And up we go again!

And up we go again!

Clack, clack, clack, like a roller coaster heading up the tracks, the market ticks higher every morning in the futures and, most of the time lately, we then sell off once the real session opens up. As you can see from Dave Fry's chart, we had a wild session yesterday with a huge open, a big dip, a sharp recovery and a bigger dip – wheeeeee!!!!

This morning, we're back up again, almost back to yesterday's highs as we wait for Draghi (7:45) and the ECB to give us a hint of MORE FREE MONEY. Just like the hints they gave us at the last 3 meetings. There's still no actual money but, as long as we believe really hard, we can still act like it's coming.

Acting is a good way to sum up this mornings PMI reports out of China. I'm not going to get into it again as we already tweeted out that commentary from the morning Member Chat but, suffice to say it was fake, Fake, FAKE!

We took advantage of the morning run-up to short Oil Futures at $107 (/CL), the S&P at 1,695 (/ES) and the Russell at 1,050 (/TF). We have tight stops above those lines but, if the ECB disappoints, we're expecting the market to throw a little temper-tantrum, much like yesterday's action.

We took advantage of the morning run-up to short Oil Futures at $107 (/CL), the S&P at 1,695 (/ES) and the Russell at 1,050 (/TF). We have tight stops above those lines but, if the ECB disappoints, we're expecting the market to throw a little temper-tantrum, much like yesterday's action.

One interesting mixed signal we're getting this morning is a sharp rise in Bond-buying, indicated by TLT shooting up from 105.76 to 107.75 since last night. That's not what you expect to see if the market is rallying.

Still, if we do get over that 1,700 line on the S&P, we need to switch off our brains and go long, long, long until that line fails us again. More likely, we form an "M" pattern as we're rejected here and the S&P falls back to 1,600, which would be a nice, HEALTHY 5% correction (5.8% to be exact). If we can consolidate between 1,600 and 1,700 between now and next earnings – I will be able to get much more bullish as we fill in that huge air pocket we have above the 200 dmas.

7:50 Update: No change from the ECB (expected) but it's all about what Draghi says – as he never actually DOES anything, does he? The press conference is at 8:30 so let's contemplate:

7:50 Update: No change from the ECB (expected) but it's all about what Draghi says – as he never actually DOES anything, does he? The press conference is at 8:30 so let's contemplate:

Draghi was born in Rome, graduated to MIT in 1976 with a PHD in econmics (he's 66) and he's had the job as head of the ECB since November 2011. Oh yes, in between he was a Goldman Sachs Vice-Chairman (2002-5) before they sent him off to run the bank of Italy and then, the ECB. So this guy will say ANYTHING to goose the markets and please his masters. The problem is he already has cried "wolf" (or, in this case "FREE MONEY") thee times this year and, all three times, the villagers have run out and bought stocks and all three times, there was no free money. Now the little central banker is going to cry "FREE MONEY" once again – will anyone listen?

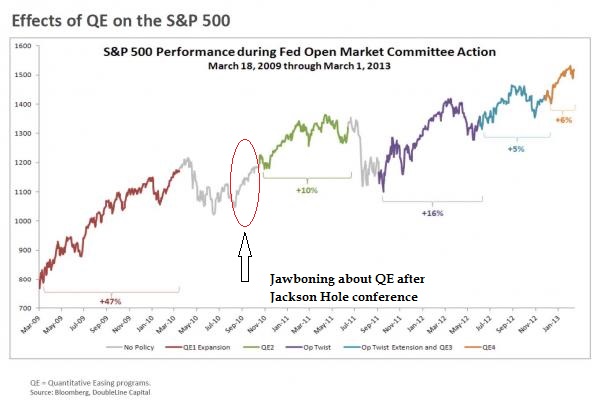

There's a very popular notion that you can't fight the Fed, and that's certainly been true for the past 4 years as the S&P has come back from 666 in March of 2009 to 1,696 yesterday (154%), adding $8Tn in market cap to the S&P, another $8Tn to the Dow, $4Tn to the Russell and I don't have fiigurs for the NYSE and the Nasdaq, but let's call it a lot – probably another $20Tn for a total of $40Tn but a lot of stocks are cross-listed so call it $25Tn US and $50Tn globally. The Fed has added about $3Tn to their balance sheets and, of course, they give cash to banks for worthless assets and the banks can then turn around and leverage that cash 10:1 so that explains $30Tn of the gains.

