Financial Markets and Economy

Hong Kong Stocks Tumble Into Bear Market Amid Global Selloff (Bloomberg)

Hong Kong stocks entered a bear market as a rout in global equities deepened and the weakest Chinese manufacturing data since the financial crisis added to concerns about the world economy.

Equity outflows at 15-week high as investors seek bond safety: BAML (Business Insider)

Equity outflows at 15-week high as investors seek bond safety: BAML (Business Insider)

Equity outflows hit a 15-week high of $8.3 billion in the past week, with fears of a China-driven global economic crisis pushing investors towards safe-haven money-market funds and Treasuries, Bank of America Merrill Lynch said on Friday.

An exodus from emerging markets also gathered steam, as investors pulled $6 billion out of EM equity funds – their seventh week in the red and the highest weekly tally in five weeks.

No Bottom for Turkish Stocks as Market Dives Below Key Support (Bloomberg)

The bottom fell out of the Turkish stock market this week.

China's currency will plunge another 10% (Business Insider)

China's currency will plunge another 10% (Business Insider)

China's shock currency devaluation started last week but it isn't over, according to a note from Barclays analysts.

They see the yuan falling another 10% against the dollar, with China selling off more foreign exchange reserves to keep the price down.

As it stands there are 6.3950 to the dollar according to data from Bloomberg, but Barclays sees this moving to 6.8 by the end of the year and 6.90 by the middle of 2016.

Why One Wall Street Analyst Thinks You'll Start Spending More (Bloomberg)

After a few middling months, U.S. consumer spending is poised for a pickup, according to one Wall Street analyst.

Novartis buys remaining rights to GSK treatment in deal up to $1 billion (Business Insider)

Novartis buys remaining rights to GSK treatment in deal up to $1 billion (Business Insider)

Swiss drugmaker Novartis said on Friday it had agreed to buy all remaining rights to Ofatumumab, which is being developed for relapsing remitting multiple sclerosis and other autoimmune indications, from Britain's GlaxoSmithKline.

Basel-based Novartis will make an initial upfront payment of $300 million to GSK for the acquisition of the compound and a further $200 million payable following the start of a phase III study in MS by Novartis.

No one knows how bad China’s economy will get (Quartz)

No one knows how bad China’s economy will get (Quartz)

China’s stock markets sank sharply today (Aug. 21), dragging Asian stock markets lowerand setting the stage for another grim day in Europe and the US.

The Shanghai Composite Index fell 4.3%, and briefly dipped below the 3,500 level at which the government has stepped in previously to prop the market up. The index fell more than 11% during the week. Despite more than $1 trillion worth of government support measures, stocks have not really stabilized since they started stumbling in June.

Greek Bank Stocks Extend Slide After Tsipras Steps Down (Bloomberg)

Greek Bank Stocks Extend Slide After Tsipras Steps Down (Bloomberg)

Greek bank stocks tumbled for a second day after Prime Minister Alexis Tsipras said he was stepping down to seek a new mandate in elections.

The four biggest lenders — National Bank of Greece SA, Piraeus Bank SA, Eurobank Ergasias SA and Alpha Bank AE — all opened lower in Athens trading, extending Thursday’s losses.

Sell-Off in Global Markets Continues Into Second Day (NY Times)

Sell-Off in Global Markets Continues Into Second Day (NY Times)

A broad sell-off in global markets continued for a second day on Friday, deepening across Asia as stocks and currencies fell amid new signs of a worsening economic slowdown in China.

Chinese shares led the rout again, with the main Shanghai index falling 4.3 percent, while the Shenzhen index closed 5.4 percent lower. Hong Kong’s Hang Seng index declined 1.5 percent after having given up all its gains for the year this week. The Nikkei 225 in Tokyo closed down 3 percent.

China stocks crashed 11% this week (CNN)

China stocks crashed 11% this week (CNN)

China's beleaguered stock market endured yet another sell off on Friday, shedding 4% to wipe away the remaining gains from a dramatic market rescue launched by Beijing in early July.

The benchmark Shanghai Composite closed just north of 3,500 points, a level that many analysts believe Beijing will try to defend at all costs. Even with a late rush of buying, the index closed down more than 11% for the week.

FBD Shows How to Lose Money in Euro Regions Best Economy (Bloomberg)

Usually, economic recovery helps companies. Not so FBD Holdings Plc.

Is a banking revolution coming to India? (CNN)

The Reserve Bank of India has authorized 11 companies to launch so-called payments banks, in a move that is likely to shake up the country's banking sector.

Payments banks, according to official regulations, can only accept deposits up to 100,000 rupees ($1,530). They aren't allowed to issue credit cards, or grant loans, and are required to primarily invest their deposits in government bonds.

