Financial Markets and Economy

The stock market hasn't gotten over its addiction to QE (Business Insider)

It turns out the stock market hasn't gotten over its addiction to quantitative easing.

Outage at one of Australia's biggest banks leaves hundreds cashless (Mashable)

Outage at one of Australia's biggest banks leaves hundreds cashless (Mashable)

A system blackout at one of Australia's biggest banks, the Commonwealth Bank, has left many customers without access to their funds.

Angry clients took to Twitter and the bank's Facebook page Friday, reporting that the outage had left them unable to use their bank cards, banking apps, pay bills or withdraw money overseas. On the plus side, some wrote on social media that their credit card and mortgage debt balances seemed to have been reduced to zero.

Brazil’s economy will likely get worse before it gets better (Market Watch)

Brazil’s economy will likely get worse before it gets better (Market Watch)

Brazil is experiencing its worst economic downturn in 25 years. And, analysts say, it’s going to get worse before it gets better.

Standard & Poor’s Ratings Services suggested as much when they downgraded the country’s foreign-currency sovereign debt by a notch to “BB+,” leaving it in junk territory for the first time since 2008.

Why the Latest Economic Data Should Make You Relieved (Bloomberg)

Why the Latest Economic Data Should Make You Relieved (Bloomberg)

Ever since August’s selloff got going (perhaps due to concerns over China and the Fed) there have been questions about whether the market’s newfound volatility would hurt the real economy. The good news is that so far there’s no real evidence that all the whiplash is bleeding through, and two high-frequency data points published on Thursday highlight that point. Initial Jobless Claims came in at 275,000, a number that remains near historical lows and is smaller than it was a week earlier. Also, the latest reading of the Bloomberg Consumer Comfort Index was unchanged since the prior reading. So for now, you should be relieved.

Citi shared central bank info with clients: ex trader (Business Insider)

Citi shared central bank info with clients: ex trader (Business Insider)

Citigroup sent details of its central bank customers' trading activity to another client and handed out details of its foreign exchange order book to customers in electronic chatrooms, a former foreign exchange trader said in a witness statement to a London court on Thursday.

Perry Stimpson, a former Citigroup currency trader who is claiming unfair dismissal, said the practices, which breached client confidentiality, were well known by senior managers.

Lululemon shares tank as earnings show inventory at sky-high levels (Market Watch)

Lululemon shares tank as earnings show inventory at sky-high levels (Market Watch)

Lululemon Athletica, Inc. shares closed down 16.4% on Thursday, after the company’s second-quarter earnings beat Wall Street estimates but alarmed analysts by showing inventory at a sky-high level.

“Holy inventory, Batman!” was how Wolfe Research responded to the report.

Why Do We Care So Much More About Losing Money Than Making Money? (Forbes)

Buy low, sell high- It’s the simplest piece of advice that all investors have heard. However, when you factor in market volatility and the psychology of the average investor, it’s much easier said than done. In the wake of China’s “Black Monday,” volatility reached record highs triggering the largest outflow from long-term mutual funds in the U.S. since the “Taper Tantrum” in 2013. In total, $27.3 billion was pulled from funds, according to Bank of America Merrill Lynch.

One Chart That Shows How Petrified Everyone Is Over China (Bloomberg)

Investor concern over China has reached fever pitch.

The world's second-largest economy has become a scapegoat for the August bloodbath in global markets, which came hot on the heels of the shock devaluation of the yuan.

The market has never been more terrified of China (Business Insider)

The world has never been more afraid that China's economy will have a hard landing.

No, the 'death cross' isn't a guarantee of stock market doom (Business Insider)

One of the more feared technical indicators in markets is the "death cross", in which the 50-day moving average of a stock or index falls below its 200-day moving average. Death crosses are scary since the shorter term moving average falling below the longer term average signals bearish momentum in the market.

Don’t be so quick to blame this strategy for stock-market volatility (Market Watch)

Don’t be so quick to blame this strategy for stock-market volatility (Market Watch)

Blaming the investment strategy known as risk parity for surging market volatility and the underperformance of some equity funds has become fashionable, but it might stem from a misunderstanding about how the approach works.

