Financial Markets and Economy

What You Missed in Global Markets: Unhinging China (Bloomberg)

A day after an ugly 9% decline on the Shanghai Composite sent shockwaves around the world, China’s benchmark index suffered another tough session and prompted the People’s Bank of China to cut its benchmark interest rate.

4 stats about what happens to stocks after violent sell-offs (Business Insider)

4 stats about what happens to stocks after violent sell-offs (Business Insider)

The S&P 500 fell 3.9% on Monday, closing at 1,893. It's now down 11.3% from its all-time high of 2,134, which it set on May 20.

For you investors, the human brain may have you convinced that the stock market will continue to go down precipitously. And perhapes this 10% correction will evolve into a 20% bear market.

No, stock investors haven’t capitulated — yet (Market Watch)

They say the time to buy is when there’s “blood on the streets.”

But if you think that’s the case on Wall Street right now, think again.

Beijing acts to boost economy – yet again (CNN)

Beijing acts to boost economy – yet again (CNN)

China has launched new stimulus measures designed to boost the country's flagging economy.

The People's Bank of China cut its key lending and deposit rates by 0.25% on Tuesday. The one-year lending rate is now 4.6% and the deposit rate is 1.75%.

Tech stocks set for solid rebound after ‘Black Monday’ (Market Watch)

Tech stocks set for solid rebound after ‘Black Monday’ (Market Watch)

After a dreadful day for technology stocks on Monday, the sector looks set for better times once U.S. markets open on Tuesday.

In premarket trading, shares in technology companies were among the biggest gainers. Futures for the tech-heavy Nasdaq 100 index NQU5, +3.84% were rallying 177 points, or 4.4%, to 4,180.25, making it the best performing benchmark among the major U.S. averages before the bell. Futures for all three stock benchmarks got a boost early in the morning after the People’s Bank of China cut interest rates in the wake of recent stock-market turmoil.

Pimco Shadow Equity Vanishes as Cash Replaces Worthless Options (Bloomberg)

Pacific Investment Management Co., beset by fund outflows and management turmoil, swapped out the part of its compensation plan that hinged on earnings growth in favor of a more stable cash incentive.

Here's a super quick guide to what traders are talking about right now (Business Insider)

Here's a super quick guide to what traders are talking about right now (Business Insider)

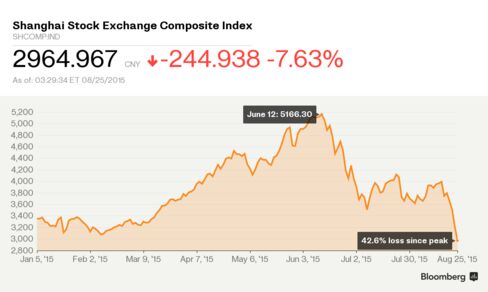

Morning! Sea o' green early this “Turnaround Tuesday”, despite Shanghai falling 7.6%, with more than 2,000 companies listed across China’s two exchanges dropping the 10% limit down as heavily-weighted blue-chips collapsed on headlines the PBOC is through trying to control the fall. That said, we’ve taken a leg higher as China's central bank cuts benchmark interest rates, lowers banks' reserve requirement ratio by 50bp (Street was lookin for 100bp) – but continue to fail those 2 resistance points I mentioned y'day in chats.

Gold dips; haven demand weakens as ‘stench of fear’ abates (Market Watch)

Gold dips; haven demand weakens as ‘stench of fear’ abates (Market Watch)

Gold futures pulled back early Tuesday as China said it would cut its benchmark interest rate to stabilize its shaky economy.

China’s announcement had the effect of stabilizing global markets and bolstering the U.S. dollar after the Shanghai Composite SHCOMP, -7.63% tumbled 7.6% lower in early Tuesday trading a day after sinking by 8.3%.

Two words for Modi’s big disinvestment plan: Good luck (Quartz)

Two words for Modi’s big disinvestment plan: Good luck (Quartz)

Among prime minister Narendra Modi’s biggest challenges after he took charge in May last year was to find a way to quickly reign in India’s widening fiscal deficit.

