Financial Markets and Economy

Stocks are chill as bonds freak out. Can this go on? (Yahoo Finance)

Stocks are chill as bonds freak out. Can this go on? (Yahoo Finance)

Government bonds and currencies are the things most sensitive to such concerns about the immediate and future cost of loans and trading capital. The jumpiness in bonds and currencies is also probably made more extreme by reduced liquidity in those markets, a result of stricter bank capital rules and the heavy presence of central banks as buyers of fixed-income paper.

The puzzle now – as yet another Greek-bailout flashpoint approaches and a US employment report helps determine the Fed’s plans – is whether stocks can continue to simply absorb the other asset market’s emotional moves without getting getting caught up in them.

Climate Deal Badly Needs a Big Stick (NY Times)

Climate Deal Badly Needs a Big Stick (NY Times)

Few economists are as versed in the global diplomatic effort to combat climate change as Nicholas Stern of Britain.

So it was particularly distressing to hear him say, at a debate in New York a few weeks ago, that the international effort to achieve a worldwide climate agreement in Paris next December is already falling short on its most critical goal. The various pledges by nations to cut their emissions of heat-trapping greenhouse gases, he noted, will not be enough to prevent the Earth’s temperature from rising beyond the level scientists consider the tipping point to devastating environmental disruption.

Bank of America thinks investors are suffering from 'Stockholm syndrome' — and the outcome looks ugly (Business Insider)

"Stockholm syndrome" is a term used to describe when hostages begin to empathise with, and even trust, their captors.

It's also what Bank of America Merrill Lynch thinks is happening to investors going big on shares right now — and their captors are central banks.

The stock market is becoming a 'lose-lose' situation (Business Insider)

It's about to be a lose-lose situation for stock market investors.

In a note to clients on Tuesday, Bank of America's Michael Hartnett wrote that with the Fed set to raise rates and the US economy underperforming, we could be be facing a tough period for investors this year.

One Company’s Struggle to Move Manufacturing to the U.S. (Wall Street Journal)

One Company’s Struggle to Move Manufacturing to the U.S. (Wall Street Journal)

Coming home isn’t easy.

Ranir LLC learned that lesson all too well. The company, based in Grand Rapids, Mich., has long used factories overseas to make many of the dental-care products it sells to big retailers like Wal-Mart Stores Inc.

Two years ago, though, Ranir executives were frustrated by the shipping costs and communications hassles associated with a plant in Asia that made replacement heads for one of the company’s most popular electric toothbrushes. Ranir was considering bringing production of the replacement heads to Michigan in 2013 when Wal-Mart, one of the company’s biggest customers, announced an initiative pressing its suppliers to make more goods in the U.S.

Oil prices fall as OPEC chatter builds (Market Watch)

Oil prices fall as OPEC chatter builds (Market Watch)

Oil prices fell on Wednesday after an industry report showed a surprise uptick in U.S. oil inventories as traders tracked comments from the OPEC seminar in Vienna.

Greek Proposals and Expensive Buybacks (Bloomberg)

European leaders are working frantically with the International Monetary Fund to finalize their proposal on how to restructure Greek debt, though differences remain "over whether Greece can hit ambitious budget surplus targets to be included in an agreed text," as well as over "whether they present their proposal to Mr Tsipras’ government during a meeting or a teleconference." This being Europe, one official says that there was "at least a meeting of the texts; minds are probably further apart," which is the opposite of how normal negotiations work.

Draghi’s statement at the June ECB meeting in full (Market Watch)

Draghi’s statement at the June ECB meeting in full (Market Watch)

The following is the full text of Draghi’s introductory statement to the press on Wednesday, as provided on the European Central Bank website:

Mario Draghi, President of the ECB, Vítor Constâncio, Vice-President of the ECB

Frankfurt am Main, 3 June 2015

Ladies and gentlemen, the Vice-President and I are very pleased to welcome you to our press conference. We will now report on the outcome of today’s meeting of the Governing Council, which was also attended by the Commission Vice-President, Mr. Dombrovskis.

Deutsche Bank is partnering with Microsoft, HCL, and IBM to launch tech labs (Business Insider)

Deutsche Bank is partnering with Microsoft, HCL, and IBM to launch tech labs (Business Insider)

Deutsche Bank will launch three innovation labs this year, partnering with big development firms to speed creation of financial technology for its own uses and will spend up to 1 billion euros ($1.11 billion) on digital development in the next 5 years.

Germany’s largest lender, which is overhauling its own infrastructure, said it would work with three technology partners for the labs, including Microsoft in Berlin, HCL in London and IBM in Silicon Valley.

