Financial Markets and Economy

Alan Greenspan “Quite” Worried About A Bond Market Bubble (Value Walk)

Alan Greenspan “Quite” Worried About A Bond Market Bubble (Value Walk)

Former Federal Reserve Chairman Alan Greenspan spoke with FOX Business Network’s (FBN) Maria Bartiromo about his concerns on the global economy. When asked whether he thinks Federal Reserve Chairman Janet Yellen will raise interest rates in September Greenspan said, “I refuse to discuss that publicly” and I’m “quite” worried about a bond market bubble. Greenspan also commented on the Unites States economic story compared to the rest of the world saying, “the United States strangely enough as badly as we are doing are still the best of the worst. Nobody is doing well.”

How to own Chinese stocks without losing (much) sleep (Market Watch)

China’s Shanghai Composite Index SHCOMP, +4.54% tumbled 32% from its peak June 12 through Wednesday, prompting inexperienced investors to run for cover.

But shareholders of the U.S.-based Emerging Markets Internet & Ecommerce ETF EMQQ, +5.33% which holds shares of many Chinese companies, fell only half as much. That’s because the Chinese stocks tracked by the exchange traded fund are publicly traded in the U.S., ensuring those companies are more transparent and mature.

Markets Love the Greek Proposal (Bloomberg)

The Greek government submitted its proposals to the creditor institutions late last night and, so far, it seems the odds of deal that would allow Greece to remain in the euro area have risen significantly on the back of that.

Market reaction has been very positive.

The debt trap (Economist)

ALMOST eight years have elapsed since the financial crisis took hold in August 2007 and still the same issues are being fought over. Who should suffer the most pain—creditors or debtors? Is the best way to achieve growth short-term fiscal stimulus or long-term structural reform? And, in Europe in particular, how does one reconcile local democracy with international obligations?

China stocks jump again after Beijing put floor under market (Business Insider)

China stocks jump again after Beijing put floor under market (Business Insider)

Chinese stocks rose strongly for a second day on Friday, buoyed by a barrage of government support measures, but worries persist about the long-term impact that four weeks of stock market turmoil may have on the world's second-largest economy.

Over the past two weeks Chinese authorities have cut interest rates, suspended initial public offerings, relaxed margin lending and collateral rules and enlisted brokerages to buy stocks, backed by cash from the central bank.

Europe Bank Bulls Are Waiting in the Wings as Greece Fears Wane (Bloomberg)

Europe Bank Bulls Are Waiting in the Wings as Greece Fears Wane (Bloomberg)

When it comes to volatility in European banks, investors are better off just waiting it out.

At least that’s what the options market is signaling, with the longer-term cost of protecting against losses in lenders hovering at the cheapest level since 2012 relative to one-month contracts.

Back-and-forth debt talks and concern of spillover effect have wreaked havoc on markets, especially banks. A gauge tracking European lenders has tumbled 7.3 percent since June 26 — the day Prime Minister Alexis Tsipras unexpectedly called a vote on whether Greeks should accept creditor demands.

China stocks rebound: Is the worst over? (CNN)

China stocks rebound: Is the worst over? (CNN)

China stocks may be pulling out of their tailspin.

The benchmark Shanghai Composite increased 4.5% on Friday, while the smaller Shenzhen Composite added more than 4%.

The performance builds on gains made Thursday, when markets rallied after regulators announced new measures designed to stop the market's slide.

U.K. Trade Deficit Narrows to Least Since 2013 as Imports Fall (Bloomberg)

U.K. Trade Deficit Narrows to Least Since 2013 as Imports Fall (Bloomberg)

Britain’s trade deficit narrowed to the least in almost two years in May as imports fell and exports to the euro region climbed.

The trade gap in goods narrowed to 8 billion pounds ($12.4 billion) from 9.4 billion pounds in April, the Office for National Statistics said in London on Friday. Economists had forecast a deficit of 9.7 billion pounds, according to a Bloomberg survey. Exports fell 0.1 percent and imports declined 4.1 percent.

U.S. stock futures, euro gain after new Greek proposals (Business Insider)

U.S. stock futures, euro gain after new Greek proposals (Business Insider)

U.S. stock futures jumped and the euro gained in early Asian trade on Friday after Greece offered new reform proposals to creditors, raising hopes of a cash-for-reform deal at a weekend summit of European leaders.

S&P 500 mini futures

rose to as high as 2061.75, up 1.0 percent from late U.S. levels. They last stood at 2058.50, up 0.9 percent.

