Financial Markets and Economy

The amount of money Americans say they spend in a day has gone basically nowhere in the last two years (Business Insider)

Gallup just released the results of a poll asking Americans how much money they spent in a day on discretionary items, excluding major home purchases and regular bills. Respondents are asked how much they spent "yesterday," or the day before they were contacted by the pollster.

Chinese Stocks Open Down Hard, "VIX" Hits Record High, "Nasdaq" Down 40% From Highs (Zero Hedge)

Despite all the hopes and prayers of illiterate farmers everywhere, Chinese stocks refuse to hold a bid and down 3-4% at the open amid suspension of around 160 individual securities. In the pre-open to open, Shanghai Composite is down 3.2%, Shenzhen is off 3.5%, and China's Nasdaq – ChiNext is down 3.8%. This leaves ChiNext down over 40% from its highs as the cost of insuring downside in Chinese stocks explodes to record highs. As China goes through the 1929 playbook to save its 'market', it appears "momentum" has shifted.

China economic uncertainty a potential risk for U.S. chipmakers (Business Insider)

China economic uncertainty a potential risk for U.S. chipmakers (Business Insider)

Tumbling markets and economic uncertainty in China pose a risk to major chipmakers such as Qualcomm Inc <QCOM.O> that derive a big portion of their sales from the world's second-largest economy.

Consumer electronics giant Apple Inc <AAPL.O> could also be vulnerable – 17 percent of the company's overall revenue last fiscal year came from China, and in the most recent quarter it sold more iPhones in the country than in the United States for the first time.

Is this the time to buy bunds? (Market Watch)

Is this the time to buy bunds? (Market Watch)

Recent moves in the eurozone’s bond market have restored some value in the German bund, which underwent a massive selloff in late April and early May, after being on a constant rally since mid-2014. But buying bunds might only make sense for European investors at this point, analysts said.

Here’s why: The overwhelming win of the “no” vote in the Greek referendumsparked flight-to-quality flows that divided the eurozone’s bond market into two teams on Monday: the eurozone’s core, viewed as a safe haven, with Germany leading the way, and the periphery, which includes Spain, Portugal and Italy — the countries that have been viewed as next in line for a potential debt crisis.

Asia shares win reprieve but Greece, China concerns limit gains (Business Insider)

Asia shares win reprieve but Greece, China concerns limit gains (Business Insider)

Asian stocks won a reprieve on Tuesday after sharp falls the previous day but investors remained on edge amid uncertainty over Greece's position in the euro and volatility in mainland Chinese share markets.

Japan's Nikkei <.N225> rose 1.2 percent while MSCI's broadest index of Asia-Pacific shares outside Japan <.MIAPJ0000PUS>, which fell to six-month low on Monday, was up 0.2 percent.

Is it Slowing China or Grexit That is Driving Financial Market Price Changes? (Gavekal Capital)

While some of the post Greferendum moves in financial markets could have been and were predicted by the financial punditry – lower euro, lower stocks, lower US bond yields, higher gold – the real moves have appeared elsewhere.

It Begins: ECB Hikes Greek ELA Haircuts; Full "Depositor Bail-In" Sensitivity Analysis (Zero Hedge)

Earlier today we reported that as Bloomberg correctly leaked, the ECB would keep its ELA frozen for Greek banks at its ?89 billion ceiling level last increased two weeks ago. However we did not know what the ECB would do with Greek ELA haircuts, assuming that the ECB would not dare risk contagion and the collapse of the Greek banking system by triggering a waterfall solvency rush in Greek banks if and when it boosts ELA haircuts. Turns out we were wrong, and as the ECB just announced "the Governing Council decided today to adjust the haircuts on collateral accepted by the Bank of Greece for ELA."

Oil prices stabilize after massive sell-off (Business Insider)

Oil prices stabilize after massive sell-off (Business Insider)

Crude oil prices stabilized on Tuesday morning after posting one of their biggest selloffs this year the previous day over Greece's rejection of debt bailout terms and China's stock market woes.

