Financial Markets and Economy

When Wall Street Meets Cord Cutters, Investors Lose $60 Billion (Bloomberg)

Cord-cutting millennials who shun cable TV have long plagued the entertainment industry. Now theyre wreaking havoc on Wall Street.

U.S. companies may be hiring but lid on wages, investment hits productivity (Business Insider)

U.S. companies may be hiring but lid on wages, investment hits productivity (Business Insider)

As the Federal Reserve puzzles over what is holding back U.S. wages and productivity six years into the economic recovery, a pasta sauce company in New Jersey may offer some answers.

Chelten House Products makes private-label sauces and dressings for high-end grocers such as Whole Foods, Trader Joe's and Kroger, and has doubled its workforce to 300 over the past five years to keep up with a booming organic food market.

S&P rates the monarchs: Queen Elizabeth comes in first and last (Market Watch)

S&P rates the monarchs: Queen Elizabeth comes in first and last (Market Watch)

When it comes to their credit rating, not all monarchies are created equal.

Standard & Poor’s released data this week looking at the sovereign debt of the world’s, well, sovereigns.

It’s hardly a trivial issue since the world’s monarchies have issued about 40% of the trillions of dollars in national debt that S&P rates.

Traders Have Disappeared From the Gold Market (Bloomberg)

As gold continues to languish near its lowest price in five years, one element seems to be missing: traders.

As China Reduces Local Spending, Cities Woo Private Investors (NY Times)

The wide new boulevards that cut across parts of Weifang in eastern China are largely free of traffic, a quiet reminder of the coastal city’s big ambitions.

“It’s empty here, and I always come here to dry my wheat,” said a 77-year-old farmer surnamed Zhang who, along with his wife and son, was spreading grain on a sidewalk in one of the city’s newer districts on a recent summer day.

Oil Trading "God" Loses $500 Million In July On Commodity Rout (Zero Hedge)

Oil Trading "God" Loses $500 Million In July On Commodity Rout (Zero Hedge)

Back in December 2014, when crude oil first crashed into a bear market and traders were desperately looking under nook and cranny for the first casualty of the commodity collapse, they found it in the face of oil trading "god", Andy Hall, best known for seeking $100 million in compensation in 2008 from Phibro's then-owner Citigroup, who would leave his long-term employer Phibro by the end of 2014 for the simple reason that after 113 years of operation, Phibro would liquidate in the US, having been unable to find a buyer (with rumors circulating that Hall's trading P&L did not exactly help the company's long or short-term prospects).

America's biggest companies can't stop worrying about these 9 things (Business Insider)

There are lot of things to worry about right now: Greece, China, plunging oil — the list goes on.

But not all of those concerns weigh equally for major companies.

Treasury prices rise ahead of Friday’s jobs report (Market Watch)

Treasury prices finish higher Thursday, pushing yields down, as a selloff in U.S. equities led by steep declines in shares of media companies, sparked appetite for Treasury bonds, which are considered safe assets.

Navigate a Growing Company in a Crowded Market With These 5 Tips (Entrepreneur)

Developing new products for a market saturated by huge competitors with multi-million dollar marketing and research and development budgets can be a challenge for any startup, and intimidating enough to dissuade entrepreneurs from starting at all.

Jack Spencer and Alexander Boswell faced this challenge while co-founding their company, Mosevic. The U.K.-based business produces a unique style of sunglasses made entirely of denim — frames are made from layered denim bonded with resin. While the sunglass market is saturated, with big companies such as Ray Ban and Diesel, which are making competing denim sunglasses, Spencer and Boswell still entered it.

The Obama economy has problems (CNN)

The Obama economy has problems (CNN)

High on the Republican presidential candidates' list of talking points is the Obama economy. Specifically, bashing it.

They have some grist to work with.

Even though the economy is way ahead of where it was four years ago, Americans aren't happy. Half of the country flat out disapproves of how the president is handling the economy, according to recent Wall Street Journal/NBC poll.

3 Warnings For Market Bulls (Street Talk Live)

There is a very interesting podcast at Financial Sense with Richard Dickson, who is the Senior Market Strategist at Lowry Research. The reason that this particular interview is so interesting is that Lowry Research has been one of the primary supports for Jeff Saut's uber bullish view on the markets over the last couple of years.

Californians Get No Joy From Oil Rout Amid High Pump Prices (Bloomberg)

Anybody looking for drivers pleased by the recent plunge in oil prices would be hard pressed to find them in Los Angeles.

Analysts Give Up On "Man-Made" China Data: It's "A Fantasy" That "No One Believes" (Zero Hedge)

When China reported that its economy grew 7% in Q2 – spot-on Beijing’s target – virtually no one believed it.

