Financial Markets and Economy

Who's In Charge Of Asia's Family Businesses? (Forbes)

Who's In Charge Of Asia's Family Businesses? (Forbes)

Many leading companies in East Asia, including Korea, Japan, Taiwan, and China, are family businesses that play a critical role in the rapid development of these economies. Samsung, like many other leading companies in Korea, is a family-controlled conglomerate. It contributes to over 20% of the country’s GDP – that almost equals total government spending. McKinsey provides a bold projection that, by 2025, an impressive 40% of the world’s large enterprises will be family or founder-controlled businesses from emerging markets. Studies have shown that family businesses in Asia tend to maintain stronger value, employee loyalty, entrepreneurship, and execution capability. This is mainly because in order to conduct and protect business transactions, private relationships are important in East Asian economies (as they are in other emerging markets).

This insane chart shows just how many ordinary Chinese are caught up in the stock market crash (Business Insider)

Stock market investing in Britain is mainly done by professionals like fund managers, folks that ordinary people trust with their money because pros understand investing better than they do. It's the same way in the US, although Americans are more likely than Brits to maintain a small portfolio of stocks they have a personal interest in.

U.S. stocks set to rebound after NYSE halt, China-fueled selloff (Market Watch)

U.S. stock futures pointed to a comeback for Wall Street on Thursday, after a sharp selloff the previous day fueled by global jitters and a suspension of trading on the New York Stock Exchange.

Investors looked ahead to the latest jobless-claims figures, a trio of Federal Reserve speakers and earnings from PepsiCo Inc. PEP, -0.82% and Walgreens Boots Alliance Inc. WBA, -1.54%.

Shanghai's crashing stock market has lost $2 trillion — more than the value of all German stocks — in 17 days (Business Insider)

China's stock collapse in the last couple of weeks has been as dramatic as its previous surge was. Despite logging its biggest one-day rise since 2009 on Thursday, the previous 17 days saw the index collapse by 32.1%.

China's stock market crash has got people worrying about 'social stability' (Business Insider)

China's stock market crash has got people worrying about 'social stability' (Business Insider)

Despite bouncing back today, Chinese stock markets have been in crisis and banks are warning that if efforts to put a floor under the market don't stick then the turmoil could get as bad as the US crash in 2008 and the debt crisis in Europe in 2012.

The main Shanghai Composite collapsed over 30% in the last month, despite repeated attempts by the government to put a floor under prices. Most people believe Chinese stocks have been in a bubble for months, and now it is bursting.

Jeff Reeves's Strength in Numbers: U.S. dollar is set to rally again — here’s how to prepare (Market Watch)

Jeff Reeves's Strength in Numbers: U.S. dollar is set to rally again — here’s how to prepare (Market Watch)

While some pundits and politicians like to get hysterical about the death of the U.S. dollar, the reality is that the greenback has remained very much in favor in recent years for a host of reasons.

And given the turmoil elsewhere in the world, it’s time for the dollar to once again stage a rally and prove it’s the world’s dominant currency.

Stock market crashes: How China's stacks up (CNN)

Stock market crashes: How China's stacks up (CNN)

The crash tearing apart China's stock market is freaking out investors around the world.

The country's biggest stock market has melted down 32% in a matter of weeks, wiping out more than $3 trillion of wealth. The mayhem is infecting other markets, driving down equities in Asia, metals like copper and even U.S. stocks.

Fed's Kocherlakota: Drop in neutral rate makes Fed's job harder (Business Insider)

Fed's Kocherlakota: Drop in neutral rate makes Fed's job harder (Business Insider)

A significant drop in the long-run interest-rate level that marks a sweet spot for a healthy U.S. economy is making it harder for the Federal Reserve to do its job, a top policymaker said on Thursday.

Fiscal authorities can ease this problem by issuing more debt, Minneapolis Fed President Narayana Kocherlakota said in remarks prepared for delivery in Frankfurt.

European stocks pushed higher; Greece deadline approaches (Market Watch)

European stocks pushed higher; Greece deadline approaches (Market Watch)

European stocks climbed Thursday, with investors gaining an appetite for risk after China’s battered markets found some relief, and as Greece faces a crucial deadline in its debt crisis.

