Financial Markets and Economy

What Does China's Devaluation Mean? (Bloomberg)

China's devaluation of the yuan Tuesday surprised global markets and left analysts wondering what it might mean. Leaders in Beijing are probably asking themselves the same thing.

China's monetary authorities cut the currency's value against the dollar by 1.9 percent, the biggest move in years. Was this a liberalization of the country's system for managing the yuan, a step to stimulate China's flagging economy, or the beginning of a currency war? Mostly, it was a combination of the first two — but the question now is how authorities will strike this balance between pro-market reform and pro-export stimulus.

Greek bank stocks are soaring (Business Insider)

Greek shares have soared on the news that a potential third bailout for Greece has been broadly agreed.

Viacom CEO Dauman Loses $3.4 Billion Betting on His Own Company (Bloomberg)

Viacom CEO Dauman Loses $3.4 Billion Betting on His Own Company (Bloomberg)

Add a stock repurchase program that now looks like a dud to the woes of Viacom Inc. Chief Executive Officer Philippe Dauman.

Viacom spent $15.2 billion buying back shares over the past five years, at an average price of $60.62 each, according to data compiled by Bloomberg. The stock closed at $47.02 Monday, meaning the company, controlled by 92-year-old Sumner Redstone and led by Dauman, has lost $3.4 billion investing in itself.

Gold prices reverse losses, spurred by China’s yuan devaluation (Market Watch)

Gold prices reverse losses, spurred by China’s yuan devaluation (Market Watch)

Gold prices turned higher Tuesday, reversing a drop that came after the surprise decision by China to devalue its currency.

Gold GCZ5, +0.81% rose $9, or 0.8%, to $1,112.60 an ounce. Prices earlier had slipped below the threshold of $1,100 an ounce after The People’s Bank of China overnight allowed the yuan USDCNY, +1.8244% to devalue by 1.9%, in an effort to boost flagging exports, spur growth in the world’s second-largest economy and allow the currency to be driven more by market forces. Prices of the yellow metal had climbed briefly the previous day, helped by a weaker dollar.

Here's what analysts are saying about Google's huge re-organization announcement (Business Insider)

Here's what analysts are saying about Google's huge re-organization announcement (Business Insider)

Google announced a major re-organization on Monday that will see the creation of a new parent company called Alphabet.

Larry Page will lead Alphabet, while former Chrome and Android head Sundar Pichai will become the CEO of Google, now a subsidiary of the bigger company Alphabet. Sergey Brin will serve as Alphabet's president.

Won Slide Limits Bank of Korea Rate-Cut Options on Outflow Risk (Bloomberg)

The risk of exacerbating capital outflows and the wons slide to a three-year low isnt giving the Bank of Korea much room to maneuver as its seeks to revive growth.

U.S. stock futures skid after China shakes forex market (Market Watch)

U.S. stock futures skid after China shakes forex market (Market Watch)

U.S. stocks were poised on Tuesday for a pullback after the previous session’s sharp rally, with futures tilting lower as investors digest a surprise devaluation in the yuan and how it may impact the timing of the first Federal Reserve rate hike.

Futures for the Dow Jones Industrial Average YMU5, -0.66% lost 77 points, or 0.4%, to 17,476, while those for the S&P 500 index ESU5, -0.60% slumped 9.05 points, or 0.4%, to 2,090.75.

Oil companies are giving dividends 'far in excess of historical norms' — and it's totally fine (Business Insider)

Oil companies are giving dividends 'far in excess of historical norms' — and it's totally fine (Business Insider)

Investors in the world's largest oil companies are worrying that the energy groups will run into trouble when it comes to paying out dividends.

This is because they believe that the combination of a low oil price, operating cost reductions, and the issuance of scrip dividends — additional stocks given to shareholders in proportion to their current amount held — would make bigger payouts unsustainable.

Dorsey Twitter Purchase Pales in Comparison With His Stock Sales (Bloomberg)

Dorsey Twitter Purchase Pales in Comparison With His Stock Sales (Bloomberg)

Twitter Inc.’s stock rose on Monday, buoyed by a tweet from interim Chief Executive Officer Jack Dorsey heralding his purchase of about $875,000 in shares of the social-media company, saying he’s “investing in @twitter’s future.”

