Financial Markets and Economy

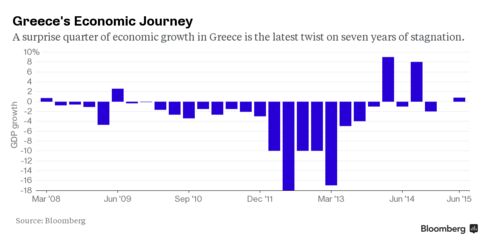

Greek Economy Unexpectedly Expanded 0.8% in Second Quarter (Bloomberg)

Greeces economy unexpectedly grew in the three months through June and a contraction in the previous quarter was revised away.

Everyone's watching the wrong central bank in the wake of China's shock devaluation (Business Insider)

Since the People's Bank of China started cutting the yuan's value against the dollar earlier this week people have been preoccupied with how that might affect the Federal Reserve's upcoming decisions.

Gold retreats, on pace to snap 5-day win streak (Market Watch)

Gold retreats, on pace to snap 5-day win streak (Market Watch)

Gold futures pulled back Thursday, catching their breath after a five-day winning streak that’s been powered in large part by turmoil in China.

December gold GCZ5, -0.62% was last down $6.30, or 0.5%, to $1,117.30 an ounce. September silver SIU5, -0.88% lost 13 cents, or 0.9%, to $15.35 an ounce

This week’s weakness in the Chinese yuan has raised concerns about the global economy, weighing on stocks and other riskier asset classes while boosting gold, often seen as a haven.

Yuan Fixing Goes From Obscure to Obsession for Global Traders (Bloomberg)

It’s the new must-watch indicator for markets worldwide, with the power to move prices from Tokyo to London and Chicago.

The Chinese central bank’s daily fixing for the yuan, long overlooked by investors outside the country, has transformed into a global market-moving event after a devaluation on Tuesday took almost everyone by surprise.

Winter is coming for oil (Business Insider)

Just how low can oil go?

Robert Lloyd George, a money manager with 24 years of experience in emerging market, thinks the price of oil could hit $30 (£19) a barrel by the end of the year, according to an interview with Bloomberg.

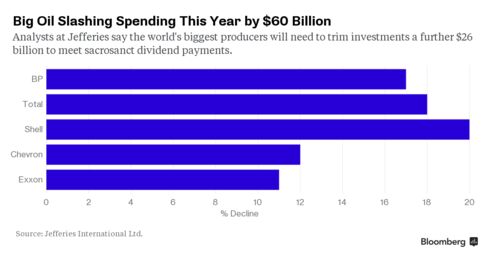

Oil Majors $60 Billion Cuts Don't Go Far Enough as Crude Slides (Bloomberg)

The $60 billion of oil-industry spending cuts this year won’t be enough as crude languishes near a six-year low.

Crude oil is hitting six-year lows and faces a glut that could run into next year (Quartz)

Crude oil is hitting six-year lows and faces a glut that could run into next year (Quartz)

Oil is falling—again.

It started its descent last summer, after OPEC decided to go to war with shale producers. It then perked back up earlier this year after those shale producers took their beating. But now that Iran might soon rejoin the global oil market and demand from China is starting to look weaker than everyone thought, all those gains are gone.

Here’s the advantage high-frequency trading firms have over everyone else (Market Watch)

Here’s the advantage high-frequency trading firms have over everyone else (Market Watch)

Eric Hunsader, founder of Nanex LLC, the U.S. financial markets consultancy, did a quote and trade time-stamp analysis recently, and what he found is worse than even he, a frequent markets structure commentator, suspected.

High-frequency trading firms have a 500-microsecond second advantage for Nasdaq NDAQ, +1.11% quote data over any firm that doesn’t use a direct feed from the exchanges to quote prices, he says.

Stocks are higher (Business Insider)

Stocks rallied in afternoon trading on Thursday after we got a raft of economic data that matched upbeat expectations.

Dollar gains; China defends yuan devaluation (Market Watch)

Dollar gains; China defends yuan devaluation (Market Watch)

The dollar was moderately higher against the yen and the euro Thursday as the Chinese central bank’s continued effort to guide the yuan lower was met with a milder reaction than previous sessions.