The Stoxx Europe 600 SXXP, +1.64% jumped 1% to 376.60, with all but the energy group advancing. The financial SXFP, +2.20% group was the best performing, with banks gaining ahead of a midnight deadline for Greece to submit a new economic-reform proposal to its creditors.

Britain is in the middle of a privatisation boom bigger than Margaret Thatcher's — but no one seems to notice (Business Insider)

Britain's Chancellor George Osborne dropped a pretty incredible statistic in Wednesday's Budget in a throwaway line that hardly anyone has picked up on.

Tata Consultancy Net Beats Estimates on Europe Outsourcing (Bloomberg)

Tata Consultancy Net Beats Estimates on Europe Outsourcing (Bloomberg)

Tata Consultancy Services Ltd. profit surpassed analysts’ estimates amid increased demand in Europe for software services.

Net income rose to 57.1 billion rupees ($900 million) in the quarter ended June, from the 50.6 billion rupees reported a year earlier, the Mumbai-based company said. That compares with the 55.1 billion-rupee median of 27 analyst estimates compiled by Bloomberg.

Economists are very worried about China stocks (CNN)

Economists are very worried about China stocks (CNN)

China's stock market plunge is keeping economists awake at night.

Fifty percent of economists surveyed by CNNMoney said that stock market turmoil is now a major risk to China's economy. This is the first time that markets have been singled out as a concern, marking a shift from earlier surveys, which showed economists were most worried about the property sector.

Japanese Investors Lose Faith In Draghi – Dump The Most Foreign Bonds In History (Zero Hedge)

Did the narrative just change? With the world's investors having entirely lost faith in China's ability to control its markets, it appears the omnipotence of global central banks is under scrutiny. First the so-called "contained" risks from Greek contagion are non-existent as despite the best efforts of The SNB (and ECB), European stocks and peripheral bonds have tumbled; and now Japanese investors have dumped over JPY 4 trillion foreign bonds in June – the most ever.

After yesterday's collapse, China's Shanghai Composite just logged its largest one-day rise since 2009 (Business Insider)

Having thrown everything bar the kitchen sink to prop up the nation’s faltering stock market, Chinese policymakers have finally had their way, with stocks rallying today.

Irrational Exuberance Triggers Chaos as China Watchdog Sidelined (Bloomberg)

Irrational Exuberance Triggers Chaos as China Watchdog Sidelined (Bloomberg)

It wasn’t exactly the same as U.S.-style “irrational exuberance,” but the run-up to China’s great crash of 2015 is leading to similar questions as to why the regulator didn’t do more.

China Securities Regulatory Commission officials had tweaked rules for brokerages’ lending for stock purchases. And, similar to former U.S. Federal Reserve Chairman Alan Greenspan, CSRC Chairman Xiao Gang had warned investors against following the stampede into the market “blindly, like sheep.”

It wasn’t enough.

Contrarians say Chinese stocks could rally 29% in three months (Market Watch)

Barely are investors served up as ideal a buying opportunity as currently provided by the Chinese stock market.

.png)

Fed Still Looking at Raising Rates This Year, Minutes Show (NY Times)

Fed Still Looking at Raising Rates This Year, Minutes Show (NY Times)

Federal Reserve officials spent their most recent policy meeting, in June, preparing to raise interest rates later this year.

Officials liked the look of recent economic data, including early signs that wages were starting to rise more quickly, according to an official account the Fed released on Wednesday after a standard delay.

U.S. funds not bailing on China yet amid free-fall in stocks (Business Insider)

U.S. funds not bailing on China yet amid free-fall in stocks (Business Insider)

As the Chinese stock market free-fall shows no signs of stopping, some U.S.-based fund managers said the government's effort to prop up stock values is having the opposite effect, even as some buy at what they consider panic-driven prices.

The Shanghai Composite Index has tumbled by 32 percent since mid-June, wiping out about $3 trillion in market value and ending a rally that had previously seen the market double from its June 2014 low. In response, Beijing has cut interest rates and stopped the trading of thousands of stocks, preventing some shareholders from selling their positions in hopes of ending the downturn.

