1,440 – Again.

1,440 – Again.

That's right, we have made not one inch of progress since we had the same exact title in last Wednesday's post, when I said: "This is the part where the MSM begins to realize that Manufacturing is slowing down, stimulus won't create jobs, earnings are not going to be as good as expected, Europe is not fixed, housing is not as strong as expected andthe stock market is being manipulated. Yep, all the stuff I've been telling you for months." Our plan was to buy into the dip and that's what we've been doing the past week as our short-term virtual portfolios are now much more bullish than they were a week ago.

As you can see from Dave Fry's weekly SPY chart, we're still in an uptrending channel and still over the major support line at 1,420 and we tested 1,430 at the end of last week but have, so far, held 1,440 this week.

Last week we were all worried about Spain because they were rioting in the streets and this week we are all worried about Spain because they haven't requested a bail-out yet. "Plus ca change, plus c'est la meme chose," as they say in the country next to Spain…

In Member Chat last Wednesday, we took advantage of Oil Futures (/CL) testing $90 to go long and by the end of the week it was back to where we liked to short it at $93 and this morning, ahead of inventories, oil is at $91.22 but we're not long today as we don't expect the bulls to have much to get excited about but, if we get a dip to $88.50 that holds – we'd like to go long there. As you can see from this USO chart – we're pretty well stuck in the channel but the bottom is about $89 so I'm thinking a build this morning takes us just below the $33 line on USO.

In Member Chat last Wednesday, we took advantage of Oil Futures (/CL) testing $90 to go long and by the end of the week it was back to where we liked to short it at $93 and this morning, ahead of inventories, oil is at $91.22 but we're not long today as we don't expect the bulls to have much to get excited about but, if we get a dip to $88.50 that holds – we'd like to go long there. As you can see from this USO chart – we're pretty well stuck in the channel but the bottom is about $89 so I'm thinking a build this morning takes us just below the $33 line on USO.

AAPL was at $666 last Wednesday and they closed at $665 yesterday but we've worked ourselves into a more bullish position there (we had several long-term bullish trade ideas on AAPL in Member Chat that day). XLF was holding $15.50 and we went longer there – now $15.69. We added QQQ Oct $70s at .30 and yesterday we had the chance to add them again after having cashed out that batch at .50 (up 66% in a week). We took $9 and ran on the PCLN Oct $595 puts in our $25KP and that nailed the high for the week, TLT was at $125 (now $124.19), the VIX was at at 15.70 (now 15.71) and my comment on HPQ hitting $16.50 to Members was "WTF?" and I reiterated our reasons for being long on that one (now $17.15).

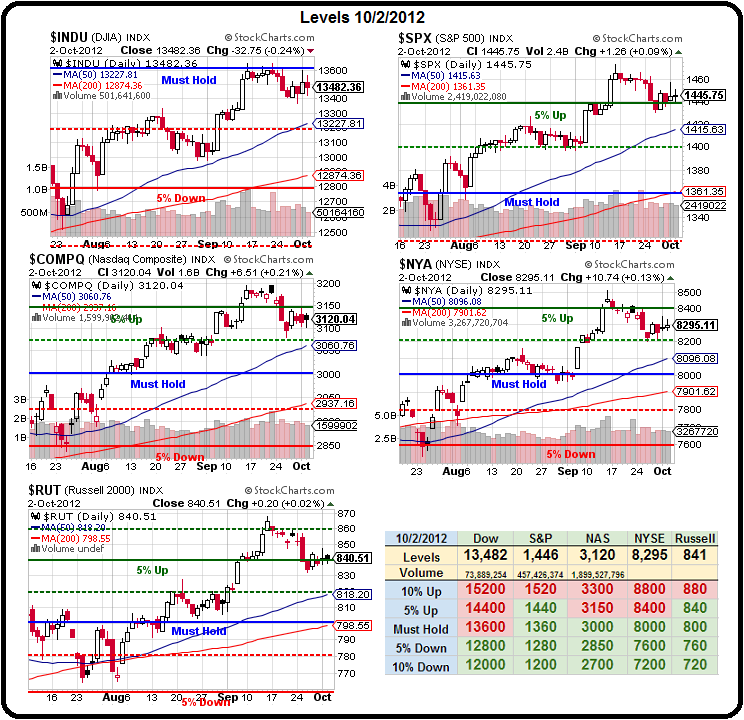

Annoying as the past 7 days have been, as you can see from our Big Chart, it's really just a bullish consolidation along our resistance lines as we wait for the Dow to build up enough steam to hit 13,600 – which our Tuesday analysis of the Dow components ("Still Waiting for the Dow to Show Some Strength") determined should be possible but we're only expecting a 600-point run at most (4.4%) from last week's 13,559 as long as earnings hold up.

