Financial Market and Economy

Chinese Stocks Tumble Despite Margin Debt Rises As Virtu Is Unleashed To Provide "Liquidity" After Citadel Ban (Zero Hedge)

No lesser liquidity-providing high-frequency-trading never-a-losing-trade shop than Virtu financial has been 'allowed' to trade Chinese capital markets. Coming just days after Citadel's ban, one can only assume that Chinese regulators made a deal with the devil CEO Doug Cifu to levitate markets at any and every cost in order to pick up pennies in front of de-leveraging, over-margined army of farmers and grandmas now seeking exits.

'Trying to time the market can be dangerous' (Business Insider)

Timing can be everything in the market, but it's not easy to do.

Investors commonly miss a rally or panic and sell too early.

Why billionaires are flocking to Puerto Rico (CNN)

Why billionaires are flocking to Puerto Rico (CNN)

Puerto Rico is in default, its economy is tanking and the government is rationing water.

But some billionaires love the island anyway.

Puerto Rico is trying to lure wealth from the mainland U.S. with generous tax exemptions or cuts on corporate taxes, personal income, capital gains and other sources of profit.

China Considers Plan to Bolster Toll Roads in Search for Growth (Bloomberg)

China Considers Plan to Bolster Toll Roads in Search for Growth (Bloomberg)

They helped China build the longest highway network in the world in three decades. Now, the country’s largely state-backed toll-road operators have run out of financial steam just as policy makers prepare to revive infrastructure spending and a slowing economy.

Enter the private investor, if President Xi Jinping’s latest drive works.

That 70's Show – epidode 1 (Bawerk)

In several articles we have shown how the world changed from the 1970s with the breakdown of the old Bretton-Woods system. For example, in China’s unfortunate dependence on the Eurodollar expansion we showed how economies like Japan and China boomed on the back of what appeared to be real demand for their products, but was nothing more than an un-backed expansion of the world reserve currency; which promptly collapsed when further ‘dollar’ expansion came to an abrupt halt, either as a result of political intervention (Plaza Accord) or because of too much capital consumption and subsequent financial crisis (Lehman).

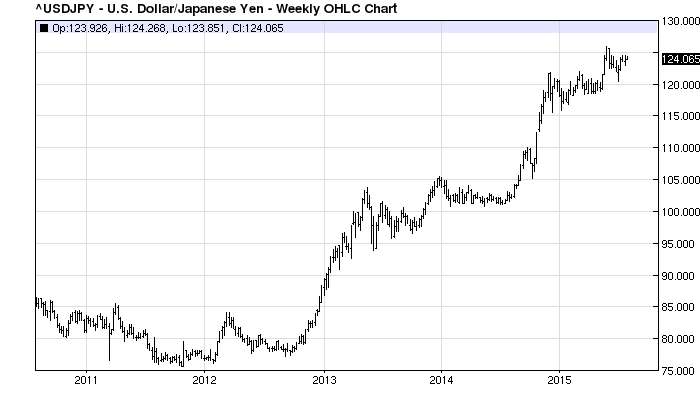

Dollar hits 2-month high vs. yen after ISM report (Market Watch)

Dollar hits 2-month high vs. yen after ISM report (Market Watch)

The dollar finished just below a two-month high against the yen Wednesday after a gauge of service-sector growth from the Institute for Supply Management rose to its highest level in 10 years.

The dollar USDJPY, -0.07% broke above ¥125 for the first time since early June, and finished the day at ¥124.83. It traded at ¥124.30 late Tuesday in New York. Meanwhile, the euro EURUSD, -0.0092% finished 0.1% higher at from $1.0905 late Tuesday in New York.

Ctrip's China Online Travel Clout Seen Growing With Tencent Deal (Bloomberg)

Ctrip.com International Ltd. is poised to strengthen its position as China’s largest travel website as it teams up with Tencent Holdings Ltd. to stave off competition, according to Morgan Stanley and Summit Research.

Cash-Strapped Saudi Arabia Hopes To Continue War Against Shale With Fed's Blessing (Market Watch)

Two weeks ago, Morgan Stanley made a decisively bearish call on oil, noting that if the forward curve was any indication, the recovery in prices will be "far worse than 1986" meaning "there would be little in analysable history that could be a guide to the cycle."

Bank of America is pulling cash from one of John Paulson's funds (Business Insider)

Bank of America is pulling cash from one of John Paulson's funds (Business Insider)

Bank of America's Merrill Lynch wealth management arm is pulling investor cash from one of hedge fund manager John Paulson's funds.

