Yesterday, we talked about the BS that is Fox News.

Yesterday, we talked about the BS that is Fox News.

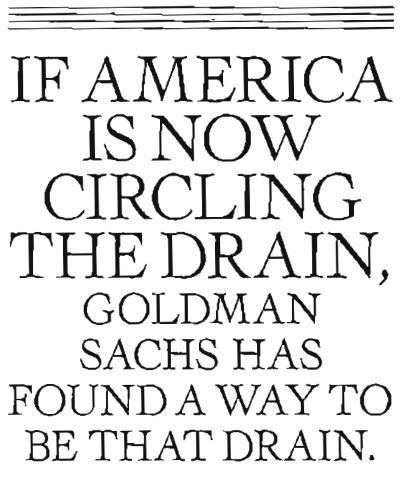

Ironically, some of the "news" outlets that generally carry my articles (who's names shall be protected because they are wimps) decided it was too controversial for their readers so we know that's not a topic we're allowed to discuss in America, for fear of being black-listed. Today we'll see if we can make it a two-fer in the Bracket of Evil, as I have a juicy resignation letter from Greg Smith of Goldman Sachs (thanks Rev Todd), who is no small player, but the head of the firm's US Equity Derivative Business in Europe, the Middle East and Africa. Just a couple of excerpts:

I believe I have worked here long enough to understand the trajectory of its culture, its people and its identity. And I can honestly say that the environment now is as toxic and destructive as I have ever seen it. To put the problem in the simplest terms, the interests of the client continue to be sidelined in the way the firm operates and thinks about making money.

What are three quick ways to become a leader? a) Execute on the firm’s “axes,” which is Goldman-speak for persuading your clients to invest in the stocks or other products that we are trying to get rid of because they are not seen as having a lot of potential profit. b) “Hunt Elephants.” In English: get your clients — some of whom are sophisticated, and some of whom aren’t — to trade whatever will bring the biggest profit to Goldman. Call me old-fashioned, but I don’t like selling my clients a product that is wrong for them. c) Find yourself sitting in a seat where your job is to trade any illiquid, opaque product with a three-letter acronym.

I attend derivatives sales meetings where not one single minute is spent asking questions about how we can help clients. It’s purely about how we can make the most possible money off of them. It makes me ill how callously people talk about ripping their clients off. Over the last 12 months I have seen five different managing directors refer to their own clients as “muppets,” sometimes over internal e-mail.

So we established yesterday that you can't trust the MSM and clearly you can't trust your Investment Banker and we KNOW we can't trust the Government (I don't even need to do a post on that, do I?) yet – based on the information THEY are giving you, the stock market is back near it's all-time highs and the VIX (fear index) is back near it's 10-year lows – as if you don't have a thing to worry about – just give them your money and all will be well…

So we established yesterday that you can't trust the MSM and clearly you can't trust your Investment Banker and we KNOW we can't trust the Government (I don't even need to do a post on that, do I?) yet – based on the information THEY are giving you, the stock market is back near it's all-time highs and the VIX (fear index) is back near it's 10-year lows – as if you don't have a thing to worry about – just give them your money and all will be well…

Are you really that dumb? Clearly they think you are. Despite being exposed by Matt Taibbi in Rolling Stone and despite Senator Carl Levin exposing internal GS Emails in which GS division heads called Timberwolf Securities a "shitty deal" at the same time as management made pushing the Timberwolf deal to clients the firm's "top priority." GS declined from $170 a share at the time of this investigation (April 2010) to $85 a share last Fall but now they are rocketing back over $125 as – hey, it's been almost 2 years – all is forgotten and forgiven, right?

This isn't about Goldman Sachs per se but about the overall investing climate in which the Corporations and the media they control, along with the puppet Government they fund through their lobbyists, have devised a massive wealth extraction machine that lurches this country from crisis to crisis (real and imagined) in order to justify first excess prices for goods and services, then excess fees for banking and insurance and then, when you begin to run out of money, exorbitant prices for food and energy (which you NEED to live) until you go broke and then they turn around and demand a bail-out to relieve them of whatever jacked up assets they are stuck with when the bubble they created finally bursts.

