Visit Phil's Stock World for the latest market news, market commentary and investing ideas and strategies.

Financial Markets and Economy

Greek banks have reopened as the country tries to return to normal (Business Insider)

Greek banks have reopened as the country tries to return to normal (Business Insider)

Greeks queued outside banks on Monday as they reopened three weeks after closing to stop the system collapsing under a flood of withdrawals, the first cautious sign of a return to normal after a deal to start talks on a new package of bailout reforms.

However capital controls will remain and payments and wire transfers abroad will still not be possible — a situation which German Chancellor Angela Merkel said on Sunday was "not a normal life" and warranted swift negotiations on a new bailout.

One surprising thing pushing women into high-paying fields (Market Watch)

Women are more likely to enter male-dominated fields during a shaky economy, suggesting that the lack of women in certain high-paying fields may have more to do with how women view their abilities and less to do with their actual abilities.

China's No-Longer Secret Hoarding of Gold May Not Be Finished (Bloomberg)

“China hasn’t been very open about its strategy, so what matters now is whether the market believes they intend to continue buying,” said Joni Teves, an analyst at UBS Group AG in London. “They do appear to leave the door open to further purchases, which should limit the downside for gold.”

Gold crashed (Business Insider)

The price of gold, courtesy of stop-loss selling and thin market conditions, endured a wild ride Monday.

U.S. stock futures rise; S&P to try to follow Nasdaq to record (Market Watch)

U.S. stock futures rise; S&P to try to follow Nasdaq to record (Market Watch)

Wall Street on Monday looked poised to add to last week’s record-setting gains, as U.S. stock futures signaled a step up at the open.

Strong earnings reports from tech companies and optimism about Greece’s crisis have boosted the stock market, and more quarterly results are due out Monday from the likes of Morgan Stanley and IBM.

This is changing Showtime's business (CNN)

This is changing Showtime's business (CNN)

Consider this: Showtime President David Nevins used to receive reports about subscriber trends once a month. Now he gets granular data every morning.

"I know exactly how many we sold and I know exactly what the usage is," Nevins told CNNMoney in an interview.

The change is profound — making Showtime more like a Silicon Valley startup and less like an old media stalwart. While the network's shows are the same, its mode of distribution and its relationship to subscribers are suddenly different.

Sadly for gold investors, all news is currently good news (Quartz)

This chart that has tongues wagging in the markets today:

.png)

Greece Said to Order Creditor Payments as Banks Reopen (Bloomberg)

Greece Said to Order Creditor Payments as Banks Reopen (Bloomberg)

Greece gave the order to repay 6.8 billion euros ($7.4 billion) to creditors after last week’s tentative bailout deal, the Finance Ministry said, as Greek banks reopened three weeks after closing to prevent economic collapse.

The payments ordered Monday by the Greek government include money owed to the European Central Bank, the International Monetary Fund and Greece’s central bank, said a Finance Ministry official who asked not to be identified in line with government policy. Greek financial markets remain closed, the country’s market regulator said in an e-mailed statement.

UK banks have axed 186,111 jobs since the 2008 crisis (Business Insider)

UK banks have axed 186,111 jobs since the 2008 crisis (Business Insider)

British banks have cut 186,111 jobs since the 2008 crisis, with the latest round being a planned 30,000 headcount reduction at Barclays, according to Reuters.

Barclays' latest cuts follow 3,700 job cuts in 2013, a further 12,000 axed in 2014, and 7,000 jobs gone in 2015 already, according to The Telegraph.

Not all the job losses were based in Britain (these banks are global). "Only" 8,000 of the 25,000 jobs gone at HSBC are expected to be from the UK, for instance.

European stocks climb for ninth straight session (Market Watch)

European stock markets advanced on Monday, extending their Greece-fueled relief rally into a ninth straight session as the debt-laden country looked set to repay loans to creditors.

