Financial Markets and Economy

Stocks Plunge, With Dow Losing 1,000 Points (NY Times)

Stocks Plunge, With Dow Losing 1,000 Points (NY Times)

The global market turmoil continued on Monday, as stocks fell sharply in the United States, Europe and Asia, led by another big sell-off in China. The Dow Jones industrial average dropped more than 1,000 points in the first minutes of trading.

Investors’ concerns over China’s economic slowdown and a souring view of emerging economies have rattled financial markets around the world in recent days, and showed no signs of letting up.

Bullish Oil Bets Sink to 5-Year Low as Futures Flirt With $40 (Bloomberg)

Its pretty lonely being an oil bull these days.

Hong Kong Stock Plunge Is Fastest Since 1987 Crash on China Woes (Bloomberg)

Hong Kongs snowballing stock losses are, by one measure, the most extreme since the crash of 1987.

MARKET MAYHEM: This is it (Business Insider)

The global market bloodletting continues as the sell-off has officially reached historic levels.

Oil below $39 for first time since 2009 (CNN)

Oil below $39 for first time since 2009 (CNN)

Get ready for even lower oil prices.

Futures for a barrel of West Texas Intermediary crude fell below $39 a barrel early Monday — a level not seen since 2009. Oil closed at $40.29 on Friday.

A stark warning this stock market has plenty more room to fall (Market Watch)

A stark warning this stock market has plenty more room to fall (Market Watch)

The Uber driver. The soccer coach. The guy at the liquor store and maybe even the gardener. If your job is in any way connected to the stock market, you’ve probably had some financial questions posed to you in the past couple days from some unlikely sources. When things go nuclear like this, everybody is searching for answers… something to cling to during the turbulence.

What do you tell them? Well, this probably won’t help your barber’s stress levels: Odds are that this thing gets worse before it gets better. Bottoms aren’t made on Fridays, and history offers us a pretty stark warning about these kinds of declines on the S&P (see “the chart” below).

Kazakh Rout Lures Credit Suisse Seeing Insulation From Oil Slump (Bloomberg)

After contributing to the biggest emerging-market selloff since 2012, Kazakhstan is back in favor.

Investors are asking if Asia's market crash will be like the 1997 crisis all over again (Business Insider)

Investors are asking if Asia's market crash will be like the 1997 crisis all over again (Business Insider)

Is the current market rout and growth slowdown in Asia going to be like a repeat of the1997 Asian financial crisis?

In 1997, one Asian currency after another tumbled, along with the countries' stock markets. A major tightening in credit ensued and some countries fell into recession.

Deyi Tan, executive director of research at Morgan Stanley, says "over the last few days, we had several questions from investors asking if this is going to be like another Asian crisis."

Metals prices fall amid global selloff (Market Watch)

Metals prices fall amid global selloff (Market Watch)

Metals dived deep into red territory on Monday as the latest rout in Chinese stock markets added to concerns that the country’s appetite for imported metals was weakening.

High-grade copper HGU5, -3.73% — one of China’s major imports — dropped 5 cents, or 2.4%, to $2.25 an ounce, keeping the contract at the lowest level in more than six years.

World Looks to China to Act as Circuit Break for Rout It Started (Bloomberg)

World Looks to China to Act as Circuit Break for Rout It Started (Bloomberg)

China’s central bank, which helped trigger a market rout with a surprise devaluation two weeks ago, may be the only one around the world with the firepower to arrest it.

With about 25 trillion yuan ($3.9 trillion) of bank deposits still locked up as reserves and the benchmark one-year interest rate at 4.85 percent, the People’s Bank of China has an ample monetary policy arsenal at its disposal. Lending rates in the U.S., Europe and Japan already are close to zero and the rout is shaking confidence that the global economy will be strong enough to withstand an expected policy tightening by the Federal Reserve.

Crude oil collapses to a stunning new low (Business Insider)

Along with almost all other assets, crude oil prices are collapsing.

In early trade on Monday morning, the price of West Texas Intermediate was down about 3% and traded under $39 a barrel, a new post-financial crisis low for the commodity that has been getting hacksawed this year.