Front-month U.S. crude futures were trading at $52.91 per barrel at 0011 GMT, up 38 cents from their last settlement. The slight gain followed an almost 8 percent fall on Monday that pulled the contract down to levels last seen in April.

Russian oil sales could get burned after the Iran deal (Business Insider)

Russian oil sales could get burned after the Iran deal (Business Insider)

An Iran nuclear deal could mean bad news for the Russian oil business.

The most obvious source of pain: The re-introduction of Iranian oil on the market after sanctions are lifted could push oil prices down again.

Given Russia's dependence on oil prices, the country's economy could suffer once again following another price decline.

Greece Fallout: Italy and Spain Have Funded a Massive Backdoor Bailout of French Banks (CFR)

In March 2010, two months before the announcement of the first Greek bailout, European banks had €134 billion worth ofclaims on Greece. French banks, as shown in the right-hand figure above, had by far the largest exposure: €52 billion – this was 1.6 times that of Germany, eleven times that of Italy, and sixty-two times that of Spain.

U.S. banks post detailed crisis plans to avoid breakup threat (Business Insider)

U.S. banks post detailed crisis plans to avoid breakup threat (Business Insider)

The largest Wall Street banks on Monday published detailed manuals of how to shut down their business during a crisis without the help of taxpayer money, a crucial step to prevent being broken up by regulators.

After the 2007-09 financial crisis, the banks were required to submit the so-called "living wills" each year to show how they would proceed though an ordinary bankruptcy during a crisis without quietly relying on government support.

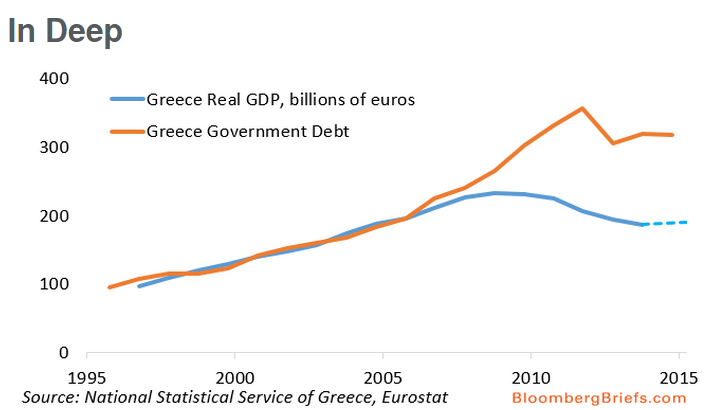

Greece's Problems Explained in Six Charts (Bloomberg)

The International Monetary Fund is willing to countenance debt relief; the Eurogroup is not. The IMF's Chief Economist Olivier Blanchard neatly summarizes the impasse between Greece and its official creditors here. The dotted line on the chart below shows the latest GDP forecasts — these are likely to deteriorate.

Investors' obsession with Chipotle might finally be dwindling (Business Insider)

Investors might be falling out of love with Chipotle.

The longtime darling of the restaurant industry has enjoyed several years of robust double-digit revenue growth and a soaring stock price to match. Shares skyrocketed to $727 in February of this year, up 1,516% since Chipotle's IPO in 2006.

But investors are slowly turning away from the chain, writes Jack Willoughby at Barron's.

This Is How Much It Cost To Keep The Shanghai Composite Green For A Day (Zero Hedge)

“The move by the broker consortium is reminiscent of an ill-fated 1929 effort by JP Morgan and others to support the US market after Black Thursday and is, according to some, doomed to fail because i) it is a laughably small effort compared to daily turnover in China, and ii) it targets the wrong kind of stocks.”

Asian Stocks Climb After Rout as Investors Weigh Greece Crisis (Bloomberg)

Asian stocks rose, with the regional benchmark index rebounding from the biggest drop since February 2014, as investors weighed developments in Greece’s debt crisis before an emergency meeting of European leaders.

The MSCI Asia Pacific Index gained 0.4 percent to 144.06 as of 9:02 a.m. in Tokyo after falling 2 percent on Monday. The initial shock waves that hit markets after Greece’s decision to call a referendum on austerity terms dissipated into a ripple by the end of Monday trading, as investors speculated the crisis wouldn’t spread beyond the nation’s borders. Greece is now under pressure to come up with a plan to stay in the euro after Greeks voted to reject further austerity in Sunday’s vote.