WE JUST SAW THIS HAPPEN PEOPLE – yet here we are, getting right back on that horse as if we are none the wiser just 3 years almost to the day after the great bottom of 2009. Markets don't crash because they were priced correctly – markets crash because the people who are buying the assets do not correctly identify the risk factors that may affect prices down the road. That's what the Big Business/Government/MSM triumvirate is all about these days – getting the masses to once again believe all is well so the can get you to run back into the markets – AT THE SAME PRICES YOU OVERPAID FOR LAST TIME!

Again, I have to ask, are you really that dumb? Just yesterday the market began to sell off after the FOMC minutes (see my comments to Members here) failed to give an indication that additional Quantitative Easing would be coming and the market began to sell off and then, by "accident" JPM (every bit as bad as GS), revealed they had passed the stress test a day ahead of schedule by announcing buybacks and dividends that couldn't occur if they hadn't. That started the rumor mill and a buying frenzy in Financials (up 3.5% in an hour) that took the market to new closing highs and then the Government backed up Big Business and fed the Media frenzy with an early release of the stress tests.

This would be truly amazing – if it weren't the exact same spike move up, in the exact same percentage – also making new highs, as we had on January 25th – the day of the last Fed meeting, when they also failed to come through with QE3. I think the real difference between investors and muppets is that the muppet knows it's being manipulated…

This would be truly amazing – if it weren't the exact same spike move up, in the exact same percentage – also making new highs, as we had on January 25th – the day of the last Fed meeting, when they also failed to come through with QE3. I think the real difference between investors and muppets is that the muppet knows it's being manipulated…

Anyway, we shall see how this all plays out today and into option expirations on Friday. Less than two weeks ago, we had 10 long-term bullish trade ideas – one per day to add for each day the S&P was over 1,360 – just 50 points higher than the line at 1,310 we drew in January so not too much to ask for a "bull market." We failed on the 6th and the 7th (back to 1,340) but have been up since and our 10 bullish trades still have a couple that can be played over 1,390 and we'll just keep pushing the line higher until the market does finally break. Our 10 trade ideas were:

- SKX Oct $10/14 bull call spread at $2.20, selling $12 puts for $1.55 for net .65, now .90 – up 38%

- SU 2014 $25/37 bull call spread at $6, selling XOM 2014 $65 puts for $5 for net $1, now net .70 – up 30% – still playable

- USO June $40/46 bull call spread at $2, selling SCO Oct $26 puts for $3 for net $1 credit, now .24 credit – up 76%. I like this one because you are long and short oil at the same time.

- AA 2014 $10 puts sold for $2, still $2 – even – still playable

- X Jan $25/2014 $20 buy write at $17.04/18.52, now $17.84 – up 5% – still playable

- PEG Sept $30 buy/write at $27.07/28.53, now $27.20 – up 1% – still playable

- HOV 2014 $2 puts sold for .90, now .85 – up 5%

- BAC 2014 $3/7 bull call spread at $2.75, selling $10 puts for $3.30 for net .55 credit, now 0 credit – up 100%. 100% seems like a lot but it's just .20 out of $5.10 (927%) of potential gains so still very playable.

- HCBK Jan $7 buy/write at $5.14/6.07, now $5.55 – up 8%

- FTR 2014 $5 buy/write at $2.43/3.71, now $2.37 – down 3% – still playable.

Not too bad, right? You didn't miss much if you held back as they are well-hedged positions where we really only care if they are "on track" or not. This Friday will be trading day 10 and I promise to have 10 new trade ideas for the next two weeks if we're still in this technical (certainly not fundamental) rally. Meanwhile, please be careful out there – this rally seems as fake as any I've ever seen and, while I don't mind playing along – I think it's prudent to always have one hand on the exit and to make sure we're one of the first ones out the door when this party begins to wind down.

Be careful out there.