Financial Markets and Economy

Goldman's Blankfein Says Data Not Compelling for a Rate Increase (Bloomberg)

Goldman's Blankfein Says Data Not Compelling for a Rate Increase (Bloomberg)

U.S. economic data don’t support the case for higher interest rates, Goldman Sachs Group Inc. Chief Executive Officer Lloyd Blankfein said.

The Federal Reserve’s end of quantitative easing and higher taxes have acted as a brake on the economy and a form of tightening, Blankfein said Wednesday at a breakfast in New York sponsored by the Wall Street Journal.

Stocks are barely higher (Business Insider)

Stocks are barely higher (Business Insider)

Stocks opened higher and are nearly flat in early going on Wednesday, day one of the FOMC's two-day policy meeting.

Near 9:52 a.m. ET, the Dow was up 11 points, while the S&P 500 and the Nasdaq were pretty much flat.

Trading volumes on the New York Stock Exchange over the past two days have dropped comparatively (Monday was the lowest level in a month), and strategists have noted that traders are standing by for the Fed's interest rate decision tomorrow.

Crude oil gains ahead of supply data (Market Watch)

Crude oil gains ahead of supply data (Market Watch)

Oil futures rose Wednesday but will likely bob sideways as the market waits to take cues from the results of the U.S. Federal Reserve’s two-day meeting that ends Thursday.

Crude futures for delivery in October CLV5, +5.40% traded at $45.29 a barrel, up 70 cents or 1.6%, while November Brent crude LCOX5, +4.61% on London’s ICE Futures Exchange rose 57 cents, or 1.2%, to $48.32 a barrel.

Gold Market Freezes With Tightest Trading Range in Eight Years (Bloomberg)

There’s so little appetite for gold that prices are moving the least since 2007.

Spot prices fluctuated in a $8.05 range on Monday and Tuesday, the smallest move in eight years, according to data compiled by Bloomberg. Volume on the Comex this week dropped to the lowest level of 2015, amounting to about half the daily average. Bullion for immediate delivery added 0.2 percent to $1,108 an ounce by 12:46 p.m. in London.

Homebuilder sentiment is at a 10-year high (Business Insider)

Homebuilder sentiment is at a 10-year high (Business Insider)

Homebuilder sentiment is at a 10-year high.

The index from the National Association of Homebuilders was 62 for September. It is based on a survey of members and aims to gauge their outlook on the single-family housing market.

Economists had estimated that the index was unchanged from the prior month at 61, a nine-year high.

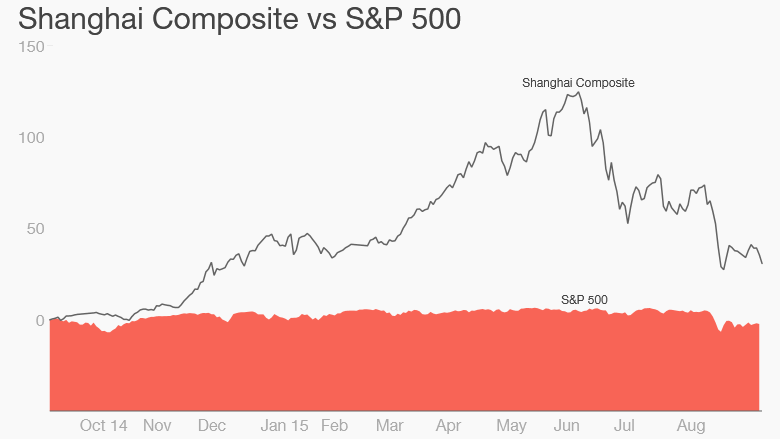

China Rebounds as the Fed Wait Ends (Bloomberg)

The long wait is almost over. The Federal Reserve begins its two-day policy meeting on interest rates today and economists surveyed by Bloomberg are split on the outcome. Traders seem more certain, putting the probability of a rate hike at 32 percent, according to futures contracts. That's up from 26 percent on Monday but below odds of 48% the day before China devalued the yuan in August.

Futures flat as investors hold off ahead of Fed meeting (Business Insider)

Futures flat as investors hold off ahead of Fed meeting (Business Insider)

U.S. stock index futures were little changed on Wednesday as investors held off on making big bets ahead of the two-day Federal Reserve meeting that will decide on an interest rate hike.