Ford to Move Current Small Car Production Outside U.S. (Wall Street Journal)

Ford to Move Current Small Car Production Outside U.S. (Wall Street Journal)

The auto industry’s attempt to build small cars profitably in the U.S. has hit a pothole.

Ford Motor Co. said a Michigan factory that assembles its small Ford Focus and C-Max wagon will end production of those vehicles in 2018 in a new setback to efforts to create a market for small cars made in the U.S. Production of the Focus will be moved outside the U.S.

Chinese Police Officially Launch Crackdown On Stock Sellers & Rumor Spreaders (Zero Hedge)

Not only has the Chinese regulator specifically asked all listed companies to submit reports, within the next two days, on the measures they will take to prop up their shares, according to the 21st Centruy Business Herald; but, as we warned yesterday, Chinese police have begun a "nationwide action plan" to work with stock regulator CSRC to crack down on now 'illegal' stock and futures trading. As SCMP reports, police are checking who sold off Ping An and PetroChina stocks in last 30 minutes of trading July 8 while Government was buying to boost index… Who needs QE? This is worse, much worse…

Why China’s Stock Market Bailout Just Might Work (NY Times)

Why China’s Stock Market Bailout Just Might Work (NY Times)

Outside of China, the consensus among economists is overwhelming: The country’s efforts to prop up its plunging stock markets are doomed, the financial equivalent of King Canute trying to halt the incoming tide. But this being China, the conventional wisdom may turn out to be wrong.

Faced with an unnerving sell-off in its major markets that at one point had wiped out nearly $3 trillion in value, China has announced a series of measures to stabilize stock prices, including the establishment of a 120 billion renminbi ($19.4 billion) fund for the country’s largest brokerage firms to buy stocks.

Asia's Women Crack Glass Ceiling, But Fail to Break Through (Bloomberg)

Asia's women are taking one step forward, two steps back when it comes to gender equality.

Family structures and entrenched notions of what constitutes women's work are holding back the region's female population from scaling the corporate ladder, according to the International Labor Organization.

Aiming for the net (Economist)

TEXTBOOKS say that banks make money by raising deposits relatively cheaply from savers and lending them, at a higher rate, to borrowers. The difference between the two rates is known in the trade as the “net interest margin” (NIM), and its size is an important factor in banks’ profits. But as the financial crisis prompted central banks around the world to lower interest rates almost to zero (and below, in a few cases), banks have been in a quandary. They cannot lower deposit rates enough to be able to lend at a decent margin, since most assume that depositors will not tolerate negative rates. Instead, they have watched the NIM shrink (see chart on next page), and tried to recoup some of the lost profits by raising fees.

U.S. stock futures leap on optimism for a Greek deal (Market Watch)

U.S. stock futures leap on optimism for a Greek deal (Market Watch)

U.S. stock futures jumped ahead of Wall Street’s open on Friday, on higher hopes that debt-troubled Greece will reach a deal with its creditors this weekend and stave off an exit from the eurozone.

Sentiment was also boosted by another upbeat trading session in China, where the main benchmarks trimmed their sharp monthly losses.

Futures for the Dow Jones Industrial Average YMU5, +0.94% climbed 143 points, or 0.8%, to 17,595, while those for the S&P 500 index ESU5, +1.12% put on 19.30 points, or 1%, to 2,060.50. Futures for the Nasdaq 100 index NQU5, +1.10% gained 40.25 points, or 0.9%, to 4,379.75.

Are Big Banks Using Derivatives To Suppress Bullion Prices? (Paul Craig Roberts, IPE)

We have explained on a number of occasions how the Federal Reserves’ agents, the bullion banks (principally JPMorganChase, HSBC, and Scotia) sell uncovered shorts (“naked shorts”) on the Comex (gold futures market) in order to drive down an otherwise rising price of gold. By dumping so many uncovered short contracts into the futures market, an artificial increase in “paper gold” is created, and this increase in supply drives down the price.

Were Not China: Filipino-Chinese Worry About Business Risk (Bloomberg)

Were Not China: Filipino-Chinese Worry About Business Risk (Bloomberg)

China’s territorial assertions in the disputed South China Sea are making life complicated for ethnic Chinese businessmen in smaller claimant nations like the Philippines.

Filipino-Chinese businessmen take care to show they are on the side of the Philippines, according to Edwin Tan, president of the Palawan Filipino Chinese Chamber of Commerce. Palawan island, which draws tourists for its pristine beaches and diving, is a Philippine gateway to the South China Sea.

