Financial Markets and Economy

93 Million Americans Remain Out of the Labor Force Despite Nearly 400K Work Pool Increase (Zero Hedge)

The reason why despite the better than expected increase in jobs the US unemployment rate rose from 5.4% to 5.5% even as the number of Unemployed workers rose by 125K to 8,674MM was due to the 397K influx into the civilian labor force which rose to 157.459MM, a new record high in the series, which on the surface would suggest declining slack as more people who have been traditionally left out of the employment calculation go back into the labor pool.

Which aslo meant that since the total US civilian non-institutional population rose by half this number, the number of Americans not in the labor force declined by 208K to just about 93 million.

“Good” Jobs Reports Sparks Market Turmoil As Rate Hike Draws Closer (Zero Hedge)

Despite the rise in the unemployment rate – which by now become nothing more than a joke – the jobs report (at the headline level) was too good for the bulls demding moar for longer. The kneejerk reaction was a selloff in bonds, commodities, and stocks as the dollar surged amid rate hike delay hopes. As time passed stocks bounced back a little but bond yields and the dollar continue to press notably higher and crude has given up all its OPEC gains.

The entire Treasury curve surged higher…

Britain's trade deficit is an economic timebomb waiting to go off (Business Insider)

Britain's trade deficit is an economic timebomb waiting to go off (Business Insider)

The British Chambers of Commerce just cut its forecast for the UK's economic growth in 2015 after citing a weak start to the year.

It said in a report that Britain's economy will expand by 2.3% in 2015, which is down from its previous forecast of 2.7%. Although it thinks the slowdown is temporary, the BCC said that it will affect its growth forecasts.

Friday: Jobs, Jobs, Jobs (Calculated Risk)

Here is the employment preview I posted earlier: Preview: Employment Report for May

And some comments on various employment indicators: Public and Private Employment Data

Goldman Sachs is forecasting 210,000 jobs added, and for the unemployment rate to be unchanged at 5.4%.

The dollar is the biggest enemy of the U.S. economy (Market Watch)

The strong dollar is killing us.

We’ve heard all kinds of valid reasons for the sharp slowdown in the economy over the past six months: the weather, the port strike, the caution of consumers, the collapse in oil-patch investments, and even something called “residual seasonality” in the statistics measuring gross domestic product.

This is the US economy's most disappointing chart (Business Insider)

This is the most disappointing chart in the US economy, via Deutsche Bank's Torsten Sløk.

June 2015 Dividend Aristocrats Spreadsheet List (Value Walk)

The Dividend Aristocrats Index is comprised of 53 businesses with 25 or more years of consecutive dividend increases. To qualify as a Dividend Aristocrat, a business must be listed in the S&P 500, have paid increasing dividends each year for at least 25 years, and meet certain size and liquidity requirements.

Japan's Peter Pan Problem (Bloomberg View)

Japan's Peter Pan Problem (Bloomberg View)

There are plenty of people in Asia who believe Haruhiko Kuroda, governor of the Bank of Japan, lives in Neverland. At the very least, economists on both sides of Japan's deflation debate — those who worry Kuroda has weakened the yen too much, and those who believe he hasn't done enough — think his policies have been out of touch.

Angola Central Bank Devalues Currency as Oil Slide Hits Revenue (Bloomberg)

Angola’s central bank devalued its currency as the drop in oil prices cut the main source of government revenue and export earnings.

The rate for the kwanza was weakened to 116.8745 per dollar on Friday, compared with 110.518 on Thursday, according to prices on Luanda-based Banco Nacional de Angola’s website. The currency dropped 6.6 percent, the most since October 2009, to 117.7085 per dollar on the interbank market as of 1:11 p.m. in the capital, a record low.

New E.T.F.s Appeal to Those With Bigger Appetites for Risk (NY Times)

Imagine a fund that offers exposure to the strategies of the world’s sharpest hedge fund investors. Or one that tracks the steady dividends paid by companies like Apple, instead of their more volatile shares.

