What is happening to this country?

What is happening to this country?

Robert Reich points out that, in announcing the Republicans’ new budget and tax plan Tuesday, House Budget Committee Chairman Paul Ryan said “We are sharpening the contrast between the path that we’re proposing and the path of debt and decline the president has placed us upon.” But the plan doesn’t do much to reduce the debt. Even by its own estimate the deficit would drop to $166 billion in 2018 and then begin growing again.

The real contrast is over what the plan does for the rich and what it does to everyone else. It reduces the top individual and corporate tax rates to 25 percent. This would give the wealthiest Americans an average tax cut of at least $150,000 a year. The money would come out of programs for the elderly, lower-middle families, and the poor. "So what’s the guiding principle here?" asks Reich. "Pure social Darwinism. Reward the rich and cut off the help to anyone who needs it.

Most Americans who do have jobs continue to lose ground. New research by professors Emmanual Saez and Thomas Pikkety show that the average adjusted gross income of the bottom 90 percent was $29,840 in 2010 — down $127 from 2009, down $4,842 from 2000, and just slightly more than $29,448 in 1966 (all figures adjusted for inflation). Ryan says too many Americans rely on government benefits. “We don’t want to turn the safety net into a hammock that lulls able-bodied people into lives of dependency.”

Well, I have new for Paul Ryan, says Robert Reich: Almost 23 million able-bodied people still can’t find work. They’re not being lulled into dependency. They and their families need help. Even if the economy continues to generate new jobs at the rate it’s been going the last three months, we wouldn’t see normal rates of unemployment until 2017.

I wish I could tell you that Ryan's Republicans made the most disturbing statement I've heard from Government officials recently – but they didn't. That honor goes to Obama's Attorney General, Eric Holder, who gave a lecture at Northwestern University outlining his three-part test for determining when it's "OK" to execute a US citizen without a trial. Steve Colbert explains it nicely:

Do you see a theme here? We are being de-humanized by both parties in our Government. They already took away your right to Liberty under the Patriot Act and Paul Ryan and his cronies are making the Pursuit of Happiness a game for the top 1% only and now we have Eric Holder saying that the right to Life is not so much a guarantee under the constitution as it is a sort of conditional privilege – as long as you don't piss off anyone in power.

At the moment, the people in power seem to be on our side so Yay!, I guess. The NSDAP rose to power in Germany with a popular "war" against Communism in which they too lobbied to change the rules of due process to "expedite" the necessary pursuit of their enemies, who could be anyone – anywhere. As they morphed into the Nazi Party, they took advantage of those "minor changes" to consolidate their power.

At the moment, the people in power seem to be on our side so Yay!, I guess. The NSDAP rose to power in Germany with a popular "war" against Communism in which they too lobbied to change the rules of due process to "expedite" the necessary pursuit of their enemies, who could be anyone – anywhere. As they morphed into the Nazi Party, they took advantage of those "minor changes" to consolidate their power.

Soon the definition of who constituted a threat expanded to Gypsies, Jews, Black People, Homosexuals and anyone else who happened to disagree with them – BUT IT WAS ALL LEGAL! When did "never again" turn back into "maybe later"?

Again, we're not "one of those people" so we have nothing to worry about, right? Actually, we are right back to where we were in 2007, when I first began warning people that the ever-expanding wealth gap in this nation only served to make the top 10% (those of us who can afford to invest in the markets) THINK that things were going well – even as they were falling apart. Even now, the infrastructure of this country is coming apart at the seams and Paul Ryan wants to cut 80% of the Government's discretionary budget over 8 years. It's not even a fantasy – it's a nightmare!

Again, we're not "one of those people" so we have nothing to worry about, right? Actually, we are right back to where we were in 2007, when I first began warning people that the ever-expanding wealth gap in this nation only served to make the top 10% (those of us who can afford to invest in the markets) THINK that things were going well – even as they were falling apart. Even now, the infrastructure of this country is coming apart at the seams and Paul Ryan wants to cut 80% of the Government's discretionary budget over 8 years. It's not even a fantasy – it's a nightmare!