Barclays Faces Toughest Test in Investment Banking (NY Times)

Barclays Faces Toughest Test in Investment Banking (NY Times)

Barclays faces the biggest test in retooling its investment bank. Chief executives at Barclays,Credit Suisse and Deutsche Bank have now all left, meaning new leaders will tackle their respective divisions’ futures. All three have lost market share to Wall Street over the last few years. But Barclays’ shrinking broker-dealer revenue makes it the top contender for further slippage.

Each bank has distinct investment banking challenges. Credit Suisse looks to be the weakest on capital: It allocates equity on the basis of 10 percent of the segment’s risk-weighted assets. Had it done so at 12 percent, as Barclays and Deutsche did last year, its investment bank’s pretax return on equity would have been 5 percentage points lower.

Taiwan Shuts Markets, Offices as Typhoon Chan-hom Approaches (Bloomberg)

Taiwan Shuts Markets, Offices as Typhoon Chan-hom Approaches (Bloomberg)

Taiwan is bracing for heavy rains and strong winds as Typhoon Chan-hom passes north of the island and heads toward Shanghai.

Rains in Taiwan’s capital city of Taipei are expected to intensify into the evening as the storm moves over the East China Sea toward mainland China, Central Weather Bureau forecaster Ping-yu Lin said by phone Friday. Schools and government offices were shut in Taipei, three other northern cities and part of the Matsu islands as a precaution on Friday. Financial markets were also closed.

The Chinese Stock Meltdown That Makes the Greece Saga Look Trivial (Bloomberg)

The Chinese Stock Meltdown That Makes the Greece Saga Look Trivial (Bloomberg)

The Shanghai Stock Exchange Composite Index has lost 28 percent since its peak on June 12, the worst selloff in two decades. About $3.9 trillion in market valuation has evaporated, more than the total annual output of Germany—the world’s fourth-largest economy—and 16 times Greece’s gross domestic product. The benchmark is still up 82 percent in the past year, the most among the world’s major markets.

As shares tumbled, companies rushed to apply for trading suspension. More than 1,400 companies stopped trading on mainland exchanges, locking sellers out of 50 percent of the market. The China Securities Regulatory Commission also banned major shareholders, corporate executives, and directors from selling stakes in listed companies for six months.

Greeks are panic queuing at ATMs because they have seen cash disappear into thin air before (Business Insider)

Greece's banks only have enough money to keep the country going until Monday. The country has extended its capital controls, which include shutting banks and restricting personal cash withdrawals to €60 (£43.24, $66.62) until then.

Banks are being flooded by Greeks, mainly pensioners. Greeks remember all too well the 1999 Athens Stock Market crash, when investors lost substantial amounts of their savings, just before Greece joined the Euro.

Chinese 'Dead Cat Bounce' Fades, "Hostile Sellers" Appear As Goldman Warns "Not Yet Fully Purged" (Zero Hedge)

Amid the highest level Typhoon warnings, China's stock market continues to storm as only49% of Chinese stocks are halted (down from 54%) as local analysts fear yesterday's bounce (just like last week's) was nothing but a dead cat bounce: "bounces like today prolong the timeframe to get that final bottom in place." For the 14th day in a row margin balances declined with the pace accelerating (down 10.9% yesterday alone) for a total over 36% decline so far. Seemingly on pain of death, someone is selling Chinese stocks as CSI-300 futures opened a mere 0.2% higher then sold off – no follow through for now. Goldman warned to expect another 30% decline margin balance and concludes, China "hasn't yet fully purged."