Britain will not escape from the China and commodity death loop (Business Insider)

What happens in China doesn't necessarily stay in China. Britain's fortunes have been linked to the global economy for centuries and 2015 is no different.

What Angel Investors Value Most When Choosing What to Fund (HBR)

Despite all the media attention venture capital gets, it’s far from the most common source of startup funding. As Diane Mulcahy explained in a 2013 Harvard Business Review article: ”Angel investors — affluent individuals who invest smaller amounts of capital at an earlier stage than VCs do — fund more than 16 times as many companies as VCs do,” she wrote, “and their share is growing.”

OPEC leader Saudi Arabia is having to borrow money (CNN)

OPEC leader Saudi Arabia is having to borrow money (CNN)

Saudi Arabia is not as rich as you thought.

The oil kingdom is facing a big hole in its budget, caused by the slump in oil prices and a sharp rise in military spending. That's forcing the government to raid its reserves, and it may even borrow from foreign investors, analysts say.

Here’s what to watch in the July jobs report (Market Watch)

Another round of solid hiring gains in July won’t seal the deal for the Federal Reserve to raise interest rates next month, but a good number will get the oven preheating.

Market Manipulation 101 – Buy $5.5Bn of a Stock, Tell People You Did It (Phil's Stock World)

Desperately needing a win after getting crushed on his Herbalife (HLF) short battle with Carl Ichan, Ackman had a $1Bn shortfall to cover (allegedly) in his Pershing Square Fund so he bet it all on black with a $5.5Bn bet on Mondelez (MDLZ), which used to be Kraft, but no one is going to value Kraft at 33 times earnings but MONDELEZ sounds foreign and webby – so why not?

Credit Suisse Tears Up Some of the Biggest Consensus Trades in the Market (Bloomberg)

It’s difficult to beat the crowd if you’re part of it.

To this end, Credit Suisse’s global equity strategy team, led by Andrew Garthwaite, surveyed 265 investors to get a handle on what the consensus views are for eight key market topics.

The Huge Hidden Costs Of Our Fossil-Fueled Economy (Fast Company)

The Huge Hidden Costs Of Our Fossil-Fueled Economy (Fast Company)

Oil companies may be the most profitable companies on the planet. But that's only because we let them destroy the planet for free.

Extracting fossil fuels is a lucrative business. Last year, ExxonMobil made $32.5 billion in profits. But, arguably, it's a business built on shaky foundations. If we were to account for the full cost of fossil fuels to the environment, it might completely wipe out the industry's profitability.

Oil at multi-month lows; hunt for new bottom as gasoline piles up (Business Insider)

Oil at multi-month lows; hunt for new bottom as gasoline piles up (Business Insider)

Oil set multi-month lows on Thursday as investors and traders sought clues about the market's next bottom after a large drop in U.S. crude inventories failed to boost prices.

A bigger-than-expected build in U.S. gasoline stockpiles last week proved more important to investors than crude storage numbers that came in three times below forecast on Wednesday.

Media stocks clobbered as Netflix drives customers to dump cable (Market Watch)

Media stocks were getting hammered Thursday after earnings reports made clear there is subscriber exodus happening.

6 Months Of Ignorance – You Are Here (Zero Hedge)

In early 2007, market internals began to weaken dramatically. Talking heads and asset gatherers said fears were overblown, risk was contained, Fed has it under control, stay the course. Six months later, the equity markets began to collapse and then accelerated lower. Today, in an eery case of deja vu all over again, it has been six months now since US equity market internals began to decouple from the manipulated index levels that manufacture wealth and happiness across America… what would you do?

BOE Cancels November Rate Fireworks as Carney Inches Toward Hike (Bloomberg)

BOE Cancels November Rate Fireworks as Carney Inches Toward Hike (Bloomberg)

On Guy Fawkes Day, there will be no fireworks. At the Bank of England, that is.

With energy costs falling and the pound surging, Governor Mark Carney said inflation will stay “muted” and there may even be another period of price declines. The remarks, along with new forecasts, cut the chance of a rate increase this year. They also undermined any expectations for a move on Nov. 5, the date of the BOE’s next projections and the U.K. celebration that traditionally features bonfires and pyrotechnics.

