What a long, strange trip it's been.

As you can see from Finviz's S&P Futures Chart, we took a big dive on Friday as the Non-Farm Payroll Reports disapppointed. This news seemed to surprise everyone – except us, of course – as we've been telling you the macro situation is falling apart for ages and this is simply evidence of it.

That's why, in Thursday's post, since this is a Free Trade Idea week at PSW, we discussed how we cashed out most of our longs and got aggressively short in our Short-Term Portfolio and we came up with not one, not two but three aggressive ways for you to short the Russell by using TZA (ultra-short Russell ETF) as a proxy.

Obviously, that is EXACTLY what you want to see the Russell do when you have bought a bunch of ultra-short positions, so you are welcome and remember – PLEASE DO NOT SUBSCRIBE TO OUR NEWSLETTER! We much prefer that you wait until July, when we will give out some more free trade ideas. After all, you wouldn't want trade ideas like these delivered to you every morning, would you?

We spent all weekend going over news and statistics in our Live Member Chat Room (the one you don't subscribe to), so I'm not going to rehash that here – not when we have so much other stuff to hash this morning…

First of all, did you know that Japan FAKED their Wage Growth Data last year? Yes, it was fake, Fake, FAKE and 6 months of positive wage announcements have now been reversed, casting great doubt upon the last 6 months, which are subject to reveiw. Overall, per Goldman:

First of all, did you know that Japan FAKED their Wage Growth Data last year? Yes, it was fake, Fake, FAKE and 6 months of positive wage announcements have now been reversed, casting great doubt upon the last 6 months, which are subject to reveiw. Overall, per Goldman:

"For CY2014, total cash wage growth was lowered 0.4 pp to +0.4% yoy, from +0.8% pre-revision, while October and November 2014 total cash wages came in negative (at -0.1% and -0.2%, respectively;wages also shrank on a nominal basis). Basic wagesremained negative yoy through December 2014 even after last spring’s shunto wage hike,before finally moving into positive territory in January 2015 (+0.2%)."

In fact (and hang on to your hats), if you adjust Japanese wages for the buying power of the Yen, you get a real glimpse into the ongoing disaster that passes the World's 3rd largest economy:

I want you to print out this chart and look at it any time you feel compelled to buy the dip! Keep in mind that each time the BOJ announced these FAKE wage numbers (all of 2014, essentially), the Asian markets skyrocketed on the "proof" that Abenomics (ie. printing money) was working. China rallied on the news, as did India, Singapore, South Korea, etc. because, surely, if Japanese wages were on the rise, then consumer spending was sure to follow.

That's left us with a lot of companies that have made a lot of gains based on speculation that has a false premise. Aside from our own jobs numbers having a nearly 50% miss on Friday, the majority of jobs being created in the US are going to people 55 and older as they are forced to remain in the work-force as Fed policies destroy retirement incomes (no interest) and push seniors back into the labor force.

That's causing youths to drop out in droves and overall participation rate is back at levels we haven't seen since the end of the 70s recession with 93.2M eligible Americans not working.

That's causing youths to drop out in droves and overall participation rate is back at levels we haven't seen since the end of the 70s recession with 93.2M eligible Americans not working.

A lot of those people are hiding out in colleges, because the Government has cut back benefit programs that would help subsidize young people who are forced to accept minimum-wage jobs in order to get started in life but no one has cut back LENDING money to "students" (and why should they at 6% rates?), so they can attend and live at college for 4-5 years on borrowed money rather than face a tight job market right after the prom.

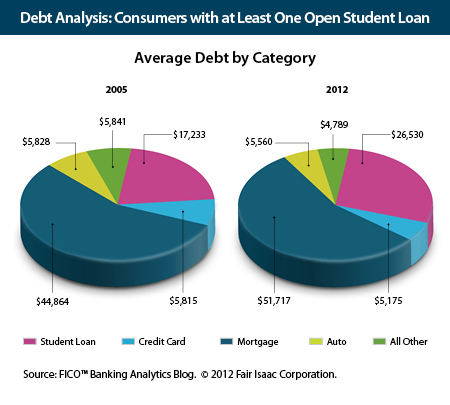

Student loan debt in the US is now over $1Tn, up almost 50% in the past 7 years and 1/3 of those loans are already in default (90 days past due) yet the loans still get made.

We tell young people thay HAVE to go to college to get a good job and that leads them to borrow an average of $26,500 (plus money pulled away from their savings and their parents savings, because who wants to deny their children a "proper" education?) – only to come out of college (deeply in debt) and find out there are no good jobs available. This is turning into a scam, folks!

That's OK though because, to succeed in Corporate America these days, you need to be a bit of a scammer. According to Deutsche Bank, 18% of the S&P's reported $118 in earnings per share are non-GAAP, pro-forma add-backs (ie. not earnings at all) and the real EPS is $102 per share, which is, essentially, just AAPL's earnings. As you can see on the chart, when you use GAAP to calculate earnings, they are negative for the year after a TERRIBLE Q4.

That's OK though because, to succeed in Corporate America these days, you need to be a bit of a scammer. According to Deutsche Bank, 18% of the S&P's reported $118 in earnings per share are non-GAAP, pro-forma add-backs (ie. not earnings at all) and the real EPS is $102 per share, which is, essentially, just AAPL's earnings. As you can see on the chart, when you use GAAP to calculate earnings, they are negative for the year after a TERRIBLE Q4.

We'll soon see if Q1 of 2015 continues this trend with AA kicking off earnings season tomorrow. Until then, we remain very cashy and VERY cautious!