Financial Markets and Economy

Why EIA, IEA, and BP Oil Forecasts are Too High (Our Finite World)

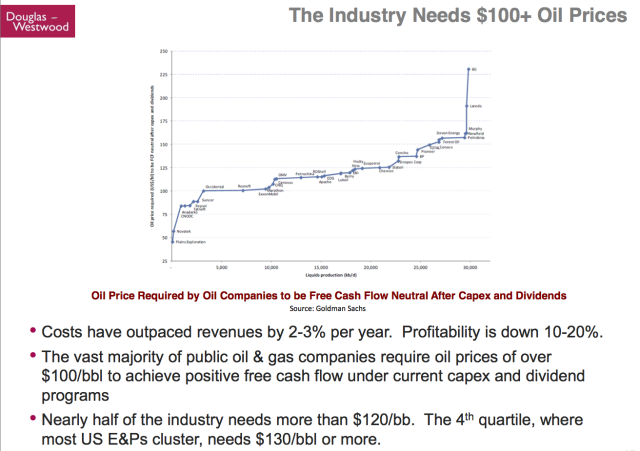

In fact, this seems to be the approach used by most forecasting agencies, including EIA, IEA and BP. It seems to me that this approach has a fundamental flaw. It doesn’t consider the possibility of continued low oil prices and the impact that these low oil prices are likely to have on future oil production. Hoped-for future GDP growth may not be possible if oil prices, as well as other commodity prices, remain low.

China Near to Joining Influential Stock Index (Wall Street Journal)

China Near to Joining Influential Stock Index (Wall Street Journal)

China took a step toward the global-investing big leagues, in a shift that will likely add to the impetus for financial overhauls in the world’s second-biggest economy, analysts and investors said.

Index provider MSCI Inc. said Tuesday that it expects to add China’s A-shares, those stocks denominated in yuan and listed in either Shanghai or Shenzhen, to its widely tracked Emerging Markets Index at some point in the future when China resolves certain market-access issues. Funds with $1.7 trillion under management track the index, likely creating a fresh source of overseas demand for Chinese shares following a sharp run-up this year.

How Could the Fed Protect Us from Economic Waves? (Zero Hedge)

Mainstream economists tell us that the Federal Reserve protects us from economic waves, indeed from the business cycle itself. In their view, people naturally tend to go overboard and cause wild swings in both directions. Thus, we need an economic central planner to alternatively stimulate us and then take away the punch bowl.

Prior to the global financial crisis of 2008, a popular term described the supposed benefits created by the Fed. TheGreat Moderation referred to the reduced volatility of the business cycle. For example, I have written before about economist Marvin Goodfriend, who asserted that the Fed does better than the gold standard.

S&P downgrades Greece deeper into junk (Market Watch)

Standard & Poor’s Ratings Services has downgraded Greece’s credit rating to triple-C, reflecting its view that the government will likely default on its commercial debt within the next 12 months, without an agreement with its creditors.

S&P has a negative outlook for the rating, which was cut one notch. Triple-C is a highly speculative rating on S&P’s scale.

Thursday: Retail Sales, Unemployment Claims, Q1 Flow of Funds (Calculated Risk)

Last month the amounts being moved by individual depositors were noticeably smaller, between €200,000 and €100,000. We’re getting to the bottom of the barrel,” [said an Athens-based banking analyst], estimating Greeks had stashed about €5bn under mattresses and floorboards since January.

World Bank lowers 2015 global growth forecast (Market Watch)

World Bank lowers 2015 global growth forecast (Market Watch)

The World Bank on Wednesday downgraded its outlook for global economic growth this year amid a broad-based slowdown in emerging markets and softer output in the U.S.

The development institution said it now expects the world economy to grow by 2.8%, 0.2 percentage point slower than it estimated in January. “Global growth has yet again disappointed,” said World Bank Chief Economist Kaushik Basu.