He didn’t make nearly as much fuss over his past stock transactions — all of them sales. Since the IPO, the co-founder has sold 378,132 shares worth $15.7 million. Another co-founder and board member, Ev Williams, has never purchased stock; instead, he’s sold about 8 million shares worth $344 million.

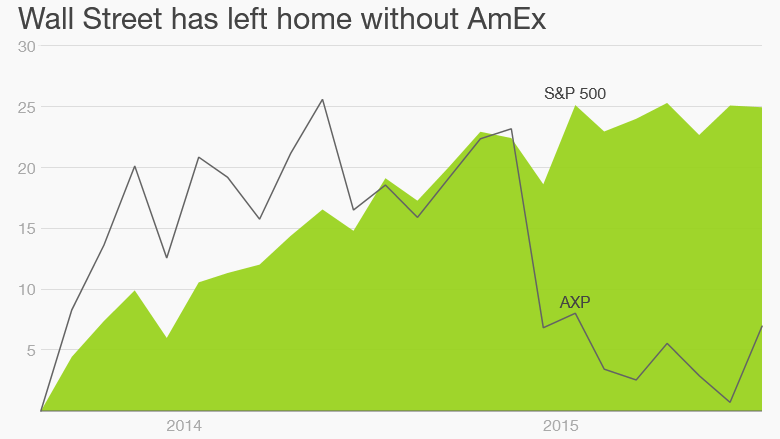

Is AmEx CEO on the hot seat? (CNN)

There are reports that the activist hedge fund that helped lead to Steve Ballmer's departure at Microsoft has taken a stake in American Express. That could be a problem for AmEx CEO Ken Chenault.

Beware of the bubble in stock market bubble warnings (Market Watch)

Beware of the bubble in stock market bubble warnings (Market Watch)

The stock market may be overvalued, but that doesn’t mean we’re in another bubble.

That’s an important distinction because the financial press is experiencing an explosion of dire warnings that we’re in another bubble like the one that popped among Internet stocks in early 2000. One headline just this week read: “Why an Uber for underwear is sure sign the tech-startup bubble is about to burst.”

The Co-op Bank escaped a £120 million fine because it was broke (Business Insider)

The Co-op Bank escaped a £120 million fine because it was broke (Business Insider)

The Bank of England is furious with the Co-operative Bank, which neared collapse two years ago as it revealed a £1.5 billion ($2.3 billion) black hole in its balance sheet.

The BoE's Prudential Regulation Unit, the banking watchdog, wanted to hand Co-op a huge £120 million ($187 million) fine for getting into the mess, but the bank is too weak to pay it. This is what they said in the statement today.

BOE's Miles Saw Reasonable Case for Rate Increase Last Week (Bloomberg)

BOE's Miles Saw Reasonable Case for Rate Increase Last Week (Bloomberg)

David Miles said there was a “reasonable” argument for the Bank of England to raise interest rates at its meeting last week in order to avoid faster tightening in future.

“I thought there was a case for beginning the journey now,” the BOE policy maker said in an interview in London on Monday as he explained how close he came to voting for higher borrowing costs at his final meeting on the Monetary Policy Committee. “It was a perfectly reasonable case.”

Oil prices edge lower as China devalues yuan (Market Watch)

Oil prices edge lower as China devalues yuan (Market Watch)

Oil prices slipped on Tuesday as investors digested China’s decision to devalue the yuan, which will make imports of a number of commodities including crude oil more expensive.

China’s move eroded a late rally in oil prices the previous day that stemmed from a weaker dollar DXY, -0.10%

The next nightmare decision for the Chinese economy is here (Business Insider)

The next nightmare decision for the Chinese economy is here (Business Insider)

As its economy slows and its stock markets whip violently up and down, China faces a brutal choice.

It can let the value of its currency, the yuan, fall and risk capital leaving the country.

Or it can maintain the value of the yuan as it has been doing and watch its exports fall quarter after quarter.

Spain’s Strong Economic Growth Held Back By Banking, But Not For Long (Value Walk)

Watch out Europe, Spain, once considered a troubled economic region mired deep in debt and unemployment, has become a relative powerhouse. While many economic indicators, most specifically unit labor costs, have led to relative prosperity, one indicator of economic prosperity lags: its stock market remains stagnant, an institutional multi-asset research piece from Source points out. However, this could change because the sector holding back stock prices is likely to get a lift.

