What idiocy!

What idiocy!

I'm listnening to the talking heads in the MSM discuss whether wel added 75,000 jobs (the low estimate) or 150,000 jobs (the high, espoused by GS to rally us yesterday) for the month of June and I'm thinking about the 12M people in this country who are officially unemployed and the 25M additional who are unofficialy unemployed or underemployed and I'm wondering how we can celebrate any number that puts us on a path to full employment in about 10 years – providing we don't let any new people in the country or have any babies that add to the current population, of course.

While yes, 10 years is better than 20 years – we discussed the consumer trends in yesterday's post and there's just no way we can be bullish on the economy with this many people unemployed unless we are adding MILLIONS of jobs each month – not tens of thousands!

Even if we are adding jobs – the chart on the left clearly indicates that the quality of those jobs has gone way down hill over the past few years. Even if we had full employment, consumer spending would still be shrinking as wages fail to keep up with inflation. You KNOW this is true – very few of us are so rich that we don't notice how expensive things have gotten. What do you think people who live from paycheck to paycheck (most of our fellow Americans) are doing?

Even if we are adding jobs – the chart on the left clearly indicates that the quality of those jobs has gone way down hill over the past few years. Even if we had full employment, consumer spending would still be shrinking as wages fail to keep up with inflation. You KNOW this is true – very few of us are so rich that we don't notice how expensive things have gotten. What do you think people who live from paycheck to paycheck (most of our fellow Americans) are doing?

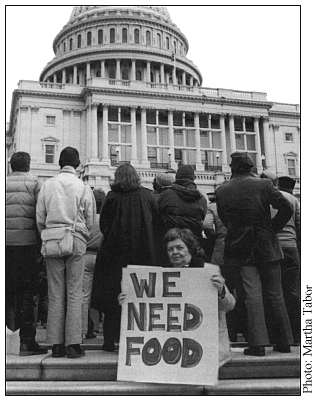

I'll tell you what 46M of them are doing – they are on food stamps! A new record was hit last month with one in seven Americans requiring food assistance (an no, they are not cheating – a study indicated less than 3% misdirected aid in the program) and the assistance they are being given no longer lasts a month with rising prices and fixed program spending.

Did I say fixed? Sorry, my bad – even as we speak, Republicans in the House of Representatives are holding up the Farm bill looking to cut the $100Bn food stamp spending by 1.6% at the same time that record numbers of Americans are in need of assistance. "Underfunding this critically important program when families temporarily rely on it to put food on the table in a tough economy is irresponsible and inhumane," said Rep. Rosa DeLauro, D-Conn., a food stamp advocate in the House.

Did I say fixed? Sorry, my bad – even as we speak, Republicans in the House of Representatives are holding up the Farm bill looking to cut the $100Bn food stamp spending by 1.6% at the same time that record numbers of Americans are in need of assistance. "Underfunding this critically important program when families temporarily rely on it to put food on the table in a tough economy is irresponsible and inhumane," said Rep. Rosa DeLauro, D-Conn., a food stamp advocate in the House.

"Irresponsible and inhumane" is, of course, the theme of this year's GOP Party platform so no one should be surprised when they literally vote to take food out of the mouths of children. It's not just the $1.6Bn cut in aid that's the issue – it's the LACK OF INCREASE IN AID as the program now services 10% more people with a lower budget. That means all 46M people will suffer for the cost of a couple of figher planes (which the Reps refuse to cut).

These are WRONG choices folks – you KNOW they are wrong. Can a family already living at the povery line have 1/10th of their food budget cut. $1.50 per meal is the current food stamp allowance – surely they can get by on $1.35 then is the Republican logic while they refuse to cut the $20Bn in tax breaks given to oil companies.

These are WRONG choices folks – you KNOW they are wrong. Can a family already living at the povery line have 1/10th of their food budget cut. $1.50 per meal is the current food stamp allowance – surely they can get by on $1.35 then is the Republican logic while they refuse to cut the $20Bn in tax breaks given to oil companies.

8:30 Update: Despite their massive tax cuts and bailouts, our "job creators" only managed create 80,000 jobs last month. That's 20% less than the 100,000 consensus and about 50% less than GS's prediction that boosted the market yesterday. For all of Q2, we have netted 225,000 new jobs, down from 684,000 in the first Quarter.

We discussed consumer spending yesterday as our reasons to flip bullish and it was a big wheeeeeee! on oil as we caught our $88.50 shorting target on the (/CL) Futures and this morning we hit $84.50 for a very nice $4,000 gain on each of those contract. In yesterday's post, we discussed our love of the SQQQ July $47 calls, which did give us the opportunity to double down at $1.05 in Member chat – hopefully those will do well, assuming we have a little sell-off this morning.

We also talked about shorting AMZN and EDZ will be an attractive add this morning but we're not going to go too crazy with the shorts until we begin to violate our supports on the Big Chart so let's keep a close eye on 12,800 on the Dow, which should be tested this morning, as well as the very critical 1,360 on the S&P.

There's no reason to be bullish at all – other than that usuaul BS that the news is so bad, it's GOOD – because the Fed will ride to the rescue and throw more money at the problem. If all the first $3Tn spent by the Fed has done is buy us 80,000 jobs – I'm not really clear what magic the next $3,000,000,000,000 is supposed to do.

We need policy changres from Washington and good luck getting that from this Congress. Never has there been a better time to throw the bums out – and you KNOW who the bums are, don't you?

Have a great weekend,

– Phil