Financial Markets and Economy

Chinese Stock Plunge Resumes With 1200 Stocks Halted Limit Down; Yellen, Greek Elections On Deck (Zero Hedge)

Chinese Stock Plunge Resumes With 1200 Stocks Halted Limit Down; Yellen, Greek Elections On Deck (Zero Hedge)

Just when the Chinese plunge protection team (and "arrest shortie" task force) seemed to be finally getting "malicious selling" under control, first we saw a crack yesterday when the composite broke the surge of the past three days as a result of yet another spike in margin debt funded purchases, but it was last night's reminder that "good news is bad news" that really confused the stock trading farmers and grandmas, which goalseeked Chinese economic "data" beat across the board, with Q2 GDP coming solidly above expectations at 7.0%, and retail sales and industrial production both beating, but in the process raising doubts that the PBOC will continue supporting stocks.

Twitter shares spike on fake Bloomberg story that it's selling for $31 billion (Business Insider)

Twitter shares spiked Tuesday on a fake report the company had found a buyer.

A report on a website made to look like Bloomberg.com said Twitter had gotten an offer to be taken over for $31 billion.

10 Everyday Items That Now Cost More ThanThe Monthly Minimum Wage in Venezuela (Bloomberg)

As Venezuela's bolivar loses its value at an unprecedented rate, the purchasing power of ordinary citizens is going down with it.

China hits bull's-eye again with 7% GDP growth (CNN)

China hits bull's-eye again with 7% GDP growth (CNN)

Well, it could be worse! The latest growth numbers show that China's economy is trundling along, expanding at a pace that is slightly faster than analysts expected.

Gross domestic product expanded by 7% in the second quarter, compared to the same period last year, according to data released Wednesday by China's National Bureau of Statistics.

Greece is starting to look like East Germany (Business Insider)

Greece is starting to look like East Germany (Business Insider)

Nomura's chief economist Richard Koo is seeing parallels between Greece and East Germany, shortly after the fall of the Berlin Wall, right now.

In a note sent to clients on Tuesday, Koo attacks Greece's creditors for negotiating a deal based on "highly unrealistic" assumptions and reaching an agreement that "resolve none of the fundamental problems facing the effectively bankrupt nation of Greece."

How Bostons Bain Came Unstuck With First Foray in Africa (Bloomberg)

Edcon Holdings Ltd. was a profitable South African retailer with few debt obligations before Bain Capital Partners LLC took control in its first foray on the continent.

U.S. stock futures inch higher ahead of key Yellen speech (Market Watch)

U.S. stock futures inch higher ahead of key Yellen speech (Market Watch)

U.S. stocks were on track for a fifth straight day of gains on Wednesday, with futures inching higher ahead of closely watched testimony from Federal Reserve Chairwoman Janet Yellen that could provide further clues on the timing of the first rate hike.

Futures for the Dow Jones Industrial Average YMU5, +0.04% nudged higher by 14 points, or 0.1%, to 17,973, while those for the S&P 500 index ESU5, +0.04% gained 1.15 points, or 0.1%, to 2,103.25. Futures for the Nasdaq 100 index NQU5, +0.19% added 8.75 points, or 0.2%, to 4,525.75.

"Everything Is Awesome" In China – Retail Sales, Industrial Production, & GDP All Mysteriously Crush Expectations (Zero Hedge)

Retail Sales increased 10.6% YoY (smashing expectations of a 10.2% YoY Gain); Industrial Production rose 6.8% (crushing expectations of a 6.0% YoY gain); and the big daddy of goalseeked data, China GDP managed to rise 7.0% (comfortably beating expectations of just 6.8% but still the lowest since Q1 2009). Now it is up to the markets to decide if good data is bad news because it gives the government less excuses to throw more "measures" at the market; or is good data, good news as it "proves" the economic fundamentals underlying massively exponential gains in Chinese stocks (and excessive valuations compared to the rest of the world) are justified. When the data hit Chinese stocks were at the lows of the day, and for now, it appears good data is bad news as stocks are not bouncing at all.

Tsipras Begins to Sell Aid Terms as Debt Outlook Worsens (Bloomberg)

Tsipras Begins to Sell Aid Terms as Debt Outlook Worsens (Bloomberg)

Greek Prime Minister Alexis Tsipras started his pitch for a bailout that’s sparked a revolt in his own party and is struggling to get off the ground as international officials ask new questions about the country’s finances.