.png)

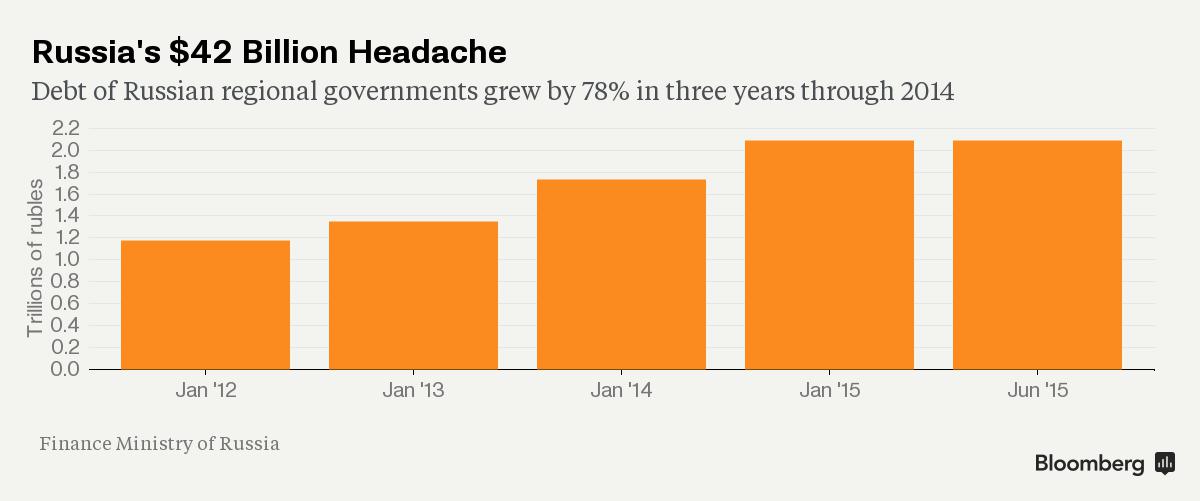

The $42 Billion Debt Trap That Putin Has Three Years to Escape (Bloomberg)

For the state of Russia’s finances, consider places like Chukotka, the territory separated from Alaska by a narrow strait.

Lies, Damned Lies, & Inflation Statistics (The Burning Flatform)

The government released their monthly CPI report this week. Even though it came in at an annualized rate of 3.6%, they and their mouthpieces in the corporate mainstream media dutifully downplayed the uptrend. They can’t let the plebs know the truth. That might upend their economic recovery storyline and put a crimp into their artificial free money, zero interest rate, stock market rally. If they were to admit inflation is rising, the Fed would be forced to raise rates. That is unacceptable in our rigged .01% economy. There are banker bonuses, CEO stock options, corporate stock buyback earnings per share goals and captured politician elections at stake.

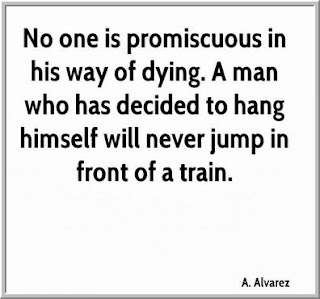

The Problem With Promiscuity In Trading (Trader Feed)

The Problem With Promiscuity In Trading (Trader Feed)

Alvarez makes a good point: on important matters in which we feel commitment, there is no promiscuity. If you're committed to physical health and being in peak conditioning, you won't be promiscuous in what you eat. If you're committed to a marriage, you won't be sexually promiscuous. If you're committed to career or a religious faith, you will necessarily be selective in what you pursue.

The problem with promiscuity is that the pursuit of breadth allows for no cultivation of depth. If I roam from one job to another each year, I never build a career–and never accumulate a career's worth of achievements. If I flit from one romantic relationship to another each week, I will never experience the depth of relationship that comes from a lifelong commitment. Once we make a commitment to something, we opt for selectivity. The pursuit of all things reflects a lack of commitment to anything.

Microsoft is reportedly planning to buy an Israeli cyber security firm for $320 million (Business Insider)

Microsoft is reportedly planning to buy an Israeli cyber security firm for $320 million (Business Insider)

Microsoft Corp plans to acquire Israeli cyber security company Adallom for $320 million, the Calcalist financial newspaper reported on Monday.

Adallom, which develops cloud security platforms, is expected to become the center for Microsoft's cyber security business in Israel, the newspaper said.

