78.50 on the Dollar!

78.50 on the Dollar!

The Yen finally got back to 77 and EUR/CHF back to 1.21 so my theory that the BOJ has given up on the Dollar and moved to boosting the Euro is playing out nicely.

This does not make me more bullish (expecting falling Dollar to boost the markets) because, in the grand scheme of things, this is kind of like now there are two kids building a sand wall on the beach instead of one – sure it will last longer than the wall just one kid was building but, eventually, the tide will get it anyway or, as Jimi Hendrix said more poetically: "Castles made of sand, fall in the sea, eventually."

Once you start messing around with Forex markets, you are messing with major macro forces that are hard to control. Japanese banks have $7.5Tn of Japanese bonds at 1% – what happens to the value of those bonds if the BOJ does push the Yen down 10%? Who takes that $750Bn hit? What if rates go up to 2% – what's the value of the bonds then? Who will bail out the Japanese Banks when they have a multi-Trillion Dollar (several hundred Trillion Yen) hole in their balance sheets? Do Japanese spreadsheets even have room for Quadrillions? They are going to need it!

Then there's this Bloomberg article on the Central Banks, who have doubled their balance sheets since 2006 to $13.2Tn but, magically, have caused no inflation (according to Ben Bernanke – not according to people who actually buy food and stuff). China is now sitting on $4.5Tn of other people's TBills (mostly ours) and that's up $1.5Tn in a year. The ECB is right behind them with $3.6Tn and another $1Tn supposedly coming in the next EFSF round and the Fed has $2.9Tn plus whatever nonsense they are running off book.

Then there's this Bloomberg article on the Central Banks, who have doubled their balance sheets since 2006 to $13.2Tn but, magically, have caused no inflation (according to Ben Bernanke – not according to people who actually buy food and stuff). China is now sitting on $4.5Tn of other people's TBills (mostly ours) and that's up $1.5Tn in a year. The ECB is right behind them with $3.6Tn and another $1Tn supposedly coming in the next EFSF round and the Fed has $2.9Tn plus whatever nonsense they are running off book.

So, how is it that WE are the bad currency here? If the Dollar is a problem, then China, who's GDP is only about $8Tn (optimistically, possibly $5.5Tn depending on who's measuring) is almost as insane as Japanese bankers and maybe more so as they are betting on our country's ability to pay and maintain the value of the Dollar (already a fail, right?). I suppose no one can ever recognize losses and just carry more and more junk on their balance sheets forever but that's kind of a scary plan because, all it takes is that one little boy to point out that the Emperors have no clothes and this whole thing can collapse like the house of cards that it is.

Anyway, my point is that Forex traders do get this and that's why you can't fight the tide. You can fool stock investors all the time, they are generally sheep who don't even understand what it is they are putting money into and, as we well know, between the low volume and the BS ratings and the pumpers on TV and the completely inaccurate guidance given by the companies themselves and the insane analysts and the people who follow them – it's a total joke. That was made evident in 2008 when the markets were "worth" what they are now in August and then, 60 days later, they were "worth" 50% less.

Anyway, my point is that Forex traders do get this and that's why you can't fight the tide. You can fool stock investors all the time, they are generally sheep who don't even understand what it is they are putting money into and, as we well know, between the low volume and the BS ratings and the pumpers on TV and the completely inaccurate guidance given by the companies themselves and the insane analysts and the people who follow them – it's a total joke. That was made evident in 2008 when the markets were "worth" what they are now in August and then, 60 days later, they were "worth" 50% less.

That doesn't happen with Picassos or Baseball Cards or Classic Cars or Comic Books or Houses or other things of actual value – they generally have enough sophisticated investors that there is genuine price discovery that holds up over time but stocks, on the other hand, can go up and down 20% on rumors because there are plenty of uninformed buyers and uninformed sellers on both sides of the aisle.

The Central Banks have taken advantage of the low tide to build some beautiful-looking sand castles and investors are flocking to admire them with the Mainstream Corporate Media simply falling over itself to congratulate them on their epic victory over reality but how many of those investors are really planning on moving into those sand castles – or will they all run out as soon as the next crisis wave laps on the walls and the begin to crumble once again?

I said to Members in early morning Chat:

Unfortunately, I've been reading the news so it all seems completely ridiculous to me and I'd say shorting the RUT (/TF) below the 830 line (just tested 833) and shorting the Dow below 12,850 (now 12,854) look like the most attractive plays in addition to same old shorting gold at $1,750 line.