One Good Icahn Energy Bet Undoes Several Years of Bad Calls (Bloomberg)

Oil’s crash would have been every bit as cruel to Carl Icahn as it was to other investors, except the billionaire had a very important ace in the hole: a little-known refiner and fertilizer maker based in Sugar Land, Texas.

Google founders’ personal and financial reasons for creating Alphabet (Market Watch)

Google founders’ personal and financial reasons for creating Alphabet (Market Watch)

Google Inc. on Monday revealed a restructuring that places its core businesses under a new parent company, Alphabet.

The move finally puts in context comments that co-founder and CEO Larry Page made about Warren Buffett’s Berkshire Hathaway. (I wrote about those remarks here.) As a reminder, Page had said to some shareholders that he saw industrial and insurance conglomerate Berkshire Hathaway BRK.B, -0.09% as a model for Google GOOG, -0.25% to emulate. In that piece, I wrote about all the ways Google isn’t like Berkshire Hathaway, and why that model would be wrong for Google. And yet, here we are facing the prospect of a conglomerate called Alphabet owning Google and a variety of other unconnected businesses.

China's Historic Devaluation Sends Equity Futures, Oil, Bond Yields Sliding, Gold Spikes (Zero Hedge)

If yesterday it was the turn of the upside stop hunting algos to crush anyone who was even modestly bearishly positioned in what ended up being the biggest short squeeze of 2015, then today it is the downside trailing stops that are about to be taken out in what remains the most vicious rangebound market in years, in the aftermath of the Chinese currency devaluation which weakened the CNY reference rate against the USD by the most on record, in what some have said was an attempt by China to spark its flailing SDR inclusion chances, but what was really a long overdue reaction by an exporter country having pegged to the strongest currency in the world in the past year.

Politics

Presidential elections don't really matter to American consumers (Business Insider)

Presidential elections don't really matter to American consumers (Business Insider)

While the 2016 presidential election is only beginning to pick up steam, candidates are bound to be asked how they plan to invigorate America's consumers and improve economic conditions.

In reality, however, the eventual winner's election probably won't make any difference on spending.

Researchers Atif Mian of Princeton University, Amir Sufi of the University of Chicago and Nasim Khoshkhou of Argus Information & Advisory Services found that politics — from elections to government shutdowns — have little impact on how consumers actually spend.

Megyn Kelly 'will not apologize' to Donald Trump (CNN)

Megyn Kelly 'will not apologize' to Donald Trump (CNN)

"I certainly will not apologize for doing good journalism," she said.

Kelly started her Fox News program on Monday night by saying it's "time to move forward" after days of Trump's attacks against her.

After briefly addressing the controversy, that's exactly what she did, shifting the spotlight off of herself and onto the evening's news from Ferguson, Missouri.

Brazil's President Dilma Rousseff Approval Rating Crashes To 8% – Worst Since Military Dictatorship (Zero Hedge)

Brazil's President Dilma Rousseff Approval Rating Crashes To 8% – Worst Since Military Dictatorship (Zero Hedge)

With the economy imploding, currency collapsing, and credit risk soaring, it is perhaps no surprise that just under a year since she was re-elected, Brazil's President Dilma Rousseff is now Brazil's most unpopular democratically elected president since a military dictatorship ended in 1985, with an approval rating of just 8%. In a recent poll, 71% said they disapprove of the way Rousseff is doing her job… and two-thirds would like to see her impeached.

Dilma Rousseff is now Brazil's most unpopular democratically elected president since a military dictatorship ended in 1985, says a poll out Thursday that put her approval rating at eight percent.

Technology

iOS slips to 62% enterprise share in Q2 2015, Android hits 32%, and Windows stays flat at 4% (Venture Beat)

iOS slips to 62% enterprise share in Q2 2015, Android hits 32%, and Windows stays flat at 4% (Venture Beat)

Apple continues to rule the mobile enterprise space, but its grip might be starting to slip. iOS lost 6 percentage points over the past quarter, dipping to 64 percent of global device activations in Q2 2015. Android device activations, meanwhile, gained the same amount to hit 32 percent of total activations last quarter.

The latest findings come from Good Technology‘s Mobility Index Report, although because BlackBerry devices use BlackBerry Enterprise Server for corporate email access, Good Technology does not have insight into the Canadian company’s handset activations. Windows stayed flat at 4 percent, with 3 percent comprising the desktop operating system on tablets and 1 percent comprising Windows Phone.