Adallom could not be reached for comment and officials at Microsoft in Israel declined to comment.

Bicycle Makers Struggle to Swat Down Counterfeits (NY Times)

Bicycle Makers Struggle to Swat Down Counterfeits (NY Times)

When Alberto Contador won the Tour de France in 2010 while riding a bicycle made by Specialized for the first time, Andrew Love was both elated and apprehensive.

“I knew they would be coming,” Love, the company’s head of brand protection, investigation and legal enforcement, recalled.

London Markets: Standard Chartered, oil firms push FTSE 100 higher (Market Watch)

London Markets: Standard Chartered, oil firms push FTSE 100 higher (Market Watch)

U.K. stocks kicked off the week in upbeat fashion on Monday, with Standard Chartered PLC and Royal Dutch Shell PLC helping push the main benchmark higher after company-specific news.

The FTSE 100 index UKX, +0.46% climbed 0.2% to 6,790.73, building on a 1.5% gain from last week.

Too-Good-to-Last Market Set to Bump, Europes Top Landlord to DAX (Bloomberg)

A German company that came close to bankruptcy in 2011 is on the threshold of becoming the first residential property owner to join a European benchmark stock index. Its meteoric rise may be hard to sustain.

Deutsche Annington Immobilien SE doubled its portfolio in three years by using cheap financing and its own buoyant shares to snap up competitors, and is now Europe’s biggest homeowner. The Bochum-based company, created by Guy Hands’ Terra Firma Capital Partners in 2001, is still hunting for deals even as the risk of higher borrowing costs increases and its largest rival says property prices are too expensive.

Monetary Metals Supply and Demand Report 19 July, 2015 (Zero Hedge)

The prices of the monetary metals cascaded downward this week, and the ratio of the gold price to the silver price rose accordingly.

Many analysts and speculators are puzzled. With everything going on in the world, goldshould go up. After all, China released its new gold holdings and the banking system in parts of the world (e.g. Greece) is a mess, and many central banks are printing money, etc.

Big fund suspected of selling gold after price crashes to 5-year low (Market Watch)

Big fund suspected of selling gold after price crashes to 5-year low (Market Watch)

Gold prices continued falling Monday, briefly hitting a more than a five-year low in Asian trade, after China indicated its gold reserves were at half the level expected.

The yellow metal has lifted up from its worst levels of the day, but still was firmly in the red.

August gold futures GCQ5, -1.77% were last down $16.60, or 1.5%, to $1,115.30 an ounce, after briefly trading around $1,080 an ounce — a level last seen in early 2010.

Audi Said to Give 1.2 Billion Yuan to Dealers in China (Bloomberg)

Audi Said to Give 1.2 Billion Yuan to Dealers in China (Bloomberg)

Audi AG is providing 1.2 billion yuan ($193 million) in financial aid to its dealers in China as demand for luxury vehicles slows in its largest market, according to people with knowledge of the matter.

The money will be paid out soon to distributors of the brand in China, according to two people familiar with the plan, who asked not to be named as the information isn’t public. The automaker also lowered its sales target for 2015 from 600,000 units to about last year’s level, the people said. It delivered 578,932 vehicles in China including Hong Kong last year.

Chinese Stocks Nosedive After Stabilization Fund Exit Comments (Zero Hedge)

Just when officials proclaimed Chinese stocks "the safest in the world," and added that "the stock market rout has been ended by timely measures," CSRC announces that they are studying an exit plan for the stock stabilization plan… and carnage ensues…

Asia Markets: China’s Shanghai index gains, but Hong Kong stocks dip (Market Watch)

Asia Markets: China’s Shanghai index gains, but Hong Kong stocks dip (Market Watch)

China shares rose modestly Monday after authorities moved over the weekend to tighten the use of informal lending channels by stock investors.

The Shanghai Composite Index SHCOMP, +0.88% closed 0.9% higher at 3992.11, after gaining 3.5% last week. It remains down 22.7% from its seven-year-plus high hit in June. The smaller Shenzhen index 399106, +1.82% ended up 1.8% at 2230.29, after jumping 7.6% last week. The index is down 29% from a June peak.