Merrill is liquidating client funds from Paulson & Company's Advantage fund.

The redemptions total $81 million, according to a person familiar with the matter. That is equivalent to around 4% of the fund's roughly $2 billion.

Treasury yields finish at 1-week high (Market Watch)

Treasury yields finish at their highest level in a week Wednesday, after a strong reading of activity in the services sector contributed to expectations the data-dependent Federal Reserve might be a step closer to an interest-rate increase.

9 Charts to Meditate On (Capitalist Exploits)

As headlines flickered across a Bloomberg news feed this morning, I was struck by the plethora of slanted views. If it was anymore slanted it'd be vertical. A mishmash of sound bytes sans fact. I was reminded of days spent imbibing on University economics. It's no wonder university students drink so much…

For Commodities, It's 2008 All Over Again (Zero Hedge)

18 of the 22 components in the Bloomberg Commodity Index have dropped at least 20%from recent closing highs, meeting the common definition of a bear market.

Bad-Luck Month of Brazils Mad Dog Menaces Rousseff Rule (Bloomberg)

Theres a sense of foreboding in Brasilia this month as politicians remember Augusts past, including the resignation of one president, the suicide of another and protests that led to Brazils first impeachment.

Brazil's economy is being blasted back in time (Business Insider)

Brazil's economy is being blasted back in time (Business Insider)

Economic indicators are flashing danger in Brazil.

Activity in the country's service sector is at its lowest level since the depths of the financial crisis, according to data from Markit Economics.

Meanwhile, economic activity is falling at almost 5% a year, according to research firm Reorient.

ADP report on job gains disappoints in July (Market Watch)

ADP report on job gains disappoints in July (Market Watch)

Private-sector hiring decelerated in June to the slowest pace in three months , according to a report released Wednesday.

Employers added 185,000 private-sector jobs in July — below the average pace for the past six months— and below the consensus estimate from economists of 220,000.

Wall Street Says Yellen Poised to End LongRun of Zero Rates (Bloomberg)

Traders have never been more convinced of a September rate hike by the Federal Reserve.

Crude oil crashes below $45 for the first time since March (Business Insider)

Crude oil is sliding again.

On Wednesday afternoon in New York, West Texas Intermediate crude futures fell nearly 2% to as low as $44.91 a barrel.

.png)

The Dow Curse Strikes Again: AAPL Tumbles, AT&T Jumps After Index Switch (Zero Hedge)

In the weeks before AAPL's adition to The Dow, the stock soared over 13% (for no good reason). In the almost 4 months since – after some sideways trading – AAPL shares have plunged. The announcement on March 6th, that AAPL would be included in The Dow on March 19th marked the end of exuberance and has now turned into a "no brainer" trade asthe curse of The Dow strikes again.

U.S. trade gap with Europe soars to record amid Greek crisis (Market Watch)

U.S. trade gap with Europe soars to record amid Greek crisis (Market Watch)

The United States in June posted a record trade deficit in goods with the European Union, a sign of the sharp divergence in fortunes between the two regions.

The overall U.S. trade deficit, which includes services, climbed 7.1% to a seasonally adjusted $43.8 billion in June, the government said Wednesday. The upturn largely reflected an all-time high in imports such as autos, drugs and commercial aircraft from Europe, whose goods are cheaper to buy because of a weakened currency.

If History Repeats, Gold Could Soon Get Very Boring (Bloomberg)

Gold has pretty much been in a $200 range, between $1,050 and $1,250, for the past two years.

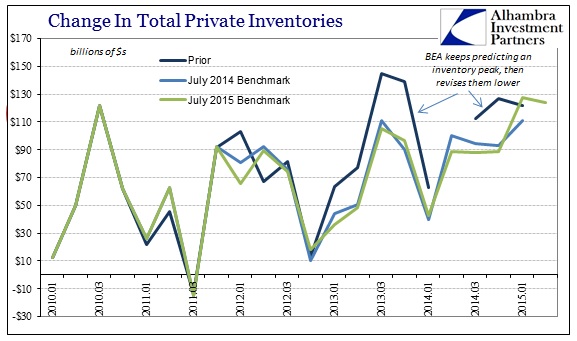

The Inventory Imbalance Might be the Worst Economic Factor for H2 (Alhambra Partners)

With factory orders continuing to be much worse than they appear, it makes sense to try to measure the effect of over-optimism accounted by inventory. Recessions themselves were once almost exclusively set up by this one factor, as the difference between production and sales, caught up within the supply chain, eventually works out toward alignment. Companies are willing to hold inventory for shorter periods of time as the sales environment is more volatile, but there comes a point when that patience finds a limitation and production suddenly and rapidly dwindles.