I would love to have a bullish play but I just can't do it – I'm sorry, I'd rather be in cash than pay these prices just because the Dollar is driven down to ridiculous levels against a currency (Euro) that is 1/3 it's size and just did a $750Bn round of QE and is about to do another $1.5Tn round and all that, so far, has barely "fixed" their smallest member state. This is like us fixing Rhode Island and the rest of the World declaring America all fixed…

Obviously, we need to watch that 78.50 line on the Dollar – below that and we can't be bearish but it should hold.

I know I promised to try to get more bullish but it is literally impossible to read the actual news (see Member Chat for today's rundown) and buy at these levels – certainly not with any long-term conviction. So this is my little therapy session where I will try to get it all off my chest as we TRY to disconnect our brains and follow this rally – assuming the madness continues just because Greece is fixed – which, as I said, is the same as declaring America's finances fixed if we bail out Rhode Island…

I know I promised to try to get more bullish but it is literally impossible to read the actual news (see Member Chat for today's rundown) and buy at these levels – certainly not with any long-term conviction. So this is my little therapy session where I will try to get it all off my chest as we TRY to disconnect our brains and follow this rally – assuming the madness continues just because Greece is fixed – which, as I said, is the same as declaring America's finances fixed if we bail out Rhode Island…

Speaking of Greece: Government revenues in January are down 7% year over year versus the 8.9% increase expected by Econonomorons, who were sure that drastic austerity was the key to prosperity. VAT receipts are off 18.7% and I guess that explains why Greece is only up 0.5% today – someone must have accidentally read this report! I'm sure the next round of austerity measures being demanded by the Troika will do the trick and turn Greece around – after all, how many times has austerity failed to produce a recovery?

I'm sorry, that was a trick question as austerity NEVER works, not in the past 200 years, at least. Even Forbes knows this and those guys are pretty slow on the take…

I'm sorry, that was a trick question as austerity NEVER works, not in the past 200 years, at least. Even Forbes knows this and those guys are pretty slow on the take…

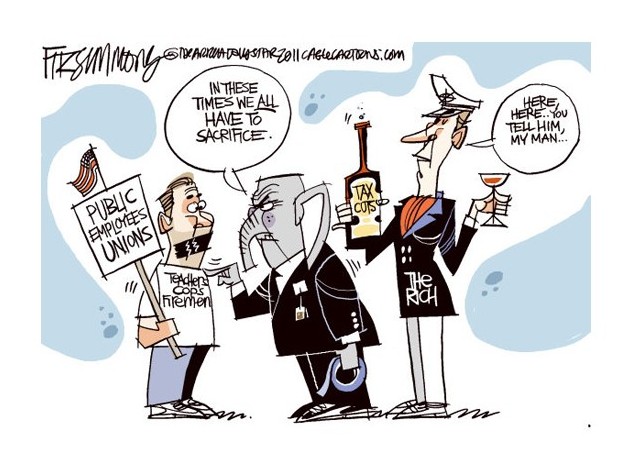

Austerity does work for the people the victim owes money too – much the way that donating 8 pints of blood works works for the vampire, but tends not to have a positive outcome for "donor." Like vampires (and I'm not the first to make this comparison), the bondholders will simply move on to their next victim once Greece is drained dry.

There are Trillions riding on a successful Greek bailout – not because of Greece itself but, by making it look like Greece is "fixed" and harsh austerity measures including pay cuts, benefit cuts, reneging on retirement promises made to the people while the Rich continue to enjoy their special loopholes – they set the stage to run rampant across all of Europe, the US and Japan with the same song and dance, just like they did in the 30s – until the "recovery" came crashing down around the World and plunged us into WWII. Ah, good times for the Military-Industrial Complex indeed!

