Good morning!

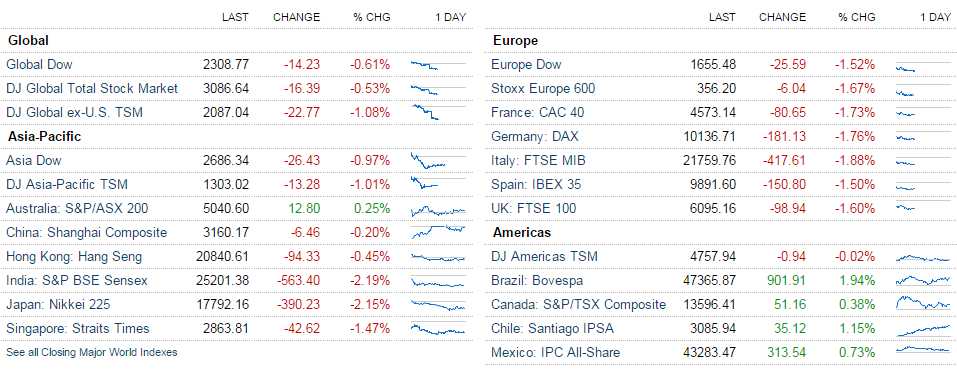

Amazingly, people were surprised German factory orders were down despite the fact that our factory orders were down 2 days ago (as well as all the other data that pointed to that outcome). Anyway, that's burst Europe's bubble and they've given back all of yesterday's gains and our Futures are trading down with them, which is extra-silly as we didn't go up with them yesterday!

Of course the key takeaway here is that the DAX sucks and now it joins team death cross at our 11,000 line. We called this, what, 3 months ago?

Futures-wise, we're back to 16,200, 1,925, 4,175 and 1,130 - yawn... This is why (and I may have mentioned this a few times) I don't like to do anything when we're bouncing around between the weak and strong bounce lines. The whole point of the lines is to wait for a confirmed breakout - one way or the other!

- Dow 16,200 (weak) and 16,650 (strong)

- S&P 1,900 (weak) and 1,950 (strong)

- Nasdaq 4,550 (weak) and 4,700 (strong)

- NYSE 10,050 (weak) and 10,300 (strong)

- Russell 1,130 (weak) and 1,160 (strong).

A lot of you may not remember this but the Big Chart used to be just the spreadsheet in the right corner of StJs chart because I went 30 years without even looking at charts and was more accurate using my 5% Rule and a spreadsheet than all the other TA people combined.

Yesterday, we lost green boxes on the S&P and the Nasdaq and the Russell turned red - that's a BAD DAY - that's all you need to know about technicals. It wasn't bad enough to make us more bearish and neither are today's drops IF these lines hold (huge if). NYSE finished right at 10,049 but will be back at around 9,900 this morning.