Resource-related, risk-sensitive currencies such as the Australian dollarAUDUSD, -0.5556% also showed more moderate reaction than the wide fluctuations seen after China’s decision to devalue its tightly controlled currency jolted global financial markets earlier this week.

Dollar Dilemma Returns: Chinas Gambit Fogs the Feds Rate Path (Bloomberg)

China’s new currency strategy is lending the dollar additional strength that may keep U.S. interest rates lower for longer.

Cisco beats, stock ticks up (Business Insider)

Cisco beats, stock ticks up (Business Insider)

Cisco just reported its 2015 fourth quarter earnings.

It's a beat across the board, and the stock is up over 2% in after hours trading.

EPS: $0.59 vs. $0.56 expected

Revenue: $12.8 billion vs. $12.65 billion expected.

Global gold demand drops 12% in second quarter (Market Watch)

Global gold demand drops 12% in second quarter (Market Watch)

Global demand for gold plummeted 12% to a six-year low in the second quarter, as vital buyers in Asia lost their appetite for the metal, the World Gold Council said Thursday.

Demand for the precious metal weighed in at 914.9 tons between March and June of this year, down from 1,038 tons during the same period in 2014, according to the industry body’s latest Gold Demand Trends report.

Surge in Commercial Real-Estate Prices Stirs Bubble Worries (Wall Street Journal)

Investors are pushing commercial real-estate prices to record levels in cities around the world, fueling concerns that the global property market is overheating.

UK shares went nowhere today (Business Insider)

The FTSE couldn't have been flatter if it tried today.

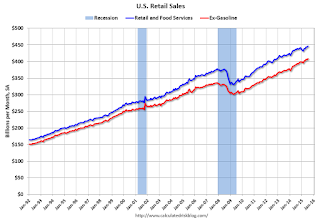

Retail Sales increased 0.6% in July (Calculated Risk)

On a monthly basis, retail sales were up 0.6% from June to July (seasonally adjusted), and sales were up 2.4% from July 2014.

Futures edge up as retail reading looms (Market Watch)

Futures edge up as retail reading looms (Market Watch)

U.S. stocks on Thursday looked ready to build on the prior day’s rally as gains in Asian markets boosted sentiment, though the tone could change after a closely watched reading on retail sales that's due before the open.

Stock-index futures showed modest gains, with those for the S&P 500 ESU5, +0.27% up 4.30 points, or 0.2%, to 2,088.50. Futures for the Dow Jones Industrial AverageYMU5, +0.29% were up 34 points, or 0.2%, to 17,401, while Nasdaq 100NQU5, +0.31% futures tacked on 11 points, or 0.3%, to 4,544.50.

How Italy's Biggest Banks Brushed Off a Sovereign Debt Shock (Bloomberg)

For a change, vast holdings of government bonds didnt hurt Italys biggest banks during the worst market selloff since 2012.

U.S. retail sales rise solidly, boosted by automobiles (Business Insider)

U.S. retail sales rise solidly, boosted by automobiles (Business Insider)

U.S. retail sales rebounded in July as households boosted purchases of automobiles and a range of other goods, suggesting solid momentum in the economy early in the third quarter.

The upbeat report from the Commerce Department on Thursday should strengthen expectations of a Federal Reserve interest rate hike as early as next month.

Why Tesla is selling $500 million of new stock (CNN)

Why Tesla is selling $500 million of new stock (CNN)

Tesla Motors is selling $500 million in additional stock, and CEO Elon Musk says he'll be one of the buyers.

Tesla announced the new offering Thursday, saying it would use the proceeds to fund some of its major and costly initiatives. Musk said he intends to purchase $20 million of the common stock at the offering price, which has yet to be set.

China’s second yuan bomb in two days caught a lot of people off guard (Quartz)

China’s second yuan bomb in two days caught a lot of people off guard (Quartz)

It turns out that China’s major devaluation its currency yesterday (Aug. 11) wasn’t a one-time deal.

