Financial Markets and Economy

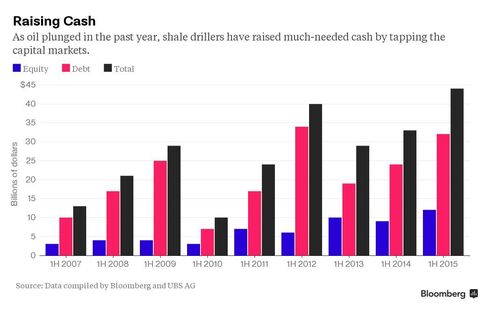

Wall Street Lenders Growing Impatient With U.S. Shale Revolution (Bloomberg)

Halcon Resources Corp. almost ran into trouble with its banks in June 2013. And again in March 2014. And in February 2015.

"The Spell Is Broken" In China, Selling Pressure To Remain "Relentless": BofAML (Zero Hedge)

Just three days ago, we outlined the series of events that ultimately led Beijing to transform China Securities Finance Corp into a half-trillion dollar, state-sponsored margin trading Frankenstein.

Crude oil just broke $50 (Business Insider)

Crude oil just fell below $50 per barrel.

On Monday afternoon in New York, West Texas Intermediate crude oil futures briefly sank below the $50 per barrel mark for the first time since April 6.

Low chances seen for government shutdown this fall, experts say (Market Watch)

Low chances seen for government shutdown this fall, experts say (Market Watch)

Talk of a federal government shutdown is brewing in Washington but two budget experts say odds of one happening are low.

Congressional Democrats and Republicans have been unable to agree on annual spending bills, with President Obama’s party demanding higher spending levels for domestic programs. Republicans, meanwhile, have pushed for increased military spending but have rebuffed Democrats’ wishes for boosting domestic outlays.

Exit Lessons From The Way Michael Jackson Purchased Neverland Ranch (Forbes)

Exit Lessons From The Way Michael Jackson Purchased Neverland Ranch (Forbes)

In 1987, a representative of Michael Jackson approached the modest Sycamore Valley ranch house in Santa Barbara, CA and knocked on the door. The owner of the ranch was shocked by the visitor’s message. He told the homeowner that he represented someone who wanted to purchase the ranch at a substantial premium over its current fair market value. He also indicated that the offer was non-negotiable and the home owner had to respond either “Yes” or “No” in a matter of hours.

Although this is a somewhat unusual real estate transaction, it reflects a surprisingly common scenario in the business world of mergers and acquisitions, with one important distinction.

Gold Leads Commodities Mess That Has Many Investors Smarting (Bloomberg)

Pity the commodity investor.

The Bloomberg Commodities Index dropped to a 13-year low Monday, weaker than after the banking meltdown of 2008 and the euro-zone crisis of 2012. From oil to copper to sugar, little has escaped the rout in the year’s worst-performing asset class.

42 Billion Reasons Why Putin's Time May Be Running Out (Zero Hedge)

Russian municipal bond risk is surging once again (at 6-week highs) heading towards crisis-levels as Bloomberg reports numerous regions (including Chukotka – across from Alaska, Belgorod -near Ukraine, and three North Caucus republics) are prompting concerns as debt-to-revenue levels top 100% (144% in the case of Chukotka).

New York Escalates Investigation Into Promontory Financial Group (NY Times)

New York Escalates Investigation Into Promontory Financial Group (NY Times)

When an executive at one of Wall Street’s top consulting firms testified before Congress two years ago, he stressed the importance of independence in reviewing bank misdeeds, declaring, “If we merely told our clients what they want to hear, we would lose credibility.”

A long-running New York State investigation into potential conflicts of interest at the firm, Promontory Financial Group, is now calling some of that credibility into question, according to lawyers briefed on the matter. And in an escalation of the investigation, state authorities recently subpoenaed several of the firm’s employees, including the executive who testified before Congress.

The weak ruble is helping Russian oil producers (Business Insider)

The weak ruble is helping Russian oil producers (Business Insider)

If oil can maintain a fairly low price of $60 per barrel, Russian energy companies can survive a drawn-out depression in the global industry, according to Wood Mackenzie, the energy and mining consultancy based in Edinburgh.

