Financial Markets and Economy

Bond Markets $2.46 Trillion Dilemma May Not Be So Bad After All (Bloomberg)

Bond Markets $2.46 Trillion Dilemma May Not Be So Bad After All (Bloomberg)

For bond investors worried about what might happen when the Federal Reserve starts whittling down its $2.46 trillion of Treasuries, there’s good news.

You’ll barely even notice.

The central bank plans to reduce its debt holdings sometime after it starts raising interest rates, and the concern is that the Fed’s attempt to reverse its unprecedented easy-money policies will trigger a jump in borrowing costs.

'Everybody is waiting for doomsday' in Texas (Business Insider)

Oil prices are at a six-year low, and almost nowhere is the pain being felt more than in Texas.

This weekend, The New York Times published a great look at how the crash in oil prices has impacted the economic fortunes of Karnes County, Texas.

.jpg)

Why gas prices are rising as oil falls to 6-year lows (Market Watch)

Why gas prices are rising as oil falls to 6-year lows (Market Watch)

Crude-oil prices haven’t been this low in nearly 6 1/2 years, but motorists in some parts of the country have seen a significant rise in prices at the gas pump this week.

Drivers can thank to refinery troubles to that puzzling move.

Lost in the Fight Over India's Interest Rates: Household Savers (Bloomberg)

While Indian Prime Minister Narendra Modi has racked up thousands of air miles seeking to woo foreign investors, tapping funds at home is just as crucial.

Nobody told these two rigs that oil was crashing again (Quartz)

Nobody told these two rigs that oil was crashing again (Quartz)

The latest US rig count is in (pdf) from Baker Hughes, and two whole explorations units came back to life last week.

The steep fall in oil prices last year wiped out a lot of oil rigs as producers focused on sites with more potential, but this is the fourth consecutive week—and the sixth week in seven—that the count has risen. West Texas Intermediate and Brent crude oil futures prices didn’t do much after the release, each up and down less than 1%, respectively.

Investors to look at Fed, earnings with China filter (Business Insider)

Investors to look at Fed, earnings with China filter (Business Insider)

Investors will comb through Wednesday's minutes of the most recent Federal Reserve meeting for indications on how the U.S. central bank will react to the recent yuan devaluation and the further decline in oil prices.

The recent outperformance of bank stocks and underperformance of utilities, both on expectations of higher Treasury yields, support current market bets that the Fed will raise rates for the first time in nearly a decade after its mid-September meeting.

Weaker Yuan Adds to Headwinds Facing Chinese Online Travel Sites (Bloomberg)

If a slowing economy andintensifying competition werent putting enough pressure on Chinese travelwebsites, now the industry faces another potential obstacle to growth: a weaker local currency.

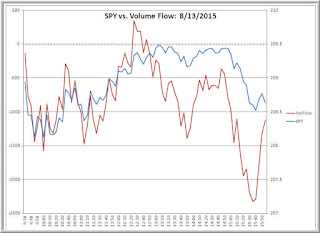

Tracking the Footprints of Supply and Demand in the Stock Market (Trader Feed)

In some ideal, dispassionate world all participants in financial markets would behave like my friend NRK and only buy at bid prices and sell at offers. It's a great way to do well in auction markets, and there are optimal execution platforms that will accomplish that for large market participants. The problem with optimal execution is that you often have to wait to get good prices, and price can get away from you while you're waiting. That can happen if you're looking for a bargain in a hot real estate market or if you try entering on limit orders in a fast market.

Japan Says Its Economy Contracted in Second Quarter (NY Times)

Japan Says Its Economy Contracted in Second Quarter (NY Times)

Burdened by weaker consumer spending and exports, Japan’s economy contracted in the second quarter, government data showed on Monday, the first such setback since a short but painful recession last year.

The Cabinet Office said gross domestic product fell at an annualized rate of 1.6 percent in the three months through June.

China yuan to move both ways, more 'adjustments' unlikely: central bank economist (Business Insider)

China yuan to move both ways, more 'adjustments' unlikely: central bank economist (Business Insider)

China's move to weaken the yuan last week could head off further similar "adjustments", and the yuan is likely to move in both directions as the economy stabilizes, Ma Jun, chief economist at the central bank said on Sunday.

The People's Bank of China (PBOC) shocked global markets by devaluing the yuan <CNY=CFXS> by nearly 2 percent on Aug. 11. The PBOC called it a free-market reform but some saw it as the start of a long-term yuan depreciation to spur exports.

