Financial Markets and Economy

Caterpiller Warns: Bad news is 'converging' and now we have to make some major changes (Business Insider)

Caterpillar has some bad news.

On Thursday, the industrial giant announced plans for it to cut as many as 10,000 jobs as part of a restructuring plan in the face of what it called "a convergence of challenging marketplace conditions in key regions and industry sectors — namely in mining and energy."

Charting the Markets: Riskier Assets Drop Before Yellen Speech (Bloomberg)

Fed Chair Janet Yellen delivers a speech today in Amherst, Massachusetts, and any clues on when the U.S. central bank is likely to raise interest rates will be welcomed by investors around the world. Global stocks, as measured by the MSCI All Country World Index, fell for a fifth day, the longest losing streak for a month. The Japanese yen and gold are today's preferred haven trades.

How GDP shares have shifted across the world since 1000 AD (Business Insider)

It's no secret that the world's economic center of gravity has been shifting east ever since the 1950's.

Gold eyes second straight gain ahead of Yellen speech (Market Watch)

Gold eyes second straight gain ahead of Yellen speech (Market Watch)

Gold futures were picking up modest gains Thursday as global stocks turned lower and as the market awaited comments from Federal Reserve Chairwoman Janet Yellen, who is slated to speak Thursday afternoon.

December gold GCZ5, +1.95% picked up $5.50, or 0.5% to $1,137 an ounce, aftersnapping a two-day losing streak Wednesday, while December silver SIZ5, +1.60%lost 2 cents, or 0.1%, to trade at $14.77 an ounce.

South African Rand at Record Low on Euro, Slumps Against Dollar (Bloomberg)

South Africa’s rand tumbled to a record against the euro and traded near its lowest levels against the dollar and the pound on Thursday.

Why this market is stuck in a ‘nervous zone’ (Market Watch)

Why this market is stuck in a ‘nervous zone’ (Market Watch)

The scaredy-cats say the bear market has started, while the Pollyannas emphasize we’re not nearing recession, so stocks soon will scamper higher.

Or the middle ground between these two extremes might best describe this market.

It’s neither crash time nor rally time, according to S&P Capital IQ’s Sam Stovall. At his shop, they “aren’t looking for a bear market, just a deeper correction,” he said in a note late Wednesday.

Durable goods orders fall less than expected in August (Business Insider)

Durable goods orders fall less than expected in August (Business Insider)

Durable goods orders fell less than expected in August, falling 2% while "core" durable goods orders declined by 0.2%.

Expectations were for the report to show orders fell 2.3% in August after a 2.2% increase in July.

July's number, however, was revised lower to show a 1.9% increase.

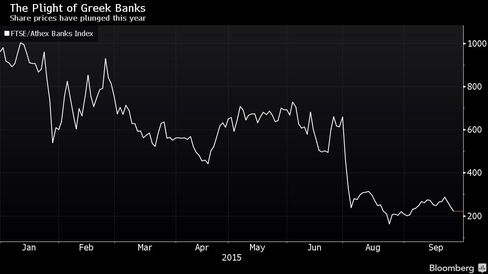

Greek Banks Said to Face Recapitalization at High End of Target (Bloomberg)

Greek banks are being told by auditors some of their assets are overvalued, meaning they may have to raise close to the maximum 25 billion euros ($28 billion) allocated for their recapitalization this fall, people familiar with the matter said.

Glencore is getting crushed after Goldman Sachs says its credit rating might be screwed (Business Insider)

Glencore shares fell 7% this morning after a Goldman Sachs analyst note cast doubt on the mining company's ability to maintain its BBB investment-grade bond credit rating.

North Dakota hit by falling oil prices (CNN)

North Dakota hit by falling oil prices (CNN)

The oil rigs in North Dakota are vanishing, a sign that the slide in oil prices is taking a big toll.

There are now only 68 rigs operating in the state, down 65% in the past year, according to state figures.

Apple and ‘frenemies’ cut out the middle man: wireless carriers (Market Watch)

Apple and ‘frenemies’ cut out the middle man: wireless carriers (Market Watch)

Apple Inc., Google Inc. and China’s Xiaomi Inc. are taking strategic steps to safeguard their revenue streams and attract new customers, at the expense of traditional wireless carriers.