The reason is that the costs of extracting oil and gas are based on a devalued ruble, which makes them low for producers such as the state-run Rosneft and Gazprom, respectively. But the two companies products are sold on the world market for dollars, not rubles, making their profit margins higher, according to a Wood Mackenzie analysis published July 17.

Investors don’t trust the stock market rally, which is why you should (Market Watch)

Investors don’t trust the stock market rally, which is why you should (Market Watch)

Anyone who talks optimistically about the stock market these days has to put up with the doom-and-gloomers and the Internet trolls saying that the next collapse is nearly upon us.

But if you’re pleased with the way your stock investments have performed over the past few years, you probably should thank the Calamity Janes and Nervous Nellies, because they have provided some balance that rising markets seem to need.

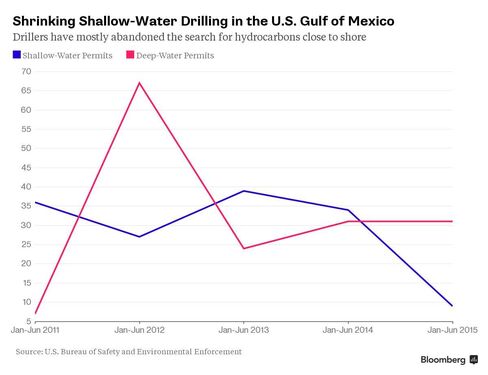

Oil Explorers Retreat From Shallow U.S. Gulf in Shift to Shale (Bloomberg)

Energy producers are retreating from the search for oil and natural gas close to shore in the U.S. Gulf of Mexico as drilling budgets shrink and exploration migrates to land-based shale fields.

Liquidity Is "Thin To Zero": Worried Bond Managers Shrink Trades, Dodge Cash Markets (Zero Hedge)

It would be no exaggeration to say that with the exception of Grexit and the spectacular collapse of the Chinese equity bubble, bond market liquidity is now the most talked about subject on Wall Street. The focus on illiquid markets comes years (literally) after the subject was first discussed in these pages, but over the past several months, pundits, analysts, billionaire bankers, and incorrigible corporate raiders alike have weighed in.

Asian shares waver, gold steadies (Business Insider)

Asian shares waver, gold steadies (Business Insider)

Asian shares got off to a wobbly start on Tuesday, while gold prices steadied after plunging more than 4 percent to five-year lows in the previous session.

MSCI's broadest index of Asia-Pacific shares outside Japan <.MIAPJ0000PUS> opened flat, and was struggling to gain in early trade.

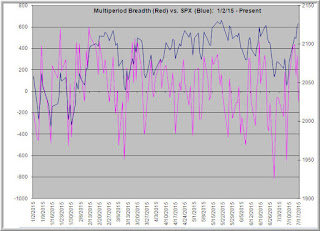

Broad Perspectives For A Summer Market Week (Trader Feed)

Above we see the daily average of 5, 20, and 100-day new highs versus new lows for all SPX stocks. (Raw data from the ever-helpful Index Indicators site). When this multiperiod breadth measure has been in its weakest quartile going back to 2014, the next five days in SPX have averaged a gain of +.64%. All other occasions have averaged a gain of only +.05%. Interestingly, when we look just two days out, the strongest breadth periods have led to an average gain of +.15% and the weakest periods have yielded an average gain of +.40%. All other occasions have averaged a two-day loss of -.02%.

Charting The Slow, 30-Year Death Of The US Middle Class In A Global Context (Zero Hedge)

When it comes to the favorable aspects of capitalism, one thing is clear: with the largest concentration of millionaires and billionaires from around the globe, the US is second to none when it comes to letting the entrepreneurial spirit flourish and rewarding it (and letting the rich get even richer).

Next S&P 500 Move Is 10% Rally to Morgan Stanley Citing Economy (Bloomberg)

Next S&P 500 Move Is 10% Rally to Morgan Stanley Citing Economy (Bloomberg)

The direction for stocks is still up after the Standard & Poor’s 500 Index topped its previous closing high, according to Morgan Stanley chief U.S. equity strategist Adam Parker.

The next 10 percent move in the U.S. equities market will be higher as low analyst earnings forecasts, a rising economy and muted investor sentiment paves the way for further gains, Parker wrote in a note to clients on Monday.

Shell expects oil's price recovery to take 5 years (Business Insider)

Shell expects oil's price recovery to take 5 years (Business Insider)

Ben van Beurden, the CEO of Royal Dutch Shell, and one of his senior executives envision low oil prices for some time unless energy producers cut production and the demand for fuel doesn’t rebound.