Annoying as the past 7 days have been, as you can see from our Big Chart, it's really just a bullish consolidation along our resistance lines as we wait for the Dow to build up enough steam to hit 13,600 – which our Tuesday analysis of the Dow components ("Still Waiting for the Dow to Show Some Strength") determined should be possible but we're only expecting a 600-point run at most (4.4%) from last week's 13,559 as long as earnings hold up.

That, we determined, is why the Dow was and is having so much trouble getting over the Must Hold line at 13,600 and we were so harshly rejected there on Monday that we fell all the way back to 13,400 yesterday before turning back up.

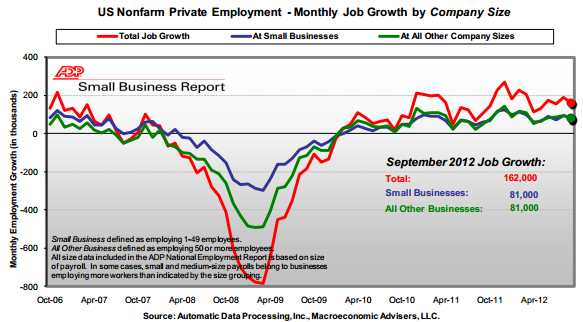

This morning's ADP Report came in better than expected, with 162,000 jobs added in the private sector. Of those 162,000 jobs, just 4,000 were manufacturing and 18,000 "goods producing" with all the rest coming from the service sector. When I was in college 30 years ago and we used to talk about transitioning to a "service economy," I don't think anyone ever imagined it could get so extreme….

That shifts the focus back to Friday's Non-Farm Payroll Report, where we're expecting about 120,000 jobs to be added but last month was surprisingly weak at 96,000.

That shifts the focus back to Friday's Non-Farm Payroll Report, where we're expecting about 120,000 jobs to be added but last month was surprisingly weak at 96,000.

Tonight jobs will be a big topic of discussion at the Presidential debate but, as you can see from this chart, it's amazing that it's an issue at all. Obama took office pretty much at the dead bottom of that trough and the improvements made since that time have been nothing but stunning but, for some reason, the Democrats allow the Republicans to take control of the narrative and act like coming into office with an economy that was losing 800,000 jobs a month was somehow Obama's fault – ridiculous!

Also ridiculous is the Romney plan to cut tax rates by 20%, which will reduce taxes paid by households with incomes over $200,000 by $250Bn a year. According to the Tax Policy Center, If you leave preferential tax rates for savings and investing (e.g., long-term capital gains and dividends) untouched, as Mr. Romney has said he would do, that leaves only $165 billion of available tax expenditures that can be eliminated from this same group of high-income earners once their marginal tax rates fall.

Also ridiculous is the Romney plan to cut tax rates by 20%, which will reduce taxes paid by households with incomes over $200,000 by $250Bn a year. According to the Tax Policy Center, If you leave preferential tax rates for savings and investing (e.g., long-term capital gains and dividends) untouched, as Mr. Romney has said he would do, that leaves only $165 billion of available tax expenditures that can be eliminated from this same group of high-income earners once their marginal tax rates fall.

That means there’s an $86 billion shortfall — the difference between $251 billion in tax cuts and $165 billion in potential tax increases on this high-income group — that needs to be accounted for somewhere. By process of elimination that somewhere must be the rest of the population, the 95 percent of households earning less than about $200,000 annually. No wonder Pinocchio Ryan said he didn't have time to do the math!

We're not expecting much of a move in the markets until after the debate because fiscally irresponsible nonsense like this scares a lot of investors – and rightly so. We also face headwinds from the BOJ having a Yentervention as they try to weaken the Yen by buying Dollars this morning. Already, at 8:45, the Dollar is back over 80 and the Yen is at 78.39, up from 78 yesterday and we assume they'll target 78.50 today and 79 tomorrow, which could bring the Dollar back to 81 if they are successful.

That will put pressure on commodities and the good news there is that gasoline is plunging below $2.80 (/RB) and weak demand evidenced in the inventory report (any kind of build) could send us all the way back to re-test $2.70, where they'll likely make a good long. Meanwhile, if the 2.80 line holds pre-market, /RB Futures make a fun bullish play over that line with tight stops below it as we don't expect the Dollar to go much higher from here (now 81.05) today.

That will put pressure on commodities and the good news there is that gasoline is plunging below $2.80 (/RB) and weak demand evidenced in the inventory report (any kind of build) could send us all the way back to re-test $2.70, where they'll likely make a good long. Meanwhile, if the 2.80 line holds pre-market, /RB Futures make a fun bullish play over that line with tight stops below it as we don't expect the Dollar to go much higher from here (now 81.05) today.

Tomorrow is a big data day with Jobless Claims, Factory Orders and FOMC Minutes while we wait for Friday's NFP report. Earnings are not very exciting but next Tuesday is AA & YUM and then we're off to the races but today is most likely a watch and wait kind of day as we wait to see what nasty things Romney has to say about our "failed" economy – the one that's no longer losing 800,000 jobs a month with a stock market that's gained an average of 25% a year since Obama took office…