Financial Markets and Economy

German Bonds Stuck in Tightest Yield Range Since May Before Fed (Bloomberg)

German government bond yields moved in the narrowest range in more than four months on Tuesday as investors awaited the end of a Federal Reserve policy meeting that may result in the first U.S. interest-rate increase since 2006.

JPMORGAN: 1 in 12 Chinese loans will be in trouble when the bubble bursts (Business Insider)

JPMORGAN: 1 in 12 Chinese loans will be in trouble when the bubble bursts (Business Insider)

There's a lot of excess debt in China. And the JPMorgan Asia financials analysis team led by Josh Klaczek thinks it knows just how it will end.

The team estimates that the peak of China's credit cycle will see about one in 12 loans, or 8.2%, becoming "nonperforming," which is when borrowers are late with their interest payments and don't have a plan to pay them.

Aussie Run Ends as China and the Fed Loom (Bloomberg)

Global markets continue to be swayed by ongoing concerns about China and Thursday's U.S. interest rate decision. Weekend data on industrial production and investment is continuing to rattle Chinese investors with the Shanghai Composite posting its biggest two-day drop in three weeks. The probability of the Fed hiking the cost of borrowing remains at 28 percent, according to futures contracts, down from 54 percent in early August. Asian and European stocks alternated between gains and losses.

In one way, buying a house in Britain has never been cheaper than it is right now (Business Insider)

Two charts emailed out in a research note from HSBC economist Liz Martins paint two different and interesting pictures of the UK housing market right now.

German Investor Confidence Damped by Emerging-Markets Slowdown (Bloomberg)

German investor confidence fell for a sixth month in September, adding to signs that the slowdown in emerging markets threatens to drag on growth in Europe’s largest economy.

Russia just threw the book at Google, and Russian rival Yandex's stock is soaring (Business Insider)

Russia just threw the book at Google, and Russian rival Yandex's stock is soaring (Business Insider)

Google has been found guilty of violating Russian antitrust regulations.

In February, Russian's Federal Antimonopoly Service started investigating Google for its method of including its own apps with the Android operating system.

South African Current-Account Gap Eases to Four-Year Low of 3.1% (Bloomberg)

South Africa posted its smallest current-account deficit in four years in the second quarter as a weaker rand boosted exports and curbed consumers’ appetite for imports.

For Apple, Boring Still Sells (The Atlantic)

For Apple, Boring Still Sells (The Atlantic)

As it has gone every year since 2007, when the first iPhone was announced, last week’s Apple event generated a lot of chatter. This year, though, some of that chatter took on a different tone. Some critics hissed at what they saw as paltry changes to their beloved device. Reactions to the iPhone 6S included: It’s boring. It looks pretty much the same as before. The changes are incremental at best. There’s no “killer new feature.” There’s a fancy new camera, but so what? (As my colleague Rob Meyer has noted, this is totally acceptable.)

Iraq Asks Oil Companies to Submit Lower 2016 Budgets by Sept. 30 (Bloomberg)

Iraq asked oil companies to reduce their 2016 spending plans in the country by Sept. 30, citing lower oil prices and government revenue.

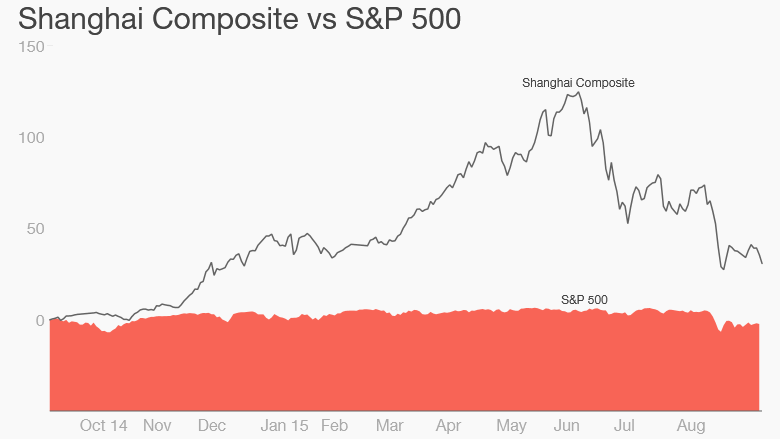

China stocks have plunged 6% in two days (CNN)

China stocks suffered another round of heavy losses on Tuesday, renewing concerns over government efforts to support markets.