All eyes will be on the Fed as it begins its meeting later on Wednesday and holds a conference on Thursday, when it will announce if it will raise long-term interest rates for the first time since June 2006.

Japan's Debt Ratings Downgraded at S&P (Bloomberg)

Standard & Poor’s cut Japan’s long-term credit rating one level to A+, saying it sees little chance of the Abe government’s strategy turning around the poor outlook for economic growth and inflation over the next few years.

How to spot a bear market before it hits (Market Watch)

How to spot a bear market before it hits (Market Watch)

By the time most investors realize a bear market has taken hold of stocks, much of the damage has been done.

Often, stealth bear markets begin while a bull market is still on its last legs. Mark D. Cook, coauthor of our book, “Prepare Now and Survive the Coming Bear Market”,included 11 stages that tell you the bear is approaching.

U.S. oil extends gains on stock-draw, Brent muted on weak Asia economy (Business Insider)

U.S. oil extends gains on stock-draw, Brent muted on weak Asia economy (Business Insider)

U.S. oil prices extended gains in Asia on Wednesday on an unexpected stockpile draw and higher gasoline prices, while international crude markets remained weak on the back of low growth expectations.

Australian bank Macquarie said that China's economic outlook for the fourth quarter of the year was muted.

Fed Stress Tests World Economy Weaker Than in Past Cycles (Bloomberg)

The world economy is about to be stress tested.

Exec at China's top brokerage caught in probe (CNN)

The president of China's largest brokerage has been caught in Beijing's widening probe of insider trading.

Cheng Boming, the president of Citic Securities, is being investigated for "insider dealing and leaking inside information," the company said in a stock exchange filing.

European Index Futures Indicate Equities to Advance Second Day (Bloomberg)

European shares looks set to extend gains for a second day, as investors count down to the Federal Reserves interest rate decision, according to stock-index futures.

Get ready for a stock market rally in Brazil (Market Watch)

Get ready for a stock market rally in Brazil (Market Watch)

Bear market rallies can be a great way to make money.

No, this isn’t about Warren Buffett-style long-term investing. That’s not the only way to win.

Instead, it’s about the old one-two punch.

Glencore Sells Shares to Raise 1.6 Billion and Reduce Debt (Bloomberg)

Glencore Plc sold $2.5 billion of new shares to pay down debt to help protect its credit rating amid a rout in commodities prices.

Apple’s iPhone payment plan could upgrade the stock (Market Watch)

Apple’s iPhone payment plan could upgrade the stock (Market Watch)

Apple Inc.’s new iPhone upgrade program isn’t going to just benefit users who want to get their hands on a new phone every year, it could also give a boost to Apple investors.

By encouraging customers to upgrade more frequently, the program — which takes effect later this month with the launch of iPhone 6S and iPhone 6S Plus sales — could produce more sustainable iPhone revenues, driving earnings per share higher and producing a better stock multiple. Analysts at UBS, who have a buy rating and $150 price target on the stock, said this week that the installment plan “could be a big deal” for Apple AAPL, +0.12% and drive its shares higher than $200.

Emerging Stocks Rally as U.S. Data Boosts Confidence; Won Climbs (Bloomberg)

Emerging-market assets jumped, with the benchmark equities index rising to the highest level this month and currencies set for the longest rally since early 2014, as Chinese shares rallied in the last hour of trading and investors awaited the Federal Reserve’s interest-rate decision.

Gold futures tip higher after CPI report (Market Watch)

Gold futures tip higher after CPI report (Market Watch)

Gold futures pushed higher in early trade Wednesday after a consumer-price report suggested that inflation might be short of the Federal Reserve’s target levels to support a rate hike. That may be good news for gold prices.

The Fed has been keenly watching employment and inflation as two key gauges to help influence its plans for kicking off the first interest-rate hike in nearly a decade. The tick down in inflation Wednesday may give some support to the camp that believes the so-called economic data-dependent central bank may hesitate to implement tighter monetary policy if it isn’t confident inflation is headed to its target 2% level.

Art Investment Platform Draws Crowd funders into the Scene (Bloomberg)

Art Investment Platform Draws Crowd funders into the Scene (Bloomberg)

Online platforms and social media are making it easier than ever to invest in original art.

Art:i:curate is a London- and New York-based startup injecting crowdfunding methods to finance emerging artists, giving anyone access to art investment.