The new government announced an ambitious disinvestment plan, under which it would look to sell minority stakes in state-owned companies to help plug the hole. But, of the Rs63,425 crore ($9.5 billion) targeted for sale in the last financial year, the government only made Rs31,350 crore ($4.6 billion), less than half of what it wanted.

Citic's Black Monday Shows Its Challenge to UBS May Be Over (Bloomberg)

China’s stock-market collapse has put an abrupt end to Citic Securities Co.’s ascent among the world’s biggest brokerages by market capitalization.

Less than eight months ago, Citic came close to matching Switzerland’s UBS Group AG. Now, after a halving of Citic’s value to $27.5 billion, the Chinese firm is sinking closer to Japan’s Nomura Holdings Inc. Catching up with UBS at $81.3 billion once more looks like a distant prospect.

Will the Fed Raise Interest Rates Anytime Soon? Investors Say No (NY Times)

Will the Fed Raise Interest Rates Anytime Soon? Investors Say No (NY Times)

As markets jitter and stock prices fall, investors increasingly are betting that the Federal Reserve will not raise interest rates this year.

Their conclusion is a striking rejection of the Fed’s stated plans — and it appears premature.

The Fed watches financial markets closely, of course. Investors are losing money they might have spent, and falling prices can be an indicator of broader economic problems.

Markets are surging (Business Insider)

After a chaotic day that ended with the S&P 500 down 77 points, or 3.9%, markets are now bouncing back fiercely.

If you don’t buy Apple’s stock today, you’re crazy (Market Watch)

If you don’t buy Apple’s stock today, you’re crazy (Market Watch)

Apple Inc. bounced back on Monday as bold investors used a decline of up to 13% earlier in the day to buy the iPhone maker’s stock on the cheap. As the saying goes, “be greedy when others are fearful.”

Those who were gutsy enough were rewarded, but bargain buys don’t necessarily have to be high-stress swing trades designed to make money in a matter of minutes. Some of the most profitable purchases for value investors can be long-term positions initiated in good stocks during a bad market environment.

Tenge Drops After Dollar Sales Ebb on Corporate Tax Deadline (Bloomberg)

Kazakhstans currency fell on speculation companies have stopped selling dollars after raising money to pay taxes due Tuesday.

China Cuts Rate and Pop (Business Insider)

After market chaos in the last two days, with the Shanghai Composite tumbling to wipe out all of its massive rally this year, the People's Bank of China is intervening and cutting rates.

Dollar recovers against euro, yen after prior day’s slump (Market Watch)

Dollar recovers against euro, yen after prior day’s slump (Market Watch)

The dollar advanced against the euro and yen Tuesday, recovering somewhat after getting beaten up by those big rival currencies a day earlier.

And in what looked to be a partial unwind of Monday’s hectic session, the dollar surrendered its gains against emerging-markets currencies as well as the so-called commodity dollars — the currencies of Australia, New Zealand and Canada.

Euro Emerging as Premier Haven in Market Rocked by Devaluations (Bloomberg)

The notion that the euro could be a haven in times of turmoil seemed preposterous just a few weeks ago.Yet thats exactly what its become as the world gets rocked by everything from devaluations to bear markets in stocks.

Don't worry, there won't be a global recession (Business Insider)

Don't worry, there won't be a global recession (Business Insider)

Goldman Sachs sent a note to clients on Tuesday reassuring them that, no, we're not heading for a global recession.

Investors no doubt need reassuring after the global rout of stock markets around the world yesterday, kicked off by "Black Monday" in China.

China is falling again today, although other markets aren't tracking them this time.

Oil prices rally 2%, try to regain $39 level (Market Watch)

Oil prices rally 2%, try to regain $39 level (Market Watch)

Oil futures gained Tuesday, bouncing back a bit after settling under $39 a barrel for the first time in six-and-a-half years, as global markets also recovered somewhat from the previous day’s rout.

