Financial Markets and Economy

The Ratings Game: Wal-Mart’s whining because Amazon’s winning, analyst says (Market Watch)

Methinks Wal-Mart Stores Inc. doth protest too much, Piper Jaffray analyst Gene Munster said in so many words.

This ex-central banker said Bank of England's imminent interest rate rise will hurt the economy so 'it's a strange thing to do' (Business Insider)

This ex-central banker said Bank of England's imminent interest rate rise will hurt the economy so 'it's a strange thing to do' (Business Insider)

Bank of England governor Mark Carney revealed that the BoE is looking to raise interest rates "at the turn of this year" — but outspoken former BoE member Danny Blanchflower warned this will hurt the economy.

Carney said in a speech on Thursday that the BoE is aiming to raise rates around the start of 2016 and rates will continue to rise over three years to around 2%. Currently, Britain's interest rates have stayed at a record low of 0.5% for the past six years.

Coal Shares Drop on Yet Another Day of Negative Headlines (Bloomberg)

Peabody Energy Corp. tumbled to an all-time low a day after being sued by coal union pension trustees seeking to force the company to fund retiree liabilities.

Etsy stock skyrockets 37% after bullish Google comments (Market Watch)

Etsy stock skyrockets 37% after bullish Google comments (Market Watch)

Shares of Etsy Inc. rocketed as much as 37% on Friday, after Google Inc. specifically named the e-commerce company as one of the developers enjoying a boost in traffic related to new Google Inc. algorithms.

The comments came from Omid Kordestani, Google’s chief business officer, on the company’s conference call late Thursday, where he pointed to Google’sGOOGL, +16.26% GOOG, +16.05% efforts to use indexing to help people find what they need within third-party apps.

Greek Prime Minister Alexis Tsipras is expected to overhaul his cabinet after a rebellion within his party (Business Insider)

Greek Prime Minister Alexis Tsipras is expected to overhaul his cabinet after a rebellion within his party (Business Insider)

Prime Minister Alexis Tsipras is widely expected to reshuffle his Cabinet, following a rebellion within his party over a parliament vote to approve painful austerity measures demanded for new bailout talks to start.

The reshuffle was expected Friday or over the weekend.

In the early hours of Thursday, 38 of Tsipras' own radical-left Syriza party members dissented and vote against him. They included two cabinet members — the energy and welfare ministers — as well as the parliament speaker and the former finance minister, Yanis Varoufakis.

Nordea CEO Warns of Negative Rate Fallout as Bank Costs Soar (Bloomberg)

Nordea CEO Warns of Negative Rate Fallout as Bank Costs Soar (Bloomberg)

The head of Scandinavia’s biggest bank warned of the consequences of persistent negative interest rates as their cost to the financial industry swells.

“I’m concerned that we have all these negative rates now when we start to have positive growth — and that goes all over Europe, and Denmark, and so on,” Christian Clausen, the chief executive officer of Nordea Bank AB, said in an interview on Thursday. “It’s clearly a sign of things not being normal. The sooner we get normalized interest rates, the better, for everyone.”

Gasoline, eggs lift U.S. consumer prices in June (Business Insider)

Gasoline, eggs lift U.S. consumer prices in June (Business Insider)

U.S. consumer prices rose for a fifth straight month in June as the cost of gasoline and a range of other goods increased, further signs of firming inflation that strengthen the case for an interest rate hike this year.

The Labor Department said on Friday its Consumer Price Index rose 0.3 percent last month after increasing 0.4 percent in May. Last month's increase pushed the year-on-year CPI rate into positive territory for the first time since December.

Consumer sentiment drops from five-month high (Market Watch)

Consumers’ attitudes soured in July, with a gauge of their sentiment pulling back from June’s five-month high.

This Is How Quickly Greece's Future Is Deteriorating (Bloomberg)

Some time ago University of Chicago economist Luigi Zingales wrote about a "horrifying joke" he heard from his colleagues that asked, "What's the difference between Japan and Greece?" The punchline was "three years." Now, even that seems too long.