Utter Desperation: Chinese Police Vow To Arrest "Malicious Short Sellers" (Zero Hedge)

In what can only be described as total and utter desperation, China's Public Security Ministry and China Securities Regulatory Commission are discussing a plan to take action against "hostile short sellers"… (via Google Translate)

An Offline N.Y.S.E. Makes Barely a Ripple in a Day’s Trading (NY Times)

An Offline N.Y.S.E. Makes Barely a Ripple in a Day’s Trading (NY Times)

Investors who wanted to buy and sell shares of companies listed on the New York Stock Exchange, such as I.B.M. or Target, were still able to do so with ease on Wednesday.

In years past, a shutdown of the N.Y.S.E. might have stopped Wall Street dead in its tracks, with a broad range of companies’ shares sitting frozen until all technical problems were unwound.

China: Lessons From Japan 50 Years Go (Value Walk)

China's stock markets continued their dive this week, and the nation's central bank has been powerless to stop it. But if you're having a bit of déjà vu right now, you're not alone.

While nothing in life is guaranteed, there are some things that are inevitable. For one, history always repeats itself. The only thing we can hope for in this regard is that we learn from our past and take cues from what happened when a similar situation arises.

U.S. bank earnings to be hit by bond trading slump: analysts (Business Insider)

U.S. bank earnings to be hit by bond trading slump: analysts (Business Insider)

Many Wall Street banks are expected to report underwhelming second-quarter results next week, after light bond market activity in the spring worsened into a downturn by June, analysts said.

Investor worries spanned the globe last quarter, ranging from fiscal woes in Greece to crashing stock markets in China, to concerns that the U.S. Federal Reserve will not be able to raise interest rates later this year.

What Greece Can Expect (Bloomberg)

What Greece Can Expect (Bloomberg)

Greece, barring some bold new initiative, is on course to exit the euro area. How badly might this hurt the economy? How quickly could it hope to recover?

Exits from currency unions are not as common as exits from fixed exchange rates. There are a few instances where highly dollarized economies tried to “de-dollarize” and return to the home currency.

Asia extends losses as China woes spread, yen shoots up (Business Insider)

Asia extends losses as China woes spread, yen shoots up (Business Insider)

Asian equities extended losses on Thursday as concerns over China's market turmoil spread, while the safe-haven yen shot to a seven-week high as global risk appetite ebbed.

MSCI's broadest index of Asia-Pacific shares outside Japan <.MIAPJ0000PUS> shed 0.2 percent, hovering near a 17-month low struck the previous day.

BRICS Bank Officially Launches As Sun Sets On US Hegemony (Zero Hedge)

Before the Asian Infrastructure Investment Bank and, to a lesser extent, the Silk Road Fund became international symbols for the end of Western economic hegemony, there was the BRICS Bank.

Here's the chaos that will ensue if Greece exits the euro and has to install a new currency (Business Insider)

Here's the chaos that will ensue if Greece exits the euro and has to install a new currency (Business Insider)

Greece's euro membership is dangling by a thread.

According to finance ministers in the rest of Europe, the Greek government has just a few days left to preserve its place in the currency union. Based on how talks have gone so far, the chances of a sudden deal don't look too positive.

But how would it actually happen?

Chinese Stocks Rise, but Fears Persist (NY Times)

Chinese investors, who have watched their shares go down 30 percent or more over the past few weeks, got a reprieve on Thursday. Stocks rose as a series of market-propping government measures appeared to have their intended effect.

Two Things the US Government Got Right (Capitalist Exploits)

In a shocking and uncharacteristic display of common sense, the US government has recently managed to pass two laws which are an absolutely fabulous idea.

Deal or No Deal, Greece Faces a Difficult Aftermath (NY Times)

Deal or No Deal, Greece Faces a Difficult Aftermath (NY Times)

As Greece hurtles toward a Sundaydeadline for either reaching a bailout deal or risking a hasty exit from the eurozone, the one certainty is that its economy is already on the brink of collapse.

Businesses and humanitarian organizations are warning that the social and commercial damage now evident could become deeper and longer lasting if Greece and its international creditors cannot finally come to terms on a new bailoutpackage.

