Financial Markets and Economy

U.S. stock futures climb; Dow on track to break 7-session losing run (Market Watch)

U.S. stock futures climb; Dow on track to break 7-session losing run (Market Watch)

Wall Street was set for a slightly upbeat day on Monday, with stock futures inching higher in the early hours as some investors feel more confident of a September rate hike from the Federal Reserve.

Futures for the Dow Jones Industrial Average YMU5, +0.22% rose 24 points, or 0.1% to 17,345, indicating the blue-chip index will rise for the first time in eight sessions. The Dow average DJIA, -0.27% on Friday logged a seven-session losing run, its worst streak of declines since 2011’s debt-ceiling crisis. The Dow is down 2.5% year-to-date, underperforming the other major benchmarks.

S&P 500 Flouts History in Break With Bonds That Often Ends Badly (Bloomberg)

S&P 500 Flouts History in Break With Bonds That Often Ends Badly (Bloomberg)

As far as credit markets are concerned, U.S. stock investors have lost touch with reality.

That’s seen in the extra yield bond investors demand over Treasuries. The spread has expanded by 0.48 percentage point from a year ago, the most since 2012, even as the Standard & Poor’s 500 Index rallied.

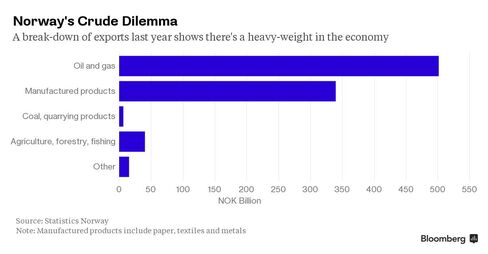

For Norway, Oil at $50 Is Worse Than the Global Financial Crisis (Bloomberg)

When the financial crisis brought the global economy to its knees, Norway was largely unscathed. But oil under $50? That's another story.

China's imports are plunging (Business Insider)

The data coming out of China at the moment make for scary reading.

Import growth fell to -8.1% in July and thef igures show that imports are approaching record lows not seen since the global financial crisis in 2008. Growth was down -6.1% year on year in June, slightly worse than the market consensus of -8.0%.

Gold flat, manages to ‘defy’ the latest solid jobs report (Market Watch)

Gold flat, manages to ‘defy’ the latest solid jobs report (Market Watch)

Gold prices on Monday showed a little resilience, trading roughly flat even as analysts suggested that the yellow metal should be under pressure after last week’s solid jobs report.

Gold futures for December delivery GCZ5, -0.05% were last up 70 cents, or less than 0.1%, to $1,094.80 an ounce, while September silver SIU5, +0.36% tacked on 8 cents, or 0.5%, to $14.90 an ounce.

Oil Trades Near Five-Month Low as U.S. Drillers Deploy More Rigs (Bloomberg)

Oil Trades Near Five-Month Low as U.S. Drillers Deploy More Rigs (Bloomberg)

Oil traded near the lowest level in almost five months in New York as a rebound in U.S. drilling signaled production is withstanding the slump in prices.

West Texas Intermediate futures fell 0.2 percent, paring an earlier drop to the lowest price since March 20. The number of rigs seeking oil rose by 6 to 670 for a third weekly gain, Baker Hughes Inc. data show. Societe Generale SA and JPMorgan Chase & Co. cut their price forecasts on weaker demand growth and oversupply.

Back to the future: Nokia prepares for mobile comeback (Business Insider)

Back to the future: Nokia prepares for mobile comeback (Business Insider)

Nokia is hiring software experts, testing new products and seeking sales partners as it plots its return to the mobile phone and consumer tech arena it abandoned with the sale of its handset business.

Once the world's biggest maker of mobile phones, the Finnish firm was wrongfooted by the rise of smartphones and eclipsed by Apple <AAPL.O> and Samsung <005930.KS>. It sold its handset business to Microsoft <MSFT.O> in late 2013 and has since focused squarely on making telecoms network equipment.

Some Ukraine Bondholders In No Rush for Accord as Payday Nears (Bloomberg)

Not everyone is hoping for a speedy resolution to Ukraines debt restructuring.

A golden goose for investment bankers has stopped laying eggs (Business Insider)

A golden goose for investment bankers has stopped laying eggs (Business Insider)

Private-equity firms are doing fewer deals and that spells bad news for investment banks.

Fees paid by the funds have historically made up a big chunk of investment-banking revenue. At this point last year they accounted for nearly one-quarter of the total.

But there's been a sharp drop-off this year as a combination of overstretched stock markets and tightening regulations dampen activity. Revenues from private-equity firms are down by one-third in 2015, according to data provider Dealogic.