Mining stocks lifted the FTSE 100 today (Business Insider)

Shares in mining companies took a breather in their downward plunge today, helping the FTSE 100 to close up 0.98%.

Fast and furious: What happened in the U.S. Treasury market? (Market Watch)

High-frequency trading firms are recruiting traders and technologist with offers of well-paying jobs that come with daily catered lunches, in-chair massages and complementary entertainment tickets. If you have strong quantitative skills—and a very cool, casual wardrobe—and if you speak a foreign language, like Python, that’s a plus.

Politics

Obama presses case on Iran nuclear deal (Market Watch)

Obama presses case on Iran nuclear deal (Market Watch)

President Barack Obama delivered a detailed broadside to opponents of his crowning foreign-policy achievement, arguing Wednesday that the diplomatic agreement to restrict Iran’s nuclear program presents Congress with a fundamental choice between war and peace.

Obama, in a speech at American University where President John F. Kennedy made a case for confronting nuclear threats with diplomacy, said that whether lawmakers approve or reject the Iran deal next month will determine the future of America, which is still recovering from more than a decade of war in the Middle East.

Hillary Clinton's FBI Investigation Is A "Criminal Probe": Post (Zero Hedge)

Hillary Clinton's FBI Investigation Is A "Criminal Probe": Post (Zero Hedge)

Following the embarrassing Snafu two weeks ago, in which the NYT reported, then unreported, that Hillary Clinton had sent at least four emails from her personal accountcontaining classified information during her time heading the State Department and as a result both the DOJ and FBI had gotten involved (with lots of confusion over what is active and what is passive voice) many were confused: was or wasn't the DOJ or FBI involved, and if not, why not? After all, there was sufficient evidence of enough negligence to merit at least a fact-finding mission.

Technology

Tesla's Model X will launch in September (The Verge)

Tesla's Model X will launch in September (The Verge)

The Model X will indeed launch in September, Tesla confirmed today in its quarterly letter to shareholders. Deliveries to the crossover's first buyers will begin in late Q3, although Tesla expects only a "small number" will make it out during the quarter. "We are building more validation vehicles, executing final engineering and testing work, enabling our new manufacturing equipment and finalizing arrangements with our suppliers," CEO Elon Musk wrote in the letter. "We have been producing release candidate Model X bodies in our new body shop equipped with more than 500 robots as we fine-tune and validate our production processes."

Health and Life Sciences

Spicy foods may help you live longer (CNN)

Spicy foods may help you live longer (CNN)

Hot, hot, hot foods are the focus of new research released this week, which suggests eating fiery ingredients such as chili peppers may do more than burn your tongue. These foods may help you live longer.

“>"There is accumulating evidence from mostly experimental research to show the benefit of spices or their active components on human health," said Lu Qi, an associate professor at Harvard School of Public Health and co-author of the study which was published this week in the BMJ. But the evidence evaluating consumption of spicy foods and mortality from population studies was lacking, he said.

Cancer survival 'lagging in England' (BBC)

Cancer survival 'lagging in England' (BBC)

England's track record for cancer survival remains poorer than other countries with similar health systems, a study suggests.

Published in the British Journal of Cancer, the research compares England's survival trends with figures for five other countries over 15 years.

Life on the Home Planet

Typhoon Soudelor remains a formidable threat to Taiwan and China (Mashable)

Typhoon Soudelor remains a formidable threat to Taiwan and China (Mashable)

Typhoon Soudelor, which has weakened from its peak intensity, remains a formidable storm as it heads for Taiwan and then coastal China late this week. The storm had reached an incredible intensity on Monday night when its maximum sustained winds were estimated at 180 miles per hour, or about 155 knots, with gusts above 200 miles per hour, making it the strongest tropical cyclone on Earth so far in 2015

As of Wednesday at 4 p.m. ET, the storm was predicted to make landfall in central Taiwan as a Category 3 or 4 storm on Aug. 7, followed by a second landfall in China the following day.

I can watch the clouds do crazy magical things forever (Gizmodo)

I can watch the clouds do crazy magical things forever (Gizmodo)

Like, wow. Because so many of us are pummeled by light pollution and the daily grind of living in a city away from the clouds up in the sky, we rarely get to see it take the shape of different monsters and beings and creatures. Here’s a short video from Mike Olbinski called The Chase that reveals the clouds for what they are, magic that blankets the sky.