Angel Investing, Government-Style (Bloomberg)

Angel Investing, Government-Style (Bloomberg)

Should the government be an angel investor? Mariana Mazzucatothinks so. The University of Sussex economist and author of the bestselling book "The Entrepreneurial State" argues that government funding is essential to the research and development that creates the companies of tomorrow. That includes funding for basic and applied research — an example would be the Defense Advanced Research Projects Agency (DARPA) funding that created much of the Internet — and also funding for startups that develop their technology in-house.

Talk to an American conservative, however, and you're likely to get a very different answer. You'll probably hear about Solyndra, the government-backed solar company that went belly up in 2011 after receiving $535 million in government loan guarantees.

Three Reasons You Shouldn't Try To Raise Venture Capital For Your Business (Forbes)

Three Reasons You Shouldn't Try To Raise Venture Capital For Your Business (Forbes)

Have you ever heard of Roy Sullivan? He was a Virginia park ranger who was struck by lightning seven times during his lifetime, a world record. He’s also, in my view, the epitome of an outlier.

As businesspeople, it’s critical for us to be able to differentiate the outliers from everyone else. Otherwise, it’s tempting to follow those at the fringes — which can lead us to make some pretty bad decisions.

Politics

Iranian Nuclear Deal Still On Table But Neither Side Conceding (Think Progress)

Iranian Nuclear Deal Still On Table But Neither Side Conceding (Think Progress)

As the extended deadline nears the likelihood of a nuclear deal with Iran is “less than 50/50”, Politico reported Wednesday.

“[Obama] said the chances he thought were less than 50-50 at this point and that he wouldn’t agree to something he thought was weak or unenforceable,” Sen. Dick Durbin (D-IL) told POLITICO on Wednesday. “But if he comes up with an agreement and it meets his standards he wanted us to take an honest look at it and not prejudge.”

Donald Trump is still running for the Republican nomination and is currently polling at 6.5 percent according to the Real Clear Politics average. Here are the latest developments in his circus of a campaign.

Corporations continue to cut ties with Trump

The PGA is the latest organization to dump Trump, canceling it's plans to hold the 2015 Grand Slam of Golf tournament at a Trump golf course. This comes after ESPN decided to move its annual ESPY Celebrity Golf Classic from the same course. Earlier this week, NASCAR announced it planned to move a banquet from the Trump's resort.

Technology

Self-Driving Taxis 'Could Cut Greenhouse Gas Emissions by 90 Per Cent' (Gizmodo)

Self-Driving Taxis 'Could Cut Greenhouse Gas Emissions by 90 Per Cent' (Gizmodo)

If you can stomach the thought of handing over control of your hotrod to a computer, you may end up doing a significant part towards ensuring the future environmental stability of this planet. According to a new report from Berkeley Lab researchers, a wholesale switch to self-driving electric vehicles could cut greenhouse emissions by as much as 90 per cent by the year 2030.

UK to develop 'universal' satellite (BBC)

UK to develop 'universal' satellite (BBC)

The development of a completely novel type of telecommunications satellite has been approved.

To be called Quantum and built in the UK, the 3.5-tonne spacecraft will break new ground by being totally reconfigurable in orbit.

Normally, the major mission parameters on satellites – such as their ground coverage pattern and their operating frequencies – are fixed before launch.

Health and Life Sciences

Promise Is Seen in an Inexpensive Cholera Vaccine (NY Times)

Promise Is Seen in an Inexpensive Cholera Vaccine (NY Times)

An inexpensive, little-known cholera vaccine appears to work so well that it can protect entire communities and perhaps head off explosive epidemics like the one that killed nearly 10,000 Haitians in 2010.

A major study published on Wednesday in The Lancet found that the vaccine gave individuals more than 50 percent protection against cholera and reduced life-threatening episodes of the infection by about 40 percent in Bangladesh, where the disease has persisted for centuries.

