Financial Markets and Economy

Greek Stock Spectacle Means Less and Less to Europe Traders (Bloomberg)

Greek Stock Spectacle Means Less and Less to Europe Traders (Bloomberg)

The plunge in Greek equities that’s erased $10 billion in market value this week is stirring up little concern among European investors.

The nation’s equities have tumbled 15 percent since the Athens Stock Exchange reopened on Monday, with banks hovering near record lows. In contrast, the Stoxx Europe 600 Index rose 0.9 percent, buoyed by what JPMorgan Chase Co. said is the best earnings season in at least six years.

What Kind Of Investor Are You? The Market Doesn't Care! (Zero Hedge)

Our monthly look at asset price correlations finds it’s getting just a little bit easier to beat the U.S. stock market with savvy sector bets. OK, not by a lot: average correlations for the 10 sectors of the S&P 500 to the index itself are down to 79.9% versus the year’s typical reading of 80.7%. The best hunting grounds have been in Technology (84.9% correlation, down from +90% the last three months) and, surprisingly, Utilities (32.9% correlation, down from 47-77% in the last three months). Both have beaten the overall market over the last month as well.

Stock futures lower ahead of July jobs data (Business Insider)

Stock futures lower ahead of July jobs data (Business Insider)

Stock index futures were slightly lower on Friday ahead of the July payrolls report, a key data point that could feed into the U.S. Federal Reserve's decision on when to increase rates.

The number of U.S. jobs is expected to have risen by 223,00 in July, on par with June, providing further sign of an improving economy that could allow the Fed to raise interest rates in September. The data is expected at 8:30 a.m. ET.

Gold inches higher before jobs data, still down for week (Market Watch)

Gold inches higher before jobs data, still down for week (Market Watch)

Gold prices edged higher Friday, with traders largely staying on the sidelines ahead of the U.S. jobs report, as the dollar and U.S. stock futures also showed little change.

The yellow metal’s slight advance built on its gain during the prior session, but it’s still on track for a pullback for the week.

Commodities investors panicked and pulled £1 billion during the China stocks crash (Business Insider)

Commodities speculators panicked in June as the Chinese market rout took hold, and pulled the money they had just put in.

How To Invest in Trends To Escape Your Core and Grow Explosively – ikeGPS and Spike (Forbes)

How To Invest in Trends To Escape Your Core and Grow Explosively – ikeGPS and Spike (Forbes)

Would you like to triple revenue next year? And have plans to keep tripling it – or more – every year into the future?

Of course you would. But is your business capable of such explosive growth? Are you in growth markets, creating new products with new technologies that meet unmet needs and have the potential to completely change your business? Or are you stuck doing the same thing you’ve always done, a little better, faster and cheaper in hopes you can just maintain your position? And you dream of growth, but it’s largely a pipe dream.

Here’s the one question every Apple investor needs to ask now (Market Watch)

Apple is the one stock I know that everybody seems to own.

Friends. Acquaintances. People you meet in Starbucks. They get on their iPhones, their iPads and the MacBooks, and they check on what’s happening to their Apple AAPL, +0.22% stock.

One Third Of All Chinese 'Gamblers' Have Shut Their Equity Trading Accounts (Zero Hedge)

It turns out making money trading stocks is not "easier than farmwork" and, as China Daily reports, a stunning 24 million Chinese 'investors' have shuttered their trading accounts since the end of June. Unlike in the U.S., where institutions dominate stock trading, retail investors are king in China, owning around 80% of listed stocks’ tradable shares, according to investment bank CICC. With the number of small investors holding stocks in their accounts sliding to 51 million at the end of July from 75 million at the end of June, it appears some grandmas and farmers have learned their lesson (for now).

Rio Tinto Faces Iron-Ore Doldrums Amid Slump It Helped Along (Bloomberg)

Rio Tinto Group’s iron-ore earnings are being hammered by a collapse in prices it helped create.

Gold isn't a safe haven anymore (Business Insider)

Something strange is happening in the gold market. It used to be the first place investors rushed to in a crisis, but that's changing.