Burned by Slump, Commodity Bulls Exit in Search of Better Return (Bloomberg)

A decade ago, Alan Gayle at RidgeWorth Investments was among the money managers pouring cash into commodities as a way to profit from Chinas expanding appetite for energy, metals and food.

India’s benchmark stock index just erased all the gains made in 2015—again (Quartz)

India’s benchmark stock index just erased all the gains made in 2015—again (Quartz)

India’s benchmark index, Sensex, has once again erased all the gains it made in the last seven and a half months.

China, of course, is the big reason. Equity markets across Asia tanked on Aug. 21 after the Caixin/Markit China Manufacturing Purchasing Managers’ Index (PMI) survey showed China’s manufacturing sector dropped to a six year low. US and European index futures fell too.

Brazil Has Yet Another Big Mess on Its Hands After State Default (Bloomberg)

Engulfed by political and economic crisis, Brazil can ill-afford to be beset by more problems.

Investors Hope to Ride Swell of SoulCycle Fever in Coming I.P.O. (NY Times)

Investors Hope to Ride Swell of SoulCycle Fever in Coming I.P.O. (NY Times)

Early on a summer morning in Manhattan’s Upper East Side, dozens of mostly young, svelte women file into a quiet, candlelit studio where they mount gleaming stationary bikes. Soft clicks can be heard as they fasten their shoes to the pedals.

Suddenly, a thumping beat blares through speakers as the room is illuminated in a soft lavender glow. The 72-strong pack begins to pedal in sync. The leader cajoles the cycling pride: “Forget about the job. Forget about the kids. These 45 minutes…are…all…about you!”

Gold climbs to six-and-a-half week high (Market Watch)

Gold climbs to six-and-a-half week high (Market Watch)

Gold rallied to a six-and-a-half-week high on Friday, as stock-market turbulence prompted investors to buy the precious metal as a store of value.

The precious metal has also gained on anticipation that the Federal Reserve will stand pat on interest rates and amid volatile currency moves. Higher U.S. interest rates would likely strengthen the dollar and weigh on gold, as it is priced in the currency.

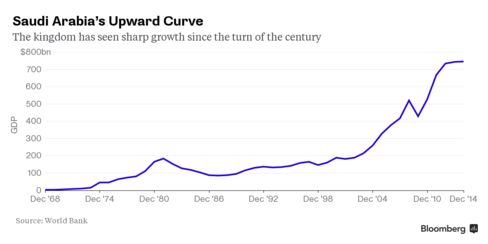

How Much Longer Can Saudi Arabia's Economy Hold Out Against Cheap Oil? (Bloomberg)

Saudi Arabia got lucky when the oil price fell in 1998. What about now?

Why your stock investing experience won’t be like Warren Buffett’s (Market Watch)

Why your stock investing experience won’t be like Warren Buffett’s (Market Watch)

Friends have been grumbling to me that their 401(k)s haven’t been rising much this year compared to the recent past.

My friends are correct, given that the S&P 500 SPX, -2.11% turned negative on the year after Thursday’s decline. But their frustration may reflect what behavioral economists call “recency bias.”

Bear Market Looms for Hong Kong Stocks as Index Sinks With China (Bloomberg)

Bear Market Looms for Hong Kong Stocks as Index Sinks With China (Bloomberg)

Hong Kong stocks slumped, closing just short of a bear market, as declines in mainland markets and the devaluation of the yuan erode support for the city’s shares.

The Hang Seng Index lost 1.8 percent to 22,757.47 at the close in Hong Kong, bringing its drop from a seven-year high on April 28 to 19.99 percent. The Hang Seng China Enterprises Index of mainland equities listed in the city, which entered a bear market last month, fell 2.3 percent.

Economists Cut Japan Growth View Again, Widening Gap With BOJ (Bloomberg)

Economists Cut Japan Growth View Again, Widening Gap With BOJ (Bloomberg)

Economists from Nomura Holdings Inc. to BNP Paribas SA lowered their forecasts for Japan’s economy this week, making the central bank’s growth outlook for this year look increasingly optimistic.

The trigger — a second-quarter contraction reported on Monday — also led Bank of America Corp. and NLI Research Institute to trim their projections for the fiscal year through March 2016. The world’s third-biggest economy is now set to grow 1.2 percent over the 12 months, according to the median of 13 estimates from economists, less than the 1.7 percent forecast by the Bank of Japan.

Dollar tumbles after downbeat China manufacturing data (Market Watch)

Dollar tumbles after downbeat China manufacturing data (Market Watch)

The U.S. dollar fell across the board on Friday, after weaker-than expected Chinese manufacturing data drove concerns about the global economy, pushing investors toward the perceived safety of the Japanese yen.