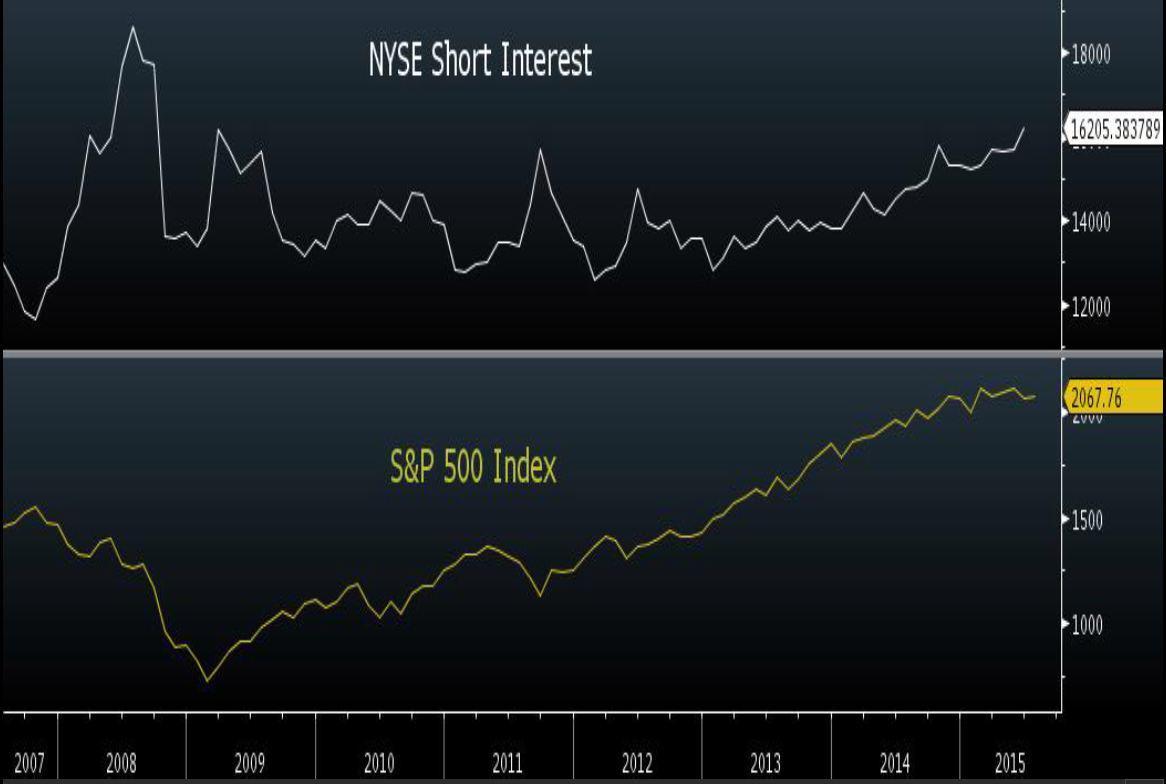

The Great Fall of China puts short-sellers back in the game (Market Watch)

Short-sellers just got a taste of what they’ve been hungry for over the past few years, and they want more. Lots more. They’ve got some making-up to do. With cracks in global markets deepening this week, traders loaded up on bearish bets to levels not seen since the financial crisis.

Even billionaire Wilbur Ross has gotten in the mood. “On balance, we’ve been a seller. We’ve sold six times as much as we’ve bought so far this year … everywhere,” he told CNBC yesterday.

An Uber I.P.O. Looms, and Suddenly Bankers Are Using Uber. Coincidence? (NY Times)

An Uber I.P.O. Looms, and Suddenly Bankers Are Using Uber. Coincidence? (NY Times)

Wall Street banks can be hidebound in their ways: insisting on suits and ties and handing out BlackBerries after everyone else has moved on to the iPhone. But if there is one thing that can push even the most conservative bank into the future, it is the prospect of business.

The latest reminder came this week when JPMorgan Chase announced that it would reimburse all of its employees for rides taken with Uber — offering access to “Uber’s expanding presence and seamless experience,” the company said in a news release.

The Equity Crowdfunding Dilemma: Public or Private Fundraising? (Forbes)

The Equity Crowdfunding Dilemma: Public or Private Fundraising? (Forbes)

Startup investing and fundraising is moving from the boardroom to the deal room (online) as new laws for equity crowdfunding in the U.S. have come into effect over the last two years.

Prior to this, traditional fundraising has been a fractured process that takes place across hundreds of private emails, calls and in person pitch meetings. But now, early stage venture capital is being disrupted and moving online in a more public way.

Green Bonds: What's Right, What's Wrong (Seeking Alpha)

Green Bonds: What's Right, What's Wrong (Seeking Alpha)

The young green bond market has grown fast.

Since the market's initial inception in 2007, the total yearly green bond issuance has expanded to $36.6 billion for 2014, triple that of 2013. As more corporate issuers entered the market, a bold prediction was made that there will be $100-billion worth of issues in 2015. But whether this prediction proves prescient or not, the value of outstanding green bonds in 2015 will remain a fraction of 1% of the global fixed-income market, now estimated at over $100 trillion. If that's the case, what explains the disproportionate buzz surrounding green bonds?

Politics

Democratic presidential hopeful Martin O’Malley cites satirical news article in policy paper (Salon)

Democratic presidential hopeful Martin O’Malley cites satirical news article in policy paper (Salon)

The "satirical" site in question is The Daily Currant, which as J.K. Trotter noted isn't really even a satirical site, inasmuch as it doesn't actually attempt to satirize anything.

The Daily Currant's sole reason for existing is to fool unwitting readers into clicking on a link in which a politician or celebrity is purported to have said something that reasonable people believe they could have said.