The People’s Bank of China dropped its exchange rate again this morning (Aug. 12) by another 1.9%, and everyone’s confused. As we explained yesterday, the move is partially a move to get in good with the International Monetary Fund.

The contrarian in you has to be intrigued by this trend in the stock market (Market Watch)

Veteran stock market strategist Richard Bernstein continues to be bullish on US stocks.

While the S&P 500 has more than tripled since its lows in March 2009, investor sentiment shows little sign of mania.

Asian stocks stage relief rally after China-inspired losses (Market Watch)

Asian stocks stage relief rally after China-inspired losses (Market Watch)

Markets across most of Asia staged a relief rally Thursday, three days after China’s surprise devaluation of the yuan.

Currencies like the Malaysian ringgit and the Indonesian rupiah rebounded from their lowest levels against the U.S. dollar since the Asian financial crisis in the late 1990s, while stocks from Hong Kong to Australia also bounced.

This is the best time for Tesla to sell $500 million in stock (Business Insider)

This is the best time for Tesla to sell $500 million in stock (Business Insider)

Tesla is selling more stock. The electric car maker said it plans to raise about $500 million through the sale of 2.1 million shares.

CEO Elon Musk will himself likely buy 84,000 shares for about $20 million in the offering, according to a regulatory filing on Thursday.

This is a completely unsurprising move. It was anticipated by Wall Street but consistently downplayed by Musk and his management team.

Greece's Economic Surprise Isn't What It Seems (Bloomberg)

Greece's economy expanded 0.8 percent in the second quarter, a forecast-busting figure that defied all expectations. But it won't last, according to economists, who say the imposition of capital controls will have taken a chunk out of production at the start of this quarter.

Emerging Markets Report: Here are 5 big losers from China’s yuan devaluation (Market Watch)

Emerging Markets Report: Here are 5 big losers from China’s yuan devaluation (Market Watch)

Commodities, exporters to China, and economies in competition with China are among the biggest losers in the wake of the unexpected decision by Beijing to weaken the yuan, according to analysts.

“We think a decline in excess of 10% is unlikely as the renminbi is 5% to 10% overvalued,” Andrew Garthwaite, an analyst at Credit Suisse, said in a report.

Nuclear Revival Sparks Cameco Rally as Uranium Demand Is Growing (Bloomberg)

Cameco Corp., the worlds second-largest producer of uranium, is emerging as a rare bright spot among Canadas largest mining companies on signs nuclear power is shaking off its post-Fukushima slump.

Treasury yields rise as data point to rate hike (Market Watch)

Treasury yields rise Thursday, snapping a two-day decline, after a flurry of economic data was taken as a sign that the U.S. economy is on firm footing and the Federal Reserve could raise interest-rate later this year for the first time in nearly a decade.

Retail Sales Show Broad-Based Gain as U.S. Consumers Spur Growth (Bloomberg)

Retail Sales Show Broad-Based Gain as U.S. Consumers Spur Growth (Bloomberg)

Sales at U.S. retailers rose in July on growing demand for everything from cars to clothing, and a decline the previous month was wiped away, signaling consumers are propelling growth in the world’s largest economy.

The 0.6 percent advance matched the median forecast of economists surveyed by Bloomberg and followed little change in June that was previously reported as a 0.3 percent drop, a Commerce Department report showed Thursday in Washington. Eleven of 13 major categories showed gains.

Politics

Early Election Now Only Option for Turkey, Davutoglu Says (Bloomberg)

Early Election Now Only Option for Turkey, Davutoglu Says (Bloomberg)

Turkey is headed for early elections after coalition negotiations with the opposition CHP party failed, Prime Minister Ahmet Davutoglu said on Thursday. His comments sent the lira to a record low.

Davutoglu, who’s also head of the governing AK Party, told a televised news conference in Ankara that there were deep divisions on education and foreign policy with the opposition party. The AK Party offered to establish a coalition government that would rule only until new elections are held, a proposal that the CHP rejected, Davutoglu said.