Dormant Saudi Bond Market Stirs as Oil Kingdom Seeks $27 Billion (Bloomberg)

Dormant Saudi Bond Market Stirs as Oil Kingdom Seeks $27 Billion (Bloomberg)

After an eight-year interlude, Saudi Arabia’s government bond sales are coming alive.

The desert kingdom that’s home to both the world’s second-biggest oil reserves and Islam’s holiest sites plans to auction as much as 20 billion riyals ($5.3 billion) on Monday as part of a program to raise a maximum of 100 billion riyals by the end of the year, two people familiar with the matter said last week. The government confirmed last month it already sold 15 billion riyals of bonds in a direct sale to private investors.

Investors Find Ways to Indirectly Profit From Valuable Start-Ups (NY Times)

Investors Find Ways to Indirectly Profit From Valuable Start-Ups (NY Times)

Airbnb’s valuation has ballooned over the last few years as large financial firms like Fidelity Investments and T. Rowe Price have rushed to invest in the start-up. But a small San Francisco-based hedge fund called Pier 88 Investment Partners has decided that the fervor for Airbnb shares creates a different kind of opportunity.

While other investors paid dearly to buy a piece of Airbnb — the start-up’s latest funding round valued it at $24 billion — Pier 88 did not invest directly in the privately held online home-rental company. Instead, Pier 88 put money into HomeAway, a publicly traded Internet company that competes with Airbnb, but has a market capitalization of just $2.95 billion.

Criminals are manipulating the stock market and regulators can't seem to stop it (Business Insider)

Criminals are manipulating the stock market and regulators can't seem to stop it (Business Insider)

On May 14 a Bulgarian stock schemer is alleged to have moved the share price of consumer company Avon Products by making a false filing to the Securities and Exchange Commission.

Three months later, nothing is stopping someone else from doing the very same thing.

The Securities and Exchange Commission says it's not making changes to its Edgar filing system.

Chinese stocks score biggest one-day gain in a month (Market Watch)

Chinese stocks score biggest one-day gain in a month (Market Watch)

Stocks in China on Monday posted their biggest one-day gain in a month on expectations Beijing will maintain its market support by buying shares.

The Shanghai Composite Index SHCOMP, +4.92% finished 4.9% higher at 3,928.42, while the smaller Shenzhen Composite 399106, +4.49% was up 4.5% to 2,274.84.

Tension Runs High in VIX as Stock Insurance Costs Most Since 06 (Bloomberg)

Tension Runs High in VIX as Stock Insurance Costs Most Since 06 (Bloomberg)

Speculators’ appetite for protection from stock-market tempests has reached the highest in nine years.

Options predicting a rise in the Chicago Board Options Exchange Volatility Index are the most expensive since 2006 relative to those betting on a drop. With gains narrowing, investors are hedging through calls on the VIX, which usually rises as the Standard & Poor’s 500 Index falls.

Verizon Gets Rid Of Contracts, Cheap Phones (For New Customers Only, Of Course) (Consumerist)

Verizon Gets Rid Of Contracts, Cheap Phones (For New Customers Only, Of Course) (Consumerist)

T-Mobile may have a fraction of the customer base of industry-leader Verizon Wireless, but the little magenta company’s decision to do away with contracts continues to influence its bigger competition. Today, Verizon announced that new customers will no longer have to sign up for contracts, which also means they will have to start paying full price for their phones.

Starting Aug. 13, Verizon is simplifying its wireless data plans for new customers. The company is now just charging for the size of the data plan, plus a monthly fee per device ($20/phone; $10/tablet or Jetpack hotspot), plus whatever your monthly payment is on your phone.

Malaysian Stocks Set for Correction as Scandal Spurs Outflows (Bloomberg)

Malaysian stocks fell, with the benchmark gauge poised to enter a technical correction, as investors pulled funds amid concern about the political scandal enveloping Prime Minister Najib Razak and the worsening economic outlook.

China tech firms pouring billions into India (CNN)

China tech firms pouring billions into India (CNN)

Two major tech firms that now make most of their products in China have pledged to dramatically expand their operations in India.

The developments are a sign that Prime Minister Narendra Modi's "Make in India" campaign is starting to pay off.

China's Slumping Car Sales Push Bitauto to Eighth Weekly Decline (Bloomberg)

Bitauto Holdings Ltd. fell for an eighth straight week, the longest slump on record,amid deepening concern that a slowdown in Chinese auto sales is eroding the car-listing website operators revenue growth.

Oil prices fall, weighed by weak Chinese data (Market Watch)

Oil prices fall, weighed by weak Chinese data (Market Watch)

Oil prices dropped early Monday, hurt by soft Chinese economic data that came out over the weekend.

Crude futures for September delivery CLU5, +0.05% were last down 13 cents, or 0.3%, to $43.74 a barrel. Oil added to its losses from last week, when it fell 6.9% to its lowest settlement level since March.