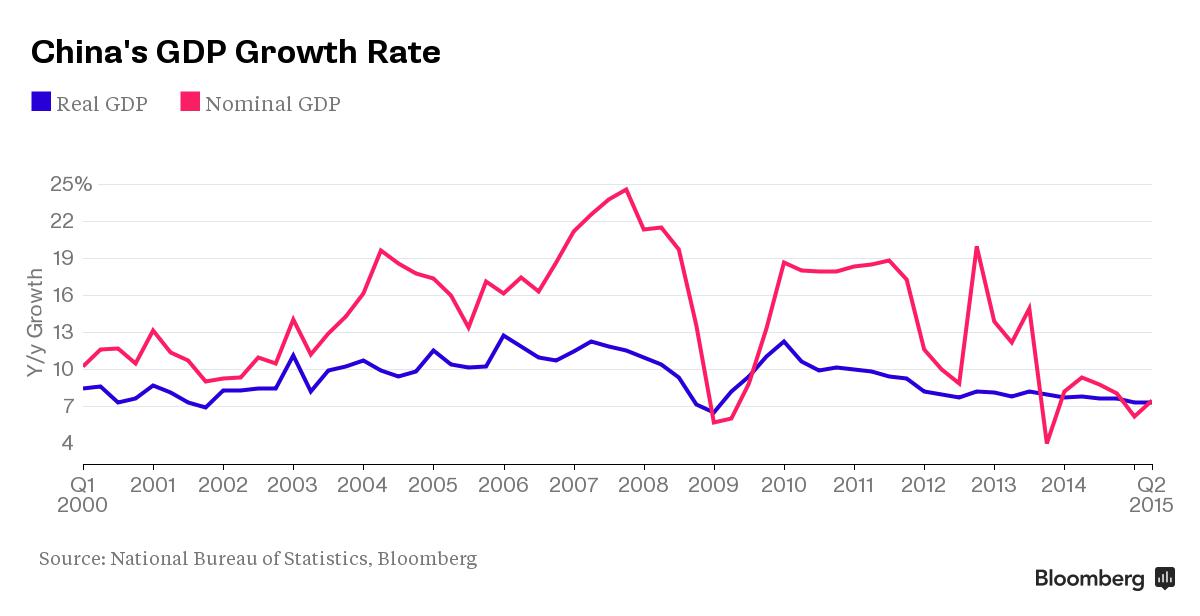

How China's Slowdown Is Worse Than You Think (Bloomberg)

On the surface at least, China's economy grew at a respectable 7 percent in the second quarter, beating expectations and right on track for the government's annual growth target.

Top money managers are turning to gold — should you? (Market Watch)

Bullion bulls now outnumber bears, an astonishing improvement, writes Brett Arends.

eBay just lost the part of its company that was driving all its growth (Business Insider)

On Friday, eBay and PayPal are splitting back into two separate companies. PayPal will begin trading on the Nasdaq under the ticker symbol PYPL, the same symbol it traded under before eBay bought it back in 2002.

Greeces Tsipras Shakes Up Cabinet in Bid to Rebuild Government (Bloomberg)

Greeces Tsipras Shakes Up Cabinet in Bid to Rebuild Government (Bloomberg)

Greek Prime Minister Alexis Tsipras replaced some ministers in a cabinet reshuffle after almost a quarter of his lawmakers rejected measures he agreed on with creditors to keep the country in the euro.

The prime minister’s office said Friday that Panagiotis Skourletis will replace Panagiotis Lafazanis, who heads the Left Platform fraction of Tsipras’s Syriza party, as energy minister. George Katrougalos will succeed Panagiotis Skourletis as labor minister.

UBS: 'The bears are bloodied and have little to show for their tenacity' (Business Insider)

"July started out promising for the US equity market Bears, as [the S&P 500] traded below its 200 day moving average for the first time since October 2014," UBS strategist Julian Emanuel said in a note to clients on Friday.

Google Surge Leaves Co-Founders Page, Brin $8 Billion Wealthier (Bloomberg)

Google Inc. co-founders Larry Page and Sergey Brin have added more than $4 billion to their individual fortunes today as shares of the Internet search giant surged 16 percent.

China just revealed how much gold it's been hoarding for the first time since 2009 (Business Insider)

China just revealed how much gold it's been hoarding for the first time since 2009 (Business Insider)

Back in April we wrote that "The Mystery Of China's Gold Holdings Is Coming To An End" as a result of China willingness to add the Yuan to the IMF's SDR currency basket which would require the disclosure of China's gold holding ahead of an IMF meeting on SDR composition which may be held in October.

By way of background, the reason why everyone has been so focused on Chinese official gold holdings is that there has been no official update to the gold inventory of the world's biggest nation, which have been fixed at 33.89 million oz since April 2009, a little over 1000 tons. In other words, the PBOC's gold inventory has been "unchanged" for over 6 years which is in stark contrast to the ravenous buying of physical gold China has been engaging in for the past 5 years.

Coal Projects Face Increasing Risk as Japan Eyes Climate Goals (Bloomberg)

With countries from China to Brazil lining up to showcase efforts to rein in pollution that causes global warming, developers of coal power plants in Japan may find themselves increasingly under pressure.