.png)

Intel to step up its cloud services with $100 million investment in Mirantis (Market Watch)

Intel to step up its cloud services with $100 million investment in Mirantis (Market Watch)

Intel Corp. is stepping up its support for free software designed to help companies achieve the kinds of benefits offered by cloud services from Amazon Inc.AMZN, -5.63% Google Inc. GOOG, -3.12% GOOGL, -4.64% or Microsoft Corp.MSFT, -2.19%

The big chip maker on Monday plans to announce its lead role in a $100 million infusion into Mirantis Inc., which sells a subscription version of the open-source software OpenStack. Intel INTC, -2.83% , whose venture-capital arm first invested in Mirantis in 2013, is contributing, along with other investors, to a $75 million funding round. The company also is committing additional money to finance future technology development by the Silicon Valley startup.

Big Investors Are Finding Ripe Start-Up Targets in Europe (NY Times)

Big Investors Are Finding Ripe Start-Up Targets in Europe (NY Times)

Klaus Hommels has invested in some of Europe’s most successful start-ups. That includes Spotify, the music-streaming service, and Klarna, a Swedish online payments company valued at more than $2 billion. He has also backed several American tech giants like Facebook and Airbnb, the vacation-rental site.

Now, the German venture capitalist is doubling-down on Europe’s tech sector.

South Korea Pledges to Stabilize Markets Amid Geopolitical Scare (Bloomberg)

South Korea Pledges to Stabilize Markets Amid Geopolitical Scare (Bloomberg)

South Korean policy makers pledged action to stabilize financial markets amid tension with North Korea that is raising concern over capital outflows and volatility.

The Bank of Korea said Monday that efforts to calm markets are important, adding that it will closely monitor external risks and come up with measures to mitigate them if needed.

Here's what analysts are saying about China's 'Black Monday' (Business Insider)

Here's what analysts are saying about China's 'Black Monday' (Business Insider)

Chinese stocks were absolutely hammered overnight on Monday, tanking 8.5% in what observers are calling the Shanghai Composite's "Black Monday".

The chaos — which has been bubbling away in Chinese markets for months — has spread to global markets, with European stock exchanges swallowing steep losses this morning.

Why some Indians are quietly celebrating China’s market meltdown (Quartz)

Why some Indians are quietly celebrating China’s market meltdown (Quartz)

China’s dramatic stock market crash has spooked bourses across the world, including in India.

India’s benchmark Sensex index has fallen around 7.6% since Aug. 11, including over 1,600 points on Monday (Aug. 24) —its biggest fall since 2009 and the third biggest crash in history in terms of absolute value.

China fears overdone? What investors need to watch (Market Watch)

China fears overdone? What investors need to watch (Market Watch)

It’s looking like another grisly day ahead for U.S. stocks, with investors talking about “another vicious down-leg” or looking poised to hit the “sell” button with gusto.

Ahead of the U.S. market’s open, Germany’s DAX DAX, -5.78% has tumbled nearly 5% and undercut the 10,000 level, crude CLV5, -5.44% is crumbling by more than 4% to below $39 a barrel and China’s Shanghai Composite SHCOMP, -8.49% closed down 8.5% for its biggest one-day dive since 2007, turning red for the year.

Chartist Who Got It Right on China Sees Dollar Gains Versus Euro (Bloomberg)

Thomas Schroeder, the strategist who called the top of Chinas stock market in April, expects the dollar to wobble before resuming its rally in 2016 when he sees it reaching a 14-year peak.

We’re live-charting the global market meltdown (Quartz)

We’re live-charting the global market meltdown (Quartz)

It all started in Asia.

In Shanghai, stocks were down 8.5% today. In Japan, the Nikkei was down 4.6%. The global selloff then spread to Europe, where the Stoxx 600 is down roughly 4.7% at last glance. Now the open in the US looks set to be ugly, too. S&P futures are down roughly 3.4% about an hour before the opening of trading in New York. We’ll be keeping track of the the rocky markets right here.

A contrarian view of the global market crash … from a member of the real economy (Business Insider)

Global market crashes are riveting events, especially for those with skin in the game.