North Korea Gains in China Coal Shipments as Vietnam Bows Out (Bloomberg)

North Korea was the only country to boost coal shipments to China this year as Vietnamese supply slumped.

Greece’s Debt Payments, Apple Earnings and Credit Suisse Results (NY Times)

Greece’s Debt Payments, Apple Earnings and Credit Suisse Results (NY Times)

After receiving a short-term loan from the European Union last week, Greece is expected to pay 4.25 billion euros ($4.6 billion) due on bonds held by the European Central Bank, as well as €2 billion in overdue payments to the International Monetary Fund. Failure to pay the E.C.B. would have forced the bank to cut off emergency funding for Greek banks, causing them and the Greek economy to collapse. The debt payments represent a step back from the precipice of a eurozone exit for Greece, but the government led by Prime Minister Alexis Tsipras must cope this week with the political turmoil caused by his decision to accept unpleasant conditions set by eurozone creditors in return for financial aid. In a move toward normalcy, Greek banks are to reopen on Monday.

Is Australia The Next Greece? (Zero Hedge)

Australian consumers are more worried about the medium term outlook than at the peak of the financial crisis, and rightfully so.

Oil steady as U.S. cuts drill rigs, Saudi crude exports fall (Business Insider)

Oil steady as U.S. cuts drill rigs, Saudi crude exports fall (Business Insider)

Oil prices held steady in early Asian trade on Monday as a resurgence in U.S. drilling activity seen earlier this month seemed to fizzle out, while data showed Saudi Arabian exports fell to the lowest in five months despite record output.

U.S. energy firms cut seven oil rigs last week, Baker Hughes Inc

said late on Friday in its closely watched report. U.S. crude futures , also known as West Texas Intermediate (WTI), briefly turned higher after the report.

Gold Plunges 4.2% to Lowest Since March 10 as Platinum Slides (Bloomberg)

Gold Plunges 4.2% to Lowest Since March 10 as Platinum Slides (Bloomberg)

Gold sank 4.2 percent to the lowest level in more than five years, dropping for a sixth day, on prospects for higher U.S. interest rates and after China said it held less metal in reserves than some analysts expected. Platinum extended its decline to the lowest since 2009.

Bullion for immediate delivery fell as low as $1,086.18 an ounce, the lowest price since March 2010, and traded at $1,099.09 at 9:42 a.m. in Singapore. Prices sank 2.5 percent last week, the most since March.

How Two Brothers Goosed Google And Turned A Dorm-Room Lark Into $15 Million Per Year (Fast Company)

How Two Brothers Goosed Google And Turned A Dorm-Room Lark Into $15 Million Per Year (Fast Company)

Who knew ugly Christmas sweaters and powerful search engine optimization could create a booming business? Fred and Mark Hajjar, that's who.

Brothers Fred and Mark Hajjar own a clothing company. And it's pretty successful, generating about $3.5 million in revenue last year. So it's reasonable to think they'd know something about fashion.

Stocks aren't the only thing moving higher in China (Business Insider)

New home prices in China continued to ease in June, although there were vastly divergent performances across the nation.

Fuel Feud Pits Saudis Secretive Ghawar Against Sprawling Bakken (Bloomberg)

How much crude the Saudis pump out of their largest field may determine the fate of some of Americas oilmen.

Chinese Stocks Drop'n'Pop After Officials Confirm "Stock Market Rout Stopped By Timely Measures" (Zero Hedge)

With shenanigans in precious metals, investors are rushing back into the safety of Chinese high beta idiotmakers stocks…

Dollar in demand, gold at five-year low (Business Insider)

Dollar in demand, gold at five-year low (Business Insider)

The U.S dollar held broad gains in Asia on Monday as investors looked ahead to higher interest rates from the Federal Reserve, while gold hit five-year lows as a lack of global inflation left little to hedge against.

Activity was light with Japan on holiday and a dearth of major data in the diary, leading to a cautious start for stocks.

