do but dream of an America long past – when people of moral conscience stood up – not because it was profitable – but because it was right.

In Bernanke's official testimony to the Senate, the Fed Chairman justifies his action with Bullshit – there is no other word for it – it's total Bullshit:

Inflation has declined, on balance, since the onset of the financial crisis, reflecting high levels of resource slack and stable longer-term inflation expectations. Indeed, over the 12 months ending in January, prices for all of the goods and services consumed by households (as measured by the price index for personal consumption expenditures (PCE)) increased by only 1.2 percent, down from 2.5 percent in the year-earlier period.

To quote Moneypenny from last night's PSW Wrap-Up show: "Are you freakin' kidding me?" This is so ridiculous I can't even bring myself to comment on it anymore – just screw it – we'll see what happens at the House today in day two of Bernanke's crap-fest but what's the point? The fact that Bernanke was allowed to leave the Senate chamber without being handcuffed says it all, doesn't it? As David Fry pointed out: "Bernanke gave his senate testimony and mostly lied his way through it. I’ve given up trying to be ambivalent about this since the lying and spin should upset everyone. The “core rate” nonsense is a manipulated smoke and mirrors diversion from the truth. Inflation is rising and we see it in our real daily experience."

Fortunately, that non-existent inflation gave us a huge winner yesterday as our longs on the oil futures (mentioned in yesterday's morning post) were huge winners, as was our TZA cover (also mentioned in yesterday's morning post) and our VIX longs, which we cashed out in the $25,000 Virtual Portfolio for another $1,230 gain, bringing our virtual cash total up to $28,761, up 15% in our 4th week and right on track for our $100,000 goal for the year. Having dumped our VIX covers into yesterday's excitement we are left with EDZ as our primary hedge in the $25KP and now we are certainly tilted bullish so we'll have to watch those Breakout II levels very carefully to make sure they hold (see chart in Monday's post).

Fortunately, that non-existent inflation gave us a huge winner yesterday as our longs on the oil futures (mentioned in yesterday's morning post) were huge winners, as was our TZA cover (also mentioned in yesterday's morning post) and our VIX longs, which we cashed out in the $25,000 Virtual Portfolio for another $1,230 gain, bringing our virtual cash total up to $28,761, up 15% in our 4th week and right on track for our $100,000 goal for the year. Having dumped our VIX covers into yesterday's excitement we are left with EDZ as our primary hedge in the $25KP and now we are certainly tilted bullish so we'll have to watch those Breakout II levels very carefully to make sure they hold (see chart in Monday's post).

If those lines don't hold up, then we're going to get a lot more aggressive, which was why I killed the VIX spread yesterday as it's NOT BEARISH ENOUGH to cover the disaster that awaits us if this downslide begins to snowball. We played bullish off the lines and I'm not schitzo – but the markets are and that's the way we have to play them with our short-term moves. Longer-term, we went long on our beloved TBT again as they tested $37.50 and we bought YRCW as planned even as we pressed EDZ with a new trade (not for the $25KP) and added short positions on MOO and BAL, which dropped like a rock after our 1:24 entry.

Actually, my 1:24 comment to Members is a fine example of how crazy the market is. EDZ is an April-targeted short but we're paying for it by selling puts in stocks we want to buy on the dips. BAL is an aggressive bear put spread – already 100% in the money thanks to yesterday's dip and MOO is an April speculative put. At the same time as we picked those 3 short plays, at the bottom of the same comment, we rolled our FAS play in the $25KP to a more aggressive position, looking for a short-term bounce in the financials. Later we picked up an even shorter-term upside play on the QQQQs, using the weekly calls to maximize leverage, looking for a bounce into the open today.