Robo advisers are planning your retirement party (Market Watch)

What has my financial adviser done for me lately? It’s a question that more investors will find themselves asking these days amid the increasingly inexpensive and digitalized portfolio management of so-called robo-advisers.

5 Things To Ponder: Beach Reading (Street Talk Live)

Today, is my last day of vacation. Later this afternoon, my family and I board a flight that will leave this tropical paradise behind and return us back home to Houston, Texas. Since I have a few hours of flight time ahead of me, I have prepared a reading list to pass the time.

Record VIX Retreat Is Just Another Crash Scare Failing to Happen (Business Insider)

Another bout of turbulence in the U.S. stock market has been defused, this time with record speed.

Goldman Sachs CEO Lloyd Blankfein is now a billionaire (Business Insider)

Goldman Sachs CEO Lloyd Blankfein is now a billionaire (Business Insider)

Lloyd Blankfein, the CEO and Chairman of Goldman Sachs since 2006, is now a billionaire.

The legendary Wall Street titan, who grew up in a housing project in Brooklyn and ended up earning degrees from Harvard University, has seen his net worth surge to $1.1 billion (£704 million).

According to the Bloomberg Billionaires Index, the massive surge in his wealth is due to him being the largest individual shareholder in investment banking giant Goldman Sachs, which manages nearly $911.5 billion (£583 billion) in assets.

Freddie Mac Said to Plan New Type of Mortgage Risk-Transfer Debt (Bloomberg)

Freddie Mac is expanding its risk-sharing efforts meant to protect taxpayers and potentially prepare the $9.4 trillion U.S. home-loan market for its future.

Canadian man pleads guilty in a multimillion US stock fraud case (Business Insider)

Canadian man pleads guilty in a multimillion US stock fraud case (Business Insider)

A Canadian man pleaded guilty on Friday to running an international boiler room scheme in a case that stemmed from one of the largest penny stock investigations in U.S. history, according to federal prosecutors.

Sandy Winick, 57, pleaded guilty to conspiring to commit wire fraud for running a $5 million scheme in which investors in U.S. penny stocks were duped into paying fees for nonexistent services, prosecutors in Brooklyn, New York, said on Friday.

China Dumps Record $143 Billion In US Treasurys In Three Months Via Belgium (Zero Hedge)

When the latest Treasury International Capital data was released yesterday, many were quick to conclude that not only had China's selling of US Treasury ceased, but that with the addition of $7 billion in US government paper, China's latest total holdings of $1270.3 billion were the highest since May of 2014. And if one was merely looking at the "China" line item in the major foreign holders table, that would be correct.

European stocks log best week since start of ECB’s QE (Market Watch)

European stocks log best week since start of ECB’s QE (Market Watch)

Europe’s benchmark-stock index logged its best weekly gain since the start of the year Friday, after an action-packed week in Greece’s debt odyssey, where fears of a default and an exit from the eurozone abated.

The Stoxx Europe 600 SXXP, +0.06% rose 0.1% to close at 405.68, marking an eighth straight session of gains. For the week, the pan-European benchmark added 4.3%, the best weekly return since the week ended Jan. 23, which was the week the European Central Bank announced its quantitative-easing program.

Pimco Finds Silver Lining to Canada Gloom in Bond-Market Gains (Bloomberg)

Canada’s souring economy is giving the country an edge in the fixed-income market, where it’s beating Group of Seven peers and drawing buyers including Pacific Investment Management Co.

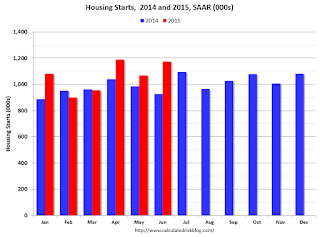

Comments on June Housing Starts (Calculated Risk)

Total housing starts in June were above expectations, and, including the upward revisions to April and May, starts were strong.

After piling into Chinese stocks last week global investors dumped them madly this week (Business Insider)

The volatility in foreign investor appetite for Chinese stocks continues according to the latest report of Asia Pacific fund flows from the ANZ Bank.

Politics

The U.S. Is Still Iran's Great Satan (Wall Street Journal)

The U.S. Is Still Iran's Great Satan (Wall Street Journal)

Three days before Iran and world powers announced a nuclear deal, Iran’s Supreme Leader Ayatollah Ali Khamenei met with university students at his official residence. A video of the event on Mr. Khamenei’s website shows male students sitting cross-legged at the center of the floor and female students, covered from head to toe in black cloth, on the side.

One student asked Mr. Khamenei what would become of Iran’s stance against estekbar—the Persian word for arrogance—after the deal was signed?