In stodgy mutual fund land, these are distant thoughts at best.

Guy Who Did Avon Hoax Was Terrible at Hoaxes (Bloomberg View)

Here is the story of Nedko Nedev, a Bulgarian living in Sofia, as told in Thursday's Securities and Exchange Commission complaint against him.

Whatever OPEC Decides, Oil Supplies Are Rising From All Sides (Bloomberg)

No matter what OPEC says Friday about its production target, the outcome is sure to be more oil.

Iran, Iraq and Libya said this week they plan to add millions of barrels to the market this year. Saudi Arabia, the biggest member in the group, is already pumping the most in three decades. And executives from the world’s biggest oil companies pledged to keep expanding by cutting costs and focusing on the most promising drilling sites.

The Real Reason Why There Is No Bond Market Liquidity Left (Zero Hedge)

Back in the summer of 2013, we first commented on what we called "Phantom Markets" – displayed quotes and prices, in not only equities, FX and commodities but increasingly in government bonds, without any underlying liquidity. The problem, which we first addressed in 2012, had gotten so bad, even the all important Treasury Borrowing Advisory Committee to the US Treasury had just sounded an alarm on the topic.

Since then we have sat back and watched as our prediction was borne out, as bond market liquidity slowly devolved then sharply and dramatically collapsed recently to a level that is so unprecedented, not even we though possible, leading first to the October 15 bond flash crash and countless "VaR shock" events ever since.

Don't forget about what happened to oil prices the last time OPEC had a meeting … (Business Insider)

On Friday, OPEC is expected to announce its latest decision regarding oil production.

OPEC, or the Organization of Petroleum Exporting Countries, is the 12-member oil cartel — of which Saudi Arabia is seen as the most influential member — that collectively decides what its oil production target will be over the next six months.

German Bonds, Europe Stocks Fall (Wall Street Journal)

German Bonds, Europe Stocks Fall (Wall Street Journal)

German government bonds and European stocks fell Friday at the end of a wild week for markets around the globe.

Greek assets also suffered losses after the government decided to bundle its loan repayments to the International Monetary Fund this month into one payment at the end of June.

Global Dairy Costs Drop to 5-Year Low on Record Milk Production (Bloomberg)

An abundance of milk from New Zealand to Europe is driving global dairy costs to the lowest in five years.

Prices have plunged almost 40 percent from a record in February 2014 as farmers ramped up production and Chinese demand slowed, according to a United Nations measure of dairy products. Global production of milk, cheese and butter will rise to records this year, according to the U.S. Department of Agriculture.

Pink Slips at Disney. But First, Training Foreign Replacements. (NY Times)

Pink Slips at Disney. But First, Training Foreign Replacements. (NY Times)

The employees who kept the data systems humming in the vast Walt Disney fantasy fief did not suspect trouble when they were suddenly summoned to meetings with their boss.

While families rode the Seven Dwarfs Mine Train and searched for Nemo on clamobiles in the theme parks, these workers monitored computers in industrial buildings nearby, making sure millions of Walt Disney Worldticket sales, store purchases and hotel reservations went through without a hitch. Some were performing so well that they thought they had been called in for bonuses.

India is battling Japan to become the world’s third largest oil consumer (QZ)

India’s already voracious appetite for oil is growing. Never mind that Asia’s third largest economy imports almost two-thirds of its total oil requirement—or that a ballooning oil import bill will do nothing to help its fiscal deficit problem.

Since last year, India has been locked in a see-sawing battle with Japan to lay claim as the world’s third largest consumer of oil, after the United States and China.