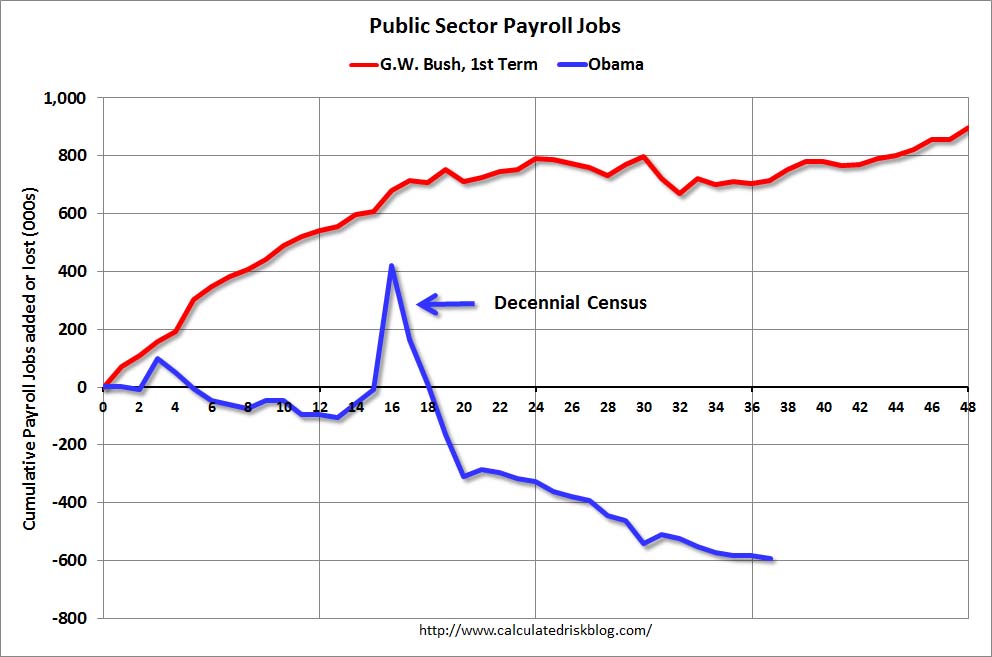

Obama has already cut Government spending more than any President since Bill Clinton and 600,000 Government employees have lost their jobs (making Obama's net job creation numbers seem much worse than they are) but no amount of cutting and gutting will ever satisfy the Republicans until our entire Government is outsourced to Corporate Interests.

You are probably thinking "Great – which ones so I can buy stock in them" but this is not a recipe for growth – this nothing more than a wealth extraction – draining America dry the same way business people drain the cash out of a near-bankrupt company by refusing to spend money and draining all of the cash flow until it dwindles away to nothing – at which point they default on the debts, lay off all the remaining employees (reneging on their pensions) while the top dogs parachute out and head off for the next fatted calf to slaughter (see SHLD).

You are probably thinking "Great – which ones so I can buy stock in them" but this is not a recipe for growth – this nothing more than a wealth extraction – draining America dry the same way business people drain the cash out of a near-bankrupt company by refusing to spend money and draining all of the cash flow until it dwindles away to nothing – at which point they default on the debts, lay off all the remaining employees (reneging on their pensions) while the top dogs parachute out and head off for the next fatted calf to slaughter (see SHLD).

15 Greek Billionaires rank among the World's richest men (an outsized number as their economy is 1/50th the size of ours) and they and the poorer 99% of the top 1% drained that country dry over the past few decades but they all get to walk away and leave the other 20M Greek citizens and their children and their grandchildren to clean up the mess they made. You can see it in Greece because there was no interruption of the program between the Reagan/Thatcher/Kohl revolution of the 80s and today, while the US had 8 years of Clinton pushing some of the wealth back to the middle class – which bought us a little more time but, with a debt to GDP ratio now over 100% and rising fast – we're not very far behind.

As you can see from the chart above, since the 70's and especially since the early 80's this country has done nothing but go massively into debt – JUST LIKE GREECE – and our wealth is being extracted by the top 1% – JUST LIKE GREECE – and they will throw the bottom 99% to the wolves when the bill comes due while the top 1% skate out of this country and leave it an ungovernable wasteland with no future – JUST LIKE GREECE but, unlike Greece – there will be no EU to bail us out.

The EU bailout is merely and "extend and pretend" move by the wealth extractors to make the bottom 99% of the nations that haven't been destroyed yet think that business as usual is still OK and, meanwhile, let's borrow more money and lower those pesky taxes and eliminate those annoying regulations because "that will fix everything." It's like the plot to a dystopian fantasy only we're not only living in it but we're playing the part of the unwitting masses whose lives are being sacrificed on the alter of profits for the puppet-masters.

I know you don't want to hear this stuff but THIS is why I am concerned about the "rally." I was right in 2007 but it took an entire year for the market to collapse – I don't think we have as long this time because our second assault on the Middle Class and the poor is akin to kicking them when they are already down. On the left we have a chart of gas sales in California – the bottom 99% simply don't have anything left to give us and if people like Paul Ryan are going to insist on bleeding them until they die (or revolt) – he's likely to get that wish a lot sooner than we all think.

I know you don't want to hear this stuff but THIS is why I am concerned about the "rally." I was right in 2007 but it took an entire year for the market to collapse – I don't think we have as long this time because our second assault on the Middle Class and the poor is akin to kicking them when they are already down. On the left we have a chart of gas sales in California – the bottom 99% simply don't have anything left to give us and if people like Paul Ryan are going to insist on bleeding them until they die (or revolt) – he's likely to get that wish a lot sooner than we all think.