West Texas Intermediate crude for October delivery CLV5, +3.48% rose 87 cents, or 2.3%, to $39.11 a barrel, while October Brent crude LCOV5, +3.35% advanced by 94 cents, or 2.2%, to $43.63 a barrel.

Out in the Real World, Oil Market Is Much Better Than It Looks (Bloomberg)

The global oil market is healthier than it looks, signaling that crudes plunge to six-year lows has probably gone too far.

Traders have literally no idea whether this is a financial crisis or not (Business Insider)

Traders have literally no idea whether this is a financial crisis or not (Business Insider)

If you were watching US stocks yesterday – which plunged and rallied and then fell again – you might be wondering what's going on.

It turns out that no one has a clue where markets are going at the moment.

There's a way of measuring it called the VVIX, which tracks the volatility of equity volatility. It's sort of like a fear index based on the fear index, known as the VIX. Low VIX is good because it indicates low fear of a volatile market.

Hong Kong Yuan Deposit Rates Surge to Record After Devaluation (Bloomberg)

Yuan deposit rates in Hong Kong climbed to a record on speculation this months surprise devaluation and a global markets rout are fueling an exodus from the currency.

The world is officially in a market correction (Business Insider)

The world is in the middle of a market correction. Stocks are tumbling everywhere, and the latest news from China makes it seem like we haven't seen the end of it.

Politics

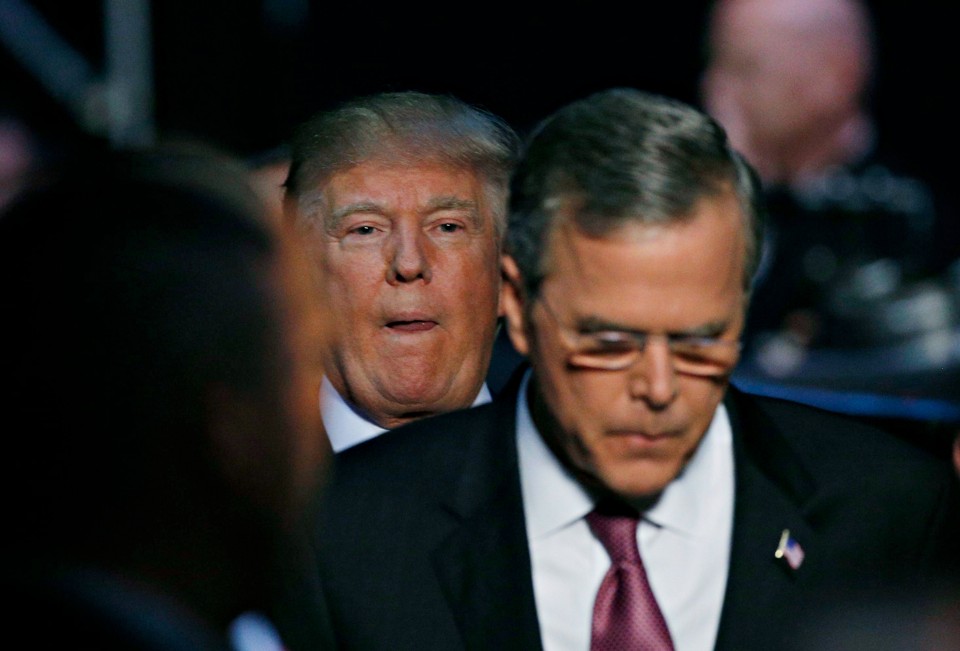

Should Jeb Bush Go After Trump? (The Atlantic)

Should Jeb Bush Go After Trump? (The Atlantic)

To be a candidate for high office is to be surrounded by a cacophony of advice. So long as things are going well, most of the advice can be politely disregarded. President George W. Bush used to explain why he disliked traveling with a large entourage: “How many people do I need telling me to be myself?” But when things go south, the advice becomes more insistent, more contradictory, and more dangerous.