Congressional Republicans Still Refuse To Ban The Confederate Flag (Think Progress)

Congressional Republicans Still Refuse To Ban The Confederate Flag (Think Progress)

House Republicans punted on two separate issues relating to the Confederate flag on Thursday, suggesting that, even while Republicans in South Carolina overwhelmingly voted to remove it from state capitol grounds following the deaths of nine African Americans at the hands of white supremacist Dylann Roof, it’s still a hot-button issue for many Republicans in Congress.

Don't Cry for the Trump Brand (Bloomberg)

Don't Cry for the Trump Brand (Bloomberg)

Judging by discounts on Donald Trump-labeled mattresses on Amazon.com, the billionaire’s brand is hurting. But his overseas business partners don’t seem to have noticed.

Trump's Macy’s deal, and others, are gone after his incendiary remarks about Mexican immigrants. Still, selling shirts and ties was “a small business in terms of dollar volume,” the real-estate mogul, reality TV star and Republican presidential contender said in a press release last week. His partners in international property licensing deals, a more lucrative business line, haven’t joined in on the dog pile.

Technology

Let Your Brain Be Your Joystick (PSFK)

Let Your Brain Be Your Joystick (PSFK)

The team at This Place got excited about Google Glass to the point they are compelled to find ways to improve the concept. They asked “What could we do to better navigate this device?” and MindRDR was their answer. MindRDR links your mind to Google glass via EEG, allowing you to control the interface with your thoughts.

This heated, water-filled hammock might be the greatest thing ever invented (Digital Trends)

This heated, water-filled hammock might be the greatest thing ever invented (Digital Trends)

Some of the greatest inventions in the world were created by combining two already awesome things. Just look at cookie dough ice cream, the Cronut, and, for those inclined, weed brownies — all of these are shining examples of the fact that when you mix two amazing things together, the resulting concoction can be greater than the sum of its parts.

Health and Life Sciences

Severe Burns May Trigger Dangerous Shifts in Gut Germs (Medicine Net Daily)

Severe Burns May Trigger Dangerous Shifts in Gut Germs (Medicine Net Daily)

People who suffer severe burns may experience potentially dangerous changes in the 100 trillion bacteria inside their gastrointestinal (GI) tract, a small study suggests.

At issue is the breakdown of good and bad bacteria typically found inside a healthy person's GI tract.

Researchers from the health sciences division of Loyola University Chicago in Maywood, Ill., observed that after a severe burn, four patients experienced a big increase in the number of potentially harmful bacteria and a corresponding drop in relatively beneficial bacteria.

New analysis of smoking and schizophrenia suggests causal link (Reuters)

In research that turns on its head previous thinking about links between schizophrenia and smoking, scientists say they have found that cigarettes may be a causal factor in the development of psychosis.

After analyzing almost 15,000 tobacco users and 273,000 non users and their relative rates of psychosis – where patients can experience delusions, paranoia and hear voices in their heads – the researchers said cigarette smoking appears to increase risk.

Life on the Home Planet

Japanese Preschool Incorporates Rainwater Play Area (PSFK)

Japanese Preschool Incorporates Rainwater Play Area (PSFK)

Dai-ichi Yochien, a preschool in Japan, developed an open area for rainy water to collect. In the space, rain collects to form a miniature pool that barely covers an adult’s feet but that lets children jump and play dependent on the season. With no roof above, it fills with water any time the heavens shower down from overhead.

Bumblebees Are Getting Trapped In A ‘Climate Vise’ As Hotter Temperatures Shrink Habitats (Think Progress)

Bumblebees Are Getting Trapped In A ‘Climate Vise’ As Hotter Temperatures Shrink Habitats (Think Progress)

The effects of global warming are shrinking the geographic home range of North American and European bumblebees, and the insects appear unable to adapt to the changing conditions — a troubling discovery for an important group of pollinators critical to the world’s food supply.

Unlike other animal species, the bees are not migrating northward where it is cooler, and their failure to do so is prompting dramatic losses of bumblebee species from the hottest areas across two continents, according to a study published Thursday in Science, the journal of the American Association for the Advancement of Science.

Watch a hammerhead shark swim in the ocean from the shark's perspective (Gizmodo)

Watch a hammerhead shark swim in the ocean from the shark's perspective (Gizmodo)

The coolest thing about being a shark is that you can swim around all you want in the ocean and you don’t have to be afraid of, well, sharks. That’s only semi-true but look at this hammerhead shark moseying about on the ocean floor and it passes by all its shark friends without a worry in the world. No one messes with it.

The footage is actually incredible. Taken from a GoPro that was attached to the hammerhead shark’s dorsal fin, we get to see the funny looking shark explore its habitat from its perspective.