The dollar USDJPY, -0.65% slid to ¥122.89 versus ¥123.44 seen in late North American trade on Thursday. The euro EURUSD, +0.4003% rose to $1.1276 against the dollar, compared with $1.1215 on Thursday, which was a one-week high.

Politics

Here’s why political ad spending is surging this election cycle (Market Watch)

Political candidates and (mostly importantly) your backers, get out your wallets: Spending on political advertising is forecast to hit a record high next year, as television airwaves and digital media fill up with the sights and sounds of Campaign 2016.

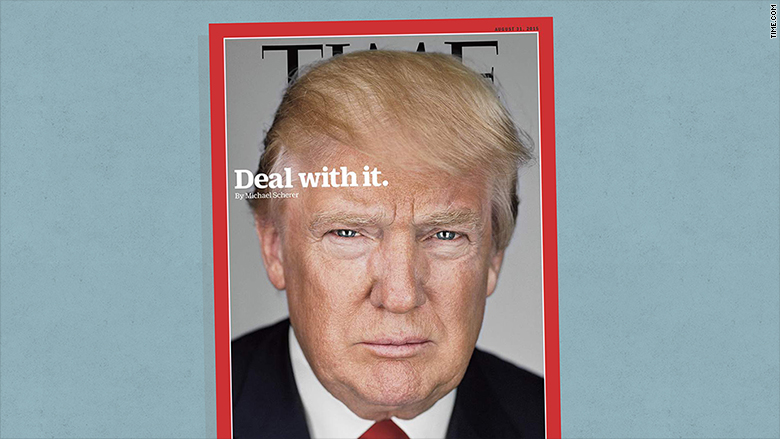

Donald Trump thinks he should be paid for interviews (CNN)

Donald Trump thinks he should be paid for interviews (CNN)

Donald Trump's business ventures have made him billions, but his latest money-making idea is a non-starter.

In interviews this week, the bombastic presidential candidate is touting his ratings-grabbing popularity and suggesting he should be paid to show up for interviews.

Technology

Using sunlight to recharge the cooling system of trailer containers (Phys)

Using sunlight to recharge the cooling system of trailer containers (Phys)

Betting on clean energy sources is the strategy of the Mexican group ISA Tracto C, which produced a series of energetically self-sustained boxes for the transport of perishable goods, with a cooling system that replaced the use of diesel with sunlight and kinetic energy.

The project leader, Nayeli Flores Huerta, said that by eliminating the use of fuel for the refrigeration systems of trucks, about 20 thousand liters of diesel could be saved annually, in addition to exponentially decreasing the total cost of the transport operation.

From Vacuuming Robot to Abstract Expressionist Painter (PSFK)

From Vacuuming Robot to Abstract Expressionist Painter (PSFK)

Meet Mr. Head: the robot artist behind abstract, Jackson Pollock-esque splatter paintings. He’s a 15-year-old robot, and he’s undergone a serious career change. He began his life as a house vacuuming, cleaning assistant. In October 2014, with the help of human HYdeJII, he transitioned to his new life a a working artist.

Health and Life Sciences

Breast Cancer Treatment and D.C.I.S.: Answers to Questions About New Findings (NY Times)

Breast Cancer Treatment and D.C.I.S.: Answers to Questions About New Findings (NY Times)

D.C.I.S. stands for ductal carcinoma in situ. It is a small pileup of abnormal cells in the lining of the milk duct. You cannot feel it because there is nothing to be felt; there is no lump. But the cells can be seen in a mammogram, and when a pathologist examines them, they can look likecancer cells. The cells have not broken free of the milk duct or invaded the breast. And they may never break free. The lesion might go away on its own or it might invade the breast or spread throughout the body. That raises questions about what, if anything, to do about it.

Want to quit smoking? 2 ways to predict if you’ll gain weight (Futurity)

Want to quit smoking? 2 ways to predict if you’ll gain weight (Futurity)

Weight gain is a big worry for many people who want to quit smoking. Will they gain a little or a lot? Experts say there are two factors that can help predict which smokers are likely to gain 20 pounds or more.

“Many smokers are concerned about gaining weight after quitting smoking and this can be a barrier for them when they are considering whether or not to make a quit attempt,” says Susan Veldheer, a registered dietitian at Penn State College of Medicine.

Life on the Home Planet

July Earth's hottest month on record (BBC)

July Earth's hottest month on record (BBC)

July was the hottest month on Earth since records began, averaging 16.6 C (61.9 F), according to US scientists.

That is 0.08 degrees higher than the previous record, set in July 1998 – a significant margin in weather records.

Scientists at the US National Oceanic and Atmospheric Administration (NOAA) said in a report that they expect 2015 to be the hottest year on record.