Monsanto Meets With Syngenta Investors to Push for Buyout Talks (Bloomberg)

Monsanto Meets With Syngenta Investors to Push for Buyout Talks (Bloomberg)

Monsanto Co., the world’s largest seed company, met this week with Syngenta AG shareholders in a bid to pressure the Swiss rival into negotiations after a $45 billion takeover offer was rejected.

Chief Operating Officer Brett Begemann and Chief Technology Officer Robb Fraley met Monday and Tuesday in Europe to discuss the merits of the bid with Syngenta investors, many of whom also own Monsanto shares, said Scott Partridge, vice president of strategy. The shareholders are frustrated the Basel, Switzerland-based company has refused to negotiate, he said.

U.S. Stocks Surge (Wall Street Journal)

U.S. stocks rose sharply, lifting the Dow to its biggest one-day gain in more than a month, as technology and financial shares pulled ahead and investors embraced encouraging signals about Greece’s financing talks.

The gains were widespread and marked a rebound from the weekslong slide in stocks. Some of the biggest strides were made by shares that had hit the skids in June.

Guess How Many Nations In The World Do Not Have A Central Bank? (Economic Collapse)

Guess How Many Nations In The World Do Not Have A Central Bank? (Economic Collapse)

Central banking has truly taken over the entire planet. At this point, the only major nation on the globe that does not have a central bank is North Korea. Yes, there are some small island countries such as the Federated States of Micronesia that do not have a central bank, but even if you count them, more than 99.9% of the population of the world still lives in a country that has a central bank.

So how has this happened? How have we gotten the entire planet to agree that central banking is the best system? Did the people of the world willingly choose this? Of course not. To my knowledge, there has never been a single vote where the people of a nation have willingly chosen to establish a central bank. Instead, what has happened is that central banks have been imposed on all of us. All over the world, people have been told that monetary issues are “too important” to be subject to politics, and that the only solution is to have a group of unelected, unaccountable bankers control those things for us.

Biotech Bubble; China Crash; Rate Rumble: How Goldman Is Hedging The "What Ifs" (Zero Hedge)

It is no secret that in recent weeks Goldman has been particular bearish (if only to the outside world), withstatements such as the following by chief equity strategist David Kostin.

Nationalization and Default Threat Risk Diminishes in Greece (24/7 Wall St)

The massive snapback rally on Wednesday in stocks in the United States and Europe is tied to word that Angela Merkel may be committed to signing a deal with Greece. This has so far been questioned and has yet to be confirmed, but the move is taking away the constant and endless pressure that Greece is exerting on markets. And now the latest news is that Merkel is meeting with François Hollande from France and Alexis Tsipras from Greece on Wednesday evening.

Is Texas America's best state economy? (CNN)

Texas was America's second fastest growing economy last year, according to the new data from the Commerce Department. The state grew by a stellar 5.2%, behind only North Dakota.

Some argue Texas is the nation's best state economy given its size and low unemployment.

What's driving all this growth? Mining and manufacturing. Texas is producing textiles, food and more these days. Real estate and tech picked up the pace too.

5 Stocks A Raging Rally Could Not Save (24/7 Wall St)

The markets were in a frenzy Wednesday with the S&P 500, NASDAQ and DJIA all rising over 1%. However, there were a few companies holding back the rally. 24/7 Wall St. has taken some of the biggest losers of the day, and added some color as well as recent stocks moves and consensus price targets.

Politics

Bill Clinton suggests he won’t give paid speeches if Hillary wins White House (Market Watch)

Bill Clinton suggests he won’t give paid speeches if Hillary wins White House (Market Watch)

Don’t look for Bill Clinton to continue giving paid speeches if his wife Hillary is elected president.

“No, I don’t think so,” former President Clinton said Wednesday when asked at a Clinton Global Initiative event, according to Politico.