In a wide-ranging interview with Oil & Gas Technology published July 14, van Beurden spoke of competing benefits of the low price of oil for fuel demand, and its liabilities for those who produce it.

“Low prices have big implications for exporting countries like Iran, Russia and Venezuela,” he said.

JPMorgan: Greek Banks Aren't Out of the Woods Yet (Bloomberg)

Greek banks; reopened, revitalized and ready to recover.

Oil and Coal Indicate the Global Economy is in a Free Fall (Zero Hedge)

In the US, Coal has become a political hot button. Consequently it is very easy to forget just how important the commodity is to global energy demand. Coal accounts for 40% of global electrical generation. It might be the single most economically sensitive commodity on the planet.

There is a potential bombshell that is flying under the radar for most investors (Business Insider)

There is a potential bombshell that is flying under the radar for most investors (Business Insider)

One of the biggest changes for investors over the next few years is going to come from the IRS. And it’s a potential bombshell that is flying below the radar for most investors. That bombshell is a result of proposed changes to the Master Limited Partnership structure that the IRS is considering.

Master Limited Partnerships (MLPs) have surged in popularity over the last decade as more and more investors have begun to realize their tax advantages. While MLPs do have some complex tax rules, they also have the potential to generate significant tax savings. This might explain why the number of MLPs has more than doubled since 2005.

Oil Guru Who Called 2014 Slump Sees Return to $100 Crude by 2020 (Bloomberg)

Oil Guru Who Called 2014 Slump Sees Return to $100 Crude by 2020 (Bloomberg)

The oil guru who predicted last year’s rout said $100-a-barrel crude is likely to return within five years as faltering supply fails to meet demand.

Gary Ross, the founder of consultants PIRA Energy Group, said oil markets aren’t nearly as oversupplied as many believe and spare capacity is tight since Saudi Arabia is pumping all the crude it can without new drilling.

The Nasdaq is on an impressive winning streak we didn't even see during the tech bubble (Business Insider)

The Nasdaq is currently at a record high.

On Monday, the tech index closed at 5,218, higher than it ever did during the peak of the tech bubble back in 2000.

It's a Bull Market. Get Intelligent About Stock Market Investing (Bloomberg)

To go to cash is easy. Far harder is to buy equities. And ever harder is to stay in equities.

Goldman's complete outlook for markets and the economy in one big slide (GS) (Business Insider)

Even though the S&P 500 was up 3.6% last week, things aren't looking good for stocks this year.

The S&P return on equity dropped 0.35% to 15.5% in Q1, marking the third straight quarter of decline.

Obama has his next pick for the Fed (Business Insider)

Obama has his next pick for the Fed (Business Insider)

President Barack Obama has chosen University of Michigan economist Kathryn Dominguez to fill the final open seat on the Federal Reserve Board of Governors, adding an expert in international economics to the central bank's leadership team.

Dominguez, who is also a research associate at the National Bureau of Economic Research, has a background in foreign exchange rates, emerging markets, and international borrowing, the White House said.

Politics

Trump Lead Surges In Polls, Again (Zero Hedge)

Since last week's FOX News poll, Donald Trump has extended his gains dramatically in the race to be GOP Presidential nominee. According to ABC-Washington Post latest poll, 24% of Republicans prefer Trump (up from 18% last week) with Scott Walker nudging ahead of Jeb Bush. Notably the poll was taken from Thursday to Sunday and so does include some reaction from Trump's McCain comments…

Back the Iran deal, and say no to the warmongers (Market Watch)

The accord struck in Vienna to rein in Iran’s nuclear activities has warmongers fulminating. Citizens worldwide should support President Barack Obama’s brave effort to outmaneuver them, taking heart from the fact that the signatories include not just the United States, but all five permanent members of the U.N. Security Council plus Germany.

Many of the warmongers are to be found in Obama’s own government agencies. Most Americans struggle to recognize or understand their country’s permanent security state, in which elected politicians seem to run the show, but the CIA and the Pentagon often take the lead — a state that inherently gravitates toward military, rather than diplomatic, solutions to foreign-policy challenges.