An analyst note from Barclays shows investors pulled money from financial derivatives based on the gold price, even as the Greek debt crisis reached its peak in June.

7 money moves to make before you turn 25 (CNN)

7 money moves to make before you turn 25 (CNN)

Even if math isn't your thing, it's important to figure out exactly what you're spending every month.

Add up all the money you have coming in — generally, that's your paycheck. Then subtract what you regularly spend. If you're not disciplined enough to write down all your purchases, ditch the cash for a month and use a debit or credit card to get an electronic record of all your spending. Just keep in mind: people tend to spend more when swiping plastic.

U.S. stock futures flat as traders don’t dare to move before jobs data (Market Watch)

U.S. stock futures flat as traders don’t dare to move before jobs data (Market Watch)

U.S. stock futures traded roughly flat Friday, showing muted action as traders waited for the July jobs report, this week’s most-anticipated economic release.

The stock market is on pace for a weekly drop, and Groupon, Cablevision and Hershey are likely to see active trading as investors take in their quarterly results.

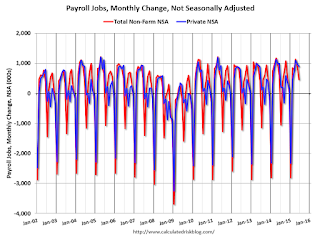

Payroll Employment and Seasonal Factors (Calculated Risk)

The seasonal adjustment for July is a little tricky, so this might be a good time to review the seasonal pattern for employment.

U.S. Economy Added 215,000 Jobs in July; Unemployment Still 5.3% (NY Times)

The Federal Reserve will be looking at the numbers as it assesses whether to raise interest rates in September.

German Industrial Production Drops as Chinese Slowdown Looms (Bloomberg)

German Industrial Production Drops as Chinese Slowdown Looms (Bloomberg)

German industrial production unexpectedly decreased in June, highlighting the risks for Europe’s largest economy from weaker growth in emerging-market countries such as China.

Output, adjusted for seasonal swings and inflation, fell 1.4 percent after rising a revised 0.2 percent in May, data from the Economy Ministry in Berlin showed on Friday. The typically volatile number compares with a median estimate of a 0.3 percent gain in a Bloomberg survey. Exports fell 1 percent while imports dropped 0.5 percent.

Dollar in limbo ahead of key jobs report (Market Watch)

Dollar in limbo ahead of key jobs report (Market Watch)

The dollar struggled for direction in Friday’s early hours, with traders treading water as they waited for the top-tier nonfarm payrolls report later in the day, which may strengthen or weaken the case for a September rate hike.

The report, along with the latest figures for wages and the unemployment rate, is due at 8:30 a.m. Eastern Time. Analysts polled by MarketWatch expect 220,000 new jobs to have been added to the economy in July, slightly below June’s 223,000 print.

The Katy Perry Economy: Japan Is Hot and Then Cold (Bloomberg)

Japan, like Katy Perry's Hot N Cold hit song, just can't get off this ride. Because of the roller coaster effect from a sales-tax boost, it saw growth and then contraction in 2014. Now it looks like it'll happen again.

Stocks Are Tanking – Dow Hits 6-Month Lows (Zero Hedge)

The Dow is now down for the 6th day in a row (and 11 of last 13 days) as it tests 17,400 – its lowest level since January. With The S&P and Small Caps tumbling towards red year-to-date, Nasdaq remains 2015's big winner but is falling precipitously today…

Made in North Korea: goods store opens to brisk business in Seoul (Business Insider)

Made in North Korea: goods store opens to brisk business in Seoul (Business Insider)

A shop in South Korea's capital specializing in goods made in the North has run nearly $140,000 through its tills in just three months of business, helping dispel the notion that products from the impoverished state are shoddy and undesirable.

The Kaesong Industrial Complex Shop opened in May showcasing North Korea and the skills of its workers, to present the country as a viable business partner to the prosperous South.

Australian stocks fall steeply as China shares nudge up (Market Watch)

Australian stocks fall steeply as China shares nudge up (Market Watch)

China’s shares gained, while falling bank shares led to steep losses in Australian stocks Friday.

