Up, up and away!

Up, up and away!

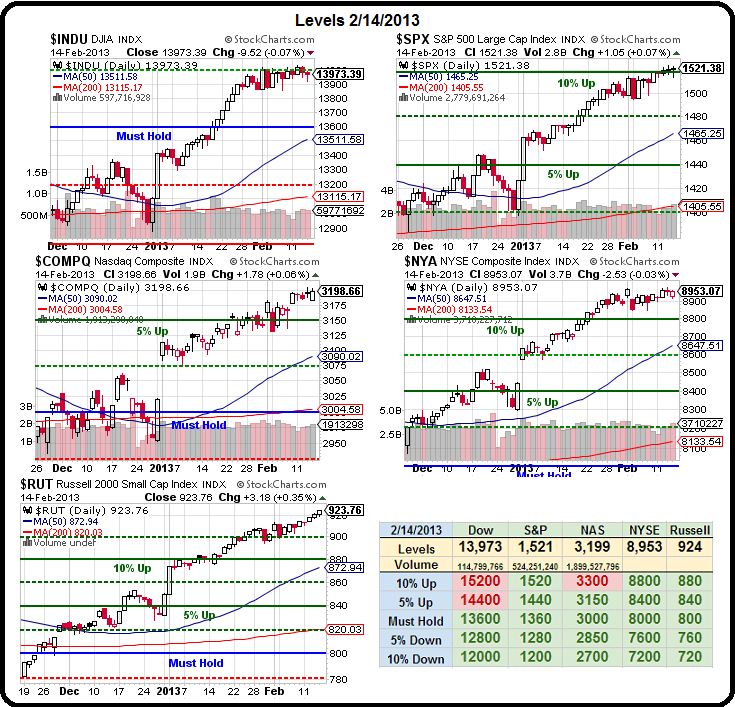

We did that one already but what more can you say about a market that simply does not go down? We WANT to be more bearish, but our levels simply won't let us. Not only are we running out of red boxes on our Big Chart (indicating it's time to roll out a higher set of goals), but the Russell is already over what would be the 15% line.

Those were, of course, our 2012 goals and we hit them on the money but we haven't been ready to lay down targets for 2013 but, after this weekend – it will be time. Since it is Friday, and a holiday weekend, let's review something we discussed in yesterday's Member Chat – which was an article by Anthony Mirhaydari titled "10 Big Worries About This Market."

Now Anthony's a smart guy so I review this out of respect but we all need to keep in mind that a lot of people are "bearish" for a lot of the wrong reasons and, since this is a list of 10 good ones – it's worth taking a hard look at them.

Before we begin, I just want to mention another smart bear who is being backed into a corner today – poor Bill Ackman is being taken to the woodshed for daring to piss off Carl Icahn, who disclosed a 13% stake in HLF today and sent the stock flying up 22% pre-market. There is nothing worse than a short squeeze when you are bearish and the worst part is, to get out of the trade you have to capitulate by BUYING the stock you hate – thereby adding to the run-up.

Before we begin, I just want to mention another smart bear who is being backed into a corner today – poor Bill Ackman is being taken to the woodshed for daring to piss off Carl Icahn, who disclosed a 13% stake in HLF today and sent the stock flying up 22% pre-market. There is nothing worse than a short squeeze when you are bearish and the worst part is, to get out of the trade you have to capitulate by BUYING the stock you hate – thereby adding to the run-up.

While we all know Bill Ackman has a litany of very good reasons to be short HLF – who cares if more people are buying than selling – especially when one or two of the buyers are so big they totally overwhelm the sellers? The whole market is like that – it's all about sentiment – until it isn't. Our job is only to know when the wind is changing so we can get out. We're not here to fight the battles with the big boys.

"Can we rally on?" asks Mirhaydari – and he acknowledges the Fed and other Central Banks as the primary driver of the rally but he also premises his outlook on what he believes is a coming Global Recession (or the continuation of one we only papered over so far) and I gave my view on what's going on in Europe in yesterday's post.

Indeed "Too Much Faith in Cheap Money" is Miraydari's worry #1 and yes, we are kicking the can down the road but, even in laying out his concern Anthony points out Japan is 230% of their GDP in debt. That means that the US, Europe and China have a very, very long road ahead to kick their cans down before we're in the same situation as Japan (which is to say up 40% in the past 6 months on the Nikkei).

What if kicking the can is the correct strategy? What if we have faith in cheap money because it works – the same way fireman have faith in water to put out fires. Will things get wet and even damaged from all the water? Sure they will, but it beats getting burned – right Japan? So let's give worry #1 a grade of C – it's a religious argument at best – Keynes vs. Hayeck – and we're not going to solve it here.

Worry #2 is "Investors are Way too Optimistic" and we'll skip that since it's silly. They are only too optimistic if they are wrong and, as I often say to Members – sometimes the reason 99% of the people are on the same side of a bet is simply because it's obvious. When the Fed stops dropping $85Bn a month into the Economy and 150,000 people a month aren't being hired and when Corporations stop reporting record earnings – DESPITE the recession in Europe – THEN I would say Investors are too optimistic but not buying into your bearish premise does not make me an optimist – maybe just a realist.

Worry #3 – "The Economic Data Are Stalling Out." In Europe, yes, in Asia, no, in the US, no way. In fact, the long-suffering Empire State Manufacturing Index just surprised up at 10.04 today, way higher than the -1.75 expected and up from -7.8 prior. New orders were up 20.49 points and shipments jumped 10 points to 13.08 and, of course, prices paid rose to 26.26 but we'll discuss inflation later. Like the Fiscal Cliff, Sequestration and the Debt Ceiling may cut the legs out from under this rally but we can cover that with some hedging – fear of things that haven't happened is not a good reason to run from the markets – as the bears learned in November (well, some of them did).

Record gas prices are mentioned but what all these analysts seem to miss is the 10% drop in demand and we can simplify that by assuming people are getting 10% better mileage on the average car or have found ways to drive 10% less and consume 10% less energy in their home Either way, unless the "record" gas prices are 10% higher than they were (they are not), then what all these clever analysts claim is a net negative for the consumer is actually a net POSITIVE as consumers don't care what they pay per gallon – they care what they pay per fill-up or per month in their energy bills. If you charged me $50 a gallon for gas but I only needed one gallon a month – how is that impacting me negatively?

OPEC (and the NYMEX crooks) have totally screwed themselves by keeping prices so high for so long. They have destroyed demand in a way that will never come back and, even worse, they have set the planet firmly on the path to alternate, renewable energy. We've been very publicly, very short on oil so take my commentary from that perspective but, even as I write this, we are having yet another $1,000 per contract morning shorting oil off the $97.50 line we've been playing for two weeks. We also have longer-term SCO and USO trades looking for bigger moves down but I think we are on very solid fundamental footing here.

Worry #4 is a good one and, since it's 9:20 I'm going to pause here and finish this article over the weekend. "Fewer Stocks are Moving Up" is a legitimate technical concern regarding rally exhaustion but I question the very brief time-frame (30 days) – especially as we're clearly consolidating along the top of long-term ranges so, of course we are taking a breather here – a healthy one perhaps. As I said above (and have been saying all year) – we MUST watch our levels and keep our emotions in check.

TO BE CONTINUED

IN PROGRESS