The Shanghai Composite shed 3.5% on Tuesday, bringing losses for the week to 6%. Declines have been even steeper on the smaller Shenzhen Composite, which has lost more than 11% over the past two trading sessions.

U.K. Stocks Little Changed as Ocado Climbs, Kingfisher Declines (Bloomberg)

U.K. stocks declined for a fourth day, with commodity producers leading losses as metals prices hovered near lows amid investor concern about slowing Chinese demand.

Cash may be a sanctuary in this fear-ridden stock market (Market Watch)

Cash may be a sanctuary in this fear-ridden stock market (Market Watch)

As retail investors wring their hands in Fed angst, it’s quite possible the big boys have their ears and hind legs up, ready to pounce.

That’s at least what some are thinking, as cash seems ever so popular right now. Perusing some Riskalyze data, Reformed Broker’s Joshua Brown notes that flows to cash were up 8.5% in the past week, a “noteworthy jump.”

Currency Speculators Leave Danish Bond Market in Liquidity Limbo (Bloomberg)

Denmark may have won the fight against speculators betting its euro peg won't hold. But the country's bonds will continue to suffer for a while yet.

Bank of Japan sparks more stimulus talk as emerging markets weaken (Market Watch)

Bank of Japan sparks more stimulus talk as emerging markets weaken (Market Watch)

The Bank of Japan says slowing emerging economies are undermining Japanese exports and production, a gloomy assessment that is giving some investors a stronger impression that additional easing may be coming soon, though Gov. Haruhiko Kuroda offered no hints Tuesday of any looming action.

Signs are growing that China’s slowdown is ricocheting across the global economy, hampering a recovery in Japan’s sputtering economy and possibly even pushing it toward a second-straight quarter of negative growth. In a statement released after a two-day policy meeting at which no new action was taken, the central bank downgraded its assessment of exports and industrial production, saying their recovery has stalled because of weakening emerging economies.

European Index Futures Little Changed After Three-Day Stock Drop (Bloomberg)

European stocks fluctuated, swinging between gains and losses before a Federal Reserve rate decision on Thursday.

If you have to buy stocks, pick these four industries (Market Watch)

The U.S. stock market has pared losses suffered in the six-day decline that started Aug. 17. So now what should investors do?

Rupee Drops Most in a Week as Stocks Witness Outflows Before Fed (Bloomberg)

Indias rupee dropped the most in a week amid outflows from local stocks ahead of the Federal Reserves rate-setting meeting.

Must-know money lessons from this volatile stock market (Market Watch)

Stock market declines are unsettling, but they also can teach important lessons. For starters, precarious markets remind us that volatility is normal. A second lesson is to find your comfort level. And third, if your portfolio is off-balance, then rebalance now.

Why Everyone is Suddenly Talking About Financial Conditions (Bloomberg)

Why Everyone is Suddenly Talking About Financial Conditions (Bloomberg)

Most economists who expect the Federal Reserve to hold off from raising interest rates on Thursday point to more restrictive financial conditions in the wake of August's market turmoil as a key reason to refrain from liftoff.

"The recent volatility in financial markets introduces a new wrinkle into the Fed’s calculus," wrote Neil Dutta, head of U.S. economics at Renaissance Macro Research, for example. "The Fed does not want to send a firecracker into fragile capital markets nor do they want to give the impression that they are captive to markets either."

Dubai Diamond Finance Seen Growing as Antwerp Loses Gem Lender (Bloomberg)

Dubai’s diamond trade will grow as the Middle East emirate attracts dealers from the industry’s traditional hub in the Belgian port of Antwerp after one of the city’s main gem lenders closed, depriving buyers of needed financing, according to National Bank of Fujairah.