Why Oil Price Rally Isn’t a Surprise, but Iron Ore’s Price Should Stay Low (Value Walk)

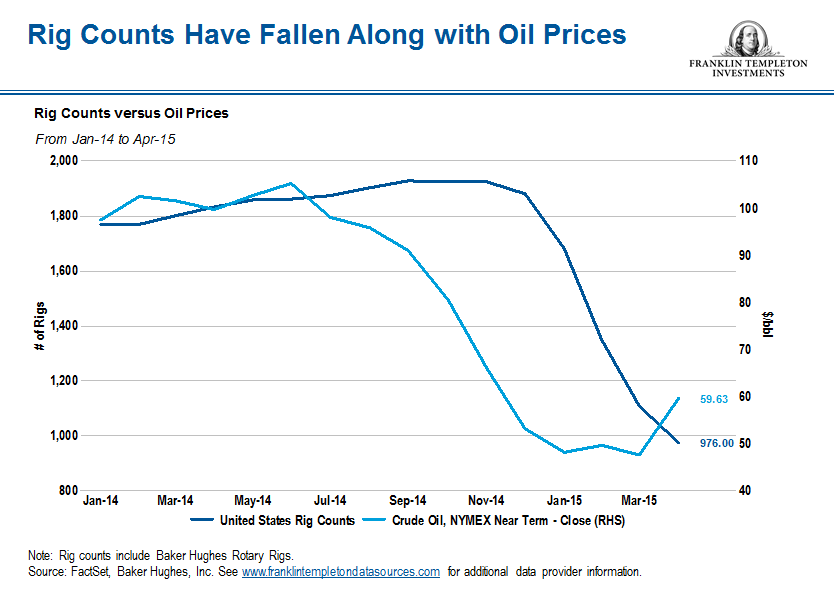

This spring, to the chagrin of consumers and the delight of energy companies, oil prices took some strides toward recovery after a precipitous collapse that began in June 2014. Maarten Bloemen, executive vice president and portfolio manager, Templeton Global Equity Group, discusses why, based on the supply and demand dynamics at play in the market, he believes that recovery trend is likely to continue. Meanwhile, Tucker Scott, executive vice president, portfolio manager, Templeton Global Equity Group, contrasts oil's supply versus demand battle with that of iron ore and offers his take on whether the depressed prices of the important steel-making mineral will recover.

MARC FABER: 'I feel like I'm on the Titanic' (Business Insider)

MARC FABER: 'I feel like I'm on the Titanic' (Business Insider)

Another Wall Street analyst is making comparisons to the Titanic.

This time it's editor and publisher of the Gloom, Boom & Doom Report, Marc Faber.

Faber warned that investors should stop bickering over which assets are the best, and start preparing their own escape plan. That is, if they don't want the same fate as Jack Dawson.

PIMCO Outflows ‘Staggering’ Amid Gross Exit: Morningstar (Value Walk)

In November 2014, just over a month after Bill Gross left PIMCO for Janus Capital, Morningstar, Inc. (NASDAQ:MORN) estimated that PIMCO could withstand $350 billion in outflows over three years without seriously reducing its profit margins or being forced to rethink its structure. Through March, PIMCO’s outflows have totaled $290 billion and operating margins had fallen from 37% to 33%. While Morningstar is ‘cautiously optimistic,’ about PIMCO’s future, the fallout from Gross’ departure was much worse than they had expected.

Sea of Red for European Stocks Means Investors Are Stashing Cash (Bloomberg)

Investors running away from the European stock selloff are hiding in an asset class that yields them nothing.

As the Stoxx Europe 600 Index heads for its first back-to-back weekly losses since the beginning of the year and bond volatility surges, traders are opting to take their profits and wait it out. Cash allocation jumped to a seven-month high, according to a Bank of America Corp. survey.

Margin Debt Simply Reflects Stock Prices: BTIG (Value Walk)

The growth in margin debt is once again on people’s minds, reaching new all-time highs this year more or less in line with the S&P 500, but even if the buildup in debt is dangerous it doesn’t tell you when the next market correction (or crash) is coming.

Data Breach Linked to China Exposes Millions of U.S. Workers (NY Times)

The Obama administration on Thursday announced what appeared to be one of the largest breaches of federal employees’ data, involving at least four million current and former government workers in an intrusion that officials said apparently originated in China.