Scott Walker: Obama should show ‘some backbone’ and cancel Chinese state visit (Market Watch)

Scott Walker: Obama should show ‘some backbone’ and cancel Chinese state visit (Market Watch)

Wisconsin Gov. Scott Walker called Monday on President Barack Obama to cancel Chinese President Xi Jinping’s state visit to the White House next month, citing the turmoil that roiled U.S. stock markets. As the Washington Post writes, analysts say that turmoil began over concerns about China’s slowing growth — and Walker was quick to pounce on Xi’s scheduled visit. “Why would we be giving one of our highest things a president can do — and that is a state dinner for Xi Jinping, the head of China — at a time when all of these problems are pending out there?” Walker said in South Carolina, according to the Post. Walker said Obama should cancel the visit because “there’s serious work to be done rather than pomp and circumstance. We need to see some backbone from President Obama.”

Technology

How To Build Industrial Robots That Don't Kill Humans (Bloomberg)

How To Build Industrial Robots That Don't Kill Humans (Bloomberg)

In June this year a robot crushed a man to death in a Volkswagen factory in Germany. The 22-year-old maintenance worker became trapped between a large robotic arm and a metal plate, in an area usually off-bounds to humans.

The tragic incident highlighted a major technological challenge: As we move towards an increasingly automated world, how do we reach a point where robots and humans can exist side-by-side, sharing space and collaborating on tasks?

Health and Life Sciences

This New Test For Antibiotic Drug Resistance Could Be A Game Changer (Forbes)

This New Test For Antibiotic Drug Resistance Could Be A Game Changer (Forbes)

Bacteria have evolved many ways to defend themselves against antibiotics, resulting in devastating infections resistant to many antibiotics. Dr. Michael Mahan and colleagues from University of California Santa Barbara havediscovered an important and novel way bacteria evade our defenses.

Now and then a new article grabs my attention with an “aha” or a “eureka” moment, presenting a game changing idea. Despite a rather dense title, this new study left me with that reaction, and wondering why no one had thought of this before. The authors tried to examine why some people fail antibiotic therapy even though the bacteria isolated from them appear susceptible (or sensitive) to that antibiotic on traditional testing. They found a host-dependent mechanism that would not be detected by the usual tests.

Turning cancer into healthy tissue (BBC)

Turning cancer into healthy tissue (BBC)

Scientists believe they may have found a way to turn cancerous cells back into healthy tissue.

Their lab-based work suggests there is a biological step that can restore normality and stop cells replicating out of control.

When the US researchers added molecules called microRNAs, it put the brakes on cancer, Nature Cell Biology reports.

Life on the Home Planet

Typhoon Goni Cuts Path Through Japans Kyushu; Injuries Reported (Bloomberg)

Typhoon Goni Cuts Path Through Japans Kyushu; Injuries Reported (Bloomberg)

Typhoon Goni made landfall on Japan’s southernmost main island of Kyushu, causing injuries and prompting evacuation orders. Cancellations of airline and train service affected thousands of people.

Goni, which had been the strength of a category 3 hurricane, came ashore in Kumamoto prefecture about 6 a.m. The storm cut a path through Kyushu and re-entered the sea near Shimonoseki, where 280,000 people in surrounding Yamaguchi prefecture were advised to evacuate due to concern over landslides, public broadcaster NHK said.

Why Frozen Sperm Can’t Save Earth’s Imperiled Species—Yet (Wired)

Why Frozen Sperm Can’t Save Earth’s Imperiled Species—Yet (Wired)

ZOO ANIMALS ARE giving humans a run for their money in the assisted reproduction department. Mei Xiang, a giant panda at the National Zoo, gave birth to twin babies this past Saturday, thanks to artificial insemination. And earlier this month, scientists announced the birth of a bouncing baby black-footed ferret, conceived with cryogenically preserved sperm from a father who had died twenty years ago.

This is great, you’re thinking. Why can’t we just artificially inseminate all the endangered animals? Game over, extinction … right?