The S&P ASX 200 XJO, -2.41% fell 2.4%, and South Korea’s Kospi SEU, -0.15% lost 0.2%.

In China, investors are weighing the prospects of consistent government support for the market against worries that traders might withdraw to subscribe for new shares. That follows reports Thursday that China’s stock regulator might start approving firms’ share-placement applications as early as this Friday.

The Irresistible China Trade That Keeps Burning Investors (Bloomberg)

The Irresistible China Trade That Keeps Burning Investors (Bloomberg)

It looked like a no-brainer for buyers of Chinese shares in Hong Kong.

Valuations in April were 25 percent cheaper than in the mainland, monetary stimulus was just getting started and money was pouring in through Hong Kong’s new exchange link with Shanghai. Bulls snapped up funds tracking so-called H shares at a record pace, while analysts at some of the world’s biggest banks predicted big gains to come.

Hedge Fund Losses From Commodity Slump Sparking Investor Exodus (Bloomberg)

Hedge Fund Losses From Commodity Slump Sparking Investor Exodus (Bloomberg)

When even Cargill Inc., the world’s largest grain trader, decides to liquidate its own hedge fund, that’s a sign that commodity speculators are in trouble.

Hedge funds focused on raw materials lost money on average in the first half, the Newedge Commodity Trading Index shows. Diminishing investor demand spurred Cargill's Black River Asset Management unit to shut its commodities fund last month. Others enduring redemptions include Armajaro Asset Management LLP, which closed one of its funds, Carlyle Group LP's Vermillion Asset Management and Krom River Trading AG.

The Bank of England wants the upcoming interest rate hike to be a surprise (Business Insider)

The Bank of England wants the upcoming interest rate hike to be a surprise (Business Insider)

The Bank of England has kept interest rates at a record low of 0.5% since March 2009 and markets are on tenterhooks about when they will be hiked.

But it looks like it is going to be a big surprise when the central bank finally increases interest rates as the BoE's deputy governor Ben Broadbent just revealed that it will not pre-announce a date for a rise.

Oil gains, but still on pace for hefty weekly drop (Market Watch)

Oil gains, but still on pace for hefty weekly drop (Market Watch)

Oil prices nudged higher Friday, though the near-term outlook remains bearish and crude is on track for a weekly loss of more than 4%.

Traders are awaiting U.S. non-farm payrolls data later in the day, which could signal firmer near-term demand. That would help trading sentiment as a supply overhang has been the biggest price driver over the past few months.

Malaysia Reserves Slide Below $100 Billion Amid Ringgits Plunge (Bloomberg)

Malaysias foreign-exchange reserves dropped below $100 billion for the first time since 2010 after the ringgit slid 18 percent in the past 12 months.

The 'God' of oil trading is getting crushed by the commodities slump (Business Insider)

The 'God' of oil trading is getting crushed by the commodities slump (Business Insider)

A commodities hedge fund run by star trader Andy Hall is getting hammered by the recent collapse in oil prices.

Hall's Astenbeck Capital Management fund lost about 17% in July, Reuters reports, citing an investor letter.

That is the second-largest loss the fund has ever experienced. Its assets under management are now about $2.8 billion, down about $500 million since June, according to Reuters.

Action Hero Seagal Seeks New Role as Diamond Investor in Siberia (Bloomberg)

Action Hero Seagal Seeks New Role as Diamond Investor in Siberia (Bloomberg)

Steven Seagal, the action movie star, film director, martial artist, musician, sometime police officer and friend of Vladimir Putin, is adding diamond investor to his bow.

The actor known for bone-crushing roles in films such as Under Siege, Hard to Kill and The Glimmer Man is on a business trip in Siberia, visiting the operations of Alrosa PJSC, the world’s largest diamond miner, the company said by e-mail on Thursday. Seagal has been interested in investing in Russian diamonds for a long time, Alrosa said, without elaborating.

Politics

Asean Is Seriously Concerned About South China Sea Reclamation (Bloomberg)

Asean Is Seriously Concerned About South China Sea Reclamation (Bloomberg)

Southeast Asian foreign ministers warned that rival territorial claims in the South China Sea risk upsetting regional stability as China defended its land reclamation there and said it had shown great restraint.