We also went long on TBT, long on AAPL (weekly into tomorrow's announcement) and long-term long on WMT – so lots of fun shopping on both sides of the fence as we test our Breakout II levels. While oil and gold may be rising on mid-east tensions, we believe we are now at the point where more money for oil simply means less money for other products – whether it's commodity purchases by speculators or or necessity purchases by cash-strapped consumers. There just is not enough spare credit capacity to pay for it all this time around – we can't all dip into our home equity to fill up the gas tank anymore – the money will have to come from somewhere else…

We also went long on TBT, long on AAPL (weekly into tomorrow's announcement) and long-term long on WMT – so lots of fun shopping on both sides of the fence as we test our Breakout II levels. While oil and gold may be rising on mid-east tensions, we believe we are now at the point where more money for oil simply means less money for other products – whether it's commodity purchases by speculators or or necessity purchases by cash-strapped consumers. There just is not enough spare credit capacity to pay for it all this time around – we can't all dip into our home equity to fill up the gas tank anymore – the money will have to come from somewhere else…

Maybe it will come from hedge funds as the top 10 hedge funds made $28Bn in the second half of last year. That's $2Bn more than the net profits of Goldman Sachs, JPMorgan, Citigroup, Morgan Stanley, Barclays and HSBC combined. Even the biggest hedge fund have only a few hundred employees and often just 100 clients to divvy up the winnings, while the six banks employ 1m between them. Isn't that just FANTASTIC! Warren Buffett is on CNBC this morning trying to explain how the top 1% are making 10 times more money PER YEAR than they made when Reagan was elected and they are paying 50% less taxes, accounting for a full 1/3 of the entire $1.8Tn annual deficit all by themselves (with the war accounting for the rest). You could hear the crickets chirping in the CNBC studios when Warren pulled out his report as clearly that was a conversation no one wanted to pursue with him – so he dropped it but kudos to him for timing it after 8pm in his interview.

Not that Buffett is a saint, mind you as it's Corporate Tax Revenues (or lack thereof) that are really driving a stake through this economy and he remains numb on that subject – perhaps as it's a fiduciary duty to his shareholders not to pee in that particular pool. Steve Forbes was on Bloomberg this morning calling for an end to Corporate Taxation and Regulation. He wants things to go back to the way way they were when Bush 1 took office, just as Reagan's policies were creating a new class of hyper-wealth while grinding the Middle class into the dust.

It's sort of a joke now, that we get all our information from people in the Financial Sector and that the President gets his advice from the Financial Sector and the Republican Party gets 40% of their campaign contributions from the Financial Sector and that the largest chunk of lobbying expenditures come from the Financial Sector and that the Financial Sector got Trillions of Dollars in bailouts and collected hundreds of Billions in bonuses all base on a crisis that they created, which had destroyed the lifestyle of the non-Financial segment of society (ie. everyone else) except those who are in the ownership class and can afford to keep their money with and/or pay fees to those self-same "financial professionals."

How willingly the lambs go to the slaughter… In fact, willingly just doesn't describe it, does it? Listen to the $15 an hour construction worker in Wisconsin telling the $18 an hour teacher how horribly overpaid they are while the $1M PER WEEK Rush Limbaugh tells us that's what's wrong with America. Today we get more lies from Bernanke and it's going to be a whopper as he's already calling for backup from Hoenig, who delivers a speech on Economic Outlook this morning and Lockhart, who speaks 10 minutes after the Beige Book is released at 2pm to take the sting of what is likely to be a downer of a report.

Mortgage Applications were off 6.5% for the week despite the 30-year mortgage rate falling back to 4.84% from 5% and Challenger Job-Cuts reported 50,702 planned layoffs in February, up from 38,519 in January and the worst it's been in 11 months. The ADP report, on the other hand, once again is pointing up, with 217,000 jobs added by the private sector in February. Unfortunately, replacing well-paid government workers with more burrito-fillers at Chipolte is not really a path to prosperity – unless, of course, you are the Chairman of the Federal Reserve – in which case it's: Mission Accomplished.

Watch those levels today – we expect a bounce up but how high?