The compromised data was held by the Office of Personnel Management, which handles government security clearances and federal employee records. The breach was first detected in April, the office said, but it appears to have begun at least late last year.

.jpg) Head of Silicon Valley's most important startup farm says we're in a 'mega-bubble' that won't last (Business Insider)

Head of Silicon Valley's most important startup farm says we're in a 'mega-bubble' that won't last (Business Insider)

Sam Altman, the head of the supersuccessful and prominent Silicon Valley startup accelerator Y Combinator — where Airbnb and Dropbox and others got their start — has a nonconventional take on whether the tech industry is experiencing a bubble.

“What about this mega-bubble that we’re definitely in and that won’t last forever?" Altman asks.

Stocks and Trading

U.S. Stocks Close Lower (Wall Street Journal)

U.S. stocks fell Thursday, with the Dow and S&P ending at their lowest levels in nearly a month.

The Dow Jones Industrial Average lost 170.69 points, or 0.9%, to 17905.58, hitting its lowest level since May 6. The blue-chip index spent most of the session in negative territory, after flirting with break-even levels briefly in midmorning trade.

Politics

Jeb Bush Facing Crucial Two-Week Stretch (Bloomberg Politics)

Jeb Bush Facing Crucial Two-Week Stretch (Bloomberg Politics)

When Jeb Bush returns next week from Estonia, the tiny, technologically advanced country that shares a border with Russia, he’ll have about 48 hours to shake off the jet lag before a June 15 rally in Miami, where he formally announces his decision to enter the race for the Republican presidential nomination.

That will be the midpoint of a crucial two weeks in which Bush will first try to establish his foreign policy credentials, and then introduce himself to voters. The week before his campaign launch, the former Florida governor travels to Germany, Poland and Estonia; the week after, he will be stumping in Iowa, New Hampshire and South Carolina.

Here's another ominous sign a nuclear deal with Iran won't work the way Obama wants it to (Business Insider)

The New York Times recently reported that Iran's stockpile of 5% enriched uranium had grown by 20%, to over 8,700 kilograms, citing an International Atomic Energy Agency report.

Uranium at that level of enrichment has undergone half of the centrifuge revolutions needed to reach weapons-grade.

It’s time to start the Rand Paul 2016 death watch: Why he may be finished already (Salon)

It’s time to start the Rand Paul 2016 death watch: Why he may be finished already (Salon)

I am on-record predicting that Sen. Rand Paul’s presidential campaign would fall well short of success. It’s an argument I’ve made early, repeatedly and, granted, with some measure of glee.

But now that Gov. Scott Walker has come out in opposition to the (somewhat toothless) National Security Agency reforms currently moving their way through Congress — joining every other legitimate GOP candidate and leaving Paul more isolated than ever — I must admit that even I am surprised by how bleak Paul’s future is beginning to look. Because it was premised on a series of fantasies and misconceptions, I always figured Paul’s campaign would falter. I just didn’t think its EKG would start beeping so frantically, so quick.

Forget Hillary and Jeb, here's who Wall Street really wants to run for president (Business Insider)

Forget Hillary and Jeb, here's who Wall Street really wants to run for president (Business Insider)

Wall Street wants Michael Bloomberg to run for president, but the billionaire isn't budging.

At the Yale CEO Summit this week, the talk was of "drafting Bloomberg" however possible.

The former New York City mayor seems like the perfect solution for Wall Street's problems with the current field of presidential candidates. The Street sees him as a centrist technocrat who adeptly managed one of the most complex cities in the world. They think he understands the global business community.

Technology

The Apple Watch is taking another step on its path to eventual world domination (Business Insider)

Apple announced on Thursday that the Apple Watch will come to retail stores in two weeks. Although the watch has been on display at Apple Stores since April, you could only order them online. Apple also said it will release the watch in 7 new countries, including Italy, Mexico, South Korea, and Spain, starting June 26.