Risk parity refers to a strategy in which portfolio allocations are made based on the risk of each holding rather than on the dollar amount of each holding. The strategy was pioneered by hedge-fund manager Ray Dalio’s Bridgewater Associates in the mid-1990s. Bridgewater, the largest hedge fund in the world, dubbed the result the “All Weather Portfolio.” A Bridgewater white paper offers a detailed account of the origin of the strategy.

Three Things To Look For In A Venture Capital Firm (Forbes)

Three Things To Look For In A Venture Capital Firm (Forbes)

The ability to attract the attention and support of a venture capital firm is a badge of honor for most entrepreneurs. The allure of an influx of capital and prestige that goes along with it can be quite strong, and it often puts entrepreneurs in the position of trying to convince potential VC partners of their viability and merit. But can that actually be a mistake?

Here’s the thing I’ve learned about real venture capital: if you have to go out of your way to convince VC investors that your business is worthy of their attention, you probably aren’t ready for their capital.

The stock market is in 'all or nothing' mode (CNN)

The stock market is in 'all or nothing' mode (CNN)

Investors have been taken on a wild ride this summer that's been nearly unprecedented.

The craziness was punctuated by the Dow's 1,000-point nosedive on August 24, its largest intraday point decline on record.

GE seeks sale of asset management arm amid industrial focus push (Business Insider)

GE seeks sale of asset management arm amid industrial focus push (Business Insider)

General Electric Co <GE.N> said on Thursday it would seek to sell its asset management arm, as the U.S. conglomerate continues to make moves to focus on its industrial products.

GE Asset Management had $115 billion in assets under management as of June 30, according to GE. GE said it would explore opportunities to sell the business to investment management firms.

Import price plunge gives yet another reason for Fed to delay hikes (Market Watch)

If Federal Reserve bigwigs want to put off an increase in interest rates in September, the surprisingly low level of inflation should give them plenty of reason to wait.

The world's largest stock-focused hedge fund might have to refund its investors (Business Insider)

The world's largest stock-focused hedge fund might have to refund its investors (Business Insider)

A $28 billion Boston-based hedge fund could be in the unusual position of having to hand out refunds to its investors at the end of the year.

Adage Capital Management, the biggest stock-focused hedge fund in the world, promises refunds to investors if the fund delivers subpar returns, according to The Wall Street Journal's Rob Copeland.

Krispy Kreme stock is getting crushed (CNN)

Krispy Kreme stock is getting crushed (CNN)

Krispy Kreme was once a cult favorite company for both doughnut aficionados and investing junkies. But not any more.

Shares of Krispy Kreme (KKD) plummeted 12% Thursday after the company reported sales and earnings that missed forecasts and gave an outlook that was, well, full of holes.

Politics

One Radical Idea for Fixing Brazil's Politics: an IMF Bailout (Bloomberg)

One Radical Idea for Fixing Brazil's Politics: an IMF Bailout (Bloomberg)

Stephen Jen has a proposal for Brazil to get out of the current economic mess: ask for a bailout from the International Monetary Fund.

Not that Brazil needs the funding, said Jen, a former IMF economist. Latin America’s largest economy holds $371 billion in foreign reserves, almost 10 times the amount of the government’s foreign-currency debt.

Jeb Bush’s Populist Tack on Taxes Finds Echoes in Unlikely Sources (NY Times)

Jeb Bush’s Populist Tack on Taxes Finds Echoes in Unlikely Sources (NY Times)

What do Jeb Bush, Elizabeth Warren and Donald J. Trump have in common? They would like to raise taxes on “the hedge fund guys.”

In his speech on tax policy on Wednesday, Mr. Bush, the former governor of Florida who is running for president, cast Republican orthodoxy adrift by proposing to raise taxes on the investment gains of high rollers in the Wall Street world of private equity and hedge funds.