Foreign ministers of the 10-member Association of Southeast Asian nations struggled to reach consensus on the South China Sea dispute in the final communique, releasing the statement last night hours after the end of a three-day meeting in Kuala Lumpur. China’s building of artificial islands and runways in the area has prompted protests from other claimant states and drawn fire from the U.S.

Republican candidates hold raucous debate (Market Watch)

Republican candidates hold raucous debate (Market Watch)

Donald Trump kicked off the first Republican presidential debate by refusing to promise not to run against the eventual party nominee if he doesn’t clinch the nomination, an unpopular stance with GOP voters that could threaten his perch atop the primary field.

His strident objection to pledging to endorse the eventual nominee—which was met with boos from the audience and an immediate rebuttal from Kentucky Sen. Rand Paul—set the stage for a rollicking debate in Cleveland on Thursday night that illustrated the carnival atmosphere Trump has brought to the race.

Technology

Researchers program robot to run from kid bullies (Engadget)

Researchers program robot to run from kid bullies (Engadget)

What happens when you leave a robot with packs of unsupervised kids? Researchers from the ATR Intelligent Robotics and Communication Laboratories, Osaka University, Ryukoku University and Tokai University in Japan have decided to find out — and the answer isn't pretty. They unleashed a Robovie 2 at a shopping complex in Osaka as an experiment and caught groups of

Satan's hellspawnsmischievous little angels kicking, hitting and even verbally abusing the robot. The machine was programmed to politely ask humans to step aside if they're in the way, but kids refused to move and blocked it on purpose in many instances. That's why the researchers' next move was to develop an "abuse-evading algorithm."

Thermos' New Smart Bottle Tells You When Your Water's Warm and Gross (Gizmodo)

Thermos' New Smart Bottle Tells You When Your Water's Warm and Gross (Gizmodo)

There’s no shortage of smart water bottles on crowdfunding sites like Kickstarter and Indiegogo. But when a brand like Thermos enters the game with a new smart lid for its bottles that tracks hydration and even monitors the temperature of your water, you better pay attention.

Thermos’ expertise is safely storing and preserving foods and liquids, not the technology needed to realize a smart bottle. So for its new Smart Lid Hydration Bottle it teamed up with a company called EXOS to develop a connected iOS app that helps athletes, and the rest of us, ensure we’re all staying properly hydrated.

Health and Life Sciences

New York City Outbreak: What Is Legionnaire's Disease? (Scientific American)

New York City Outbreak: What Is Legionnaire's Disease? (Scientific American)

At least seven people in New York City have died and 86 have been infected in an outbreak of Legionnaires' disease. The illness can cause high fevers and pneumonia.

But despite the current outbreak, most people in the region aren't at any increased risk of getting Legionnaires'. The disease is not communicable between people, and only those with weakened immune systems or other health impairments tend to fall ill. In addition, most people who do get Legionnaires' can be treated with antibiotics.

Is picky eating a ‘red flag’ for depression? (Futurity)

Is picky eating a ‘red flag’ for depression? (Futurity)

Picky eating among children is a common but burdensome problem that can result in poor nutrition for kids, as well as family conflict and frustrated parents.

Although families see picky eating as a phase, a new study suggests moderate and severe picky eating often coincides with serious childhood issues such as depression and anxiety that may need intervention.

Life on the Home Planet

Coasts 'final frontier' for study (BBC)

Coasts 'final frontier' for study (BBC)

Archaeologists want to enlist the help of the public as they attempt to tackle what they describe as the "final frontier": England's coastline.

They hope to establish a network of volunteers around the nation to survey and monitor stretches of the shore.

Thousands of sites are being lost to the sea before they have been recorded by experts, they observed.

High-altitude climate change to kill cloud forest plants (Phys)

High-altitude climate change to kill cloud forest plants (Phys)

Australian scientists have discovered many tropical, mountaintop plants won't survive global warming, even under the best-case climate scenario.

James Cook University and Australian Tropical Herbarium researchers say their climate change modelling of mountaintop plants in the tropics has produced an "alarming" finding.