As Tsipras went on national television on Tuesday night to argue for a deal that he only agreed to with “a knife at my neck,” European officials were at a loss over how to put together a bridging loan that will keep Greece from defaulting on the European Central Bank and its own citizens next week.

China's growth steady at 7 percent as investment rebounds (Business Insider)

China's growth steady at 7 percent as investment rebounds (Business Insider)

China's economy grew an annual 7.0 percent in the second quarter, steady with the previous quarter and slightly better than analyst forecasts, though further stimulus is still expected after the quarter ended with a stock market crash.

It has been a difficult year for the world's second-largest economy. Slowing growth in trade, investment and domestic demand has been compounded by a cooling property sector and deflationary pressures.

European stocks slip with vote on Greek deal ahead (Market Watch)

European stocks slip with vote on Greek deal ahead (Market Watch)

European stocks ebbed lower Wednesday, with focus swinging back to Greece, where lawmakers face a deadline to approve creditors’ austerity measures or risk losing much-needed bailout aid.

The Stoxx Europe 600 SXXP, +0.25% slipped 0.1% to 397.93, with only the energy, utility and technology sectors posting modest gains.

China Growth Beats Economists Forecast as Stimulus Kicks In (Bloomberg)

China Growth Beats Economists Forecast as Stimulus Kicks In (Bloomberg)

China’s economic growth proved resilient in the second quarter as policy makers stepped up support and a stock market boom — since soured — spurred services.

Gross domestic product rose 7 percent in the three months through June from a year earlier, the National Bureau of Statistics said Wednesday, unchanged from the first quarter and beating economists’ estimates for 6.8 percent. Industrial output in June rose 6.8 percent, while fixed-asset investment increased 11.4 percent in the first half.

What a Mystery Company Can Teach You About Stock Charts (Bloomberg)

Let's play peekaboo.

Let's take a mystery company, one I call Amalgamated Cupertino, and run four quick charts.

Singapore Home Sales Dropped to the Lowest This Year in June (Bloomberg)

Singapore Home Sales Dropped to the Lowest This Year in June (Bloomberg)

Singapore home sales dropped 42 percent in June to the lowest this year as fewer projects were offered.

Developers sold 375 units last month compared with a revised 643 units in May, according to data released Wednesday by the Urban Redevelopment Authority.

Among companies that put up projects for sale, Watervine Homes Pte sold six of 145 units marketed in a northeastern suburb, according to data from the authority. Sims Urban Oasis Pte sold 11 units of the 50 it offered in the east, data showed.

As $170 billion hedge fund Bridgewater noted, "new participants are now discovering that making money in the markets is difficult," and sure enough, as WSJ reports, Asian hedge funds have suffered steep losses in June. Several hedge funds were hit with losses on longs (unable to square positions due to suspensions) as well as a dearth of effective tools to short, or bet against, Chinese stocks as they dropped, highlighting the downside of investing in an environment where managing risks is difficult and government actions are unpredictable.

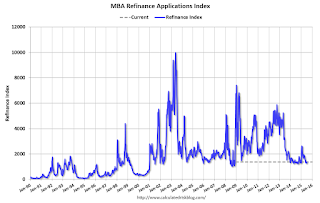

Mortgage Applications Decrease in Latest Weekly Survey, Purchase Index up 17% YoY (Calculated Risk)

Mortgage applications decreased 1.9 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending July 10, 2015. The prior week’s results included an adjustment for the July 4th holiday. …

Oil prices wobble after inventory data, Iran deal (Market Watch)

Oil prices wobble after inventory data, Iran deal (Market Watch)

Crude-oil futures slumped on Wednesday, as investors continued to gauge the Iranian nuclear accord’s impact on energy market.

On the New York Mercantile Exchange, light, sweet crude futures for delivery in August CLQ5, -0.70% fell 49 cents, or 0.9%, to $52.55, after swinging between small gains and losses earlier in the day. August Brent crude on London’s ICE Futures exchange LCOQ5, -0.87% fell 63 cents, or 1.1%, to $58.05 a barrel.

Google stock jumps on report that the company has curbed hiring (Business Insider)

Google stock jumps on report that the company has curbed hiring (Business Insider)

Google's stock rose more than 3% Tuesday following a Wall Street Journal story about the company's recent spending and hiring curbs.

