Go TASR! (one of our old trades)

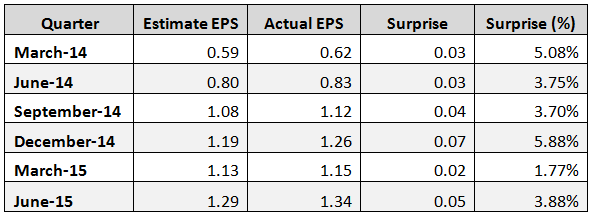

SWKS/Nick - It's a nice little under-the-radar sort of business and gets unfairly beaten up with the semis when the market falls. They have beat for the last 6Qs and there's no reason to doubt estimates of 20% advances next year to $6 per share (p/e 14 is great for a grower):

I would have loved them last week at $70 and I'm not too keen on paying more but you can sell the 2017 $60 puts for $7 with the stock at $84, so why not do that for a net $53 entry (37% off) and leave it at that? You're Oct $85/95 bull call spread is about $3.70 and makes $6.30 tops but needs a 10% gain. My idea pays you first and you only have to give the money back if the stock drops over 37% - though a longer time-frame.

As we're always looking for our monthly $4,000(ish) in the LTP, let's sell 5 of the SWKS 2017 $60 puts for $7 ($3,500) as that's certainly a stock we don't mind owning way down from here.

S&P/Pstas - The headline is nonsense. For one thing, Q2 last year was easy comps because the market crashed after poor Q2 results were announced last July/Aug. 2nd of all, look at this chart:

S&P 500 2Q15 year-over-year blended earnings growth rates

| Sector | 2Q15 |

| Consumer Discretionary | 12.7% |

| Consumer Staples | -0.2% |

| Energy | -56.2% |

| Financials | 18.5% |

| Health Care | 11.7% |

| Industrials | -1.1% |

| Materials | 8.3% |

| Technology | 6.5% |

| Telecom Services | 9.3% |

| Utilities | 4.3% |

| S&P 500 | 1.4% |

| S&P 500 Ex-Energy | 8.9% |

| S&P 500 Ex-AAPL | 0.2% |

| S&P 500 Ex-Citi | -0.3% |

| S&P 500 Ex-BAC | 0.4% |

| S&P 500 Ex-(Citi, BAC) | -1.3% |

| S&P 500 Ex-(Energy, AAPL) | 7.8% |

| S&P 500 Ex-(Energy, AAPL, Citi, BAC) | 4.7% |

| S&P 500 Ex-(Energy, AAPL, Citi) | 5.9% |

| S&P 500 Ex-(Energy, AAPL, BAC) | 6.7% |

| S&P 500 Ex- (Energy, Citi, BAC) | 6.0% |

| S&P 500 Ex- (Energy, Citi) | 7.1% |

| S&P 500 Ex- (Energy, BAC) | 7.9% |

| S&P 500 Ex- (AAPL, Citi, BAC) | -2.6% |

| S&P 500 Ex- (AAPL, Citi) | -1.5% |

| S&P 500 Ex- (AAPL, BAC) | -0.9% |

So, if not for three (3) stocks, the S&P 497 would be down 2.6% from last year.