Magnitogorsk Waits for Iron Ore Rebound to Sell Fortescue Stake (Bloomberg)

Magnitogorsk Waits for Iron Ore Rebound to Sell Fortescue Stake (Bloomberg)

OAO Magnitogorsk Iron & Steel plans to wait for a recovery in the iron ore market to sell its 5 percent stake in Fortescue Metals Group Ltd.

Magnitogorsk is looking for higher prices, which may happen if there’s a merger between major iron ore suppliers that reduces some of the oversupply, Chief Financial Officer Sergey Sulimov said in an interview on Aug. 13. Without industry consolidation, low prices and slowing demand for the raw material used in steel production may persist for a decade, according to Sulimov.

The oil industry is acting like the worst is over (Business Insider)

The oil industry is acting like the worst is over.

This week, oil prices fell to their lowest level in six years.

Storms fail to knock down U.S. stocks (CNN)

Storms fail to knock down U.S. stocks (CNN)

China is in turmoil. Oil is at six-and-a-half-year lows. Copper and other metals are tumbling. Earnings growth has vanished. The strong U.S. dollar is hurting exports. And a rate hike from the Federal Reserve looms.

But the U.S. stock market seemingly can't be knocked down. Stocks aren't going gangbusters like in previous years — the S&P 500 is up just 1.5% — but they've performed admirably, all things considered.

Yuan Devaluation Sparks Biggest Crash In US Corporate Bonds Since Lehman (Zero Hedge)

Just two days ago we warned of the dramatic disconnect between equity insurance and credit insurance markets – at levels last seen before Bear Stearns collapse. As the Yuan devaluation shuddered EURCNH carry traders and battered European assets, US equity markets stumbled onwards and upwards, impregnable in their fortitude with The Fed at their back no matter what. However, US corporate bond markets were a bloodbath…

Biggest Danish Phone Company Drops M&A as Creditors Come First (Bloomberg)

Biggest Danish Phone Company Drops M&A as Creditors Come First (Bloomberg)

TDC A/S, which last year unnerved both bond and share investors with a $2 billion takeover, won’t enter any new deals as preserving credit ratings becomes its priority.

That’s according to Pernille Erenbjerg, who took over as chief executive officer on Friday, replacing Carsten Dilling after three years of disappointing returns.

Tesla is entering another crisis (Business Insider)

Tesla is entering another crisis (Business Insider)

This past week, Tesla announced that it would sell $500 million in stock, in an offering designed to raise cash to fund construction of a massive battery factory in Nevada and to scale up the company's Supercharger network of charging stations.

The company then upped the amount of stock on offer, to $640 million. CEO Elon Musk will likely purchase $20 million in shares himself.

Facebook Cutting Out Cisco Gives a Much-Needed Boost to EZchip (Bloomberg)

Shares of EZchip Semiconductor Ltd. have been stuck in a multi-year slump on concern large customers such as Cisco Systems Inc. would become competitors. Now they're rallying on the prospect it may not need Cisco at all.

These are the stocks the biggest names in the hedge fund industry have been buying and selling (Business Insider)

These are the stocks the biggest names in the hedge fund industry have been buying and selling (Business Insider)

Hedge funds had to publish their 13F filings on Friday, and that means we have insight into what the biggest names in finance were buying and selling in the second quarter.

There are a few standout investments: Tech-focused hedge fund Tiger Global took a big position in Netflix, while Jana Partners invested in Precision Castparts right before Warren Buffett announced a takeover of the company.

'Looming unrest in the oil sector' is rattling Central Asia's biggest country (Business Insider)

'Looming unrest in the oil sector' is rattling Central Asia's biggest country (Business Insider)

Oil has been sliding again recently, hitting its lowest level in six years last week.

Kazakhstan, like many others, is feeling the pain as black gold dips lower and lower.

But that's not the Central Asian's country's only problem: The government is also concerned about "looming unrest in the oil sector" that has followed lower oil, according to a new report by Stratfor.

Goldman's 4 Reasons Why The S&P Will Remain Unchanged For The Rest Of 2015 (Zero Hedge)

Anyone expecting a surge in market volatility as Mario Draghi recently warned, will be disappointed to read Goldman's latest forecast which not only does not budge on its year end S&P forecast of 2100, but predicts that the market will be flat as a pancake for the balance of the year.