As Google becomes more complex, it's trying to find ways to make itself more efficient, specifically by being increasingly judicious about hiring in areas that don't have clear business objectives.

This is something analysts and investors have been barking about on recent earnings calls: As Google's profit margins have slimmed down, they want proof that the company isn't pouring too much money into its so-called "moonshot" projects, instead of finding ways to grow its core business.

Chinese Buyers of U.S. Golf Courses Tee Up Revival Plan (Bloomberg)

As Nick Dou bends down to inspect the 14th green at his revered Pine Lakes Country Club, with its antebellum-style clubhouse and Magnolia trees, a question hangs in the humid South Carolina air.

Can Chinese investors save American golf?

Pine Lakes, built in 1927, is the oldest course on the Grand Strand, a verdant coastal strip that includes Myrtle Beach and stretches 60 miles along the Atlantic Ocean. Like most golf meccas, the Grand Strand is struggling to recover from the boom and bust that has cut the value of most of its courses in half.

China stocks fall despite rosy growth data (Market Watch)

China stocks fall despite rosy growth data (Market Watch)

Stocks in China fell Wednesday as surprisingly strong growth data dims hopes for more stimulus, while worries persist that triggers of the recent selloff could still inflict more damage.

The Shanghai Composite SHCOMP, -3.03% ended down 3% at 3805.70, shedding gains from a three-day rally that lifted the benchmark roughly 13%. The index is 26.3% off its peak on June 12. The smaller Shenzhen Composite 399106, -4.22% fell 4.2% to 2058.84 and the small-cap ChiNext board 399006, -4.99% shed 5% to 2590.93. Both are down about a third since highs in June.

Tesla had its all-time trading high in its sights but has slipped back (Business Insider)

Tesla had its all-time trading high in its sights but has slipped back (Business Insider)

Since bottoming out at $185 per share in March, Tesla stock recovered steadily to reach $280 earlier this month.

Tesla's all-time trading high of $291 was reached in September 2014.

The stock had that figure in its crosshairs. But over the past week, the stock has fallen back a bit, bottoming at $255.

Bank of Japan Keeps Record Stimulus, Trims Inflation Outlook (Bloomberg)

Bank of Japan Keeps Record Stimulus, Trims Inflation Outlook (Bloomberg)

The Bank of Japan refrained from increasing its monetary stimulus even as it trimmed its inflation outlook, as officials count on the economy pulling out a soft patch and consumer price gains accelerating toward its target.

The central bank will continue to expand the monetary base at an annual pace of 80 trillion yen ($648 billion), it said in a statement on Wednesday in Tokyo. It cut its inflation outlook for the fiscal year through March 2016 to 0.7 percent from 0.8 percent and forecast 1.9 percent for the next fiscal year.

GOLDMAN SACHS ELEVATOR: Wall Street isn't like 'Wolf of Wall Street' — but not because it isn't wild (Business Insider)

GOLDMAN SACHS ELEVATOR: Wall Street isn't like 'Wolf of Wall Street' — but not because it isn't wild (Business Insider)

Wall Street isn't like 'Wolf of Wall Street', says John LeFevre, the man behind the parody Twitter feed, Goldman Sachs Elevator.

But it's not because the culture is more staid in reality — the debauchery is real.

"I'm saying Wolf of Wall Street is about scumbags who dropped out of community college and went to Long Island and commit crimes and partied like rock stars," said LeFevre in an interview with Andrew Ross Sorkin on CNBC's Squawk Box.

Bank of America, Intel, Netflix earnings in focus (Market Watch)

Bank of America, Intel, Netflix earnings in focus (Market Watch)

Among the shares expected to see active trade in Wednesday’s session are those of Bank of America Corp., Intel Corp. and Netflix Inc.

Bank of America BAC, +2.39% is projected to report second-quarter earnings of 36 cents a share, according to a consensus survey by FactSet. The financial firm reported earnings of 19 cents a share a year ago. The bank is among the stocks that Morgan Stanley is upbeat on ahead of its earnings report.

Politics

This 2016 candidate is waging a war on Wall Street (Business Insider)

This 2016 candidate is waging a war on Wall Street (Business Insider)

Former Maryland Gov. Martin O'Malley (D) has made Wall Street reform a central component of his presidential campaign.