Big question: Will the Greek crisis delay a Fed rate hike? (CNN)

Big question: Will the Greek crisis delay a Fed rate hike? (CNN)

Greece could start a domino effect that hits Washington D.C. this summer. It could even knock the Federal Reserve off course.

Here's the problem: The Federal Reserve is on course to raise interest rates in September, but Greece's ongoing crisis could create enough uncertainty in U.S. markets or with the U.S. dollar to make the Fed delay its long-awaited rate hike.

How A Bull Views Blackhawk After Completing Its Acquisition (24/7 Wall St)

How A Bull Views Blackhawk After Completing Its Acquisition (24/7 Wall St)

Blackhawk Network Holdings, Inc. (NASDAQ: HAWK) has recently completed its acquisition of Achievers Corp., a provider of employee recognition services. Based upon the new estimates and expectations, Argus reiterated its Buy rating and raised its price target to $48 from $4 in the call.

The independent research firm expects the acquisition to be neutral against earnings in 2015. More importantly, it expects that the deal will be accretive in 2016. Another positive driver was that this acquisition was on the heels of a strong first quarter and that the deal increases its full-year outlook.

Technology

The Latest Revolution in Paris: Tourism Goes Hi-Tech (Forbes)

The Latest Revolution in Paris: Tourism Goes Hi-Tech (Forbes)

It would be tempting to think of Paris as a city of Luddites after watching several days of taxi-drivers burning tires and barricading airports and train stations to protest the incursion of Uber drivers into the city.

“Luddites,” you remember, were a working-class anti-technology movement in Britain back during the 19th century industrial revolution, named after Ned Ludd, a young man who first started smashing machines a century earlier, in 1779. All-in-all a local vociferous objection to a global phenomenon – like today.

GoPro, like Apple, on track to create ‘virtuous cycle’ of hardware, software (Market Watch)

GoPro, like Apple, on track to create ‘virtuous cycle’ of hardware, software (Market Watch)

GoPro Inc.’s just-announced HERO4 Session camera was not enough to reverse a selloff on Monday as shares of the action camera maker fell more than 3% at one point following a note from Goldman Sachs initiating coverage on the stock with a neutral rating.

But Goldman analyst Simona Jankowski is bullish on the company long term.

Health and Life Sciences

Global Health: Study Shows Diseases Like Plague Can Perilously Evolve (NY Times)

Global Health: Study Shows Diseases Like Plague Can Perilously Evolve (NY Times)

Contrary to what was previously believed, the bacterium responsible for the Black Death probably caused small outbreaks of lung disease for many years before it evolved its better-known bubonic form, according to a new genetic study.

Blocking brain protein could stop memory loss caused by ageing (New Scientist)

Blocking brain protein could stop memory loss caused by ageing (New Scientist)

There might be a way to stave off the memory loss people experience as they get older.

As people age, a protein that disrupts brain cell repair gradually builds up. The offending protein, called beta2-microglobulin (B2M), has now been shown to affect how mice perform in memory tests.

Life on the Home Planet

'More hot summers' for parts of UK (BBC)

'More hot summers' for parts of UK (BBC)

Scorching summers such as the one in 2003 look set to become more common in England and Wales, a study suggests.

And devastating rains such as in Britain's worst winter in 2013-14 may be less likely in the decades ahead.

Scientists Shoot Down Claim That Alien Life May Be on Comet (Time)

Scientists Shoot Down Claim That Alien Life May Be on Comet (Time)

Scientists have picked holes in a widely-reported presentation by researchers claiming microbial life may exist on the comet now home to the Philae lander.

The claim originated in a presentation before the Royal Astronomical Society, in which researchers said the makeup of the comet, 67/P Churyumov-Gerasimenko, suggested the presence of living organisms. The scientists argued that data from Rosetta, the European Space Agency probe orbiting the comet, showed the capacity for micro-organisms to eke out life beneath the comet’s black crust.