Ruble Strengthens Most in Emerging Markets as Volatility Jumps (Bloomberg)

The ruble strengthened the most in emerging markets as oil advanced amid wagers the Federal Reserve will hold off raising interest rates this week.

Here's a quick guide to what traders are talking about right now (Business Insider)

US Futures are basically flat, with large caps outperforming smalls early – this mirrors tentative action in Europe, as traders eyeball holiday volumes and the FOMC in 2 days. The DAX is gaining 40bp as Consumer and Tech shares rally despite German economic optimism dropping sharply. Utilities in Europe are under solid pressure, with the index off 2% on headlines they are €30b short of requirements for Nuclear clean-up costs (Spiegel). European equities have been softening as investors rotate towards Bunds, and Miners weigh on the FTSE, with Glencore off ~7%, and Rio/BHP off 3%. Over in Asia, Shanghai lost 3.5%, and Shenzen 5% with every sector dropping – Steel, technology and defense sectors led the decline. China’s weakness spread to other exchanges, with Nikkei giving up early gains – Aussie lost 1.5% as it coped with a new PM and downbeat minutes from their Central Bank, and while Korea rallied small, most Emerging Markets were under pressure.

Poised for Rate Increase, Investors Hope for Small Ripples (NY Times)

Poised for Rate Increase, Investors Hope for Small Ripples (NY Times)

The moment that Wall Street has long been dreading could happen this week.

The Federal Reserve on Thursday may increase interest rates for the first time in more than nine years. A rise would be the beginning of the end of a monetary stimulus policy that lifted stock and bond markets to new heights and brought the good times back to Wall Street after the crash of 2008.

Politics

The Margin: Trump’s ‘face’ comment has been etched into Carly Fiorina’s campaign (Market Watch)

The Margin: Trump’s ‘face’ comment has been etched into Carly Fiorina’s campaign (Market Watch)

Just last week, a Rolling Stone cover story revealed Donald Trump taking a swipe at Fiorina’s looks (though he claims he was only talking about her “persona”). It quoted Trump as saying, as he watched his Republican rival on television: “Look at that face! Would anyone vote for that? Can you imagine that, the face of our next president?!”

Fiorina brushed it off. “Maybe I’m getting under his skin a little bit, because I am climbing in the polls,” she said.

What the Republicans are saying about taxes (CNN)

What the Republicans are saying about taxes (CNN)

Carried interest, flat tax and fair tax.

The Republican candidates for president have been throwing around a lot of unfamiliar terms as they roll out their plans to reform the nation's tax system. And they'll likely talk more about these proposals at Wednesday's debates on CNN.