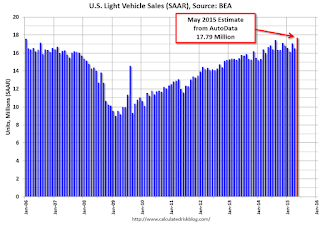

U.S. Light Vehicle Sales increased to 17.8 million annual rate in May (Calculated Risk)

Based on an AutoData estimate, light vehicle sales were at a 17.9 million SAAR in May. That is up 6.2% from May 2014, and up 7.3% from the 16.5 million annual sales rate last month.

U.S. trade deficit sinks 19% in April (Market Watch)

U.S. trade deficit sinks 19% in April (Market Watch)

The U.S. trade deficit shrank 19% in April after hitting a seven-year high in March, a big swing caused by a dockworker’s strike that briefly muddled the nation’s trade picture but left longer-term trends unchanged.

The trade gap shrank to a seasonally adjusted $40.9 billion from a revised $50.6 billion in March, the Commerce Department said Wednesday. Economists polled by MarketWatch had expected the deficit to fall to a seasonally adjusted $43.5 billion.

The smaller trade deficit in the first month of the second quarter suggests trade will be less of a drag on the U.S. economy in the spring. Gross domestic product, or the value of everything an economy produces, improves when the trade deficit declines.

OPEC is set to carry on pumping oil nearly flat-out for months more (Business Insider)

OPEC is set to carry on pumping oil nearly flat-out for months more (Business Insider)

OPEC is set to carry on pumping oil nearly flat-out for months more, content that last year's shock market therapy has revived moribund demand and knocked back growing competition.

With oil prices having stabilized, for now, at around $65 a barrel, some $20 off their January lows, there's little appetite within the Organization of the Petroleum Exporting Countries to modify production limits, as some analysts have suggested is an outside possibility.

For U.S. Manufacturing, Opportunities and Challenges (Wall Street Journal)

Willy Shih, a professor of management at Harvard Business School, has spent more time in factories than in academia.

The son of Chinese immigrants, he grew up in Wisconsin and Illinois and earned a doctorate in chemistry at the University of California, Berkeley. Dr. Shih worked for 28 years in industry, including executive jobs at International Business Machines, Silicon Graphics and Eastman Kodak, before becoming a professor in 2007. He is also a director of Flextronics International, a Singapore-based global manufacturer, and advises the Manufacturing Academy of Denmark.

U.S. stock futures climb after ADP jobs report (Market Watch)

Wall Street was poised for a positive session on Wednesday, with futures inching higher as investors digested data showing 201,000 private-sector jobs were created last month.

The job growth was in line with expectations and market reaction was largely muted.

Stocks and Trading

The NFL draft is a lot like investing in the stock market (Business Insider)

The NFL draft is a lot like investing in the stock market (Business Insider)

A research paper written by Richard Thaler and Cade Massey concluded the biggest mistake NFL teams make during the draft process is paying too much for the chance to draft top players. The two lessons learned from these mistakes: "The best player (or company) does not necessarily make the best pick " and "NFL general managers (and investment managers) overpay for glamour." Stocks nobody wants are similar to late-round draft picks, they often provide the best value for the money.

Are Stocks Due For A Big Move? (Dana Lyon's Tumblr)

With last month’s failed (so far) breakout in the U.S. equity market, stocks are relegated once again to range-bound status. Essentially the market has gone nowhere since the beginning of the year and, by some measures, 2015 has been the quietest start to a year in over a century. One characteristic of the stagnant action has been a lack of out-sized daily moves in the market, up or down. Specifically, as detailed in today’s Chart Of The Day, June 1, 2015 marked 111 days since the S&P 500 last had a 2% daily gain or loss. This is the index’s longest streak without a 2% day since the one that ended on June 1, 2012 at…111 days.

Politics

Iowa Poll: Bill and George W. May Not Hurt Hillary Clinton and Jeb Bush (Bloomberg)

Iowa Poll: Bill and George W. May Not Hurt Hillary Clinton and Jeb Bush (Bloomberg)

The nation's next president may well be advised by a former one. For the most part, that prospect doesn't seem to trouble Iowa caucus-goers.

Fifty-seven percent of likely Republican caucus-goers in a new Bloomberg Politics/Des Moines Register Iowa Poll said that it would be “mostly good” for Jeb Bush's presidency if he were to tap his older brother, George, as a close adviser. Thirty-three percent said such an arrangement would be “mostly bad” for Jeb Bush's presidency.