Bill Clinton’s speeches came under scrutiny in a recent book titled “Clinton Cash,” which asserts that foreign entities that made payments to the Clinton Foundation and to the former president through speaking fees got favors from the State Department when Hillary Clinton headed it. Bill Clinton has said his charity never did anything “knowingly inappropriate.” In May, he also said he wouldn’t stop giving high-price speeches, because “I gotta pay our bills.”

Bush Brother Calls Putin "Bully", Warns Of "Consequences" For Russia If Elected (Zero Hedge)

Bush Brother Calls Putin "Bully", Warns Of "Consequences" For Russia If Elected (Zero Hedge)

On Monday we highlighted what looks to be the new campaign strategy for Republican presidential hopefuls: blame the “Putin boogeyman.”

Note that this goes beyond the usual Russophobic rhetoric that plays well with the hopelessly naive American public. In 2009, Hillary Clinton famously presented Russian foreign minister Sergei Lavrov with a big red “reset” button which the two pressed together in a priceless (for its sheer absurdity) photo op in Geneva. The media spectacle was meant to mark a new era for US-Russian relations.

Technology

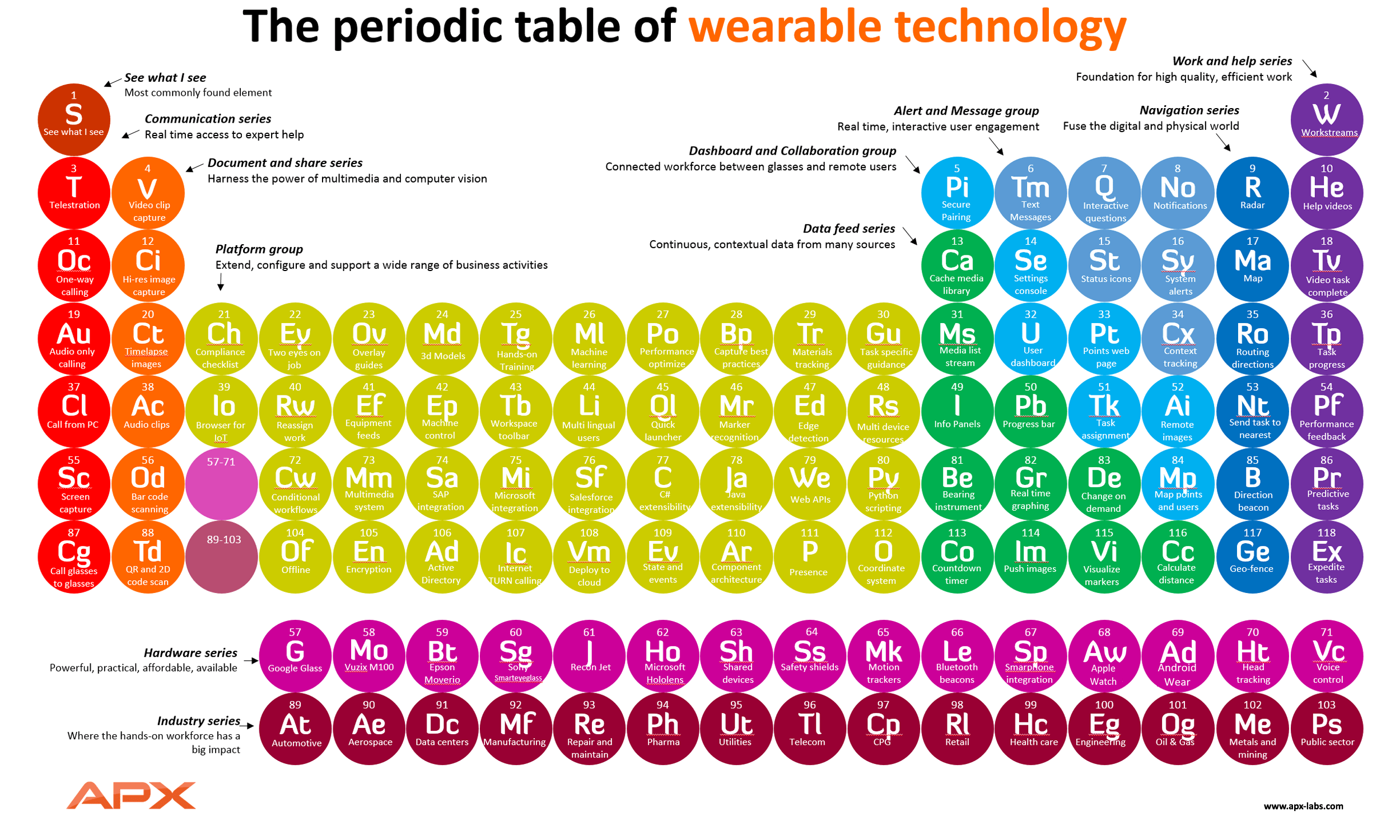

A Periodic Table Of Wearable Technology (Tech Crunch)

A Periodic Table Of Wearable Technology (Tech Crunch)

There is a surprisingly rich ecosystem of devices, a plethora of uses, and importantly, a wealth (both in quantity and value) of markets that are investigating the value of wearables in the enterprise.

To capture the different hardware types, uses, and common capabilities we’ve seen applied to wearables, our Periodic Table of Wearable Technology groups together the major elements of wearables to outline what executives need to know before deploying these devices to their workforce.

Health and Life Sciences

Brain Tumor’s Genetic Makeup Critical in Treatment, Research Finds (NY Times)

Brain Tumor’s Genetic Makeup Critical in Treatment, Research Finds (NY Times)

Doctors can more effectively treat many brain tumors by first ascertaining their genetic characteristics, rather than studying tissue samples under a microscope, the standard practice, two teams of researchers reported on Wednesday.