Sign of the Bear: The Demise Conspicious Consumption (Acting-Man)

A friend recently mailed us an article from the Hong Kong Standard which describes how extremely high retail shop rents in Hong Kong can no longer be paid even by retailers of luxury brands.

Politics

How voter demographics have changed in the last 30 years (Business Insider)

The voting demographics in the United States have changed noticeably over the last 30 years.

As you can see in these charts from a recent Wells Fargo note, back in 1984 — which saw Ronald Reagan's re-election — 87% of the registered voters were white, 10% were black, and 3% were Hispanic.

Hillary Clinton is a ‘Buffett conservative’ when it comes to investing (Market Watch)

Hillary Clinton is a ‘Buffett conservative’ when it comes to investing (Market Watch)

Hillary Clinton has the mutual-fund portfolio of a politician.

It also happens to be close to the portfolio legendary investor Warren Buffett has suggested for his wife.

That doesn’t mean that Clinton is fit to lead the country any more than is Donald Trump, who has the investment portfolio of a businessman and long-time investor. But after I analyzed Trump’s portfolio two weeks ago, I was swamped by notes from both sides wondering why I had not put the leading Democratic candidate’s fund portfolio to the same scrutiny.

Will Trump Save America and the World By Doing A Deal With Putin? (Sputnik)

Will Trump Save America and the World By Doing A Deal With Putin? (Sputnik)

Washington hawks want regime change in Russia, no more and no less. Their hatred of Putin, who has the guts to have his own opinion of world affairs, and who stands firm for his country’s right to look after its security interests, makes him the ultimate evil.

For the past few weeks we have heard plenty of statements from Washington about the huge threat to U.S. National Security coming from Russia. Secretary of Defense Ashton Carter and top Pentagon brass are convinced — or say they are — that the Russian threat is an absolute reality. The latest in this row is the statement by the Head of the US Special Operations Command General Joseph Votel, who also views Russia as an "existential threat" to the United States, repeating accusations against Moscow over the Ukrainian crisis.

Technology

The Newest User Interface? Rhythm (Fast Company)

The Newest User Interface? Rhythm (Fast Company)

Forget sight and sound. Haptics are an increasingly sophisticated way for wearable devices to communicate information.

Haptics are tactile sensations that convey information. The vibration of your silenced cellphone, the rumble control on your gaming joystick, and the nudge from your Apple watch's Taptic Engine: These are means to communicate, without using words. You have a message. You blew something up. Time to go to your meeting.

Health and Life Sciences

Health Secrets Of The World's Oldest People (Forbes)

Health Secrets Of The World's Oldest People (Forbes)

Doctors say that healthy habits will help get you to age 85, but how to live beyond that remains a medical mystery. We interviewed people in their 100s to find out how they did it.

The largest concentration of healthy 100-year-olds is in Okinawa, Japan. The people there eat a diet high in grains, vegetables and fish, and low in eggs, meat and dairy. In the U.S., Daisy McFadden, who will turn 101 in November, follows suit. She regularly eats oatmeal and fruit for breakfast, a salad with chicken or fish for lunch, and steamed vegetables and lean meat for dinner.

Stem cells help researchers study the effects of pollution on human health (Science Daily)

Embryonic stem cells could serve as a model to evaluate the physiological effects of environmental pollutants efficiently and cost-effectively. The use of stem cells has found another facade. In the world we live in today, people are constantly exposed to artificial substances created by various industrial processes. Many of these materials, when exposed to humans, can cause acute or chronic diseases. As a consequence, validated toxicity tests to address the potential hazardousness of these pollutants have become an urgent need.

Life on the Home Planet

The Canaries Continue To Drop Like Flies (Mark St. Cyr)

The Canaries Continue To Drop Like Flies (Mark St. Cyr)

One would think as “canary” after “canary” falls silent either sickened with laryngitis, or worse – completely comatose, that those on Wall Street as well as the financial media itself would not only have seen, but heard, many of the warning calls that have been obvious for quite some time. Yet, history always shows; not only do they not see, but more often than not – they don’t want to see, nor hear the warning calls.

Even when all the warning signs are screaming danger – not only are they ignored, they’re explained away as if those which saw or heard them, should be ignored as they’ll contend not only did one not see; but couldn’t see.

Awesome footage of rare white whale off the coast of Australia (Mashable)

Awesome footage of rare white whale off the coast of Australia (Mashable)

A rare white humpback whale has been spotted off the coast of Queensland on Monday, and whale watchers are hoping it is Australia's famous whale Migaloo

Migaloo, a name giving by Aboriginal Elders that means "white fella," is one member of a rare group of white whales that have been spotted swimming in Australian waters.