No longer do the two sides of the mobile coin — the actual device and the wireless data that powers its functionality — live in separate but mutually beneficial worlds. As companies like Apple AAPL, -1.01% take greater control of hardware sales, and others buy swaths of data to sell directly to consumers, they are pushing out the traditional carrier.

Here's Why Fed and BoE Liftoffs Will Probably Look Very Similar (Bloomberg)

Here's Why Fed and BoE Liftoffs Will Probably Look Very Similar (Bloomberg)

Forward guidance as a concept had much to recommend it. The theory was that by communicating their thinking, central bankers would allow markets to more accurately price in the trajectory of interest rate hikes and through this, smooth the path to rate normalization.

The problem that they encountered was that transparency is not the same as clarity. Instead, it has proven to be synonymous with complexity.

Volkswagen's shares are going crazy (Business Insider)

Volkswagen's share chart is starting to look like a roller coaster.

It's barely lunchtime on Thursday in Europe, but VW has already popped 8%, crashed to -1.2%, and is now rallying again.

Japan stocks fall, led by car makers (Market Watch)

Japan stocks fall, led by car makers (Market Watch)

Shares in Japan fell Thursday, tracking regional losses earlier this week, as the fallout from Volkswagen AG’s diesel-emissions scandal hit Japan’s auto-related sectors.

The Nikkei Stock Average NIK, -2.76% ended down 2.8%, as trading resumed after a three-day holiday.

Russian Stocks Slide as Putin Tax Concern Sends Miners Slumping (Bloomberg)

Russian stocks headed for their longest streak of losses in more than a year as the nation’s biggest mining companies fell on concern they may be targeted in a government drive to extract more taxes to cover a budget shortfall.

Here's how much private debt countries have racked up since the financial crisis (Business Insider)

Citi Research's latest global economic outlook is out, and it's crammed full of interesting data and charts on the state of the world right now. One of those charts shows how much private debt countries have accumulated since 2008.

A Big Bet That China’s Currency Will Devalue Further (NY Times)

A Big Bet That China’s Currency Will Devalue Further (NY Times)

When Mark L. Hart III, a hedge fund investor based in Texas, makes an investment bet, he does it in the style of his home state: big time.

Since 2007, his winners have included high-risk, high-return wagers that the United States housing market would collapse and that Greece would go bankrupt.

Flash-Crash Trader Faces Fight to Stop Extradition to the U.S. (Bloomberg)

Flash-Crash Trader Faces Fight to Stop Extradition to the U.S. (Bloomberg)

Navinder Singh Sarao is used to fighting other traders on the stock markets. The 36-year-old faces a much tougher battle Friday when his lawyers try to convince a London judge he shouldnt be extradited to the U.S. to face criminal charges.

A one-day hearing will determine whether the U.S. has grounds to force Sarao to leave the U.K. to face a 22-count indictment for fraud and market manipulation. Whatever the outcome at London’s Westminster Magistrates’ Court, an appeal is certain, according to lawyers.

Whole Foods could use the help of an activist investor to whip it into shape (Business Insider)

Whole Foods could use the help of an activist investor to whip it into shape (Business Insider)

Fighting off new competitors, lawsuits over pricing fraud, and poor earnings have plagued specialty grocery store Whole Foods in the past few months. And now, analysts are starting to lose hope for a turnaround.

Deutsche Bank conducted a "detailed" risk/reward analysis on specialty grocery store Whole Foods and came away bearish on the company's growth prospects.

Oil Companies in Europe Seek Creative Funding as Lenders Retreat (Bloomberg)

Oil services companies in Europe are finding alternative ways to raise cash and repay debt after falling crude prices made it difficult for them to get funding from traditional sources.

Europe bounces back (Business Insider)

Europe bounces back (Business Insider)

After tanking on Tuesday, Europe's stock markets are rallying on Wednesday.

The FTSE 100 just closed up 1.62% in London, while Germany's DAX is up 0.42%, France's CAC 40 is up 0.16%, and the Euro Stoxx 50 is up 0.11%.

In the driving seat, once again, is Volkswagen. After dragging shares down yesterday, arebound for VW has helped boost confidence today.

U.K. Stocks Little Changed After Swinging Between Gains, Losses (Bloomberg)

The rout that’s affecting miners is showing no signs of abating, dragging U.K. shares down for a second time in three days.