Republicans Resist F.C.C. Proposal for Lifeline Broadband Subsidies (NY Times)

Republicans Resist F.C.C. Proposal for Lifeline Broadband Subsidies (NY Times)

Republicans pushed back on Tuesday against a plan from the chairman of the Federal Communications Commission to subsidize broadband Internet for poor Americans.

At a Senate subcommittee hearing, no one disputed that broadband can be critical to filing job applications and completing schoolwork. But many lawmakers questioned just how costly the undertaking might be.

Technology

Apple’s Tim Cook Delivers Blistering Speech On Encryption, Privacy (Tech Crunch)

Yesterday evening, Apple CEO Tim Cook was honored for ‘corporate leadership’ during EPIC’s Champions of Freedom event in Washington. Cook spoke remotely to the assembled audience on guarding customer privacy, ensuring security and protecting their right to encryption.

“Like many of you, we at Apple reject the idea that our customers should have to make tradeoffs between privacy and security,” Cook opened. “We can, and we must provide both in equal measure. We believe that people have a fundamental right to privacy. The American people demand it, the constitution demands it, morality demands it.”

Apple’s plan to take over your entire home will start in these two categories (Business Insider)

The first batch of products built on top of Apple’s HomeKit — a framework that helps develop iPhone-controlled home appliances — are finally out. The products range from a lighting dimmer and an air quality monitor to an energy consumption tracker and a door locks controller.

Meet the New Generation of Robots for Manufacturing (Wall Street Journal)

Meet the New Generation of Robots for Manufacturing (Wall Street Journal)

A new generation of robots is on the way—smarter, more mobile, more collaborative and more adaptable. They promise to bring major changes to the factory floor, as well as potentially to the global competitive landscape.

Robots deployed in manufacturing today tend to be large, dangerous to anyone who strays too close to their whirling arms, and limited to one task, like welding, painting or hoisting heavy parts.

Health and Life Sciences

Ultrasound is making new waves throughout medicine (Science Daily)

Ultrasound is making new waves throughout medicine (Science Daily)

Mention "ultrasound" and most people likely will think of an image of a fetus in a mother's womb. But while providing peeks at the not-yet-born is one of ultrasound's most common applications, that's only a small part of the picture.

Ultrasound, also called sonography, is probably the most widely employed imaging tool in medicine today.

Game-Changing Discovery Links the Brain and the Immune System (Time)

New research could affect how we approach everything from Alzheimer's to autism

Researchers at the University of Virginia School of Medicine have made a dazzling discovery, published this week in Nature: the brain is directly connected to the immune system by previously unknown vessels.

“The first time these guys showed me the basic result, I just said one sentence: ‘They’ll have to change the textbooks,'” Kevin Lee, chairman of the UVA Department of Neuroscience, told Science Daily. He added that the discovery “will fundamentally change the way people look at the central nervous system’s relationship with the immune system.”

Life on the Home Planet

As Hopes Dim for Yangtze Survivors, China Keeps Information Under Wraps (NY Times)

As Hopes Dim for Yangtze Survivors, China Keeps Information Under Wraps (NY Times)

In a show of openness on Wednesday, the Chinese government allowed a handful of reporters to visit the scene of rescue efforts on the Yangtze River, where a cruise ship with 456 passengers and crew had capsized more than a day earlier.

But the time of transparency was brief. Police checkpoints prevented access to the river and movement through parts of the nearby town of Jianli. Hotels were told not to accept journalists unless they had registered at a media center run by local propaganda officials. Likewise, the police blocked journalists’ access to local hospitals.

THE SUMMIT: The story of the deadliest day on the world's most dangerous mountain (Business Insider)

THE SUMMIT: The story of the deadliest day on the world's most dangerous mountain (Business Insider)

"The Summit," a documenatry that chronicles the deadliest day in K2's history, is now available to stream on Netflix.

The film, directed by Nick Ryan, attempts to piece together what happend on a single day in 2008, when 11 climbers perished on the second-highest mountain in the world.

E.P.A. to Set New Limits on Airplane Emissions (NY Times)

E.P.A. to Set New Limits on Airplane Emissions (NY Times)

The Obama administration is set to announce that it will require new rules to cut emissions from airplanes, expanding a quest to tackle climate change that has included a string of significant regulations on cars, trucks and power plants.

The Environmental Protection Agency is expected to report as early as Friday its conclusion that greenhouse gas emissions from airplanes endanger human health because they significantly contribute to global warming, although people familiar with the agency’s plans said the announcement could slip into next week.