Show us the money!

TSLA (we're short) popped 9.15% yesterday based on an upgrade by Jefferies with a price target of $130, sending the stock to $117.18 for the day and the shorts are probably not done being squeezed. Analyst Elaine Kwei's logic is based on the fact that TSLA is a luxury car that is out-competing BMW, Mercedes, Audi and Porsche, accounting for all of the luxury car market's sales growth this year.

Based on reported sales this calendar year and customer VIN numbers, "we believe there is likely upside to prior 2Q guidance for deliveries of 4,500 units, as well as 2013 guidance of 21,000 units," Kwei said in her research note. "We estimate TSLA has taken 9% market share in the U.S. full-size luxury sedan market, accounting for nearly all growth in the segment. We increase our estimates and PT (price target) to $130 based on a 10-year DCF (discounted cash flow) and update our EV market forecast."

That sounds great – to people who have no concept of math! TSLA may sell more than 21,000 cars in 2013? Let's see, even if they sold an average car for $80,000 and sold (let's go crazy) 25,000 of them – that's $2Bn. Now, let's keep the insanity flowing and assume they make double the industry average of 5% and rake in $200M in profits on those sales.

$200M is a nice amount of money. Even a multi-Billionaire like Elon Musk is happy to have an extra $200M but TSLA Motors, Inc has floated 115M shares of stock so $200M, unfortunately, only works out to $1.74 per share and that means, if you buy TSLA stock for the current price of $117, it will take them 67 years to make your money back.

$200M is a nice amount of money. Even a multi-Billionaire like Elon Musk is happy to have an extra $200M but TSLA Motors, Inc has floated 115M shares of stock so $200M, unfortunately, only works out to $1.74 per share and that means, if you buy TSLA stock for the current price of $117, it will take them 67 years to make your money back.

If they DOUBLE their business (from our super-rosey outlook) to 50,000 cars in two years (ignoring the fact that it's taken them 10 years to get to 21,000 cars) and then they double it again to 100,000 cars in two more years – now it's 2018 and we're assuming that everything went perfectly and they're still getting $80,000 per car (essentially the ENTIRE current luxury car market) and they are still making double the industry-standard margins and it STILL will take you 17 more years (2035) to get your $117 per share back!

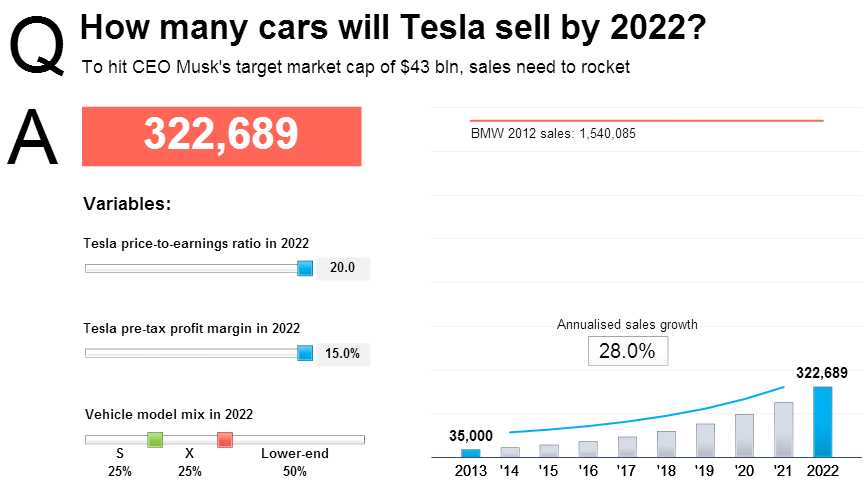

On the above left is a cool Thomson/Reuters calculator that shows how many cars TSLA has to sell over the next 10 years (now 9 and they are WAY behind already) in order to justify the projected market cap of $43Bn. For this example, I've pegged both the p/e and the profit margins to the max – to give them the complete benefit of doubt but feel free to put in your own numbers and see how ridiculous this is.

Note the Wedbush chart that shows the ENTIRE luxury car market (over $50,000) is about 300,000 cars. So, Ms Kwei projects TSLA wipes out the competition without a fight? Without losing margin?

Maybe, as with the Reuters calculator, she's assuming they come out with a cheaper car (that doesn't exist yet) and they sell 200,000 of those but then they would have to make 20% margins on $40,000 cars to make up for the fact that they aren't making 10% on $80,000 cars. This is just math folks, I'm sure it's a prerequisite for an analyst job at Jefferies.

And I don't mean to pick on Ms. Kwei or Jefferies or even TSLA (who we're short on) but they just happen to be an excellent example of the shoddy BS that passes for analysis these days and it's this kind of insane, baseless rationalizations that are driving many of our market's top performers. When you price TSLA at 136 times FORWARD earnings projections then pricing AMZN (we're also short) at 88 times seems reasonable.

NFLX is another good one (and we sold our longs yesterday) as they popped 5% yesterday after announcing they had gotten an exclusive deal to show RERUNS of "New Girl" from Fox (NWS). Now, NFLX is a $12.5Bn company, after being an $11.9Bn company yesterday morning and you may wonder why having the right to show reruns of a show that 4.4M people out of 310M people in America watch should be worth $600M (the amount NFLX paid is undisclosed) and, if that's the case – you can't be an analyst because analysts aren't allowed to ask logical questions like that anymore.

Still, we can assume NFLX is BRILLIANT and that they have the customer metrics that led them to believe they had a New Girl-sized hole in their demographic offerings and those 4.4M people were 3.4M people who don't use NFLX now and 10% of them are likely to get NFLX to follow their favorite show in reruns (seems generous, doesn't it?) and that's 700,000 x $10 per month = $84M a year. So, it actually IS a good deal for them – assuming they know what they're doing and everything goes well for them, of course.

Still, $12.5Bn for NFLX, who made $17M (not a typo) in 2012 seems a tad steep at 735 to one. In fact, valuations like this make me look at TSLA and say "Hey, that's a good deal!" While I don't like NFLX at this price ($225) I don't HATE them the way I did in 2011, when they were $300 per share. At that time, my main objection wasn't their business model but the bandwidth they were sucking up – as I felt it placed an upward limitation on their growth. Now, just two years later – capacity is way up and that, then, expands their potential customer base and nothing is better than having millions of people giving you $10 a month (by the way, do you subscribe to Stock World Weekly?).

Keep in mind these are just example but, overall, the whole market is valued just a tad high based on rosey expectations that may not pan out. We're rolling right into earnings next week, with AA kicking off the majors on Tuesday and we'll see if US-based corporations can shake off the Global malaise. Until then, we remain cautious and very skeptical of this sudden rush of analyst upgrades – which is running counter to the 80% of the companies who are giving negative as opposed to positive guidance so far.

Be careful out there!