Politics

Donald Trump’s immigration plan is out — and here’s what’s in it (Market Watch)

Donald Trump’s immigration plan is out — and here’s what’s in it (Market Watch)

Donald Trump has made headline after headline with his remarks on immigrants and immigration, but now his presidential campaign has put together its “Immigration Reform That Will Make America Great Again” plan. And, for one thing, yes, Mexico will be paying for that wall.

Trump wants a wall constructed along the U.S.’s southern border. (“The Mexican government has taken the United States to the cleaners. They are responsible for this problem, and they must help pay to clean it up.”)

Technology

How to keep technology from mocking your broken heart (Mashable)

How to keep technology from mocking your broken heart (Mashable)

After 16 years of marriage, the text from Lisa Arends’ husband read: “I’m sorry to be such a coward leaving you this way but I’m leaving you and leaving the state.”

She collapsed to the floor. And never received any communication from him again.

But their digital interactions haunted her in a way she never could have imagined. With linked email accounts, she saw in his junk email that he had failed to pay the tab on the cost of a band — for his recent wedding.

Apple Is Already Looking For Testing Sites For Its Self-Driving Car (Fast Company)

Apple Is Already Looking For Testing Sites For Its Self-Driving Car (Fast Company)

Apple’s plan to build a self-driving car, known as Project Titan, is "further along than many suspected," according to The Guardian. Through a public records request, the newspaper obtained documents that provide hard evidence that Apple is considering testing the vehicles at a former naval base.

Health and Life Sciences

Why vaccines alone won’t beat dysentery (Futurity)

Why vaccines alone won’t beat dysentery (Futurity)

Despite improvements in sanitation and clean water access, dysentery remains a major public health burden that most often affects children in low-income countries.

New research uses genomic techniques to reveal more about the bacteria Shigella flexneri, a leading cause of the disease.

Researchers sequenced the DNA of Shigella flexneri from samples taken from Africa, Asia, and South and Central America, along with samples from historical collections dating back to 1913.

Health effects of coffee: Where do we stand? (CNN)

Health effects of coffee: Where do we stand? (CNN)

It's one of the age-old medical flip-flops: First coffee's good for you, then it's not, then it is — you get the picture.

Today, in 2015, the verdict is thumbs up, with study after study extolling the merits of three to five cups of black coffee a day in reducing risk for everything from melanoma to heart disease, multiple sclerosis, type 2 diabetes, Parkinson's disease, liver disease, prostate cancer, Alzheimer's, computer-related back pain and more.

Diabetes cases soar 60% in a decade (BBC)

Diabetes cases soar 60% in a decade (BBC)

The number of people living with diabetes has soared by nearly 60% in the past decade, Diabetes UK warns. The charity said more than 3.3 million people have some form of the condition, up from 2.1 million in 2005.

The inability to control the level of sugar in the blood can lead to blindness and amputations and is a massive drain on NHS resources.

Life on the Home Planet

Indonesian Plane Carrying 54 People Missing Over Papua (Gizmodo)

Indonesian Plane Carrying 54 People Missing Over Papua (Gizmodo)

An ATR42-300 aircraft operated by Trigana Air as Flight 267 has gone missing near Papua, according to various reports. The twin turboprop was said to be carrying 54 people and lost contact with air traffic controllers about 30 minutes after taking off from Jayapura in Papua. The flight was headed for Oksibil, also in Papua.

Some reports are indicating that Flight 267 crashed into a mountain, with local villagers witnessing a low-flying aircraft plunge into terrain in the midst of inclement weather. There are currently no reports of any survivors, or if anyone on the ground was injured during the course of the crash. [UPDATE: Wreckage of the aircraft has been located.]

How Life and Luck Changed Earth’s Minerals (Wired)

How Life and Luck Changed Earth’s Minerals (Wired)

Is evolution predictable, or was it heavily shaped by random events? Biologists have argued over this question for decades. Some have suggested that if we replayed the history of life on our planet, the resulting species would be different. Opponents counter that life is largely deterministic.

Recently, researchers have begun to ask the same questions about rocks. About 5,000 minerals—crystalline substances such as quartz, zircon and diamond—have been found on Earth. But minerals didn’t just appear all at once when the Earth formed. They materialized over time, each crystal arising in response to the conditions of the particular epoch in which it formed. Minerals evolved—in some cases, in response to life…