Hillary Clinton Says She Would Phase Out Fossil Fuel Drilling On Public Lands — Just Not Yet (Think Progress)

At a town hall event in New Hampshire, Hillary Clinton became the latest presidential candidate to wrestle with what should be done about fossil fuel extraction on public lands.

Elaine Colligan, a 350.org Action Fellow, asked Clinton “will you commit to banning fossil fuel extraction on public lands in this country … yes or no will you ban this?”

Hillary Clinton’s Digital Team Likes Barack Obama’s Style (Time)

Hillary Clinton’s Digital Team Likes Barack Obama’s Style (Time)

Hillary Clinton campaign’s deputy digital director said Friday that the White House’s online outreach is a model for how public figures can connect with voters, offering a hint into how the Democratic frontrunner will Instagram, Tweet, and email during the 2016 race.

Speaking during a panel at Netroots Nation, a convention of liberal activists in Phoenix, Jenna Lowenstein pointed to the increasing importance of using the web to create a feeling of intimacy with voters.

President Obama Gets Greeted by Confederate Flags in Oklahoma City (Mother Jones)

President Obama Gets Greeted by Confederate Flags in Oklahoma City (Mother Jones)

The incident comes in the midst of a renewed national push to remove the battle flag from government sites after the massacre inside a historic black church in Charleston, South Carolina, last month. Similar counter rallies embracing the slogan "Confederate Lives Matter" were scheduled in Oklahoma City ahead of the president's visit.

Following the attack in Charleston, Obama delivered an impassioned eulogy for Rev. Clementa Pinckney, a South Carolina state senator and one of the nine people murdered, in which the president called the flag's enduring presence in the South a "reminder of systemic oppression and racial subjugation."

Technology

Tesla is launching a new Roadster in four years (The Verge)

Tesla is launching a new Roadster in four years (The Verge)

The original Roadster, a highly modified version of the small, lightweight Lotus Elise, was Tesla's first production vehicle revealed in 2006 — long before today's Model S sedan. (On the call, Elon Musk confirmed in response to a question that the new Roadster will be an all-new car.) Over the years, that first model has largely fallen by the wayside — it was always intended to be a niche vehicle — though the company has continued to support it, most recently with a "Roadster 3.0" upgrade that improves performance and range.

Health and Life Sciences

'Slim chance' of return from obesity (BBC)

'Slim chance' of return from obesity (BBC)

The chance of returning to a normal weight after becoming obese is only one in 210 for men and one in 124 for women over a year, research suggests.

For severe obesity, shedding excess weight in a year is even more unlikely, a study of UK health records concluded.

Researchers say current strategies for helping obese patients are failing.

How exactly fetal tissue is used for medicine (CNN)

How exactly fetal tissue is used for medicine (CNN)

Fetal tissue has been used since the 1930s for vaccine development, and more recently to help advance stem cell research and treatments for degenerative diseases such as Parkinson's disease. Researchers typically take tissue samples from a fetus that has been aborted (under conditions permitted by law) and grow cells from the tissue in Petri dishes.

Many of the uses of fetal tissue — and much of the debate — are not new. "It's just that the public is finding out about it," said Insoo Hyun, associate professor of bioethics at Case Western Reserve University.

Life on the Home Planet

Is it too late to save California’s mountain lions? (Futurity)

Is it too late to save California’s mountain lions? (Futurity)

Humans are the biggest threat facing mountain lions in California, where the animals only have about a 56 percent survival rate.

The findings of a 13-year study, published in PLOS ONE, show that even though hunting them is prohibited in California, humans caused more than half the known deaths of mountain lions studied.

Northern Lights Over Newfoundland Make Me Happy to Be An Earthling (Gizmodo)

Northern Lights Over Newfoundland Make Me Happy to Be An Earthling (Gizmodo)

It’s Friday, and the end of a looong week of peering into the far reaches of our solar system and being astounded by what we found. But as much as we love Pluto, we don’t need to gaze billions of miles away to see incredible sights. We’ve got them right here on Earth.

These stunning images of the northern lights were captured by astrophotographer Adam Woodworth in L’anse aux Meadows, Newfoundland—the only confirmed Viking settlement in North America—on the night of June 22nd and the early morning hours of June 23rd.

How mosquitoes zero in on hot bodies (BBC)

How mosquitoes zero in on hot bodies (BBC)

Biologists recorded the movement of hungry mosquitoes inside a wind tunnel.

The insects were instantly attracted to a plume of CO2, much like a human breath; after sniffing this gas they would also home in on a black spot.

Finally, over much shorter distances, the mosquitoes were also drawn towards warmth.