Technology

The new Apple TV won’t change what you watch (Quartz)

The new Apple TV won’t change what you watch (Quartz)

When Steve Jobs introduced a major revision of the Apple TV streaming media device in 2010, he started by talking about what the company had learned about video from its customers since launching the first Apple TV three years earlier.

“The first thing is: The number one, two, and three thing they want, is they want Hollywood movies and TV shows whenever they want them,” Jobs said. “It’s that’s simple. It’s not really complicated. They want Hollywood movies and TV shows. They don’t want amateur hour. They want professional content.”

Health and Life Sciences

GM embryos 'essential', says report (BBC)

GM embryos 'essential', says report (BBC)

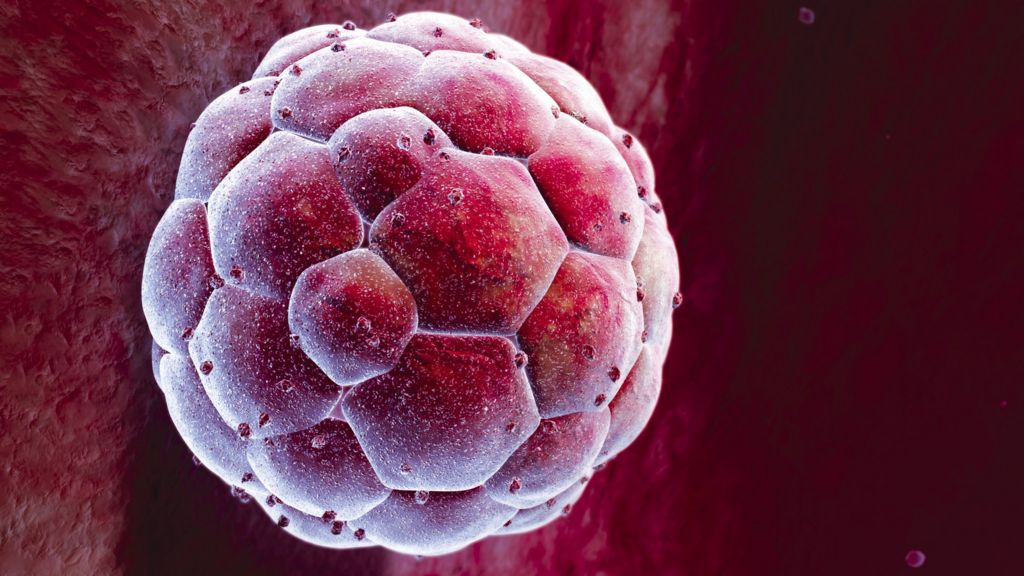

It is "essential" that the genetic modification of human embryos is allowed, says a group of scientists, ethicists and policy experts.

A Hinxton Group report says editing the genetic code of early stage embryos is of "tremendous value" to research.

It adds although GM babies should not be allowed to be born at the moment, it may be "morally acceptable" under some circumstances in the future.

A Pregnancy Souvenir: Cells That Are Not Your Own (NY Times)

A Pregnancy Souvenir: Cells That Are Not Your Own (NY Times)

Recently a team of pathologists at Leiden University Medical Center in the Netherlands carried out an experiment that might seem doomed to failure.

They collected tissue from 26 women who had died during or just afterpregnancy. All of them had been carrying sons. The pathologists then stained the samples to check for Y chromosomes.

Life on the Home Planet

Hungarian police caught on video tossing food at refugees (Mashable)

Hungarian police caught on video tossing food at refugees (Mashable)

Hungarian police officers were caught on camera haphazardly throwing food at refugees gathered at a food bank in the Röszke refugee camp.

In footage that emerged Thursday, officers can be seen tossing bags of food into a shouting crowd that included children waiting for aid to be distributed.

Ocean plants 'can help freeze clouds' (BBC)

Ocean plants 'can help freeze clouds' (BBC)

Scientists say tiny ocean plants could play a significant role in the formation of ice in clouds.

An international team has shown that the top few millimetres of the sea is rich in secretions from phytoplankton.

The group’s tests demonstrate that this microscopic material can nucleate ice crystals if lifted into the atmosphere by crashing waves and sea spray.