The findings could alter diagnosis and treatment decisions for thousands of patients, experts said, and mark an important advance in so-called precision medicine, in which cancer treatments are customized according to the genetic makeup of the patient’s tumors.

“Prognosis is going to be more accurately delineated by these kinds of genetic subtypes, outstripping the value of looking through a microscope,” said Dr. David J. Langer, the chief of neurosurgery at Lenox Hill Hospital in New York, who was not involved in the research.

UC study links brain inflammation triggered by chronic pain to anxiety and depression (Eurek Alert)

Brain inflammation caused by chronic nerve pain alters activity in regions that regulate mood and motivation, suggesting for the first time that a direct biophysical link exists between long-term pain and the depression, anxiety and substance abuse seen in more than half of these patients, UC Irvine and UCLA researchers report.

This breakthrough finding also points to new approaches for treating chronic pain, which is second only to bipolar disorder among illness-related causes of suicide. About a quarter of Americans suffer from chronic pain, making it the most common form of enduring illness for those under the age of 60. The Institute of Medicine estimates that this costs our society more than $635 billion per year.

Laughter Helps Toddlers Learn Better (Big Think)

Laughter Helps Toddlers Learn Better (Big Think)

There's nothing quite as infectious as a toddler's laugh, and BPSreports that new research shows how moments of the giggles are an opportune time for tots to learn.

Rana Esseily headed up a study where her colleagues split 53 18-month-olds into two groups to see if laughter would help the little ones learn how to reach a toy duck with a cardboard rake. One group (comprised of 16 toddlers) was given a straight explanation as to how the wee ones could reach the duck with the rake.

Life on the Home Planet

Chimpanzees found to drink alcoholic plant sap in wild (BBC)

Chimpanzees found to drink alcoholic plant sap in wild (BBC)

They have shown an understanding of language and a sense of fairness, and now humans' closest primate cousins have even been found to share a taste for alcohol.

Scientists studying chimpanzees in Guinea have seen evidence of long-term and recurrent ingestion of ethanol by apes.

The 17-year study recorded chimps using leaves to drink fermented palm sap.