Technology

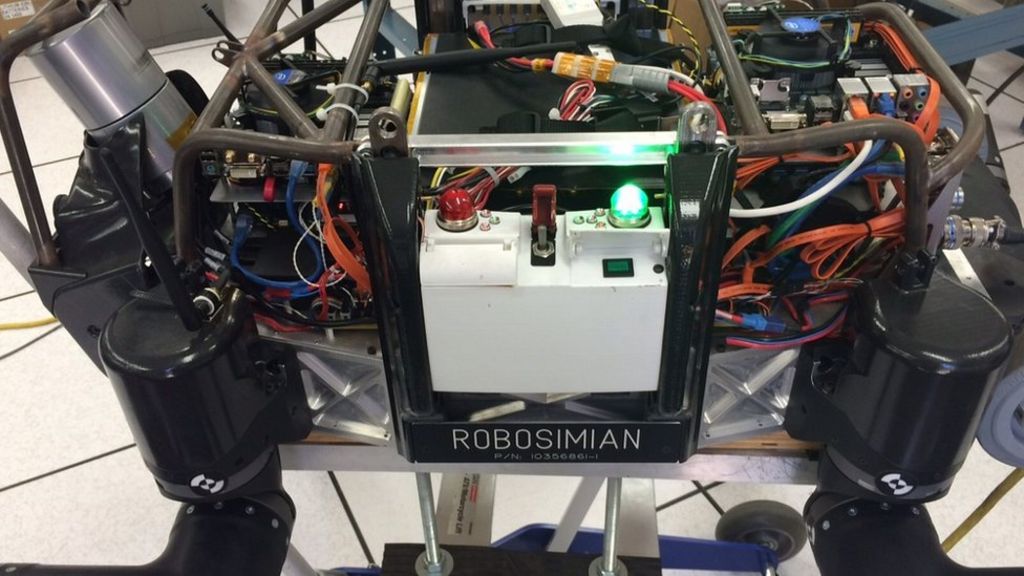

How safe can artificial intelligence be? (BBC)

How safe can artificial intelligence be? (BBC)

If Hollywood movies are your only guide to Artificial Intelligence, we face a terrifying future in which machines become so clever that they dominate or even destroy us.

And influential figures have added fuel to the fire: Stephen Hawking says AI could spell the end of the human race while the genius entrepreneur Elon Musk says it is "like summoning the demon".

So, does this make conquest by computer inevitable?

Technology doesn't make school pupils smarter, study says (Phys)

Technology doesn't make school pupils smarter, study says (Phys)

Computers do not noticeably improve school pupils' academic results and can even hamper performance, an OECD report said Tuesday that looked at the impact of technology in classrooms across the globe.

While almost three quarters of pupils in the countries surveyed used computers at schools, the report by the the Organisation for Economic Cooperation and Development found technology had made no noticeable improvement in results.

Health and Life Sciences

Restaurant report card: Antibiotics in meat (CNN)

Restaurant report card: Antibiotics in meat (CNN)

A new report is sounding the alarm about the use of antibiotics in the meat and poultry supply chains of the 25 largest U.S. fast food and "fast casual" restaurants.

Most top U.S. restaurant chains have no publicly available policy to limit regular use of antibiotics in their meat and poultry supply chains, according to the "Chain Reaction" report by Friends of the Earth, the Natural Resources Defense Council and four other consumer interest, public health and environmental organizations.

Psychiatrist Shortage Worsens Amid 'Mental Health Crisis' (Forbes)

The demand for psychiatrists is becoming a more pressing issue for state and federal lawmakers and has contributed to an expansion of insurance coverage of telehealth to increase access to mental health services in shortage areas.

Companies who recruit doctors for health facilities say psychiatrists are almost as desired as primary care doctors, which have for years been the most in-demand physicians in the health care labor market.

Expert Panel Recommends Daily Aspirin to Prevent Cancer (Time)

Expert Panel Recommends Daily Aspirin to Prevent Cancer (Time)

Doctors have long recommended taking a low-dose aspirin daily to reduce the risk of heart problems, but in the past year, those recommendations have seen reversals, with some experts saying that for people who have not had a cardiac event, a daily aspirin isn’t not only unnecessary—it’s dangerous. And it won’t prevent a first heart attack.

Now, an expert panel, United States Preventive Services Task Force, is recommending daily aspirin to prevent heart attacks, stroke, and colorectal cancer.

Life on the Home Planet

Progress in Africa Will Help Ease the Global Migrant Crisis (Time)

Progress in Africa Will Help Ease the Global Migrant Crisis (Time)

Images of refugees attempting to reach Europe through any and all possible means have dominated global media for weeks. Yet recent action by EU leaders to address this crisis, although laudable, in no way addresses the underlying challenges fueling the waves of migrants heading for European shores.

Most of the migrants are refugees from war-torn Syria in the Middle East, but thousands of others are actually from my continent—Africans seeking better economic opportunities. The images of whole families carrying little more than the clothes on their backs trekking through an unforgiving desert and sailing across a perilous sea to reach Europe is juxtaposed against the preeminent narrative of the last decade of “Africa rising.”

Border protest: 'No food, no water' (BBC)

Border protest: 'No food, no water' (BBC)

Migrants who have been stopped at the Serbian border have started to protest at not being allowed to cross to Hungary.

Some people were holding up signs reading "No food" and "No water", in what appeared to be a hunger strike.