Australia's main index <.AXJO> was a fraction weaker, while MSCI's broadest index of Asia-Pacific shares outside Japan <.MIAPJ0000PUS> dipped 0.1 percent.

Lockheed to Buy Sikorsky for More Than $8 Billion, Reuters Says (Bloomberg)

Lockheed to Buy Sikorsky for More Than $8 Billion, Reuters Says (Bloomberg)

Lockheed Martin Corp. agreed to buy United Technologies Corp.’s Sikorsky unit for more than $8 billion, Reuters reported, citing a person familiar with the negotiations.

The two companies intend to announce the transaction on Monday, Reuters said, citing the person, who wasn’t authorized to speak publicly.

With a deal, Lockheed would add the largest maker of military helicopters to a lineup that includes warplanes and missiles, as United Technologies opts for the sale over a possible spinoff to shareholders. The transaction would extend Lockheed’s status as the world’s largest defense contractor and widen its lead over Boeing Co. as No. 1 in the U.S.

The crown jewel in Disney's cable empire is facing an unprecedented crisis (Business Insider)

Walt Disney Co. is arguably the world's most powerful and best-known media and entertainment company. Not only does it own the famous theme parks and movie studios, but it also counts several subsidiaries under its auspices including ABC, ESPN, Pixar, Marvel, and Touchstone Pictures.

Missile Jammers Drive Elbit Sales as Insurgent Stockpiles Grow (Bloomberg)

The spread of portable anti-aircraft missiles to militants and terrorists in ungoverned territories from Syria to Libya is helping Elbit Systems Ltd. increase sales of technology that can block the weapons.

German economy likely grew by around 0.3 percent in second-quarter: finance ministry (Business Insider)

German economy likely grew by around 0.3 percent in second-quarter: finance ministry (Business Insider)

The German economy likely grew by around 0.3 percent in the second quarter, the finance ministry said on Monday, adding that the mood in corporate boardrooms remained largely optimistic despite the Greek debt crisis.

In the first quarter, growth in Europe's largest economy slowed to 0.3 percent, mainly due to weaker foreign trade, after an unexpectedly strong 0.7 percent expansion between October and December last year.

Politics

Frances Hollande Proposes Creation of Euro-Zone Government (Bloomberg)

Frances Hollande Proposes Creation of Euro-Zone Government (Bloomberg)

French President Francois Hollande said that the 19 countries using the euro need their own government complete with a budget and parliament to cooperate better and overcome the Greek crisis.

“Circumstances are leading us to accelerate,” Hollande said in an opinion piece published by the Journal du Dimanche on Sunday. “What threatens us is not too much Europe, but a lack of it.”

While the euro zone has a common currency, fiscal and economic policies remain mostly in the hands of each member state. European Central Bank President Mario Draghi made a plea this week for deeper cooperation between the euro members after political squabbles over Greece almost led to a rupture in the single currency.

The West is blind to the appeal of China's model of authoritarian capitalism (Business Insider)

The West is blind to the appeal of China's model of authoritarian capitalism (Business Insider)

Under President Xi Jinping , China is succeeding in creating an alternative vision for global leadership designed to challenge Western, and in particular American, dominance.

Momentum is gathering behind the Asian Infrastructure Investment Bank, a US$100 billion initiative officially launched by China last month, in the face of US opposition, to finance Asia's infrastructure needs.

It is the first time the US is without a role in what will be a leading financial institution in the world.

Jon Stewart gets President Obama for one last time (CNN)

Jon Stewart gets President Obama for one last time (CNN)

President Obama will make his seventh and final appearance with Stewart on July 21. This will be Obama's third time coming on the show since taking office.

Obama has appeared with the satirical host in 2005, 2007, 2008 twice, 2010, and 2012.

The guest spot for the president is expected to be the first of many famous faces that grace the "Daily Show" stage before Stewart signs off from his long-time post on August 6.

Donald Trump Not Sorry for Comments, Not Dropping Out (Wall Street Journal)

Donald Trump Not Sorry for Comments, Not Dropping Out (Wall Street Journal)

Republican presidential candidate Donald Trump said Sunday he’s not sorry and he’s not withdrawing from the race over remarks he made about Arizona Sen. John McCain‘s status as a war hero.