Technology

Want MicroSD in Your Galaxy S6? Consider This Battery Boosting Case (Gizmodo)

Want MicroSD in Your Galaxy S6? Consider This Battery Boosting Case (Gizmodo)

We called the Galaxy S6 the best smartphone you can buy. Some would consider that a betrayal. After all, the S6 doesn’t have removable batteries or SD card slots anymore—it’s completely sealed. But you know what? There’s a new case that might solve at least one of those problems.

The $90 Incipio Offgrid not only includes a built-in 3700mAh battery that will (allegedly) double the runtime of your Galaxy S6 or Galaxy S6 Edge smartphone, it also has a microSD card reader that can add up to 128GB of additional space. Just slot in your favorite microSD card, flip a switch on the back, and Incipio claims it’ll expand the onboard storage of your device accordingly.

The first successful drone delivery in the US has taken place (Quartz)

The first successful drone delivery in the US has taken place (Quartz)

The first drone delivery approved by the Federal Aviation Administration went off without a hitch last week in Wise County, Virginia. Flirtey, an Australian drone-delivery startup, piloted a drone carrying medical supplies from an airfield to a medical clinic.

As the Wall Street Journal noted (paywall), the July 17 trip from the supplying pharmacy to the clinic is about 35 miles, over windy roads. Flirtey’s drone, like most commercial drones on the market, isn’t able to stay in the air for that sort of distance, and so the company worked with NASA, which flew the supplies to an airfield about a mile from the clinic. NASA’s plane was an experimental drone of its own—a modified Cirrus SR22 that can be controlled remotely.

Health and Life Sciences

Women will take HIV-prevention pills under the right circumstances, CDC study shows (The Verge)

Women will take HIV-prevention pills under the right circumstances, CDC study shows (The Verge)

Women in developing countries will take HIV-prevention drugs — as long as they know they're receiving them, and not a placebo, a new study suggests.

Previous research — in placebo-controlled trials — showed that the treatment didn’t work, mainly because participants didn’t take their pills. A recent study of 5,000 women in Zimbabwe, for instance, showed that fewer than 40 percent of the blood samples taken in the study contained detectable levels of the drug. As a result, some scientists speculatedthat false rumors about the drug's safety and lack of social support — combined with the possibility that the women had been assigned a placebo — may have discouraged the women from taking the drug. Many scientists hoped that this trend would change if women were guaranteed that the drug was the real thing.

New saliva test may catch Alzheimer's (CNN)

A test detecting Alzheimer's disease early may become easily available thanks to one plentiful bodily substance: saliva, a recently released study shows.

The saliva test was presented at the 2015 Alzheimer's Association International Conference in Washington this week. Though research is still in its infancy, the saliva test represents the exciting future of diagnostic tools in development for the detection of the neurodegenerative disease.

Life on the Home Planet

Manatee army and confused humans face off in tense showdown (Mashable)

Manatee army and confused humans face off in tense showdown (Mashable)

An update from the manatee revolt currently taking place in Florida: it appears that a group of high-ranking manatees made contact with local humans.

From this helicopter footage taken above Pompano Beach, it is clear that a sole manatee leader — perhaps a general or some kind of dignitary — is addressing a crowd of humans while its pack just kind of floats around beside it.

Arctic Sea Ice Rebounds, but Not Recovering (Scientific American)

Arctic Sea Ice Rebounds, but Not Recovering (Scientific American)

Over the last few decades, and particularly in recent years, the area of the Arctic Ocean covered by a skin of sea ice has steadily shrunk. But it’s not just this extent that matters—the volume of sea ice, which takes into account its thickness, is also important, but traditionally much more difficult to measure.

The 2010 launch of the European Space Agency’s CryoSat-2 satellite finally allowed scientists to take a wide-scale view of Arctic sea ice volume, and the first five years of data have yielded some surprises.

The record-breaking heat of June 2015 means this could be Earth’s warmest year in history (Quartz)

The record-breaking heat of June 2015 means this could be Earth’s warmest year in history (Quartz)

Temperatures across the globe last month were higher than any previous June since record-keeping began in 1880. Three meteorological agencies have concluded that June 2015 was the warmest June ever recorded, and that 2015 is on track to have the hottest average surface temperatures in history.

The earth’s average global surface temperature in June 2015 was 0.88 degrees Celsius higher than the 20th century average. That compares to June 2014, which was 0.6 degrees Celsius higher than the century’s average.