Testing Android Smart Watches for Travel (NY Times)

Testing Android Smart Watches for Travel (NY Times)

If you want a smartwatch to make travel easier, Apple Watch is hard to beat. But what about all those Android competitors? There are too many to list here, including models from Sony and Samsung. Still, after taking Apple Watch for a test run several weeks ago, I gave a few popular watches for Android users a whirl (one nimble contender, Pebble, is compatible with both Android and iOS devices).

Apple Watch, among the newest additions to the smartwatch market, raised the bar in terms of intuitiveness and elegant functionality. And its travel apps are perhaps the most useful to date. But of course, not everyone wants an Apple. Below, a look at three popular Android options, and the pros and cons for travelers.

Health and Life Sciences

Do cheaters have an evolutionary advantage? (Science Daily)

Do cheaters have an evolutionary advantage? (Science Daily)

Anyone who has crawled along in the left lane while other drivers raced up the right lane, which was clearly marked "lane ends, merge left," has experienced social cheating, a maddening and fascinating behavior common to many species.

Although it won't help with road rage, scientists are beginning to understand cheating in simpler "model systems," such as the social amoeba,Dictyostelium discoideum.

Forgetting is key to your brain’s capacity to remember (QZ)

Forgetting is key to your brain’s capacity to remember (QZ)

The brain is truly a marvel. A seemingly endless library, whose shelves house our most precious memories as well as our lifetime’s knowledge. But is there a point where it reaches capacity? In other words, can the brain be “full”?

The answer is a resounding no, because, well, brains are more sophisticated than that. A study published in Nature Neuroscienceearlier this year shows that instead of just crowding in, old information is sometimes pushed out of the brain for new memories to form.

Life on the Home Planet

There's a Better Way for California to Water its Farms (Wired)

There's a Better Way for California to Water its Farms (Wired)

California’s Central Valley farmers have a problem. Agriculture accounts for about 80 percent of the state’s water consumption, and in the midst of a historic drought, it is the largest potential source of water savings. Farmers want to be good stewards of the land by helping save water—it is, after all, what sustains them. But there’s a limit to what they can eke out of the soil with the water governor Jerry Brown has given them to work with.

Global Warming ‘Hiatus’ Challenged by NOAA Research (NY Times)

Global Warming ‘Hiatus’ Challenged by NOAA Research (NY Times)

Scientists have long labored to explain what appeared to be a slowdown inglobal warming that began at the start of this century as, at the same time, heat-trapping emissions of carbon dioxide were soaring. The slowdown, sometimes inaccurately described as a halt or hiatus, became a major talking point for people critical of climate science.

Now, new research suggests the whole thing may have been based on incorrect data.

Dinosaur Fossil Is From a Close Relative of Triceratops (NY Times)

Dinosaur Fossil Is From a Close Relative of Triceratops (NY Times)

A newly described horned dinosaur with peculiar ornamentation was a close relative of Triceratops, paleontologists have found. The dinosaur had a longer nose horn than Triceratops, and two small horns above its eyes. But its most distinctive feature was a radiating frill, a set of large, pentagonal plates like a crown atop its head. Researchers at the Royal Tyrrell Museum of Palaeontology in Canada named their find Regaliceratops peterhewsi. They first stumbled on the bones sticking out of a cliff along the Oldman River, in southeastern Alberta, about a decade ago. Like other horned dinosaurs, Regaliceratops probably evolved during the late Cretaceous, 65 million to 100 million years ago. Its nearly complete skull is described in the journal Current Biology.

Colorado Battered By Hail, Heavy Rainfall, and Tornadoes (Time)

Colorado Battered By Hail, Heavy Rainfall, and Tornadoes (Time)

Hail the size of grapefruit, heavy rainfall, and several tornadoes caused damage and flooding across parts of the Rockies and Plains overnight into Friday, officials and meteorologists said.

Seven tornadoes were reported in Colorado and one in Kansas, according to the National Weather Service.