Donald Trump and the Search for the Republican Soul (The Atlantic)

Donald Trump and the Search for the Republican Soul (The Atlantic)

Imagine for a moment that you are Ted Cruz, the junior senator from Texas and proud voice of the Tea Party. You have built your career by stoking the rage of conservatives, much of it against the very Republican Party to which you, and they, belong.

You are standing, now, on a dimly lit stage in Atlanta; you’ve walked out in front of the podium to seem vigorous and connected to the members of the audience, who are arrayed before you, sitting around tables in a vast hotel ballroom. You are trying, as you always do, as you are so good at doing, to give the people what they want.

Brazils Rousseff Says She's Never Considered Resigning Her Post (Bloomberg)

Brazils Rousseff Says She's Never Considered Resigning Her Post (Bloomberg)

Brazilian President Dilma Rousseff said she has never considered stepping down even as her popularity sinks and her ruling coalition crumbles.

“I have never considered resigning,” she said in an interview with SBT TV on Wednesday. “Disagreements can’t lead to the ouster of an elected president.”

Technology

Italian E-motorcycle Maker Energica Challenges Harley (Forbes)

Italian E-motorcycle Maker Energica Challenges Harley (Forbes)

In the U.S., motorcycles conjure images of loud, reverberating, menacing engines on stout, chrome-heavy frames adorned in black leather. We’re talking Harley Davidson rallies in Sturgis and Daytona, the cinematic scenes of Dennis Hopper and Peter Fonda in Easy Rider, the disgruntled war veterans, immigrants and roughnecks riding in gangs like Hells Angels, the Bandidos and the Outlaws.

Tomorrow's Battlefield Will Be Much Broader Than Today's (Popular Science)

Tomorrow's Battlefield Will Be Much Broader Than Today's (Popular Science)

More than 1,200 active satellites circle the globe; the lifeblood of modern military operations flows through many of them. In May, the U.S. Air Force announced a $5 billion budget to develop space-based offensive and defensive weapons. Other countries too are building capabilities on high. To win the next war, any great power will need to hold the ultimate in commanding heights.

Health and Life Sciences

Rapid Eye Movements Show When The Scenes Change In Your Dreams (Popular Science)

Rapid Eye Movements Show When The Scenes Change In Your Dreams (Popular Science)

You can do a lot while you sleep.

It’s easy to know when someone is in REM sleep—her eyes move quickly back and forth. Researchers have long known that the movements accompany dreaming, and theorized that the nature of the movements were indicative of some aspect of the dreams. Now researchers have monitored the activity of individual neurons to find that the eye movements are associated with a sort of “scene change” in the dream, they say. The researchers reported their findings this week in Nature Communications.

Gel 'eases inflammatory bowel problems' (BBC)

Gel 'eases inflammatory bowel problems' (BBC)

A gel that "sticks" to affected tissue and delivers medicine gradually over time could help treat some inflammatory bowel problems, researchers say.

Patients with ulcerative colitis often have to rely on medicine given by enema, but this can be uncomfortable, messy and inconvenient.

Now a US team has developed a hydrogel that attaches to ulcers and slowly releases a drug to help treat them.

Life on the Home Planet

‘Icequake’ sensors track tidewater glacier melt (Futurity)

‘Icequake’ sensors track tidewater glacier melt (Futurity)

Researchers for the first time have used seismic sensors to track meltwater flowing through glaciers and into the ocean, an essential step to understanding the future of the world’s largest glaciers as climate changes.

Meltwater moving through a glacier into the ocean is critically important because it can increase melting and destabilize the glacier in a number of ways: The water can speed the glacier’s flow downhill toward the sea; it can move rocks, boulders, and other sediments toward the terminus of the glacier along its base; and it can churn and stir warm ocean water, bringing it in contact with the glacier.

Amazon slowly eaten away by gold rush's illegal mines (Phys)

Amazon slowly eaten away by gold rush's illegal mines (Phys)

Seen from above, the Amazon resembles a huge billiards table—a field of intense green pockmarked by brown stains.

These are the sites of illegal mines, and they reveal the scope of a gold rush that threatens the lungs of the planet.

"The loss of our natural resources is incalculable," says Antonio Fernandez Jeri, Peru's high commissioner on illegal mining.