How the market carnage is deepening, in four charts (Market Watch)

How the market carnage is deepening, in four charts (Market Watch)

The brutal rout in financial markets accelerated on Monday, led by the biggest one-day plunge for China’s Shanghai Composite since 2007.

Monday’s plunge in Dow Jones Industrial Average futures hit 850 points shortly before the market open.

The severe selloff in China has underscored fears of a sharp slowdown in growth for the world’s second-largest economy, which already has triggered a rapid dive in commodity prices. It’s also seen as potentially complicating the Federal Reserve’s interest-rate decisions.

Fortescue Full-Year Earnings Plunge 88% on Iron Ore Collapse (Bloomberg)

Billionaire Andrew Forrests Fortescue Metals Group Ltd. reported full-year profit tumbled a more-than-expected 88 percent after iron ore prices plunged on a global glut and a slowdown in Chinas steel industry.

Commodity prices just slumped to their lowest level since 1999 (Business Insider)

Commodity prices just slumped to their lowest level since the end of the 20th century,according to a widely-used Bloomberg index.

Why You Can't Get Rich Inventing The Banana Split (Fast Company)

Why You Can't Get Rich Inventing The Banana Split (Fast Company)

The creator of the banana split never received royalties. Because ideas in food belong to culture.

In 1904, a 23-year-old apprentice pharmacist named David Strickler was manning the soda fountain at a drug store in Latrobe, PA. On a whim, he sliced a banana lengthwise and put ice cream inside for a few customers. Evidently, they liked it, because the banana split would go viral in the early 1900s, spreading to soda shops everywhere, transcending from a 2,000 calorie uber dessert to a piece of Americana recognized around the world.

Market chaos just sent the 'fear index' exploding to its highest level in years (Business Insider)

Both Asian and European markets opened in pieces on Monday, with major declines recorded across the board — China's Shanghai Composite has wiped out nearly all its gains for the year and European stocks are reversing the boom seen earlier in the year.

Truffle Find on Billionaires Farm Fuels South Africa Industry (Bloomberg)

Truffle Find on Billionaires Farm Fuels South Africa Industry (Bloomberg)

The fungi are ugly, wrinkly and smelly, but the Jack Russell-cross named Clyde who discovered the first black winter truffle in South Africa’s Western Cape province has helped confirm the country can grow these valuable tubers.

Clyde’s 200-gram (7-ounce) black truffle had been growing for six years under an oak tree on the Altima wine farm near Franschhoek owned by billionaire Johann Rupert, chairman of luxury-goods maker Cie Financiere Richemont SA. Cape Town-basedWoodford Truffles (Pty) Ltd., the company that inoculated English oaks with mycelium spores and planted them in Altima’s orchards in 2009, thinks South Africa can reach annual sales of 250 million rand ($19.3 million) within 10 years.

Robot Families, Pig Organs For People And A Stock Market Shellacking (Forbes)

Robot Families, Pig Organs For People And A Stock Market Shellacking (Forbes)

One week after Google wowed Wall Street with an investor friendly reorganization and the promise of future clarity, the company is making a big fuss over its new home WiFi router. Oh Google, you are so easily distracted. For its trouble, GOOGL lost $100 billion in market cap this week in the broad market rout. … Apple lost $172 billion in market cap, slimming to $603 billion. For perspective, in one week Apple lost the entire market cap of Coca-Cola. So much for the first trillion-dollar company. You had to know that when that chatter started for a five-product company, it was the beginning of the end.…

China Now Has Company in Supporting Stocks as Neighbors Follow (Bloomberg)

China Now Has Company in Supporting Stocks as Neighbors Follow (Bloomberg)

China isn’t the only country resorting to extraordinary measures to shore up its tumbling stock market.

Taiwan on Sunday slapped a ban on short-selling of borrowed stocks at prices lower than the previous day’s close, while South Korea’s finance ministry said it will act “pre-emptively” after the nation’s largest exchange-tra ded fund suffered the biggest weekly withdrawal since its inception 15 years ago. China itself said over the weekend it will allow pension funds to invest in stocks for the first time, while penalizing major shareholders at publicly traded companies for violating rules that limit stake sales.