Mr. Trump drew fire after he said Saturday that Mr. McCain, the party’s 2008 presidential standard-bearer who spent five years as a prisoner of war in Vietnam, was “not a war hero.” Mr. Trump explained his dislike of seeing Mr. McCain described that way by saying that Mr. McCain was “a war hero because he was captured. I like people who weren’t captured.”

Technology

Samsung announces new iPad-sized Galaxy Tab S2 (The Verge)

Samsung announces new iPad-sized Galaxy Tab S2 (The Verge)

Samsung has announced the Galaxy Tab S2, a new tablet that comes in 9.7-inch and 8.0-inch variants, set to launch in global markets in August. The new devices come in a particularly light and thin metal frame — they're only 5.6 milimeters in thickness and weigh just 389 grams for the 9.7-inch model, and 265 grams for the 8.0-inch. Both variants have Super AMOLED displays at 2048×1536 resolutions, and Quad 1.9GHz and Quad 1.3GHz octacore processors. A microSD slot allows buyers to bump onboard storage space up to 128GB on both devices.

The Backed Pack: Buddy robot tends to the family, patrols the home (Venture Beat)

The Backed Pack: Buddy robot tends to the family, patrols the home (Venture Beat)

Each week our friends at Backerjack highlight a cool, crowdfunded gadget. This week we look at Buddy, which has more than doubled its original $100,000 goal.

There are a growing number of multi-function robots on crowdfunding sites. While some, such as JIBO, may strike consumers as too robotic to warm up to, others, like the Personal Robot, may be rejected as too creepy because of their attempts to seem human.

Health and Life Sciences

More Exercise = More Fat Loss for Older Women, Study Finds (Medicine Net Daily)

Older women who fit more minutes of heart-pumping exercise into their week will lose more body fat, a new study shows.

Canadian researchers found that postmenopausal women who got five hours of moderate-to-vigorous aerobic exercise every week — double the normally recommended amount — lost significantly more body fat within a year than women who exercised less.

Living With Invisible Illness (The Atlantic)

Living With Invisible Illness (The Atlantic)

Jackie Todd is 27 years old, with sly eyes, a laugh that seems to come from deep in her belly, and thick, dirty-blond hair that she dyes a fiery copper hue. She also has a small computer inside of her chest. It’s constantly collecting information; it’s a diary of dates, times, and events. In a sense, Jackie’s whole life is archived in a code that she can’t interpret. She jokes that she’s part cyborg, but it’s not entirely a gag: a $50,000 machine is keeping her alive. “This device will do everything it can to prevent my heart from stopping,” she says.

Life on the Home Planet

'Sharks don't like to eat people': attack statistics contradict untested theories (The Guardian)

'Sharks don't like to eat people': attack statistics contradict untested theories (The Guardian)

More of us are in the water than ever before – and while we kill 100m of them every year, it seems that sharks just don’t like the way we taste.

Mick Fanning’s close shave with a shark while competing in South Africa is likely to amplify mutterings from some ocean-goers over what they perceive as a dangerous escalation in shark numbers.

Stephen Hawking and Yuri Milner Announce $100M Initiative to Seek ET (Scientific American)

Stephen Hawking and Yuri Milner Announce $100M Initiative to Seek ET (Scientific American)

SETI—the Search for Extraterrestrial Intelligence—has been one of the most captivating areas of science since its inception in 1960, when the astronomer Frank Drake used an 85-foot radio telescope in the first-ever attempt to detect interstellar radio transmissions sent by beings outside our solar system. Yet despite its high public visibility and near-ubiquity in blockbuster Hollywood science fiction, throughout most of its 55-year history SETI has languished on the fringes of scientific research, garnering relatively scant funding and only small amounts of dedicated observation time on world-class telescopes.

Today, in a live webcast originating from London and set for 6:30 am Eastern, the Russian entrepreneur Yuri Milner, along with the physicist Stephen Hawking, is announcing his intentions to change that. Watch the live streamed event below, starting at 6:30 am.