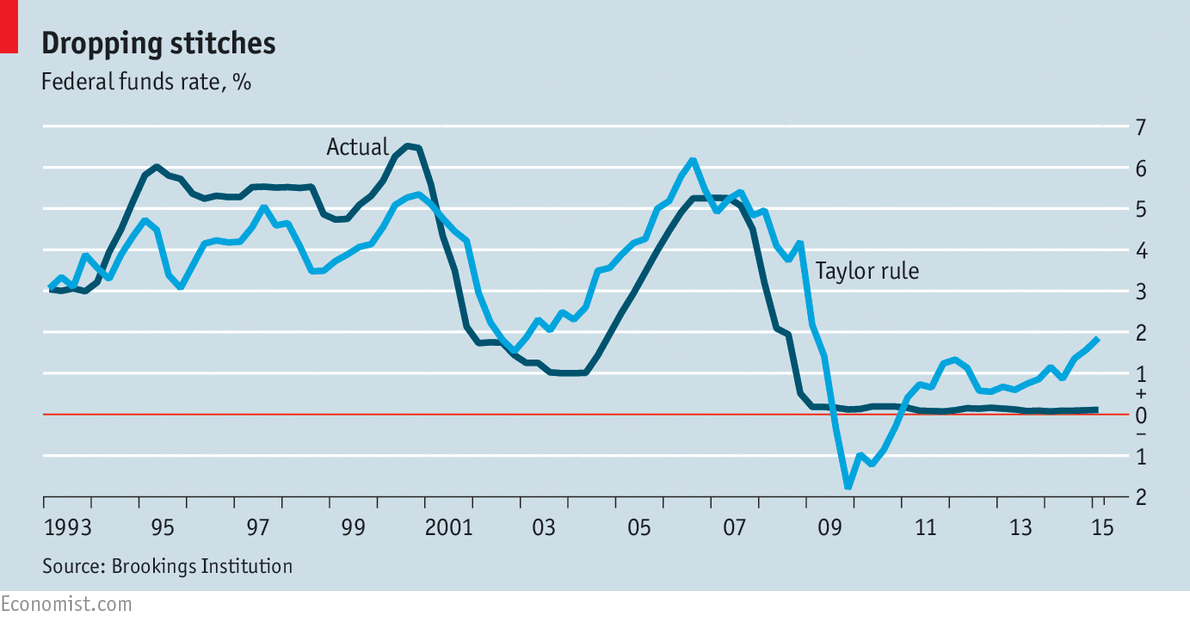

Rule it out (Economist)

SHOULD experts in the public service follow rules, or rely on their own judgment? The answer is crucial for many areas of public policy, including criminal sentencing, immigration and education. It is also of pivotal importance to monetary policy.

The UK is beating the US in the peer-to-peer alternative lending market — here's why (Business Insider)

The UK generated nearly $2.3 billion in peer-to-peer (P2P) loans in 2014, making its alternative lending market the largest in the world on a per capita basis. To illustrate,72% more lending volume is transacted in the UK than in the US per person.

Gold, metals enjoy mini rally as stocks sell off (Market Watch)

Gold, metals enjoy mini rally as stocks sell off (Market Watch)

Gold prices bounced higher Thursday ahead of a key employment report that is expected to set the tone for the battered precious metal.

The yellow metal gained ground as U.S. stocks registered sharp falls. Stocks tumbled as shares of Walt Disney Co. DIS, -1.79% and Viacom Inc. VIA, -13.35% led a media selloff amid fears of an exodus of pay-TV subscribers.

Credit Suisse Says Chinese Equities Have Returned to Fair Value (Bloomberg)

Chinese stocks have continued their steep decline, with the Shanghai Composite now down 29 percent from its June 12 high. This has prompted a number of measures from the government as it attempts to stem the rout, and also sparked many analysts’ attempts to figure out what comes next for this massive market.

Alexander Redman and Arun Sai at Credit Suisse are the latest to wade in.

The Nasdaq is getting slammed (Business Insider)

It's another red day for stocks and media stocks are taking most of the beating.

Near 12:15 pm ET, the Dow was off 138 points, the S&P 500 was down about 20 points, and the Nasdaq was off 93.

Crude oil settles below $45 as oversupply fears persist (Market Watch)

Crude oil settles below $45 as oversupply fears persist (Market Watch)

Crude-oil futures extended their slide Thursday as a persistent global supply glut, a strengthening dollar and concerns about China’s economy continued to throw a bearish pall over the market.

“Record production levels by several OPEC members and Russia, multi-decade high production levels in the U.S., the strong dollar, expectations of increasing Iranian exports, and indications of decreasing fuel demands in China have combined to erase 85% of the market’s spring rally and indications that the market’s slump could be prolonged continue to drag oil prices lower,” said Derek Salvino, vice president for market research at Tradition Energy in Stamford, Conn., in a note.

Currencies in Freefall Handcuff Bankers From Chile to Colombia (Bloomberg)

Central bankers in commodity-dependent Andes economies arent even considering interest-rate cuts to revive growth, even as prices for oil, copper and other raw materials collapse.

The FTSE went on a wild ride on 'Super Thursday' (Business Insider)

The FTSE was on a rollercoaster today, but ended back where it started.