Anyway, so that's what's bothering me but we can't let it stop us from playing the market to higher – we just need to recognize that it probably won't last. Last week on Thursday and Friday, we featured 10 bullish trade ideas, as promised, to take advantage of the insanity because – as we often say – we don't care IF the markets are fixed, as long as we can figure out HOW they are fixed and take advantage of it. Our plan was to add one bullish trade each day we were over our breakout levels and here we are at day 5 already so let's see how we're doing:

- FAS Feb $77/80 bull call spread at $2, selling $75 puts for $1.50 for net .50, now net $2.25 – up 350%

- FAS March $75/80 bull call spread at $3.05, selling $70 puts for $3 for net .05, now $2.15 – up 4,200%

Not bad for a week's work, right? As a bonus, in Thursday's post, we also featured some alternate bullish offsets that were less aggressive than selling short FAS puts:

- CHK Jan $17.50 puts sold for $2.05, now $1.74 – up 15%

- GE 2014 $17 puts sold for $2.50, now $2.23 – up 10%

- GOOG June $450 puts sold for $4, now $2.35 – up 41%

- ISRG Jan $310 puts sold for $10, now $7.66 – up 23%

- KO Jan $62.50 puts sold for $3, now $2.60 – up 13%

- MO 2014 $23 puts sold for $2.15, now $2.05 – up 5%

- PFE 2014 $20 puts sold for $2.65, now $2.80 – down 6%

- XOM Jan $65 puts sold for $2.50, now $1.95 – up 22%

I know – so dull! Still it's a great way to enter positions and a great way to use your sidelined cash to generate a little additional income – a strategy we concentrate on in our Income Portfolio, which was also updated this weekend. You don't want to sit around in a bull market like a deer in the headlights – just because you think it's nonsense. Surely there must be SOME stock you would be willing to buy if it drops 20%? If so, then sell the put at that strike and someone will be paying you just for promising to buy a stock at a lower price than it is today. This is not complicated, folks…

I know – so dull! Still it's a great way to enter positions and a great way to use your sidelined cash to generate a little additional income – a strategy we concentrate on in our Income Portfolio, which was also updated this weekend. You don't want to sit around in a bull market like a deer in the headlights – just because you think it's nonsense. Surely there must be SOME stock you would be willing to buy if it drops 20%? If so, then sell the put at that strike and someone will be paying you just for promising to buy a stock at a lower price than it is today. This is not complicated, folks…

In addition to our aggressive FAS trade ideas, which were meant to make big money if the rally held up to help balance out too-bearish positions, we had a few longer-term trade ideas featured in Thursday's morning post:

- CHK 2014 $15/20 bull call spread at $2.65, selling 2014 $15 puts for $2.35 for net .30, now $1.16 – up 286%

- AA July $8/10 bull call spread at $1.40, selling 2014 $10 puts for $2.10 for net .70 credit, now .40 to buy back – up 42%

- AMZN Jan $170/180 bull call spread at $5.20, selling Jan $110 puts for $4.15 for net $1.05, now $2.90 – up 176%

Friday we continued to concentrate on long-term trade ideas as FAS was already looking promising and there were no aggressive plays I liked better:

- BA 2014 $60/80 bull call spread at $11, selling $65 puts for $8 for net $3, now $3.45 – up 15%

- F 2014 $8/12 bull call spread at $2.40, selling $10 puts for $1.50 for net .90, now $1.25 – up 38%

- GS 2014 $80/110 bull call spread at $20, selling $90 puts for $12.50 for net $7.50, now $8.10 – up 10%

I ran out of time in the post but, in the Morning Alert to Members, we added:

- SVU at $7.10, selling 2014 $7 puts and calls for $3.70 for net $3.40/5.20, now net $2.97 with SVU at $6.87 – with buy/writes, we're either on or off track but .13 below our exit strike is still on track on this one and an even better entry now than it was on Friday for a possible double in 2 years.

- HPQ 2014 $20/30 bull call spread at $5.60, selling $23 puts for $3 for net $2.60, now net $2.97 – up 14%

- SKX July $11/13 bull call spread at $1.20, selling $11 puts for .90 for net .30, now .70 – up 133%

- 2 BTU 2014 $30 puts sold for $5.40 ($10.80), buying 1 Jan $40/50 bull call spread at $3.20 for net credit of $7.60, now $5.30 to buy back – up 30%

So let's not fear the rally. Of course we balance out our winners with a few bear hedges (see yesterday's Member Chat for TZA spread) to lock in some of our quick gains. Also, there's nothing wrong with taking some cash back off the table here as this "rally" is just ridiculous and, if the tide comes in this week or next, we'll be thrilled to get back to cash but, if we're going to head up forever – we can do this week after week so we're not going to miss much by sitting out a few!

Let's be careful out there…