Politics

Greek Election: Syriza 2.0 vs. What's Left (Bloomberg)

Greek Election: Syriza 2.0 vs. What's Left (Bloomberg)

Prime Minister Alexis Tsipras is betting he has more chance of building a governing coalition from Greece’s fractured political landscape after a new election than by trying to rein in rebels within his party.

As Tsipras seeks allies that can help him meet the conditions of the country’s third bailout package, here’s what he’s got to work with. Polling numbers come from the latest survey, published by Metron Analysis last month.

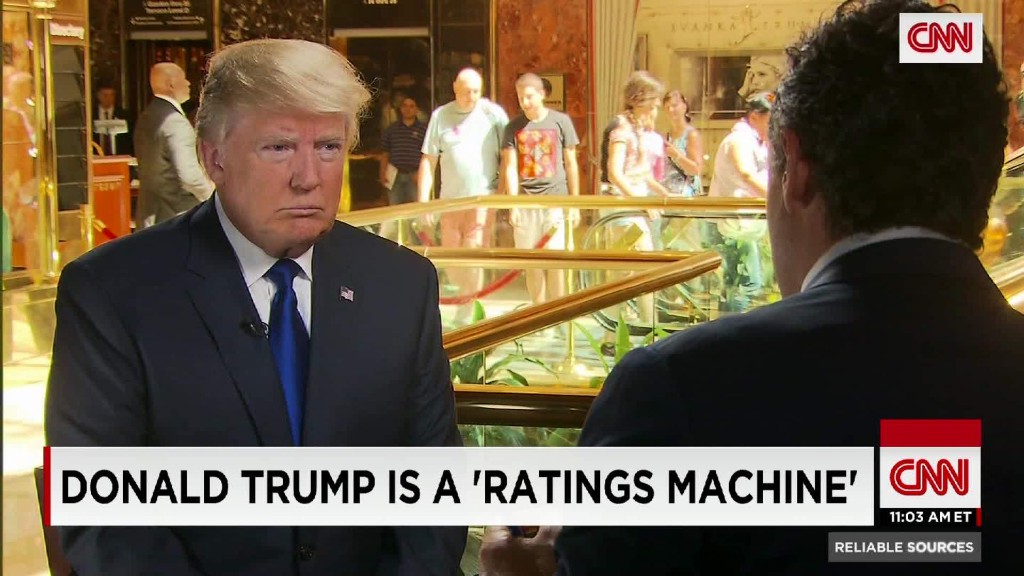

Trump coverage dwarfs other GOP candidates (CNN)

Trump coverage dwarfs other GOP candidates (CNN)

Since the first Republican presidential debate, Donald Trump has received more attention on the nightly news than his 16 rivals — combined.

In fact, Trump coverage alone almost doubled all the other GOP candidate coverage.

Joe Biden leans toward running for president in 2016 (Market Watch)

Joe Biden leans toward running for president in 2016 (Market Watch)

Vice President Joe Biden, who has long been considering a presidential bid, is increasingly leaning toward entering the race if it is still possible he can knit together a competitive campaign at this late date, people familiar with the matter said.

Biden still could opt to sit out the 2016 race, and he is weighing multiple political, financial and family considerations before making a final decision. But conversations about the possibility were a prominent feature of an August stay in South Carolina and his home in Delaware last week, these people said. A surprise weekend trip to Washington to meet with Sen. Elizabeth Warren (D., Mass.), a darling of the party’s liberal wing, represented a pivot from potential to likely candidate, one Biden supporter said.

Technology

The world's rivers and oceans will soon be full of robots (Mashable)

The world's rivers and oceans will soon be full of robots (Mashable)

While the world goes crazy for drones, a hardworking set of marine robots are helping scientists learn more about our global waterways.

Aquabots are the most advanced way to measure the reaches of the ocean, rivers and lakes, Matthew Dunbabin, a principal research fellow at the Institute for Future Environments at the Queensland University of Technology, told Mashable Australia.