The world's largest brewer wants to buy the world's 2nd-largest brewer to form a global brewing behemoth (Business Insider)

The world's largest brewer wants to buy the world's 2nd-largest brewer to form a global brewing behemoth (Business Insider)

The maker of Bud Light is interested in getting together with the maker of Miller Lite.

Shares in the brewing giant SABMiller just exploded upward after the company confirmed that its rival drinks giant Anheuser-Busch InBev is planning to buy the company.

Politics

Meet the New Hillary (The Atlantic)

Meet the New Hillary (The Atlantic)

Hillary Clinton, the once-inevitable Democratic nominee, has lately hit some snags. She is plummeting in the polls; her campaign lacks direction. So Hillary—I’m going to call her Hillary, like it says on her signs—would like to start over. She’s rolling out a new persona: spontaneous, funny, relatable, personable. A regular person, just like the good people of Milwaukee, who have come to see her on a drizzly September weekday.

Obama to press Republicans to end ‘carried interest’ tax break (Market Watch)

Obama to press Republicans to end ‘carried interest’ tax break (Market Watch)

President Barack Obama is preparing to join the fight over the federal budget by pushing Republicans to scrap a tax advantage for private-equity Masters of the Universe.

In a speech on Wednesday, Obama is expected to call on the GOP to end the tax break for so-called carried interest, the New York Times writes. He’ll call for using the funds to pay for spending increases on domestic and national security programs, and will enlist business leaders to help him make his case.

Technology

Samsung’s foldable ‘Project Valley’ smartphone leaks, hints at January unveiling (Venture Beat)

Samsung’s foldable ‘Project Valley’ smartphone leaks, hints at January unveiling (Venture Beat)

While this isn’t the first we’re hearing about Samsung’s elusive and top-secret foldable smartphone project, code-named “Project Valley,” a new leak surfaced Tuesday on Chinese microblogging site Weibo purporting to show the device.

We first caught wind that Samsung may be working on the odd smartphone in late March, when Business Korea reported a Samsung official as hinting, “The industry believes that the commercialization of foldable smartphones will be possible in 2016.”

Stealthier Stealth? Seventh Upgraded Chinese Stealth Fighter Prototype Aims to take Flight (Popular Science)

Stealthier Stealth? Seventh Upgraded Chinese Stealth Fighter Prototype Aims to take Flight (Popular Science)

2016 First Look

Jeff Head at Sinodefence Forum

"2016" makes its first debut, with noticeable improvements, such as apparently changed DSI bumps on the intakes (though blurry photo quality makes a certain judgment difficult).

Health and Life Sciences

How video games can change your brain (BBC)

How video games can change your brain (BBC)

The video game industry is a global phenomenon. There are more than 1.2 billion gamers across the planet, with sales projected soon to pass $100bn (£65bn) per year.

The games frequently stand accused of causing violence and addiction. Yet three decades of research have failed to produce consensus among scientists.

In laboratory studies, some researchers have found an increase of about 4% in gamers' levels of aggression after playing violent games.

These 2 questions quickly identify delirium (Futurity)

These 2 questions quickly identify delirium (Futurity)

Asking just two questions can help nurses and doctors quickly and easily identify delirium in hospitalized older adults.

Delirium is a reversible cognitive condition that can be resolved if caught and treated early.

“Delirium can be very costly and deadly—and with high-risk patients, time matters,” says Donna M. Fick, professor of nursing and co-director of the Hartford Center of Geriatric Nursing Excellence at Penn State. “Our ultra-brief two-item bedside test for delirium takes an average of 36 seconds to perform and has a sensitivity of 93 percent.”

Life on the Home Planet

Delhi battles dengue fever surge (BBC)

Delhi battles dengue fever surge (BBC)

The Indian capital, Delhi, is in the grip of the worst outbreak of dengue fever in five years, officials say.

More than 1,800 cases have been recorded in recent weeks, compared to 1,695 cases for all of 2010. Five deaths have been reported so far.

The mosquito that carries the dengue virus breeds in containers with clear, stagnant water.

Humor

Millions Watch American Democracy’s Final Episode (Andy Borowitz, The New Yorker)

Millions Watch American Democracy’s Final Episode (Andy Borowitz, The New Yorker)

American democracy, a long-running institution whose popularity endured for over two hundred years, drew millions of viewers to its final episode Wednesday night.

While the official ratings for democracy’s finale will not be available until Thursday, initial reports indicated that a larger than expected number tuned in to witness the last moments of the nation’s system of government.