The UK's share index closed down 0.08%, or 5.32 points to 6747.09, after an early fall was wiped out when the Bank of England's "Super Thursday" data dump went live at 12pm.

The Sweet, Sickly Stench Of QE 'Success' (TTMYGH)

Six years ago, hardly anybody outside financial circles had any idea what Quantitative Easing was – hell, many within financial circles had no idea what QE entailed.

Gold Crash Costs Russia and China $5.4 Billion in Just Three Weeks (Bloomberg)

Gold’s meltdown has cost Russia and China about $5.4 billion.

Friday's jobs report is critical — Here's what 11 top Wall Street economists are looking for (Business Insider)

Friday's jobs report is critical — Here's what 11 top Wall Street economists are looking for (Business Insider)

Friday's jobs report is huge.

The Fed has reiterated time and again that interest rate hikes will be done with a focus on economic data.

All reports ahead of the September meeting of the FOMC, when many analysts expect the first rate hike, will be closely watched.

Politics

Here's what Republican Presidential candidates want to do about Social Security (Business Insider)

Here's what Republican Presidential candidates want to do about Social Security (Business Insider)

The first Republican Presidential debate takes place Thursday evening. While the topics aren't revealed ahead of time, what to do about the Social Security will surely be discussed at some point during the election process. Candidates' opinions on the issue range from Jeb Bush calling for no changes for those currently receiving benefits to Rand Paul suggesting the full retirement age should be raised to 70 to Chris Christie saying benefits should be reduced if a retiree meets certain income thresholds.

This Economist's Computer Model Is Forecastinga Clinton Victory (Bloomberg)

This Economist's Computer Model Is Forecastinga Clinton Victory (Bloomberg)

Hillary Clinton will win the 2016 presidential election by the narrowest of margins — if a computer model put together by Moody's Analytics Inc. is to be believed.

The model, which uses economic and political data to predict the election's outcome on a state-by-state basis, has the Democratic Party's nominee for president garnering the minimum 270 electoral votes needed for victory to 268 for the Republican contender. While the model uses only generic candidates for each party in forecasting the future, Clinton is the favorite by far to be the Democrats' nominee.

Technology

Tesla's prehensile car charger plugs itself in automatically (Engadget)

Tesla's prehensile car charger plugs itself in automatically (Engadget)

Keep your flying cars and robot maids, we are already living in Elon Musk's future. Tesla officially unveiled its automatic charging system today and whaaaaa? When Musk first announced its development last December, he compared it to a "solid metal snake" and he was not lying. In the video below you can see the charger bend and flex like one of Doc Oc'sappendages as it pokes around the backside of a Model S before inserting a nozzle on its tip into the vehicle's charging port.

Thanks To This Device, Stealing Your Car Has Never Been Easier (Popular Science)

Thanks To This Device, Stealing Your Car Has Never Been Easier (Popular Science)

Samy Kamkar is a car buff. The cyber security expert enjoys tinkering, particularly in the intersection of automation and the Internet of Things. "I love the new technology that car companies are introducing," he says, "but I worry whether the manufacturers are actually paying attention to the security of these connected vehicles."

Health and Life Sciences

Scientists Turn Skin Cells into Brain Cells, Using Alzheimers Patients (Gizmodo)

Scientists Turn Skin Cells into Brain Cells, Using Alzheimers Patients (Gizmodo)

You are looking at freshly-made human neurons, or brain cells. But they used to be common skin cells. And their existence could change how we treat Alzheimers.

Using a special mix of small molecules, two groups of scientists in China have successfully turned human skin cells into neurons. They hope that their technique could one day help rejuvenate failing tissues in the brains of Alzheimers patients.

Life on the Home Planet

Nepal’s Quake May Have Primed the Area for Another Big One (Wired)

Nepal’s Quake May Have Primed the Area for Another Big One (Wired)

IN APRIL, A magnitude 7.8 earthquake struck Gorkha, Nepal. In Kathmandu, the capital, people fled into the streets as buildings buckled and collapsed. Historic architecture, hundreds of years old, crumbled. More than 8,000 people died.

Potentially even worse, though: According to a paper published in Nature Geoscience today, the Nepal earthquake may have made another Nepal quake even more likely.

Devil Tree Threatens the World's Rarest Zebras (Scientific American)

Devil Tree Threatens the World's Rarest Zebras (Scientific American)

The Devil is coming for Ethiopia’s zebras.

Only about 140 Grevy’s zebras (Equus grevyi) remain in Ethiopia, where they share the Allideghi Wildlife Reserve with thousands of humans and their livestock. It’s not an easy balance; the zebras—the rarest and largest equid species—face continual threats from poaching, habitat fragmentation and competition with livestock for food and water.