Stepping Into This Shower Feels Like Hugging a Warm Cloud (Wired)

Stepping Into This Shower Feels Like Hugging a Warm Cloud (Wired)

THE NEBIA TEAM has a very hard job. The young company is trying to reengineer the shower, a home appliance most of us use every day. Its goals are lofty: to not only build a business and create a brand that will sustain for years, but also to dramatically impact the environment through home water conservation.

But none of that stuff is the hard part. The hard part is asking people—lots and lots of people—to strip down and give their shower a test run.

Robots are going to learn to play jazz (Quartz)

Robots are going to learn to play jazz (Quartz)

As the band gets into their groove, the guitarist gets ready to rip a solo he’s practiced for endless hours. The crowd knows he’ll pull it off perfectly. That’s because he’s a robot; it’s always perfect.

This is the future that researchers, funded by the US Defense Advanced Research Projects Agency (DARPA), are hoping to produce, according to Tech Insider. A team, lead by Kelland Thomas from the University of Arizona, is trying to teach artificial intelligence software how to jam to jazz music, in the hopes of one day designing robots that can play real instruments and make sweet music.

Health and Life Sciences

A Quiet Revolution in the Treatment of Childhood Diarrhea (NY Times)

A Quiet Revolution in the Treatment of Childhood Diarrhea (NY Times)

Far from the world’s fears about Ebola and MERS, a quiet revolution is taking place in the diagnosis of a disease much more prosaic but far more threatening: childhood diarrhea. After pneumonia, diarrhea is the deadliest threat to infants worldwide, killing about 700,000 every year.

More than 40 pathogens — viruses, bacteria and parasites — cause diarrhea in children in developing countries. According to decades-old guidelines from the World Health Organization, these children should receive oral rehydration; intravenous rehydration if they cannot keep fluids down; and a zinc supplement.

The Nasal Spray Flu Vaccine May Soon Be Available for Infants and the Elderly (Gizmodo)

The Nasal Spray Flu Vaccine May Soon Be Available for Infants and the Elderly (Gizmodo)

Flu shots may soon be a lot less painful for young children and older adults. Researchers say they’ve found a way to modify the nasal spray version of the vaccine to make it work for those two groups.

The nasal spray vaccine — which uses a weakened, but live, form of the virus — isn’t approved for children younger than two years or adults older than 49. It’s too strong to be safe for kids younger than two years, and it’s too weak to trigger a useful response in adults older than 49. By the time people hit their fifties, most have been exposed to many strains of the flu over the years, so their immune systems already have lots of antibodies, and that makes it hard for the weakened virus to last long enough to provoke an immune response and generate antibodies against this year’s strain of the virus.

Life on the Home Planet

Massive Toxic Algae Blooms May Prove a Sign of Climate Change to Come (Scientific American)

Massive Toxic Algae Blooms May Prove a Sign of Climate Change to Come (Scientific American)

The water began turning a barely perceptible brownish-green in early May, a sign that algae were present and growing in the waters of Monterey Bay. By the end of month, Raphael Kudela, a professor of ocean sciences at the University of California, Santa Cruz, and his team, who run a regional algae monitoring project, were measuring some of the highest levels of the neurotoxin domoic acid ever observed in the region.

Although domoic acid, produced by marine diatoms of the genus Pseudo-nitzschia, is a naturally occurring toxin, during a toxic algal bloom, it accumulates at dangerous levels in shellfish and small fish like sardines and anchovies, which are then eaten by larger marine creatures and humans. Contaminated seafood can cause nausea and vomiting in people. At high levels, the toxin can cause brain damage, memory loss and even death.

Wildfires Have Devasted 5 Million Acres, and Alaska is Still Burning (Gizmodo)

Wildfires Have Devasted 5 Million Acres, and Alaska is Still Burning (Gizmodo)

Alaska’s wildfires burned through their 5 millionth acre this week, making 2015 the third most destructive wildfire season ever recorded in the state, and NASA’s Terra satellite captured this striking image of the fires from above.

Terra’s Moderate Resolution Imaging Spectroradiometer (MODIS) took this photograph of Alaska Areas that are actively burning are outlined in red on the image.