South Korean Stock Trading Surges With Small Companies in Focus (Bloomberg)

Trading on South Korea’s stock exchange surged amid speculation investors are reshuffling portfolios to include small-capitalization companies.

Wanted: Fed Officials Who Care Less About Bond Market Volatility (Bloomberg)

Damned if you hike, damned if you hold.

Such may be the feeling inside the Federal Reserve a week since it met the expectations of financial markets by postponing its first interest-rate increase since 2006, in part because “financial developments” threaten to impede growth and inflation.

Emerging Stocks Set for Fourth Day of Losses as Thai Baht Slides (Bloomberg)

Price swings in emerging-market stocks widened to the most in four years and currencies slid to a record in a sign the Federal Reserve’s decision to delay an interest-rate increase is leaving investors more nervous instead of calming them.

Why Shippers Are Turning to LNG-Powered Vessels (Bloomberg)

When TOTE Inc., a shipper that operates between the U.S. and the Caribbean, launched its latest container ship last month, the 760-foot craft carried a certain distinction: It’s only the second of the massive vessels worldwide fueled by liquefied natural gas.

Futures are getting smoked (Business Insider)

Stock futures are sliding ahead of the market open on Thursday.

Near 8:53 a.m. ET, Dow futures were down 142 points, S&P 500 futures were off 15 points, and Nasdaq futures was off 38. The three indexes were down nearly 1%, and its a 5th straight down day on Wall Street.

_edited-1.png)

Politics

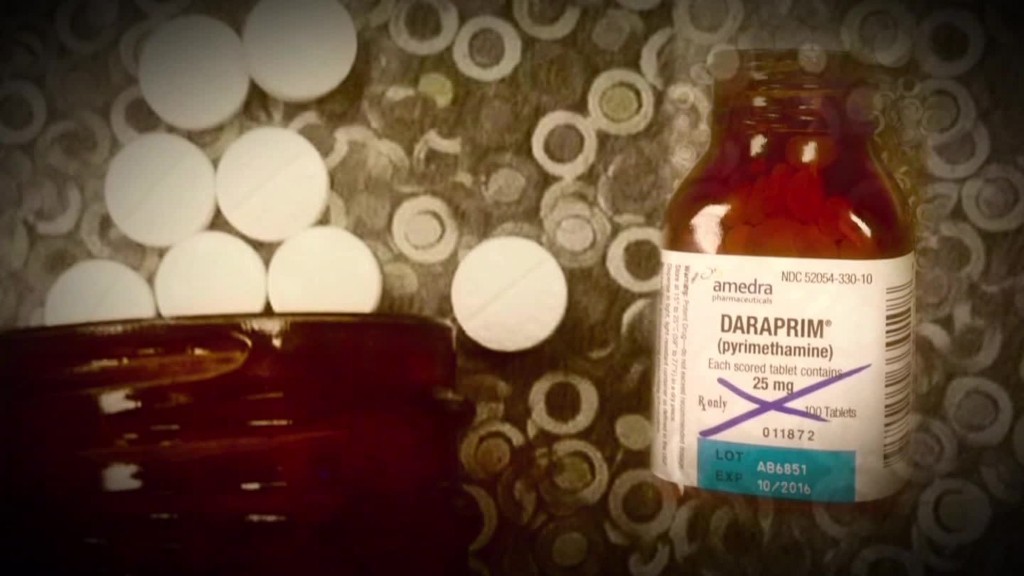

Donald Trump trashes former hedge-fund guy who jacked up drug price: 'He looks like a spoiled brat' (Business Insider)

Donald Trump trashes former hedge-fund guy who jacked up drug price: 'He looks like a spoiled brat' (Business Insider)

Republican presidential front-runner Donald Trump on Wednesday lit into Martin Shkreli,the hedge-fund-manager-turned-pharmaceutical-CEO who came under fire this week for raising a 62-year-old drug's price from $13.50 to $750 per pill.

"He looks like a spoiled brat to me," Trump told reporters at a press conference in South Carolina, where he spent the day campaigning. "You want to know the truth? He looks like a spoiled brat."