Last week, O'Malley released a white paper detailing his plan to bring a mix of structural changes including the reinstatement of Glass-Steagall and strengthened regulations to the financial industry. On Tuesday, O'Malley sat down with Business Insider for his first interview about his Wall Street policy push. In that conversation, he railed against what he described as "lawbreakers" in the industry who he likened to bank robbers.

Bernie Sanders shows Donald Trump how it’s done (Market Watch)

Bernie Sanders shows Donald Trump how it’s done (Market Watch)

He's been drawing huge, enthusiastic crowds in states such as Iowa, New Hampshire and Wisconsin. He speaks with passion about the plight of the middle class and the growing wealth and income inequality in America. He says the system is rigged in favor of the very rich. He advocates for the same redistributionist policies today as he has for his entire life.

With Bernie Sanders, the second-term Independent senator from Vermont and self-declared socialist turned presidential candidate, “what you see is what you get,” according to a recent Politico profile.

Iran Deal Boosting Lira as Oil Effect Vies With Political Risk (Bloomberg)

Iran Deal Boosting Lira as Oil Effect Vies With Political Risk (Bloomberg)

Iran’s nuclear deal may have just given the Turkish lira another leg up.

Already the best-performing emerging-market currency in the past month as slumping oil prices reduced pressure on Turkey’s import bill, the lira climbed to a seven-week high on Tuesday as Iran and six world powers sealed a historic accord to end sanctions. The nation’s two-year notes also gained on speculation the country will benefit from business opportunities in its southeastern neighbor.

Technology

Ultrasound technology captures life-like heart images (Engadget)

Ultrasound technology captures life-like heart images (Engadget)

Traditional ultrasound allows doctors to see patients' hearts, but those photos are nowhere as detailed as they would like. Now, GE Healthcare has developed advanced software called "cSound" for its new cardiovascular ultrasound machines that can render realistic 4D — that's 3D plus time — heart images. GE claims cSound is so powerful, it can crunch a full DVD's worth of data in just a second. If it comes across any data it can't process immediately, it stores that info and uses algorithms to analyze it to generate images as close to the real thing as possible. The software also has built-in color maps that assigns specific hues to different tissues.

Health and Life Sciences

Prenatal Gene Tests Can Sometimes Spot Cancer in Mom-to-Be (Medicine Net)

Prenatal Gene Tests Can Sometimes Spot Cancer in Mom-to-Be (Medicine Net)

Abnormal results on noninvasive, prenatal genetic tests don't always indicate a problem with the fetus. In some cases, these tests may uncover maternal cancers, a new study reports.

"If the test comes back abnormal, the patient should not panic," said study researcher Dr. Diana Bianchi, executive director of the Mother Infant Research Institute at Tufts Medical Center in Boston. "It doesn't necessarily mean anything is wrong with the fetus."

Drug-encapsulating nanoparticle to measure how anticancer chemotherapy formulations enter cells (Phys)

Drug-encapsulating nanoparticle to measure how anticancer chemotherapy formulations enter cells (Phys)

Polymer nanoparticles that release medicine at controlled rates inside cells have the potential to enhance the efficacy of many clinical drugs. A*STAR researchers have now developed an eye-catching way to evaluate the performance of different polymer drug-delivery formulations using luminescent quantum dots as imaging labels.

Tiny, inorganic quantum-dot crystals are finding increasing use as biological probes due to their powerful optical characteristics. By stimulating the dots with laser light, researchers can obtain sharp images to monitor processes such as drug delivery for much longer time frames than nearly any other technique. However, a key challenge lies in incorporating hydrophobic quantum dots into biocompatible, water-soluble polymers.

Life on the Home Planet

IT'S OFFICIAL: NASA has taken us to Pluto for the first time (Business Insider)

IT'S OFFICIAL: NASA has taken us to Pluto for the first time (Business Insider)

It's now official: NASA has successfully taken us to Pluto, and beyond.

What's more, the spacecraft collected all of the data it was designed to, which means scientists now have boat loads of information about Pluto and its largest moon, Charon, which they will start to receive bit-by-bit over the next 16 months.

New Ebola cases in Sierra Leone (BBC)

New Ebola cases in Sierra Leone (BBC)

Health officials in Sierra Leone have warned that new cases of Ebola are continuing to emerge, more than year after the major outbreak was first declared.

Despite a decline in cases in recent months, there has been a sudden rise in new infections in the capital Freetown.