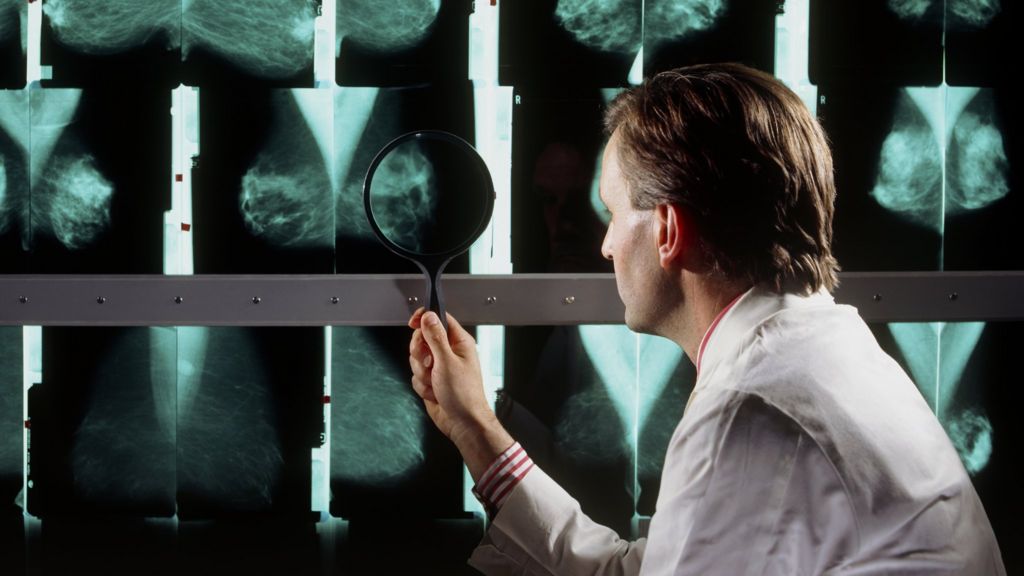

Drug 'may slow breast cancer growth' (BBC)

Drug 'may slow breast cancer growth' (BBC)

A cheap and safe drug could help half of women with breast cancer to live longer, scientists suggest.

Their study, published in Nature, is in its early stages, but hints that the hormone progesterone could be used to slow the growth of some tumours.

The UK and Australian researchers say the findings are "very significant" and they are planning clinical trials.

Life on the Home Planet

Smog Exacerbated Disastrous Flooding In China (Popular Science)

Smog Exacerbated Disastrous Flooding In China (Popular Science)

Air pollution in Shanghai in 2008.

Two years ago, severe floods in central China triggered landslides, washed out roads and houses, and killed 200 people. And according to a recent study, air pollution may be partly to blame.

Particles in the air don't cause strong storms, but they can redirect them. In the case of the Chinese floods, soot particles in the air prevented rain clouds from forming during the day. The dark particles of soot absorbed sunlight, which warmed up the air and kept the moisture in the air from condensing into clouds. The moist air moved into the mountains, where the cooler air condensed quickly, causing dramatic evening storms.

One Man’s Quest to Save the Most Colossal Fishes on Earth (Wired)

One Man’s Quest to Save the Most Colossal Fishes on Earth (Wired)

ZEB HOGAN WAS already familiar with the legendary Mekong giant catfish. After all, he’d been studying the beasts, which grow to hundreds and hundreds of pounds, for years. But when a colleague in Thailand phoned him up in 2005 to say that fishermen had hauled a 646-pounder ashore, it seemed…unprecedented. So Hogan, a biologist at the University of Nevada, Reno, did some poking around. He found some records that showed that it was not only the biggest Mekong giant catfish, but the biggest recorded freshwater fish ever caught.

And it all got him thinking: Could there be even bigger freshwater fish out there? National Geographic apparently thought it was a good enough question to fund him, so cash in hand he set out to find the answer. On over 50 expeditions across six continents so far, Hogan’s been wading through river after river and hooking giant fish after giant fish—building a better picture of Earth’s little-understood freshwater monsters in the process. So far that 646-pound catfish stands as the world’s biggest, but in his quest Hogan has found that the picture he’s built ain’t pretty.

How Cities Are Adapting to More Coyotes, Cougars and Urban Wildlife (Gizmodo)

How Cities Are Adapting to More Coyotes, Cougars and Urban Wildlife (Gizmodo)

Several times this spring, coyotes made national headlines when spotted roaming the streets of New York, from Manhattan to Queens.

In recent years, a host of charismatic wild species, the coyote being only the most famous, have returned to American cities in numbers not seen for generations. Yet the official response in many areas has been, at best, disorganized, and people’s responses varied. The time has come for us to accept that these animals are here to stay, and develop a new approach to urban wildlife.