Of course, that's a simplistic model and, of course, the economy has improved as well. In fact, just yesterday they recalculated the GDP to add $550Bn more dollars and, if we lever that 10:1 we have another $5Tn to add to market caps (see yesterday's post).

Of course, that's a simplistic model and, of course, the economy has improved as well. In fact, just yesterday they recalculated the GDP to add $550Bn more dollars and, if we lever that 10:1 we have another $5Tn to add to market caps (see yesterday's post).

Regardless of what kind of BS you think messing with the GDP is – it's a done deal so let's call that $5Tn also "legitimate" and that means that we're good for about even $55Tn – that's another 10% up from here! It will take a while for the Banksters to recalculate that last 10% though so I'm not expecting it to impact us immediately, the way Fed injections do.

BUT – keep in mind that MOST of the gains of the past 4 years are due to Fed stimulus – the economy itself is not all that exciting BUT, it is improving. Over time, I'm happy to accept a larger market valuation but it's simply a question of too much too soon and there's always the overriding danger that the Fed or one of the other Central Banksters may reverse policy and WITHDRAW stimulus – which would have the net opposite effect from when they put it in (obviously, I hope).

Long-term, we don't think they can possibly reverse fast enough to put the brakes on runaway inflation caused by too much liquidity in the market. At the moment, the economy is so bad that, even though Corporations and Financials are swimming in cash – they aren't spending any of it. Not for hiring, not for lending (except to each other in the top 1%), not for capital goods, not for any R&D that isn't deductable. That's why our economy is in such a slow-motion recovery – despite the MASSIVE change in our Monetary Base over the past 4 years.

Long-term, we don't think they can possibly reverse fast enough to put the brakes on runaway inflation caused by too much liquidity in the market. At the moment, the economy is so bad that, even though Corporations and Financials are swimming in cash – they aren't spending any of it. Not for hiring, not for lending (except to each other in the top 1%), not for capital goods, not for any R&D that isn't deductable. That's why our economy is in such a slow-motion recovery – despite the MASSIVE change in our Monetary Base over the past 4 years.

In the bigger picture, all this QE has been having diminishing returns and that's why it's not going to take more than Draghi crying "MORE FREE MONEY" to pop the S&P over that 1,700 line, where the next stop should be 2,000, up 200% from our 2009 lows. Even if we give them the GDP and assume that money trickles into Market Caps over the next 6 months, we're still going to be $500Bn – $1Tn shy from the Fed and the other Central Banks (who would need to, as a group, at least match the Fed). Either they have to step up or the Global Economy has to pick up buit there will be no free ride over that 1,700 line on the S&P – we simply need more stimulus to get there.

More stimulus? Why not? The alternative is unpalitable to our Political Class, who are threatened with becomming one of the 500M Global Unemployed (14% of the workforce) if they can't keep their phoney-baloney jobs. Kicking cans down the road is pretty much all our "leaders" are good at these days.

More stimulus? Why not? The alternative is unpalitable to our Political Class, who are threatened with becomming one of the 500M Global Unemployed (14% of the workforce) if they can't keep their phoney-baloney jobs. Kicking cans down the road is pretty much all our "leaders" are good at these days.

Speaking of unemployent, we got that number at 8:30 and it was very good, with just 326,000 people losing their jobs last week, vs 345,000 the week before. Now, is that good news or bad news? It's good if people are working but bad if a few thousand more people working leads the the Fed withrawing even $100Bn of stimulus – which would knock $1Tn (2%) off the markets per our simplistic model.

“Confidence indicators have shown some further improvement from low levels and tentatively confirm the expectation of a stabilization in economic activity,” Draghi said at a press conference in Frankfurt today after the ECB kept its benchmark rate at 0.5 percent. Policy makers expect to keep borrowing costs “at the present or lower level for an extended period of time,” he said, repeating a formula first deployed last month.

Sounds like "wolf" to me – we'll see if the sheeple are buying it today.