Hillary Clinton's plan to lower Americans' medical costs (CNN)

Hillary Clinton's plan to lower Americans' medical costs (CNN)

A day after taking on price gouging by drug companies, Hillary Clinton unveiled a plan to help Americans' afford the rising cost of seeing the doctor.

Under the Democratic presidential candidate's proposal, patients would be able to visit the doctor three times a year without having to meet their deductible first. Also, they could apply for a new tax credit of up to $5,000 if they face excessive costs, the campaign said Wednesday.

Technology

AI Helps Humans Best When Humans Help the AI (Wired)

AI Helps Humans Best When Humans Help the AI (Wired)

Clara’s creators bill it as “the first intelligent, natural language interface that feels human—a virtual employee you can depend on.” Starting today, after months of private testing, it’s available to the world at large. I first noticed it about a year ago, when Techcrunch, the popular tech tabloid, said the company behind the tool, Clara Labs, had landed some funding from big-name venture capital firm Sequoia Capital.

Drones vs. driverless cars: A tale of two robotics policies (Market Watch)

Drones vs. driverless cars: A tale of two robotics policies (Market Watch)

When a 2-pound drone crashed on the White House lawn in January, the nation was thrown into drone hysteria.

That drone was a $1,000 model made by Chinese technology company DJI, but a basic camera-equipped drone can be had for $40—a fact not lost on those who pontificated about the crash. “It’s pretty worrisome if you’re in the Secret Service, you’re in law enforcement, a drone comes in and you don’t know if this is some 14-year-old kid who got a drone or if this is some al Qaeda sympathizer wanting to send a message,” CNN’s Wolf Blitzer said at the time.

Health and Life Sciences

Stem cell ‘organoid’ mimics developing brain (Futurity)

Stem cell ‘organoid’ mimics developing brain (Futurity)

Scientists are using stem cell-derived tissue models to reduce the number of drug failures in clinical trials. The findings offer a cost-effective approach for assessing chemical safety.

The researchers have developed a screening system for predicting developmental neurotoxicity—damage caused to nervous tissue by toxic substances—using stem cells to model features of the developing human brain. The findings appear in the Proceedings of the National Academy of Sciences.

Brain reader helps man move legs again (BBC)

Brain reader helps man move legs again (BBC)

Brainwaves were interpreted by a computer, which then controlled the electrical stimulation of his leg muscles.

The US study, in the Journal of Neuroengineering and Rehabilitation, showed he was able to walk just under four metres with support.

Experts said maintaining balance was an issue that needed to be addressed.

Life on the Home Planet

Over 717 Die In Saudi Arabia Following Deadliest Stampede In Hajj History (Zero Hedge)

And like on many previous occasions, the Muslim pilgrimage to Mecca once again led to a tragic loss of life in what may be the deadliest stampede in pilgiramge history when at least 717 people died and another 805 were injured.

According to the NYT, the deaths occurred around 9 a.m., on the first day of Eid al-Adha, as millions of Muslims were making their pilgrimage, or hajj, to Mecca. The accident took place at the intersection of two roads in Mina, causing many to fall and others to panic, according to Saudi Arabia’s civil defense directorate.

BBC adds that the incident happened when there was a “sudden increase” in the number of pilgrims heading towards pillars, the statement said.

Botanist to study responses of trees, shrubs to extreme drought (Phys)

Botanist to study responses of trees, shrubs to extreme drought (Phys)

As is well known now, California is in its fourth year of drought. As a result, mass mortality of trees and shrubs is happening more quickly than researchers can quantify. Rapid changes in vegetation cover are already leading to loss of biodiversity, opportunities for invasive species, and novel ecosystems with entirely new plant communities.

Louis Santiago, an associate professor of botany and plant sciences at the University of California, Riverside, has now received a grant of $180,000 for two years from the National Science Foundation to study how trees and shrubs respond to extreme drought.

How fertilizer alters soil microbes around the world (Futurity)

How fertilizer alters soil microbes around the world (Futurity)

Adding nitrogen and phosphorous to the soil beneath grasslands shifts the natural communities of fungi, bacteria, and microscopic organisms called archaea that live in the soil.

Scientists associated with the Nutrient Network, a global grid of scientists who investigate ecological responses in grasslands around the world, reveal that microbial community responses to fertilizer inputs were globally consistent and reflected plant responses to the inputs.