Robots Will Steal Our Jobs, But They’ll Give Us New Ones (Wired)

Robots Will Steal Our Jobs, But They’ll Give Us New Ones (Wired)

AT THE DUSSELDORF airport, robotic valet parking is now reality. You step out of your car. You press a button on a touch screen. And then a machine lifts your car off the ground, moving all three tons of it into a kind of aerial parking bay. Built by a German company called Serva Transport, the system saves you time. It saves garage space, thanks to those carefully arranged parking spots. And it’s a sign of so many things to come.

But the one thing it doesn’t do, says J.P. Gownder, an analyst with the Boston-based tech research firm Forrester, is steal jobs. In fact, it creates them. Before installing the robotic system, the airport already used automatic ticket machines, so the system didn’t replace human cashiers. And now, humans are needed to maintain and repair all those robotic forklifts. “These are not white-collar jobs,” Gownder tells WIRED. “This is the evolution of the repair person. It’s harder to fix a robot than it is to fix a vending machine.”

Health and Life Sciences

The New Health Care: No, You Do Not Have to Drink 8 Glasses of Water a Day (NY Times)

The New Health Care: No, You Do Not Have to Drink 8 Glasses of Water a Day (NY Times)

If there is one health myth that will not die, it is this: You should drink eight glasses of water a day.

It’s just not true. There is no science behind it.

And yet every summer we are inundated with news media reports warning that dehydration is dangerous and also ubiquitous.

Life on the Home Planet

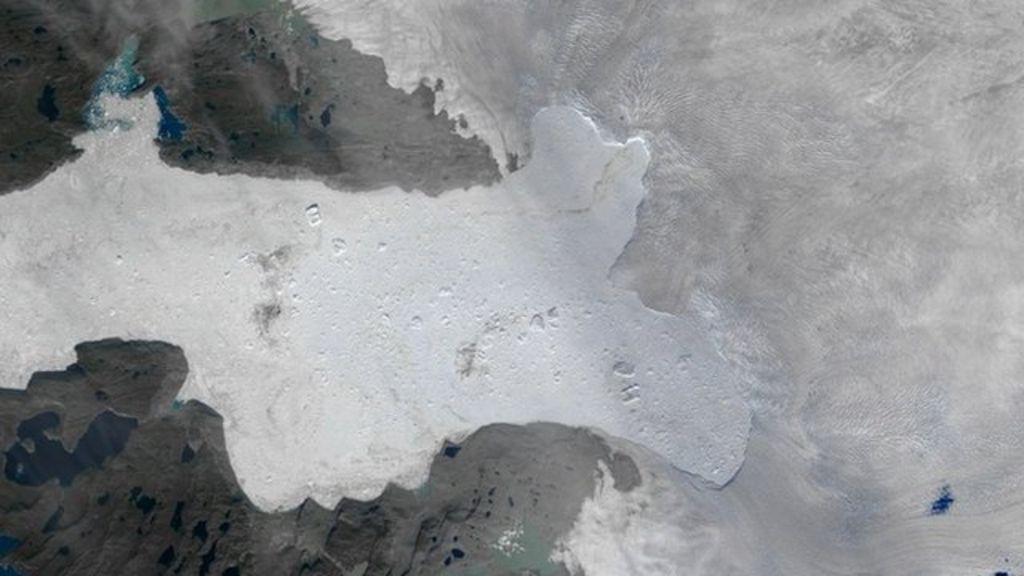

Greenland glacier sheds big ice chunk (BBC)

Greenland glacier sheds big ice chunk (BBC)

Scientists are studying a big mass of ice that has broken off the Jakobshavn Glacier in Greenland.

They say the 12.4km sq section is among the largest ever witnessed to come away from the ice stream's calving front.

Satellite imagery suggests the break-up occurred sometime between 13 and 19 August.

Evidence of species loss in Amazon (Phys)

Evidence of species loss in Amazon (Phys)

Researchers studying plants, ants, birds, dung beetles and orchid bees in the Brazilian Amazon have found clear evidence that deforestation causes drastic loss of tropical forest biodiversity.

Publishing this week in Ecology Letters, researchers highlighted how remaining areas of undisturbed and recovering forest provided the last refuge for many species unable to withstand the impact of human activity.